Seed Processing Market size (2023 - 2030)

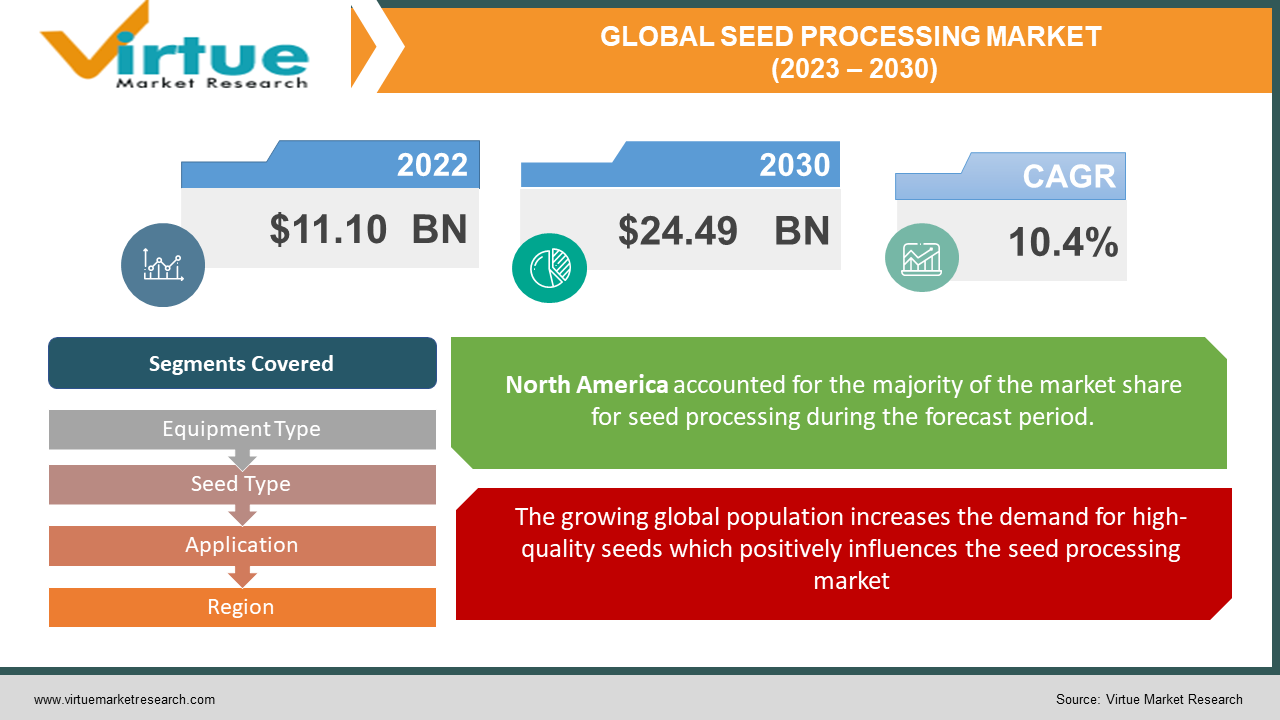

The global Seed Processing Market is estimated to be worth USD 11.10 Billion in 2022 and is projected to reach a value of USD 24.49 Billion by 2030, growing at a CAGR of 10.4% during the forecast period 2023-2030.

The seed processing market involves cleaning, grading, treatment, and packaging of seeds to prepare them for planting and distribution. This is an essential step in agriculture to ensure the production of high-quality and genetically pure seeds for better crop yields and diversity. There are several key aspects of the seed processing market like seed cleaning and grading, seed treatment, seed packaging, automation and technology, and regulatory controls. Seed cleaning involves the removal of impurities from seeds using equipment and various cleaning techniques like screening and gravity separation. Seed treatment is the process where protective chemicals and biological or chemical agents are applied to the seed to enhance overall seed health and germination. Proper packaging is crucial for maintaining seed quality and viability. Automation and advanced technology are widely adopted in the seed processing industry for improving efficiency. Different regions gave regulations and standards for seed quality and labeling which seed companies have to adhere to.

Global Seed Processing Market Drivers:

The growing global population increases the demand for high-quality seeds which positively influences the seed processing market

The consistent increase in the global population is driving the demand for more food production. To fulfill these demands, higher yields and efficient crops are required which is possible by utilizing high-quality seeds. These high-quality seeds are produced through seed processing method which plays a crucial role in enhancing overall agricultural yield. To meet the global demand for food, high-quality seeds are exported to different countries where seeds should meet international quality and standards. This is achieved by seed processing techniques to ensure seeds meet the regulatory guidelines for export.

Demand for crop protection, disease resistance, and sustainable agricultural practices fuels the growth of the seed processing market

Seed processing enhances the tolerance and resistance capabilities of crops through various treatments. Diseases and pests are prevalent problems in agriculture, which drives the need for improved seeds. This is achieved by incorporating efficient seed processing techniques. Sustainable and environment-friendly practices are also increasing in which seed processing technologies like precision planting and integrated pest management are promoted. These are sustainable practices in seed processing technology.

Global Seed Processing Market Challenges:

Environmental concerns and regulatory compliance hinder the growth of the seed processing market

Some seed treatments like sing coatings and chemicals might raise environmental concerns. Seed processing companies must address this issue and use effective treatments with environmental sustainability. Similarly, using harmful chemicals and techniques could lead to penalties for seed processing companies due to non-compliance. Hence, the regulations and standards set for seed quality, safety, and labeling should be strictly followed. These factors hinder market access and growth.

Resistance and adaptation to pests and diseases challenge the effectiveness of seed-processing methods

Processed and treated seeds develop resistance to pests and diseases with time which is a complex phenomenon and poses long-term challenges for seed processing companies. Pests and diseases have a high potential for adaptation and evolution which allows them to become resistant to treatments. This is a big challenge for seed processing companies, and there is a need to develop more effective treatments which could adapt to evolving situations.

COVID-19 Impact on the Global Seed Processing Market:

The COVID-19 pandemic had various impacts on the agriculture and seed processing market. Lockdowns and restrictions disrupted the global supply chain leading to delays in procurement, production, and shipment. Labor shortage affected the seed processing operations like quality control, maintenance, and packaging. There was a shift in demand for certain seed varieties and crops and the focus was on essential food production like staple crops, which require specific seed processing techniques. Consumer and farmer behavior changes led to uncertainty and demand for a specific type of seeds.

International trade and transportation were disrupted which affected the movement of materials and processed seeds. Various facilities faced restrictions in movement and access which led to delays in development and research activities. Regulatory and certification procedures faced delays affecting the approval of new seed varieties.

Global Seed Processing Market Recent Developments:

-

In June 2023, Syngenta introduced a novel seed treatment, called EQUENTO, which provides enhanced control over soil pests from the initial stage of the crop, helping farmers to increase the sustainability of their operations.

-

In March 2023, Rijk Zwaan started building a second facility in De Lier, Netherlands, for seed treatment and storage. This move aims to expand the facilities of Rijk Zwaan to cater to the growing demand for vegetable seeds.

-

In March 2023, the Minister of Agriculture and Farmers Welfare, Government of India, inaugurated the seed processing and storage facility at ICAR-IGFRI, Uttar Pradesh, focusing more on women farmers and utilizing the climate conditions of the region to expand the agricultural sector of the country.

SEED PROCESSING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.4% |

|

By Equipment Type, Seed Type, Application, and Region |

|

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Buhler Group, Cimbria, AGCO Corporation, Syngenta Group, Monsanto (now part of Bayer), DowDuPont (now Corteva Agriscience), KWS SAAT SE, Limagrain, Rijk Zwaan, Sakata Seed Corporation |

Global Seed Processing Market Segmentation: By Equipment Type

-

Cleaning and Grading equipment

-

Coating equipment

-

Sorting and Sizing equipment

-

Packaging equipment

Cleaning and Grading equipment is used to remove impurities from seeds and remove the damaged seeds from the seed lot, which ensures that only high-quality seeds are processed for further processing and planting. That’s why this segment is the largest, as cleaning and grading, are foundational components in the whole seed processing technique. Coating equipment is used to apply coatings, additives, and various treatments to protect the seeds and enhance their performance. Sorting and Sizing equipment segregates the seeds based on their physical properties, like shape, size, and color, ensuring equality and uniformity in the whole lot. Packaging equipment is used to package the processed seeds to ensure their quality and prevent any contamination. These processed seeds are then distributed or stored.

Global Seed Processing Market Segmentation: By Seed Type

-

Conventional Seeds

-

Genetically Modified Seeds

-

Organic Seeds

Conventional seeds are seeds that have undergone standard breeding and are widely used in traditional agriculture. While processing conventional seeds, the focus is mainly on maintaining the natural genetic makeup along with ensuring that they meet quality standards. Genetically Modified (GM) seeds demand specialized techniques and methods to ensure the traits engineered into the seeds are preserved. Organic seeds require processing that aligns with the principles of sustainable and organic farming. Natural treatments are mainly used for processing organic seeds to avoid contamination with non-organic materials. Conventional seeds are the largest contributor to this segment because conventional seeds are

widely accepted and used globally. The fastest-growing segment is Genetically Modified Seeds due to their capability to enhance crop yield and provide resistance along with tolerance to various adverse conditions, making it a viable option among farmers who are seeking more efficient practices.

Global Seed Processing Market Segmentation: By Application

-

Agricultural crops

-

Horticultural crops

-

Industrial crops

Agricultural crops need high-quality seeds which require efficient seed processing. These crops are responsible for fulfilling global food demand and include staples such as grains, vegetables, and oilseeds. Seed processing techniques for agricultural crops include cleaning, grading, and treating seeds to enhance crop yield and prevent diseases. Horticultural crops include plants used for ornamental purposes and require specialized seed processing techniques to enhance germination and promote root and shoot development. Industrial crops are grown for industrial purposes like biofuels, fibers, and medicinal uses. Specific treatments are involved in seed processing for industrial crops. The agricultural crops segment is the largest because of the consistently high demand for staple crops to feed the growing population and livestock. The fastest-growing segment is Industrial crops due to increasing demand for biofuels, bioplastics, and other industrial uses.

Global Seed Processing Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America has a vast seed processing market with advanced agricultural technologies along with the adoption of genetically modified crops which may impact the seed processing market. Europe has a well-established seed processing market and diverse agricultural practices, with a growing emphasis on organic farming and sustainable agriculture. Asia-Pacific has a significant seed processing market with a wide variety of crops grown including staple food crops, industrial crops, and specialty crops. South America is a major exporter of many agricultural commodities like corn, coffee, and soybean, playing an important role in the seed processing market. Middle East and Africa have traditional farming practices which might also shape the seed processing market, though these regions face challenges with water scarcity and adverse climate.

North America is the largest segment having a significant agricultural sector growing a wide range of crops and incorporating large-scale commercial farming, catering to both domestic and global food supplies. Asia-Pacific is the fastest-growing segment due to its expanding population, which demands more food and industrial crops.

Global Seed Processing Market Key Players:

-

Buhler Group

-

Cimbria

-

AGCO Corporation

-

Syngenta Group

-

Monsanto (now part of Bayer)

-

DowDuPont (now Corteva Agriscience)

-

KWS SAAT SE

-

Limagrain

-

Rijk Zwaan

-

Sakata Seed Corporation

Chapter 1. SEED PROCESSING MARKET- Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SEED PROCESSING MARKET- Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. SEED PROCESSING MARKET- Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. SEED PROCESSING MARKET- Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. SEED PROCESSING MARKET- Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SEED PROCESSING MARKET- By Equipment Type

6.1 Cleaning and Grading equipment

6.2 Coating equipment

6.3 Sorting and Sizing equipment

6.4 Packaging equipment

Chapter 7. SEED PROCESSING MARKET- By Seed Type

7.1 Conventional Seeds

7.2 Genetically Modified Seeds

7.3 Organic Seeds

Chapter 8. SEED PROCESSING MARKET- By Application

8.1 Agricultural crops

8.2 Horticultural crops

8.3 Industrial crops

Chapter 9. SEED PROCESSING MARKET– By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. SEED PROCESSING MARKET– Key Players

10.1 Buhler Group

10.2 Cimbria

10.3 AGCO Corporation

10.4 Syngenta Group

10.5 Monsanto (now part of Bayer)

10.6 DowDuPont (now Corteva Agriscience)

10.7 KWS SAAT SE

10.8 Limagrain

10.9 Rijk Zwaan

10.10 Sakata Seed Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global Seed Processing Market is estimated to be worth USD 11.10 Billion in 2022 and is projected to reach a value of USD 24.49 Billion by 2030, growing at a CAGR of 10.4% during the forecast period 2023-2030.

The Global Seed Processing Market Drivers are the Growing global population and demand for crop protection, disease resistance, and sustainable agricultural practices.

Based on the Seed type, the Global Seed Processing Market is segmented into Conventional seeds, genetically modified seeds, and Organic Seeds

North America is the most dominating country in the Global Seed Processing Market.

Buhler Group, Cimbria, AGCO Corporation, and Syngenta Group are a few of the leading players in the Global Seed Processing Market.