Seamless Pipes Market Size (2024 – 2030)

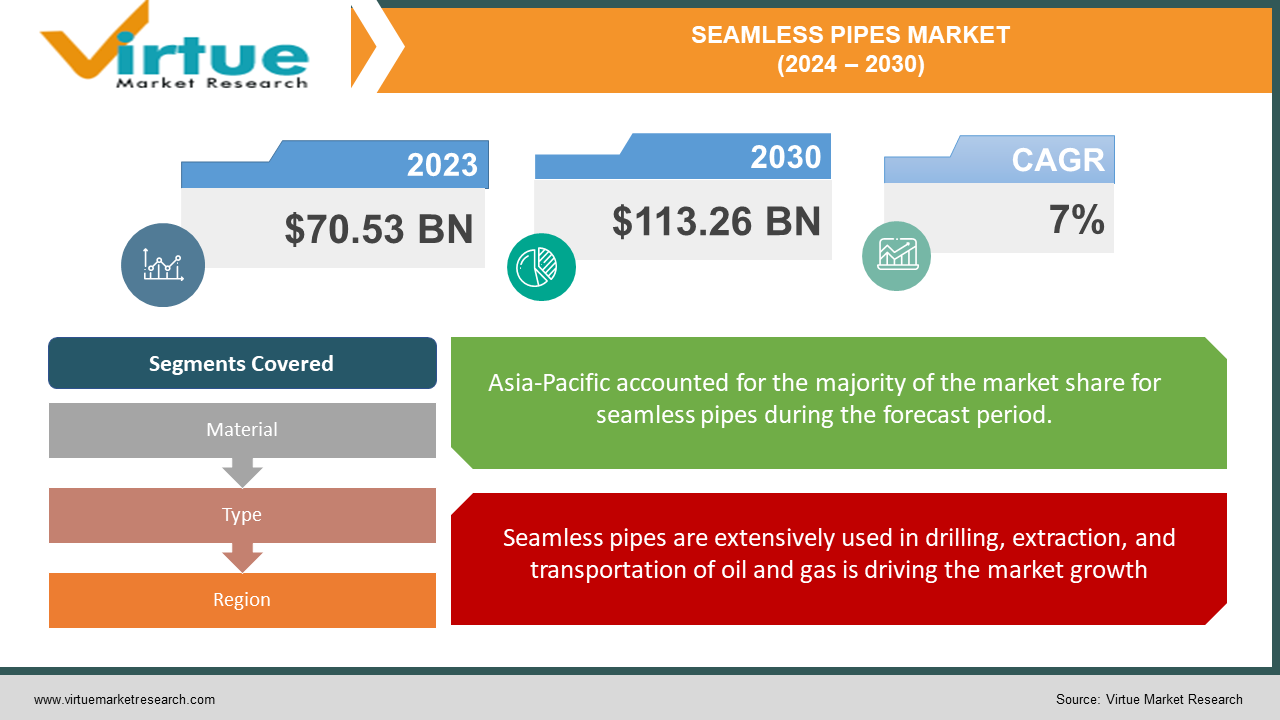

The Global Seamless Pipes Market was valued at USD 70.53 billion in 2023 and will grow at a CAGR of 7% from 2024 to 2030. The market is expected to reach USD 113.26 billion by 2030.

Seamless pipes are extensively used in the drilling, extraction, and transportation of oil. Their superior strength and resistance to bursts ensure they can handle the high pressures and corrosive environments encountered deep underground. Seamless pipes are used in building construction for applications like water supply, sewage systems, and structural support. The seamless pipe market is undergoing a transformation fueled by innovation. From exploring advanced materials like high-performance alloys and composites to embracing sustainable practices with recycled steel and green production methods.

Key Market Insights:

-

Asia-Pacific currently holds the largest market share, exceeding 37.2% in 2023. This dominance is attributed to the region's booming oil and gas sector, which heavily utilizes seamless pipes

-

Oil & gas is the primary end-use industry for seamless pipes, accounting for nearly 40% of the market share in 2023

-

The seamless pipe market is segmented based on the manufacturing process, with hot finishing being the most prevalent method due to its cost-effectiveness.

-

The seamless pipes market is expected to reach US$117 billion by 2034, growing at a higher CAGR

Global Seamless Pipes Market Drivers:

Seamless pipes are extensively used in drilling, extraction, and transportation of oil and gas is driving the market growth

The lifeblood of the oil and gas industry flows through seamless pipes. From the very beginning of the extraction process, seamless pipes are crucial for withstanding the demanding conditions encountered during drilling. Their superior strength and resistance to bursts ensure they can handle the high pressures and corrosive environments encountered deep underground. Seamless pipes don't stop there; they're also vital for transporting extracted oil and gas over long distances. Whether traveling through underground pipelines or offshore rigs, seamless pipes guarantee safe and efficient transportation, minimizing the risk of leaks or ruptures that could be environmentally catastrophic. This critical role becomes even more important as global energy demands continue to rise. As exploration activities extend to harsher environments like deep sea exploration or unconventional resource extraction, the dependable performance of seamless pipes becomes even more valuable. Their ability to handle extreme pressures, temperatures, and corrosive substances makes them the go-to choice for ensuring the safe and efficient extraction and transportation of oil and gas, a vital resource for the global economy.

Seamless pipes are used in building construction for applications like water supply, sewage systems, and structural support is driving the market growth

The hidden backbone of modern buildings, seamless pipes play a vital role in building construction. They ensure the smooth flow of essential utilities and even contribute to the structural integrity of a building. Seamless pipes are the workhorses behind our water supply systems, delivering clean water throughout a building. Their durability and resistance to leaks prevent pipe bursts that could cause water damage and disruptions. Similarly, seamless pipes are the unseen heroes of sewage systems, efficiently transporting wastewater away from buildings. Their robust construction ensures they can handle the pressure and potential corrosive elements within the system. But seamless pipes go beyond utilities. In some constructions, they are used as structural support elements, particularly for columns and beams. Their high strength-to-weight ratio allows them to bear significant loads, contributing to the overall stability of the building. This versatility, coupled with the growing urbanization and infrastructure projects in developing economies, is fueling the demand for seamless pipes in the construction industry. As cities expand and new buildings rise, seamless pipes will continue to be the silent partners ensuring the functionality and safety of our built environment.

Modernization of Aging Infrastructure is driving the market growth

Time takes its toll on everything, and our underground pipe infrastructure is no exception. Years of wear and tear, coupled with potential corrosion and leaks, can leave aging pipelines compromised and in desperate need of replacement. This is where seamless pipes step in as the knight in shining armor for our water distribution systems. Unlike traditional welded pipes, seamless pipes boast a key advantage – the absence of welds. These weak points in welded pipes are particularly susceptible to failure, potentially leading to catastrophic bursts and disruptions. Seamless pipes, on the other hand, eliminate this risk thanks to their uniform construction. Their superior strength and resistance to corrosion make them ideal for enduring the harsh underground environment. This translates to a longer lifespan for the replaced pipelines, minimizing the need for frequent repairs and disruptions. Seamless pipes offer a cost-effective solution in the long run, reducing the need for constant replacements and maintenance associated with deteriorating infrastructure. As cities invest in upgrading their aging water distribution systems, seamless pipes become the reliable choice for ensuring a safe and sustainable supply of clean water for generations to come.

Global Seamless Pipes Market challenges and restraints:

Competition from Welded Pipes is restricting the market growth

The seamless pipe market faces a growing challenge from advancements in welding. These innovations have resulted in welded pipes with strength and reliability nearly matching seamless options. This puts pressure on seamless pipe prices, particularly for applications where welds are no longer a significant concern. Since seamless pipes involve a more complex manufacturing process, they can be more expensive. To stay competitive, seamless pipe manufacturers may need to focus on niche applications where their superior strength or ability to withstand high pressure remains unmatched.

Stringent Environmental Regulations are restricting the market growth

Stricter environmental regulations can pose a double-edged sword for seamless pipe manufacturers. While these regulations are crucial for sustainability, they can limit production capacity in two ways. Firstly, adhering to stricter emission standards might necessitate upgrades to manufacturing facilities, potentially leading to temporary shutdowns or reduced output. Secondly, regulations around waste disposal can add extra steps and costs to the process. For instance, proper treatment of wastewater or implementing stricter recycling procedures can increase operational expenses. However, these challenges can also be opportunities. Manufacturers who invest in eco-friendly technologies or adopt closed-loop manufacturing processes can not only comply with regulations but also burnish their environmental credentials, potentially attracting eco-conscious clients.

Market Opportunities:

The Seamless Pipes Market presents exciting growth opportunities. Firstly, the increasing focus on renewable energy infrastructure, like wind and solar power, creates demand for high-performance pipes that can withstand extreme weather conditions. Seamless pipes, with their superior strength and durability, are well-positioned to meet these needs. Secondly, the growing urbanization trend in developing countries necessitates robust pipelines for water distribution and sewage systems. Here, seamless pipes' resistance to corrosion and high pressure makes them a compelling choice. Furthermore, advancements in material science can unlock new opportunities. Developing lighter yet stronger alloys can make seamless pipes even more competitive and open doors to applications in weight-sensitive sectors like aerospace or transportation. Additionally, the oil and gas industry, though facing some fluctuations, is expected to see long-term growth, particularly in offshore exploration. Seamless pipes remain the preferred choice for their ability to handle the high pressure and harsh environments encountered in deep-sea drilling. By capitalizing on these trends and continuously innovating, the Seamless Pipes Market can solidify its position as a vital component in building a sustainable and resilient future.

SEAMLESS PIPES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Material, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ArcelorMittal, Nippon Steel & Sumitomo Metal Corporation., JFE Steel Corporation, Tenaris SA, Vallourec SA, Jindal Saw Ltd, United States Steel Corporation, Tata Steel, Mahler Polska Spółka zo.o., Tianjin Pipe (Group) Corporation |

Seamless Pipes Market Segmentation - By Material

-

Steel & Alloys

-

Copper & Alloys

-

Nickel & Alloys

-

Aluminum and Magnesium Alloys

Within the Seamless Pipes Market, steel and its alloys reign supreme. This dominance stems from the inherent strength and affordability of steel. While copper, nickel, and aluminum alloys offer specialized advantages in corrosion resistance, weight reduction, or extreme temperature tolerance, their production pales in comparison to steel. The sheer cost-effectiveness and inherent durability of steel make it the go-to material for most seamless pipe applications. However, within the steel segment itself, there's further differentiation. Depending on the specific needs of the application, sub-segments like carbon steel, low-alloy steel, and high-alloy steel cater to varying requirements for strength, pressure tolerance, and cost.

Seamless Pipes Market Segmentation - By Type

-

Hot Finished Seamless Pipes

-

Cold Finished Seamless Pipes

Hot Finished Seamless Pipes dominate the market due to their affordability and efficient manufacturing process. They're produced by hot rolling, a simpler and faster method compared to the cold rolling used for cold-finished pipes. This translates to lower production costs, making them the go-to choice for many applications where tight tolerances or a super smooth surface aren't essential. While cold-finished pipes offer superior qualities, their higher price tag makes them more suitable for specialized situations.

Seamless Pipes Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific leads the pack as the dominant region in the seamless pipes market. This dominance is fueled by a booming oil and gas industry, particularly in countries like China and India. Extensive pipeline networks for oil, gas, and water are driving demand for these high-quality pipes. The Fastest-growing region is South America and the Middle East & Africa. These regions are experiencing significant growth due to factors like rising oil and gas exploration activities, government investments in infrastructure development, and a growing focus on modernizing aging pipelines.

COVID-19 Impact Analysis on the Global Seamless Pipes Market

The COVID-19 pandemic cast a shadow on the seamless pipes market, causing a temporary setback in 2020. The initial shockwaves sent ripples through various industries that heavily rely on seamless pipes. Lockdowns and travel restrictions disrupted oil and gas exploration activities, leading to a decline in demand for pipes used in drilling and transportation. Furthermore, the stalling of construction projects due to labor shortages and supply chain disruptions caused a drop in demand for seamless pipes in the building and infrastructure sectors. This resulted in a market value erosion estimated to be around USD 25 billion in 2020.

However, the impact wasn't permanent. As economies began to adapt to the "new normal," signs of recovery emerged. The oil and gas industry, a crucial driver for seamless pipes, showed signs of a rebound as energy demands returned. Infrastructure projects resumed, and construction activities picked up pace, reigniting the demand for seamless pipes in these sectors. Additionally, a growing focus on upgrading aging pipelines to ensure safety and efficiency in water distribution systems presented a new opportunity for seamless pipes.

The pandemic also triggered a shift towards online marketplaces for seamless pipes, offering a convenient alternative to traditional brick-and-mortar stores. While the long-term impact of COVID-19 is still unfolding, the market is expected to recover and reach pre-pandemic levels by 2025. Looking ahead, factors like rising global energy demands, ongoing infrastructure development in developing economies, and the need to replace aging pipelines are expected to propel the seamless pipes market toward a steady growth trajectory in the coming years.

Latest trends/Developments

The seamless pipe market is undergoing a transformation fueled by innovation. From exploring advanced materials like high-performance alloys and composites to embracing sustainable practices with recycled steel and green production methods, manufacturers are pushing the boundaries of what these pipes can achieve. Industry 4.0 is also making its mark with automation improving efficiency and digitalization streamlining everything from inventory management to predictive maintenance. The market itself is evolving geographically, with Asia-Pacific's booming infrastructure projects leading the surge, while regions like South America and the Middle East & Africa see rising demand due to increased focus on oil & gas exploration and infrastructure development. This dynamic landscape presents exciting opportunities for manufacturers who can adapt and cater to the evolving needs of the future.

Key Players:

-

ArcelorMittal

-

Nippon Steel & Sumitomo Metal Corporation

-

JFE Steel Corporation

-

Tenaris SA

-

Vallourec SA

-

Jindal Saw Ltd

-

United States Steel Corporation

-

Tata Steel

-

Mahler Polska Spółka z o.o.

-

Tianjin Pipe (Group) Corporation

Chapter 1. Seamless Pipes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Seamless Pipes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Seamless Pipes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Seamless Pipes Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Seamless Pipes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Seamless Pipes Market – By Type

6.1 Introduction/Key Findings

6.2 Hot Finished Seamless Pipes

6.3 Cold Finished Seamless Pipes

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Seamless Pipes Market – By Material

7.1 Introduction/Key Findings

7.2 Steel & Alloys

7.3 Copper & Alloys

7.4 Nickel & Alloys

7.5 Aluminum and Magnesium Alloys

7.6 Y-O-Y Growth trend Analysis By Material

7.7 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Seamless Pipes Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Material

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Material

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Material

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Material

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Material

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Seamless Pipes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ArcelorMittal

9.2 Nippon Steel & Sumitomo Metal Corporation

9.3 JFE Steel Corporation

9.4 Tenaris SA

9.5 Vallourec SA

9.6 Jindal Saw Ltd

9.7 United States Steel Corporation

9.8 Tata Steel

9.9 Mahler Polska Spółka z o.o.

9.10 Tianjin Pipe (Group) Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Seamless Pipes Market was valued at USD 70.53 billion in 2023 and will grow at a CAGR of 7% from 2024 to 2030. The market is expected to reach USD 113.26 billion by 2030.

Seamless pipes are extensively used in drilling, extraction, and transportation of oil, Seamless pipes are used in building construction for applications like water supply, sewage systems, and structural support these are the reasons that are driving the market.

Based on product type it is divided into four segments – Steel & Alloys, Copper & Alloys, Nickel & Alloys, Aluminum and Magnesium Alloys.

Asia-Pacific is the most dominant region for the Seamless Pipes Market.

ArcelorMittal, Nippon Steel & Sumitomo Metal Corporation, JFE Steel Corporation, Tenaris SA