Sensors and Controls Market Size (2024 – 2030)

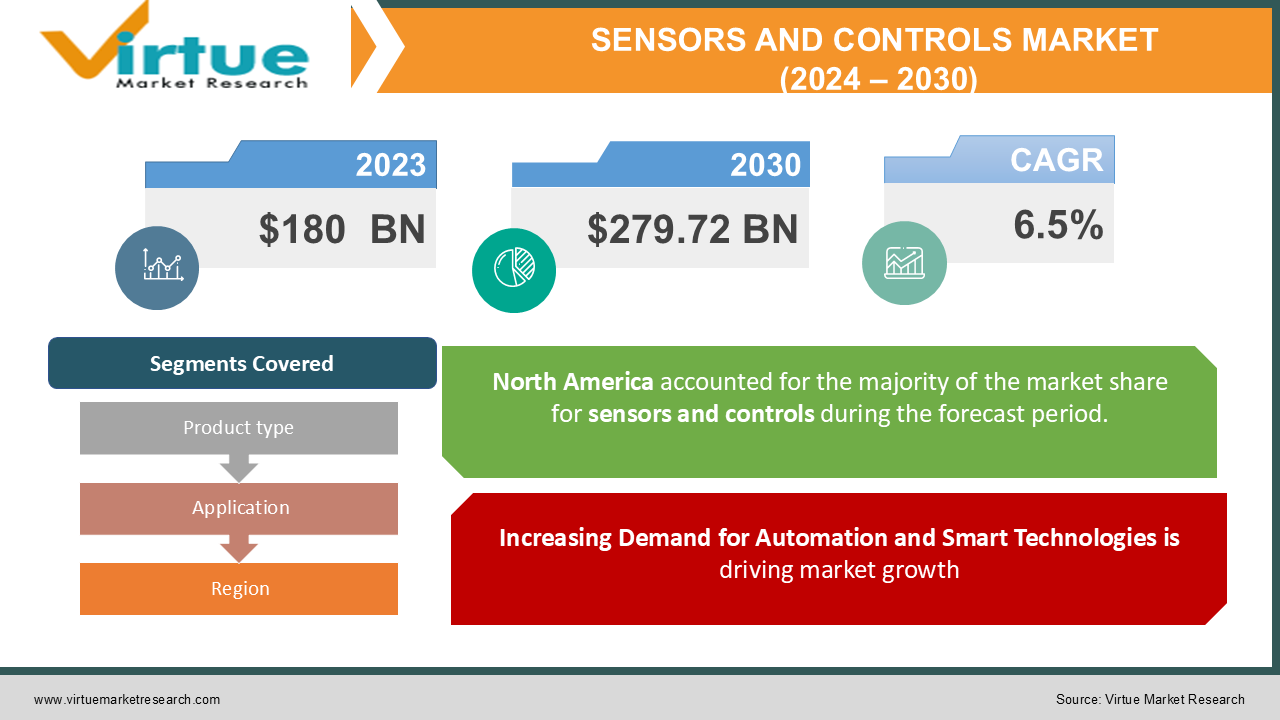

The Global Sensors and Controls Market was valued at USD 180 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030, reaching approximately USD 279.72 billion by 2030.

The market encompasses a wide range of devices that convert physical parameters such as temperature, pressure, light, motion, and chemical composition into signals that can be read and interpreted by electronic systems. This includes various types of sensors (such as temperature, pressure, proximity, and flow sensors) and control devices used in applications across industries such as automotive, healthcare, industrial automation, consumer electronics, and smart homes.

Key Market Insights:

-

Automotive applications are expected to dominate the market, accounting for over 30% of total revenue due to the increasing adoption of advanced driver-assistance systems (ADAS).

-

The industrial sector is also a major contributor to the market, with the demand for sensors in automation and process control driving growth.

-

The healthcare sector is experiencing a surge in demand for sensors and controls, particularly in remote monitoring and wearable health devices, fostering innovations in medical technology.

-

Emerging markets in Asia-Pacific are expected to witness the highest growth rates, attributed to rapid industrialization and increasing investments in smart infrastructure.

-

The miniaturization of sensors is a key trend, enabling their integration into compact devices and systems for enhanced performance and functionality.

Global Sensors and Controls Market Drivers:

Increasing Demand for Automation and Smart Technologies is driving market growth: The trend of automation across various sectors is thus the major driving factor for growth in the market for sensors and controls. Businesses across industries are then utilizing the implementation of automation towards increased efficiency, operational costs and productivity enhancement. A business using sensors in an industrial process has real-time monitoring and control of activities, thereby making informed decisions based on correct data. For instance, in manufacturing, sensors are necessary for the monitoring of equipment performance as well as for anomaly detection and optimization of maintenance scheduling. Moreover, smart technologies, such as smart home and smart city applications, have fuelled demand for sensors that can collect and transmit data to centralized systems. Sensor and control usage is going to gain pace as consumers and businesses look to deliver new solutions to make life more convenient, secure, and energy efficient.

Expansion of the Internet of Things (IoT) is driving market growth: The increased adoption of IoT devices is changing many aspects of the sensors and controls market. Sensors are the most basic components of the IoT systems since they help in data acquisition from the physical environment. As more and more gadgets are networked, demand for advanced sensors in real-time data has increased manifold. Agrotechnology, healthcare, transport, and energy industries deployed IoT solutions to optimize operations and enhance different decision practices. For instance, in smart agriculture, sensors monitor soil moisture and temperature as well as crop health, providing data-driven choices to the farmers to promote further yield growth. The advance of IoT applications continuously directs growth into the sensors and controls market.

Rising Awareness of Safety and Environmental Concerns is driving market growth: Rising awareness about safety regulation as well as environmental sustainability remains a significant market driver for sensors and controls. Stringent safety standards are being introduced globally by governments and their local regulatory bodies concerning workers and consumers, thus ensuring the use of advanced sensors for monitoring and controlling mechanisms. Sensing devices help workers and the related sectors in manufacturing, construction, and others in detecting hazardous conditions; monitoring equipment performance to give advance warnings of potential failures. Indeed, the current environmental concerns have spurred organizations to utilize sensors in monitoring the quality levels of air, water, and emissions. Sensors combined with an environmental monitoring system allow the collection of real-time data by enabling organizations to address environmental issues. Because the focus on safety and sustainability will be raised in the future, the call for sensors and controls is expected to rise accordingly.

Global Sensors and Controls Market Challenges and Restraints:

High Initial Costs of Implementation is restricting market growth: One of the major drawbacks in the sensors and controls market is that it involves advanced sensor technologies that entail high initial installation costs. Although sensors eventually bring about long-run savings and operational efficiency, the huge initial investment to purchase and install such systems may act as a barrier for most organizations, but especially for the SMEs. Installation and maintenance costs together with the cost of training people on use and maintenance of sensor systems are the remaining barriers to adoption. Additionally, uncertainty of return on investment may discourage organizations from investing in sensor technologies for industries where profits are always tight. Effective strategies that may surmount this barrier will be managing to offer solutions with low cost and cost of implementation, together with demonstration of long-term benefits of sensor and controls.

Data Security and Privacy Concerns is restricting market growth: Data security and privacy are the most critical issues surrounding the growth of the sensors and controls market. With increased interconnectivity of devices in a system, the threat potential through cyberattacks and unauthorized access to sensitive information also increases. Organizations deploying sensors must, therefore, ensure that adequate security measures are developed and deployed for protection of such data collected from these devices. With any security breach involving data, significant financial losses, loss of reputation, and litigation could occur. Moreover, regulatory frameworks for data protection also are in the process of evolution; so the organizations would be required to stay compliant with the emerging regulations to avoid litigations. All these aspects contribute toward ensuring consumer and business confidence, which would further drive sensor and control adoption.

Market Opportunities:

High growth and innovation opportunities abound in sensors and controls over the next three years with fast advancement in technology-including artificial intelligence and machine learning. Organizations can tap into advanced data analysis, predictive maintenance, and real-time decision-making by integrating AI algorithms in sensor systems. This capability makes the sensors result in more significant efficiencies of operation with much reduced time losses; hence, more valuable to diverse industries. The growing demand for smart city projects would open great opportunity for sensor manufacturers. Cities need to develop infrastructure, modes of transportation, and social services, making sensors integral components of city management systems. Applications include traffic management, waste management, and environmental monitoring. The health sector is another sector that is predicted to experience a great increase in demand for sensors and controls, primarily due to the rising need for home-based monitoring and telehealth services. There are opportunities for developing advanced sensors that can provide real-time health data-from growing wearable devices and monitoring systems. Healthcare providers will be able to give more personalized care, and patient care will improve by considering this focus. With growing industries focused on sustainability, the demand for sensors monitoring environmental parameters and energy consumption will be on the rise. Companies developing environment-friendly sensors and controls would likely find an open market for their products among organizations striving to attain sustainability goals. Sensors and controls collectively, on the basis of technological advancement, changes in consumer preference, and focus on sustainability, offer sufficient prospects for growth.

SENSORS AND CONTROLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., Siemens AG, ABB Ltd., Texas Instruments Incorporated, Bosch Sensortec GmbH, Analog Devices, Inc., TE Connectivity Ltd., STMicroelectronics N.V., Emerson Electric Co., Schneider Electric SE |

Sensors and Controls Market Segmentation: By Product Type

-

Temperature Sensors

-

Pressure Sensors

-

Proximity Sensors

-

Level Sensors

-

Flow Sensors

-

Gas Sensors

-

Motion Sensors

-

Image Sensors

-

Others (Humidity Sensors, Light Sensors, etc.)

The temperature sensors segment is currently the most dominant in the market, accounting for a significant share due to their widespread application across various industries, including HVAC, automotive, and healthcare. The versatility of temperature sensors, combined with their critical role in monitoring and controlling processes, makes them essential components in many systems. Their ability to provide accurate temperature measurements and facilitate process optimization is driving the demand for these sensors, ensuring their continued dominance in the market.

Sensors and Controls Market Segmentation: By Application

-

Automotive

-

Industrial Automation

-

Healthcare

-

Consumer Electronics

-

Environmental Monitoring

-

Aerospace and Defense

-

Agriculture

-

Others (Smart Homes, Retail, etc.)

The automotive application segment is the most dominant area for sensors and controls, driven by the increasing adoption of advanced driver-assistance systems (ADAS) and the growing demand for electric vehicles (EVs). Sensors play a crucial role in enhancing vehicle safety, improving fuel efficiency, and enabling the development of autonomous driving technologies. As automotive manufacturers continue to innovate and integrate advanced sensor technologies into their vehicles, this segment is expected to maintain its leading position in the market.

Sensors and Controls Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The sensors and controls market is currently dominated by North America, and a major share goes to such companies of major technologies and advanced manufacturing capabilities. The interest in the research and development in the region is strong, along with investments in automation and IoT technologies, thus increasing demand for such sensors in applications. Also, support in regulatory terms for safety standards and environmental sustainability adds up to growth in the market. North America, again the United States, is a major customer of sensors and controls in the automotive sector, which again is on the rise in the light of the higher adoption of advanced sensor technologies by vehicle makers. With the region yet to be held at the pinnacle of high-tech innovation and adoption, the dominance in the sensors and controls market is bound to be sustainable over time.

COVID-19 Impact Analysis on the Sensors and Controls Market:

The COVID-19 pandemic had a tremendous impact on the sensor and control market; as the virus transformed the behavior of consumers and hence industry dynamics, the worst interruption in the production and delivery of their sensors was what manufacturers faced. However, as sectors slowly got into the new normal, demand for sensors upticked in many areas, especially in health care and remote monitoring applications. The pandemic took telehealth and remote patient monitoring to the next level by underscoring the role of sensors in offering real-time health data, thereby intensifying investments in healthcare technology. Apart from that, the pandemic hastened the adaptation of automation as well as digital transformation across industries. Businesses realized the imperative need for efficient and contactless operations, which led to a shift towards automated systems reliant on sensors for monitoring and control. Such trends are forcing the demand for sensors to drive growth in industrial automation, smart buildings, and supply chain management. In a bid to increase resilience and preparedness for such future disruptions, investments in smart technologies and IoT solutions will continue growing. Sensors and controls will see a boost as priorities shift to real-time data collection, remote monitoring, and automated processes. The pandemic crisis has brought various challenges but, paradoxically, also produced opportunities for growth and innovation in the sensors and controls market, with renewed attention to technology and automation.

Latest Trends/Developments:

Sensor and control market trends Several dominant trends are transforming the face of sensors and controls. One of these trends is the increasing role of artificial intelligence and machine learning in the sensor technology space. Through this, the advanced analysis of data opens up the predictive maintenance and much better decision-making capabilities through the integration of AI and machine learning capabilities in sensor technologies. Organizations can extract valuable insights from sensor data with artificial intelligence algorithms, enhancing operations and reducing downtime. Miniaturization of sensors is also emerging-it now can be inserted in miniature systems and small devices. As such, the compact sensors became developed over time by manufacturers to provide high performance and accuracy to products, including wearable products, IoT devices, and smart products. Such trends are particularly significant in the health sector, whereby wearable health monitors and diagnostic appliances necessitate small, efficient sensors. Sustainability is yet another driving force for innovations with regard to sensor technologies. Manufacturers are inventing eco-friendly sensors to ensure that the environment is free from unnecessary pollution while providing accurate and reliable data. This also goes in the direction of growing focus on sustainability everywhere, and organizations are embracing the technologies that help them meet their environmental targets. A new application domain of sensors is the smart cities. The development of smart cities will open up more applications of sensors. Urban spaces are trying to improve infrastructure and standards of living for inhabitants by putting sensors into the management of the city. These sensors can also monitor the traffic flow, air quality, waste management, and public safety, that will result in much more productive and environmentally friendly cities. In short, this market of sensors and controls is moving forward to growth with the impetus of technology advancement, shifting consumer needs, increasing observance on the sustainability, and smart technologies.

Key Players:

-

Honeywell International Inc.

-

Siemens AG

-

ABB Ltd.

-

Texas Instruments Incorporated

-

Bosch Sensortec GmbH

-

Analog Devices, Inc.

-

TE Connectivity Ltd.

-

STMicroelectronics N.V.

-

Emerson Electric Co.

-

Schneider Electric SE

Chapter 1. Sensors and Controls Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sensors and Controls Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sensors and Controls Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sensors and Controls Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sensors and Controls Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sensors and Controls Market – By Product Type

6.1 Introduction/Key Findings

6.2 Temperature Sensors

6.3 Pressure Sensors

6.4 Proximity Sensors

6.5 Level Sensors

6.6 Flow Sensors

6.7 Gas Sensors

6.8 Motion Sensors

6.9 Image Sensors

6.10 Others (Humidity Sensors, Light Sensors, etc.)

6.11 Y-O-Y Growth trend Analysis By Product Type

6.12 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Sensors and Controls Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Industrial Automation

7.4 Healthcare

7.5 Consumer Electronics

7.6 Environmental Monitoring

7.7 Aerospace and Defense

7.8 Agriculture

7.9 Others (Smart Homes, Retail, etc.)

7.10 Y-O-Y Growth trend Analysis By Application

7.11 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Sensors and Controls Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Product Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Sensors and Controls Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Honeywell International Inc.

9.2 Siemens AG

9.3 ABB Ltd.

9.4 Texas Instruments Incorporated

9.5 Bosch Sensortec GmbH

9.6 Analog Devices, Inc.

9.7 TE Connectivity Ltd.

9.8 STMicroelectronics N.V.

9.9 Emerson Electric Co.

9.10 Schneider Electric SE

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Sensors and Controls Market was valued at USD 180 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030, reaching approximately USD 279.72 billion by 2030.

Key drivers include increasing demand for automation and smart technologies, the expansion of the Internet of Things (IoT), and rising awareness of safety and environmental concerns.

The market segments include Temperature Sensors, Pressure Sensors, Proximity Sensors, Level Sensors, Flow Sensors, Gas Sensors, Motion Sensors, Image Sensors, and others by product type. By application, the segments include Automotive, Industrial Automation, Healthcare, Consumer Electronics, Environmental Monitoring, Aerospace and Defense, Agriculture, and others.

North America is the most dominant region in the sensors and controls market, driven by major technology companies, strong manufacturing capabilities, and significant investments in automation and IoT technologies.

Key players include Honeywell International Inc., Siemens AG, ABB Ltd., Texas Instruments Incorporated, Bosch Sensortec GmbH, Analog Devices, Inc., TE Connectivity Ltd., STMicroelectronics N.V., Emerson Electric Co., and Schneider Electric SE.