Sensor Fusion Market Size (2025 – 2030)

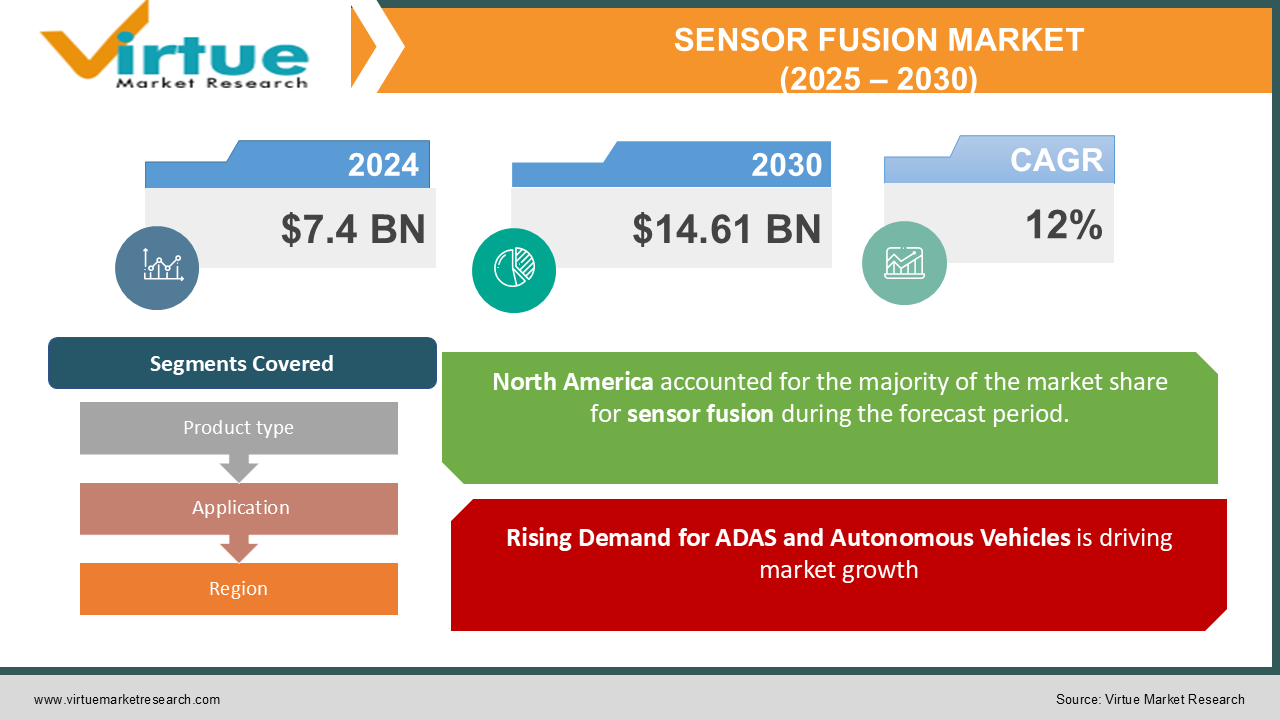

The Global Sensor Fusion Market was valued at USD 7.4 billion in 2024 and is projected to grow at a robust CAGR of 12% from 2025 to 2030. The market is expected to reach USD 14.61 billion by 2030.

Sensor fusion involves the integration of data from multiple sensors to improve the system's accuracy and reliability in understanding its environment. The technology is widely used in automotive, consumer electronics, industrial automation, and healthcare applications. Increasing adoption in advanced driver assistance systems (ADAS), wearable devices, and IoT applications is driving rapid market expansion. Sensor fusion’s ability to provide enhanced data insights and improved operational efficiency has made it an essential component in modern technological ecosystems.

Key Market Insights

-

Sensor fusion is crucial for autonomous vehicles, with adoption increasing at a CAGR of 20% due to its ability to integrate radar, lidar, and camera data for superior situational awareness.

-

The consumer electronics sector accounts for over 35% of the market share, driven by the growing use of sensor fusion in smartphones, tablets, and wearable devices.

-

In industrial automation, sensor fusion enhances precision and reliability, contributing to a growth rate of 16% in this segment.

-

North America dominates the market, contributing nearly 40% of the revenue, owing to advanced adoption of sensor technologies in automotive and aerospace industries.

-

Low-power consumption and miniaturization are key trends driving innovation in sensor fusion technology, particularly for wearable devices and IoT applications. The increasing deployment of sensor fusion in healthcare, including wearable monitoring devices, is expanding market opportunities.

-

Key partnerships between sensor manufacturers and AI companies are fostering advancements in sensor fusion algorithms for real-time data analysis. Governments worldwide are supporting sensor fusion adoption through initiatives aimed at boosting smart infrastructure and connected technologies.

Global Sensor Fusion Market Drivers

Rising Demand for ADAS and Autonomous Vehicles is driving market growth:

The global push toward autonomous vehicles and advanced driver assistance systems (ADAS) is a major driver of the sensor fusion market. Sensor fusion enables the integration of data from radar, lidar, ultrasonic sensors, and cameras to provide accurate and real-time information for vehicle control and safety. With automotive manufacturers investing heavily in autonomous technologies, the demand for sensor fusion is skyrocketing. Features like adaptive cruise control, automatic emergency braking, and lane-keeping assistance rely on sensor fusion for seamless functioning. Governments' stringent safety regulations and increasing consumer preference for enhanced vehicle safety further fuel the adoption of sensor fusion in the automotive sector.

Growth of IoT and Connected Devices is driving market growth:

The proliferation of IoT and connected devices in industries such as smart homes, healthcare, and industrial automation is driving the demand for sensor fusion technology. In IoT ecosystems, multiple sensors are used to gather data, and sensor fusion integrates this data to provide actionable insights. Applications like smart thermostats, home security systems, and wearable health monitors leverage sensor fusion for enhanced performance and user experience. Additionally, advancements in communication protocols and edge computing are enabling more efficient implementation of sensor fusion in connected devices, making it a critical enabler of the IoT revolution.

Increasing Adoption in Consumer Electronics is driving market growth:

Sensor fusion technology is becoming indispensable in consumer electronics, particularly in smartphones, wearables, and gaming devices. In smartphones, sensor fusion integrates data from accelerometers, gyroscopes, and magnetometers to provide functionalities such as step counting, orientation tracking, and motion sensing. Wearable devices, including fitness trackers and smartwatches, rely on sensor fusion to deliver accurate activity and health monitoring. The rising consumer demand for feature-rich, high-performance devices is compelling manufacturers to adopt advanced sensor fusion technologies, contributing significantly to market growth.

Global Sensor Fusion Market Challenges and Restraints

High Costs and Complexity is restricting market growth:

The development and integration of sensor fusion systems involve significant costs, including hardware components, software algorithms, and calibration processes. For industries adopting sensor fusion, these costs can become a barrier, especially for small and medium enterprises (SMEs). Additionally, the complexity of sensor fusion algorithms, which require advanced computational capabilities to process large volumes of data in real-time, adds to the challenges. Ensuring the seamless interaction of multiple sensors and minimizing errors further complicate the implementation, posing challenges to widespread adoption.

Data Security and Privacy Concerns is restricting market growth:

As sensor fusion technology becomes increasingly integrated into IoT and connected devices, concerns about data security and privacy are rising. Sensor fusion systems often collect and process sensitive data, such as location, health metrics, and behavioral patterns, which can be vulnerable to cyberattacks. Breaches or unauthorized access to this data can have severe consequences, including financial loss and compromised user trust. Addressing these concerns requires robust cybersecurity measures and compliance with data protection regulations, which can increase costs and complexity for manufacturers and users alike.

Market Opportunities

The Sensor Fusion Market offers vast opportunities, particularly in emerging applications such as smart cities, healthcare, and augmented reality (AR). In smart city initiatives, sensor fusion is critical for traffic management, environmental monitoring, and public safety systems. The healthcare industry is witnessing growing adoption of sensor fusion in wearable devices and remote monitoring systems, enabling early detection and management of chronic conditions. Moreover, AR and virtual reality (VR) technologies are leveraging sensor fusion for immersive user experiences, creating new growth avenues. The advancement of artificial intelligence and machine learning algorithms further enhances the potential of sensor fusion, enabling predictive analytics and decision-making across various sectors. With increasing investments in 5G networks and edge computing, the scope of sensor fusion applications is expected to expand significantly, offering lucrative opportunities for market players.

SENSOR FUSION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bosch Sensortec, InvenSense, STMicroelectronics, Texas Instruments, NXP Semiconductors, Analog Devices, Hillcrest Labs, Kionix, Renesas Electronics, Qualcomm |

Sensor Fusion Market Segmentation - By Product Type

-

Inertial Sensors (Accelerometers, Gyroscopes)

-

Image Sensors

-

Environmental Sensors

-

Radar Sensors

-

Others

Inertial sensors dominate the market, accounting for over 30% of the total share, driven by their extensive use in automotive and consumer electronics applications.

Sensor Fusion Market Segmentation - By Application

-

Automotive

-

Consumer Electronics

-

Healthcare

-

Industrial Automation

-

Others

The automotive segment leads the market, contributing 40% of the total revenue, due to the increasing adoption of sensor fusion in ADAS and autonomous driving systems.

Sensor Fusion Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is the leading region, accounting for 40% of the market share, owing to the advanced adoption of sensor technologies in the automotive, aerospace, and healthcare sectors. The presence of key market players, strong R&D investments, and government support for technological innovation further solidify its dominance.

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant and dual impact on the Sensor Fusion Market. While some sectors experienced temporary setbacks, others saw accelerated growth. The automotive and industrial automation sectors were notably affected by disruptions in supply chains, factory closures, and reduced manufacturing activity, leading to a decline in demand for sensor fusion technologies in these industries. However, the healthcare and consumer electronics segments experienced an upturn in demand. In the healthcare sector, the need for wearable health monitoring devices and remote diagnostic solutions soared during the pandemic. With a surge in telemedicine, virtual healthcare services, and the growing focus on personal health, sensor fusion technologies became integral to the development of advanced health monitoring devices. These devices, which combined multiple sensors to collect and analyze data more accurately, saw rapid adoption as healthcare systems sought solutions to better manage patient care remotely. Similarly, the consumer electronics industry benefited from the surge in remote work and online activities. The increased reliance on smartphones, tablets, and other connected devices during lockdowns drove the demand for advanced features, including those powered by sensor fusion. These technologies, which enable the integration of data from multiple sensors to improve device performance and user experience, became essential for enhancing devices’ functionality, such as improving camera capabilities, gesture recognition, and navigation systems. As industries adapted to the new normal, there was a notable shift toward automation and digital transformation. These changes created new opportunities for sensor fusion applications across various sectors. The demand for smarter, more efficient systems to support automation and remote operations further fueled the growth of sensor fusion technologies, positioning them as critical components for future innovations in multiple industries.

Latest Trends/Developments

The Sensor Fusion Market is experiencing significant advancements, fueled by the integration of AI and machine learning algorithms that enhance data processing and decision-making. These technologies enable the fusion of data from multiple sensors, allowing for more accurate and efficient analysis in real-time. A key trend in the market is the growing demand for low-power sensor fusion systems, particularly in wearable devices and Internet of Things (IoT) applications. These systems offer energy efficiency, addressing the need for longer battery life in devices like fitness trackers, smartwatches, and other connected technologies. The automotive industry is increasingly focused on sensor fusion technologies to support the development of Level 4 and Level 5 autonomous vehicles. These vehicles require real-time environmental mapping and navigation capabilities, which sensor fusion provides by combining data from various sensors such as cameras, LiDAR, and radar. The result is improved accuracy, safety, and reliability in self-driving vehicles, accelerating their adoption on roads. In healthcare, sensor fusion is enabling the development of advanced wearable devices for continuous health monitoring and predictive diagnostics. By integrating data from multiple sensors, these devices can track a person’s vital signs and detect abnormalities, offering real-time alerts for potential health issues. This innovation is contributing to the shift towards personalized and proactive healthcare management. Furthermore, strategic collaborations between sensor manufacturers, software developers, and AI companies are driving further innovation and expanding the sensor fusion market. These partnerships enable the creation of more sophisticated solutions that meet the diverse needs of industries such as automotive, healthcare, and IoT, fueling market growth and technological advancements in the sensor fusion landscape.

Key Players

-

Bosch Sensortec

-

InvenSense

-

STMicroelectronics

-

Texas Instruments

-

NXP Semiconductors

-

Analog Devices

-

Hillcrest Labs

-

Kionix

-

Renesas Electronics

-

Qualcomm

Chapter 1. Sensor Fusion Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sensor Fusion Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sensor Fusion Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sensor Fusion Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sensor Fusion Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sensor Fusion Market – By Product Type

6.1 Introduction/Key Findings

6.2 Inertial Sensors (Accelerometers, Gyroscopes)

6.3 Image Sensors

6.4 Environmental Sensors

6.5 Radar Sensors

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Sensor Fusion Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Consumer Electronics

7.4 Healthcare

7.5 Industrial Automation

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Sensor Fusion Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Sensor Fusion Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bosch Sensortec

9.2 InvenSense

9.3 STMicroelectronics

9.4 Texas Instruments

9.5 NXP Semiconductors

9.6 Analog Devices

9.7 Hillcrest Labs

9.8 Kionix

9.9 Renesas Electronics

9.10 Qualcomm

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Sensor Fusion Market was valued at USD 7.4 billion in 2024 and is projected to grow at a robust CAGR of 12% from 2025 to 2030. The market is expected to reach USD 14.61 billion by 2030.

Key drivers include rising demand for ADAS and autonomous vehicles, the growth of IoT, and increasing adoption in consumer electronics.

The market is segmented by product into (inertial sensors, image sensors, etc.) and application into (automotive, consumer electronics, healthcare, etc.).

North America is the dominant region, accounting for 40% of the market share.

Leading players include Bosch Sensortec, InvenSense, STMicroelectronics, Texas Instruments, and NXP Semiconductors.