Secure Logistics Market Size (2024 – 2030)

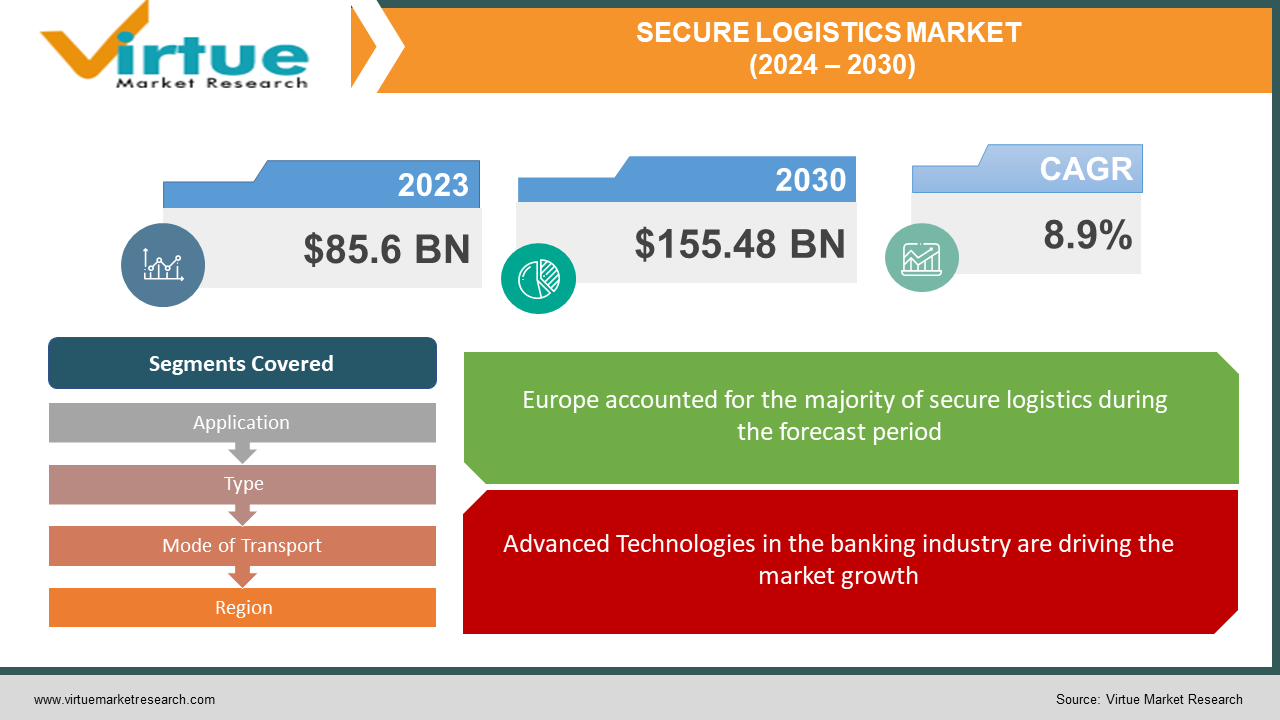

The Secure Logistics Market was valued at USD 85.6 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 155.48 billion by 2030, growing at a CAGR of 8.9%.

Secure logistics encompasses the secure storage, handling, and transportation of various items, including products, goods, and confidential information, as they traverse the supply chain from their origin to their destination. Stringent security measures are essential to mitigate potential risks during transportation, such as theft, damage, loss, or unauthorized access.

The demand for secure movement and management services for currency has escalated due to heightened security concerns within the corporate and banking sectors. In response to these challenges, the European Union has instituted a framework to address constraints and facilitate the smooth mobility of production factors, namely land, labor, and capital.

The global banking industry is undergoing a transformation driven by technical innovation and the deregulation of financial services. This evolution is reshaping the landscape of financial institutions worldwide.

Key Market Insights:

In recent years, the secure logistics market has experienced significant growth, driven by a surge in contracts and a rising demand for outsourcing branch and ATM services globally. Additionally, major industry players have shown a proclivity for the development of high-quality software and systems designed to facilitate secure transactions between businesses and consumers.

Secure Logistics Market Drivers:

Advanced Technologies in the banking industry are driving the market growth.

In emerging economies, the banking sector has historically been characterized by stringent regulations, including controlled deposits and limitations on domestic and foreign market entry. Nevertheless, technological progress and macroeconomic influences have compelled the banking industry to liberalize and welcome foreign competition. Among the emerging economies, BRICS nations are anticipated to attract substantial Foreign Direct Investments (FDIs). The driving forces behind this trend include an expanding skilled labor force, the rapid pace of globalization, and an increasing number of young consumers in these regions.

Secure Logistics Market Restraints and Challenges:

High service costs may restrain market growth.

Secure Logistics specializes in transporting valuable assets like jewelry, diamonds, fine arts, and precious metals. The considerable expenses associated with the transportation and security of these assets ensure the highest level of safety and protection. To handle the transfer of such valuable items, logistics firms require security personnel who are highly trained and skilled. These professionals are responsible for handling and safeguarding packages, possessing specialized training and expertise in weapon handling.

Transporting these assets necessitates the use of armored vehicles and advanced security technology, including tamper-evident seals and GPS tracking systems. The acquisition, maintenance, and upgrading of such equipment entail significant costs. Additionally, companies in the secure logistics market must obtain proper authorization and certification for the use of these equipment and weapons. Many firms engage in research and development to create customized solutions based on client packages and requirements. The implementation of these rigorous security measures and ongoing developments contributes to the overall cost of services provided by secure logistics firms. The high expenses associated with these security measures render the service financially inaccessible to many businesses and individuals.

Secure Logistics Market Opportunities:

The increase in the number of young consumers is creating more opportunities.

The expanding population of High Net-worth Individuals (HNIs) and the escalating demand for wealth management services are poised to have a significant impact on the growth of the banking sector in emerging markets. High net-worth individuals are anticipated to channel their investments into various avenues such as cash deposits, real estate, debt portfolios, and equities. Notably, financial institutions like the State Bank of India (SBI) are strategically emphasizing wealth management, retail banking, and personal banking services to cater to the evolving needs of this affluent demographic.

SECURE LOGISTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.9% |

|

Segments Covered |

By Application, Type, Mode of Transport, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

CMS, Brink's Incorporated., Zegmax Logistics and Security Services, GardaWorld, G4S plc, Cash Logistik Security AG, Loomis Armored US, LLC., Lee & Muirhead Pvt. Ltd, Securitas AB, DynCorp International LLC. |

Secure Logistics Market Segmentation: By Application

-

Cash Management

-

Diamonds

-

Jewelry and Precious Metal

-

Manufacturing

-

Others

While the cash management segment currently dominates the market share, the jewelry & precious metal segment is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period, 2024-2030. This projection is attributed to the increased emphasis on safety standards and the adoption of advanced equipment by secure logistics firms. These measures instill confidence in clients by ensuring the secure transportation of gemstones and jewelry, contributing to the segment's anticipated growth.

Secure Logistics Market Segmentation: By Type

-

Static

-

Mobile

The static segment currently commands the largest market share, contributing to approximately two-thirds of the total revenue in the global secure logistics market. However, the mobile segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period, 2024-2030, driven by the secure mobility features it provides. In mobile logistics solutions, conventional vehicles are eschewed in favor of armored vehicles equipped with advanced security systems for transportation. Additionally, the mobile logistics sector offers air cargo services, facilitating the shipment of precious cargo via aircraft. This approach ensures faster transportation over longer distances, making international movement feasible.

The mobile segment is expected to experience the most rapid growth during the forecast period, thanks to continuous advancements in secure journey management services. Service providers in this segment supply vehicles equipped with electronic countermeasures, radio communication systems, and satellite communication systems. Financial institutions primarily utilize electronic safes provided by these service providers to minimize management downtime. Collaborating with various safe manufacturers, these providers offer a comprehensive range of electronic safe services in different sizes.

Secure Logistics Market Segmentation: By Mode of Transport

-

Roadways

-

Railways

-

Airways

The roadways segment presently holds the largest market share, contributing to almost half of the total revenue in the global secure logistics market. However, railways are anticipated to demonstrate the highest Compound Annual Growth Rate (CAGR) during the outlook period. This projection is attributed to the dedicated and controlled tracks of railways that can be efficiently tracked through the integration of GPS tracking and monitoring systems. The bulk movement of cargo or packages by railways has the potential to decrease overall transportation costs and, in numerous instances, can be more cost-effective compared to road transport. This capability of railways is expected to significantly enhance the market's growth.

Secure Logistics Market Segmentation: by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

Europe currently commands the largest market share, surpassing 42.1% of the global market and establishing itself as one of the most influential markets. The regional growth is expected to be fueled by the increasing penetration of ATMs, especially in emerging economies. The heightened use of ATMs in these regions, coupled with the rising circulation of cash and trade investments among European countries, creates a spectrum of opportunities for secure logistics.

Emerging markets such as Brazil, Nigeria, and Iran are anticipated to exhibit high demand for new ATMs as financial institutions develop in the region. Notably, collaborative efforts such as the Reduce Aviation Freight Theft (RAFT) project, a joint venture between the Australian Federal Police and customs, aim to investigate aviation theft in Australia. The Transported Asset Protection Association (TAPA) forum, uniting global manufacturers, freight carriers, logistics providers, law enforcement agencies, and other stakeholders, strives to reduce losses in international supply chains. In the European Union, the theft of high-risk, high-value products was estimated to cost over 8.2 billion Euros annually.

The Asia Pacific market is poised to register the fastest Compound Annual Growth Rate (CAGR) at 12.2% during the forecast period. Factors contributing to this growth include the increasing demand for ATMs, the expansion of financial institutions, and a rise in freight theft. In North America, a significant market share is expected, driven by the prevalence of cash transactions and consumer preferences for payment methods. Logistics firms in North America are focusing on recruitment opportunities and investments in digital technologies, contributing to the digitization of the logistics supply chain market in the region.

COVID-19 Pandemic: Impact Analysis

The global impact of the COVID-19 pandemic was felt across major industries worldwide, including automobiles, electronics, pharmaceuticals, medical equipment and supplies, and consumer goods. In the initial months of 2020, Chinese ports experienced a 10.1 percent decline in total container volumes handled. substantial constraints globally, affecting key exporting nations like Brazil, China, India, and Mexico, as well as importers such as the European Union. The widespread restrictions imposed across the globe significantly impeded the growth of the market.

Latest Trends/ Developments:

-

In March 2023, The Brink's Company announced the launch of its BLUebeam digital cash payment solution on Clover from Fiserv, a prominent point-of-sale (POS) and business management system supporting the success of small and mid-sized businesses (SMBs). Through this innovative approach, Clover retailers can efficiently collect cash earnings, receiving an advance credit to their bank accounts the following day.

-

In May 2023, SISnet, the insurance core of Prosegur AVOS, introduced its 13th edition, aiming to provide users with greater control over platform features through the Zero Code paradigm. Additionally, advanced technologies like machine learning are employed to identify anomalies in the monitored processes, expanding the market's growth potential globally.

-

In 2022, Prosegur and Forética, a prominent organization in corporate social responsibility and sustainability in Spain, entered into a cooperation agreement to establish alliances that accelerate the transition to a sustainable model. Market players are increasingly focusing on partnerships and collaborations as strategies to gain competitive advantages.

-

In February 2022, Brink’s Inc. forged a partnership agreement with Courtyard, a physically-backed NFT platform, showcasing the ongoing trend of collaborations within the industry.

Key Players:

These are the top 10 players in the Secure Logistics Market: -

-

CMS

-

Brink's Incorporated.

-

Zegmax Logistics and Security Services

-

GardaWorld

-

G4S plc

-

Cash Logistik Security AG

-

Loomis Armored US, LLC.

-

Lee & Muirhead Pvt. Ltd

-

Securitas AB

-

DynCorp International LLC.

Chapter 1. Secure Logistics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Secure Logistics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Secure Logistics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Secure Logistics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Secure Logistics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Secure Logistics Market – By Type

6.1 Introduction/Key Findings

6.2 Static

6.3 Mobile

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Secure Logistics Market – By Application

7.1 Introduction/Key Findings

7.2 Cash Management

7.3 Diamonds

7.4 Jewelry and Precious Metal

7.5 Manufacturing

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Secure Logistics Market – Mode of Transport

8.1 Introduction/Key Findings

8.2 Roadways

8.3 Railways

8.4 Airways

8.5 Y-O-Y Growth trend Analysis Mode of Transport

8.6 Absolute $ Opportunity Analysis Mode of Transport, 2024-2030

Chapter 9. Secure Logistics Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 Mode of Transport

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 Mode of Transport

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 Mode of Transport

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 Mode of Transport

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 Mode of Transport

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Secure Logistics Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1 CMS

10.2 Brink's Incorporated.

10.3 Zegmax Logistics and Security Services

10.4 GardaWorld

10.5 G4S plc

10.6 Cash Logistik Security AG

10.7 Loomis Armored US, LLC.

10.8 Lee & Muirhead Pvt. Ltd

10.9 Securitas AB

10.10 DynCorp International LLC.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The secure logistics market has experienced significant growth, driven by a surge in contracts and a rising demand for outsourcing branch and ATM services globally.

The top players operating in the Secure Logistics Market are - CMS, Brink's Incorporated., Zegmax Logistics and Security Services, GardaWorld, G4S plc, Cash Logistik Security AG, Loomis Armored US, LLC., Lee & Muirhead Pvt. Ltd, Securitas AB, DynCorp International LLC.

The global impact of the COVID-19 pandemic was felt across major industries worldwide, including automobiles, electronics, pharmaceuticals, medical equipment and supplies, and consumer goods.

The expanding population of High Net-worth Individuals (HNIs) and the escalating demand for wealth management services are poised to have a significant impact on the growth of the banking sector in emerging markets.

The Asia Pacific market is poised to register the fastest Compound Annual Growth Rate (CAGR) at 12.2% during the forecast period. Factors contributing to this growth include the increasing demand for ATMs, the expansion of financial institutions, and a rise in freight theft.