Self-Service Kiosk Market Size (2025 – 2030)

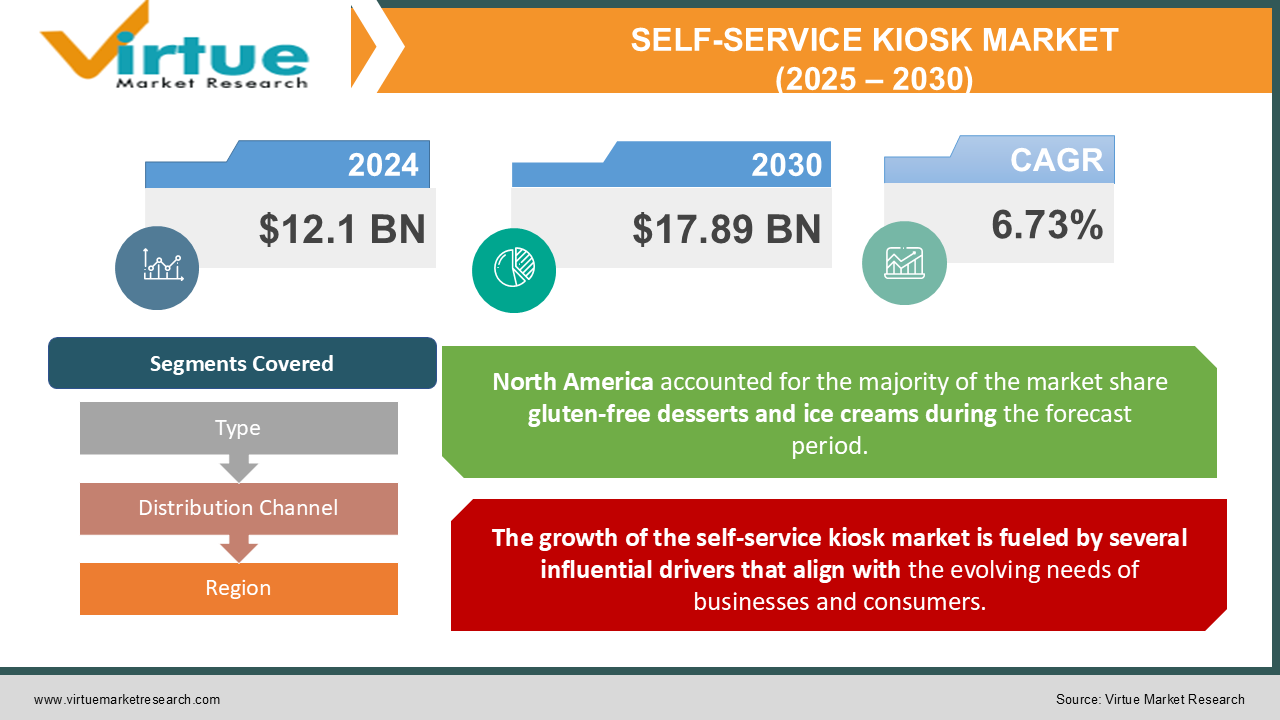

The Self-Service Kiosk Market was valued at USD 12.1 Billion in 2024 and is projected to reach a market size of USD 17.89 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.73%.

The self-service kiosk market is evolving rapidly, driven by the integration of advanced technologies and the growing demand for customer-centric solutions across various sectors. These kiosks, ranging from simple ticket vending machines to sophisticated healthcare diagnostic stations, have transformed the way businesses interact with their customers. By offering convenience, efficiency, and reduced operational costs, self-service kiosks have become indispensable in industries such as retail, healthcare, banking, and hospitality. Their ability to handle multiple functions—such as transactions, information dissemination, check-ins, and personalized services—has significantly enhanced user experiences. Moreover, advancements in artificial intelligence (AI), touchless interfaces, and cloud-based systems have propelled the capabilities of these kiosks, making them smarter and more versatile. Businesses are leveraging self-service kiosks to meet the demands of a tech-savvy consumer base while simultaneously addressing challenges like labor shortages and the need for operational efficiency. The growing adoption of these devices can also be attributed to the significant shift in consumer behavior post-pandemic.

Key Market Insights:

-

Over 42% of retail outlets implemented self-service kiosks in 2023 to enhance customer experience.

-

The average transaction time on self-service kiosks decreased by 18%, improving efficiency significantly.

-

75% of restaurants reported increased order accuracy due to kiosk usage.

-

68% of customers preferred using kiosks over traditional check-out methods in retail settings.

-

The banking sector witnessed a 23% rise in kiosk usage for account management services.

-

Self-service kiosks contributed to a 30% reduction in operational costs for quick-service restaurants.

-

Healthcare kiosks handled over 15 million registrations globally in 2023.

-

52% of businesses using kiosks noted increased customer retention.

-

Over 90% of kiosks were integrated with contactless payment systems by the end of 2023.

-

55% of consumers rated kiosks as "extremely convenient" in a recent survey.

-

The hospitality sector saw a 21% growth in kiosk installations for check-ins and check-outs.

-

Self-service kiosks processed over 1.2 billion transactions in 2023 globally.

-

The food and beverage industry reported a 40% increase in upselling opportunities via kiosks.

Market Drivers:

The growth of the self-service kiosk market is fueled by several influential drivers that align with the evolving needs of businesses and consumers.

One of the primary drivers is the increasing demand for efficient and contactless solutions, especially in a post-pandemic environment. As consumers prioritize hygiene and convenience, self-service kiosks equipped with touchless technologies like QR code scanning, NFC payments, and voice-activated interactions have emerged as a preferred choice. These kiosks minimize human interaction while maintaining service quality, making them highly desirable in the retail, hospitality, and healthcare sectors. Businesses benefit from reduced labor costs and enhanced customer satisfaction, driving widespread adoption. Another key driver is the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and IoT within kiosks. AI-powered kiosks enable personalized interactions, analyzing customer behaviors and preferences to suggest relevant products or services. For instance, in retail, kiosks can recommend complementary items based on purchase history, boosting upselling opportunities. IoT-enabled kiosks provide real-time data on usage, maintenance needs, and customer preferences, empowering businesses to optimize their operations. Furthermore, the rising availability of 5G connectivity has enhanced the capabilities of self-service kiosks, ensuring faster transactions and seamless integration with cloud-based systems. The affordability and scalability of self-service kiosks have also played a pivotal role in their adoption across businesses of all sizes. Modular designs and flexible payment plans make kiosks accessible to small and medium enterprises (SMEs), allowing them to compete with larger players. Additionally, the increasing emphasis on digital transformation has prompted governments and organizations to invest in smart city initiatives, where self-service kiosks are used for public utilities, ticketing, and information dissemination.

Market Restraints and Challenges:

Despite its rapid growth, the self-service kiosk market faces several challenges. One major restraint is the high initial cost of kiosk installation and integration. While kiosks can reduce long-term operational costs, the upfront investment required for hardware, software, and customization can deter smaller businesses. Maintenance costs, particularly for outdoor kiosks exposed to harsh environmental conditions, add to the financial burden. Cybersecurity concerns also pose a significant challenge. As kiosks handle sensitive customer data, including payment details and personal information, they are vulnerable to hacking and data breaches. Ensuring robust security protocols, such as encryption and regular software updates, is essential but can increase costs and complexity for businesses. Another challenge lies in user adaptability. While younger, tech-savvy consumers readily embrace kiosk technology, older or less technologically inclined users may struggle with the interface, leading to dissatisfaction. Businesses must strike a balance between technological advancement and user-friendly design to ensure inclusivity. Additionally, the lack of standardization across kiosk designs and functionalities creates integration challenges, particularly for large organizations operating in multiple locations. Variations in hardware and software compatibility can hinder the seamless implementation of kiosk networks, slowing down market penetration.

Market Opportunities:

The self-service kiosk market presents immense opportunities for innovation and growth. One of the most promising areas is the integration of biometric authentication. Kiosks equipped with facial recognition, fingerprint scanning, or retina scanning can enhance security and personalization, particularly in banking, healthcare, and airport settings. These features streamline identity verification processes, offering unparalleled convenience. Another opportunity lies in the expansion of self-service kiosks into emerging markets. As developing countries invest in infrastructure and digitalization, the demand for kiosks in sectors like transportation, retail, and public utilities is expected to rise significantly. Localized solutions catering to regional languages and cultural preferences can unlock untapped potential in these markets. The rise of green and sustainable technologies also opens doors for eco-friendly kiosk designs. Solar-powered kiosks, recyclable materials, and energy-efficient components align with global sustainability goals, appealing to environmentally conscious consumers and businesses. Kiosks designed with modular components can also extend product lifecycles, reducing e-waste and maintenance costs. Moreover, the growing trend of personalized shopping experiences provides opportunities for kiosks to integrate augmented reality (AR) and virtual reality (VR) technologies. Retail kiosks equipped with AR can offer virtual try-on features for clothing, accessories, or makeup, enhancing customer engagement and satisfaction.

SELF-SERVICE KIOSK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.73% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery, Liebherr Group, Terex Corporation, Deere & Company, Bell Equipment, Doosan Infracore, Hyundai Construction Equipment |

Self-Service Kiosk Market Segmentation - by Type

-

Information Kiosks

-

Ticketing Kiosks

-

Self-Checkout Kiosks

-

Vending Kiosks

-

Interactive Kiosks

-

Healthcare Kiosks

-

Banking Kiosks

The most dominant type in the market is the self-checkout kiosk, which is widely used in retail and hospitality for faster transactions and reduced labor dependency. The fastest-growing type is the healthcare kiosk, driven by the increasing need for patient registration, telemedicine, and diagnostic services.

Self-Service Kiosk Segmentation - by Distribution Channel

-

Direct Sales

-

Distributors

-

Online Platforms

The most dominant channel is direct sales, as businesses prefer to work closely with manufacturers for customized solutions. The fastest-growing channel is online platforms, offering a broader range of options and competitive pricing, particularly appealing to SMEs.

Self-Service Kiosk Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

North America commands the largest share of the global self-service kiosk market, accounting for approximately 42% of the total revenue in 2023. This dominance is driven by high adoption rates across sectors like retail, healthcare, and financial services. The United States leads within the region due to its advanced technological infrastructure, high consumer preference for self-service solutions, and the widespread deployment of kiosks in fast food chains, airports, and public spaces. Additionally, government initiatives promoting digital transformation and contactless transactions have further accelerated kiosk adoption.

Asia-Pacific is the fastest-growing region, with a market share of approximately 22% in 2023. Rapid urbanization, rising disposable incomes, and the growing influence of digitalization in countries like China, India, and Japan are key contributors to the region's exponential growth. The retail sector in Asia-Pacific is undergoing a significant transformation, with self-service kiosks playing a crucial role in improving customer experiences and streamlining operations

COVID-19 Impact Analysis on the Self-Service Kiosk Market:

The COVID-19 pandemic significantly accelerated the adoption of self-service kiosks. Businesses sought contactless solutions to minimize physical interactions, making kiosks essential in retail, healthcare, and hospitality. Demand for kiosks with antimicrobial surfaces and touchless payment options surged, addressing hygiene concerns. In healthcare, kiosks play a critical role in managing patient inflows, symptom assessments, and vaccination registrations. Retailers adopted kiosks to enable self-checkout and minimize staff-customer contact, ensuring compliance with social distancing norms. While the initial disruption of supply chains posed challenges, the pandemic ultimately highlighted the resilience and adaptability of the self-service kiosk market. Businesses increasingly recognized kiosks as vital tools for operational continuity in uncertain times, further solidifying their role in the post-pandemic landscape.

Latest Trends and Developments:

The self-service kiosk market is witnessing several innovative trends. The adoption of AI and ML continues to enhance personalization, with kiosks offering tailored product recommendations and dynamic pricing strategies. Voice-activated kiosks are gaining traction, providing an intuitive and accessible interface for users. Biometric integration, including facial recognition and fingerprint scanning, is becoming standard in high-security environments like banking and healthcare. Additionally, kiosks are evolving into multifunctional hubs, combining services like ticketing, information dissemination, and advertising. The emphasis on sustainable designs and the integration of AR/VR technologies are further reshaping the market, catering to the demands of an increasingly digital and eco-conscious consumer base.

Key Players in the Market:

-

Caterpillar Inc.

-

Komatsu Ltd.

-

Volvo Construction Equipment

-

Hitachi Construction Machinery

-

Liebherr Group

-

Terex Corporation

-

Deere & Company

-

Bell Equipment

-

Doosan Infracore

-

Hyundai Construction Equipment

Chapter 1. Self-Service Kiosk Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Self-Service Kiosk Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Self-Service Kiosk Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Self-Service Kiosk Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Self-Service Kiosk Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Self-Service Kiosk Market – By Type

6.1 Introduction/Key Findings

6.2 Information Kiosks

6.3 Ticketing Kiosks

6.4 Self-Checkout Kiosks

6.5 Vending Kiosks

6.6 Interactive Kiosks

6.7 Healthcare Kiosks

6.8 Banking Kiosks

6.9 Y-O-Y Growth trend Analysis By Type

6.10 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Self-Service Kiosk Market – By distribution channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 Online Platforms

7.5 Y-O-Y Growth trend Analysis By distribution channel

7.6 Absolute $ Opportunity Analysis By distribution channel, 2025-2030

Chapter 8. Self-Service Kiosk Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By distribution channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By distribution channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By distribution channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By distribution channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By distribution channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Self-Service Kiosk Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Caterpillar Inc.

9.2 Komatsu Ltd.

9.3 Volvo Construction Equipment

9.4 Hitachi Construction Machinery

9.5 Liebherr Group

9.6 Terex Corporation

9.7 Deere & Company

9.8 Bell Equipment

9.9 Doosan Infracore

9.10 Hyundai Construction Equipment

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

With the shift toward digital-first interactions, consumers are increasingly prioritizing convenience and speed. Self-service kiosks address these needs by enabling efficient, contactless transactions in areas like retail, healthcare, food services, and banking.

. One of the most significant barriers to entry for businesses, especially small and medium enterprises (SMEs), is the high upfront cost associated with purchasing and deploying self-service kiosks.

The self-service kiosk market is competitive, with key players focusing on innovation, technology integration, and strategic partnerships to maintain their market positions. Companies like NCR Corporation, Diebold Nixdorf, and Glory Global Solutions lead the market with advanced solutions. Other notable players include KIOSK Information Systems, Embross, Acrelec, Advantech Co., Ltd., Zebra Technologies, RedyRef Interactive, Olea Kiosks Inc., Meridian Kiosks, Slab Kiosks, Evoke Creative, Source Technologies, and Fabcon Digital.

North America currently holds the largest market share, estimated at around 35%.

Asia Pacific has shown significant room for growth in specific segments.