Seam Tapes Market Size (2024-2030)

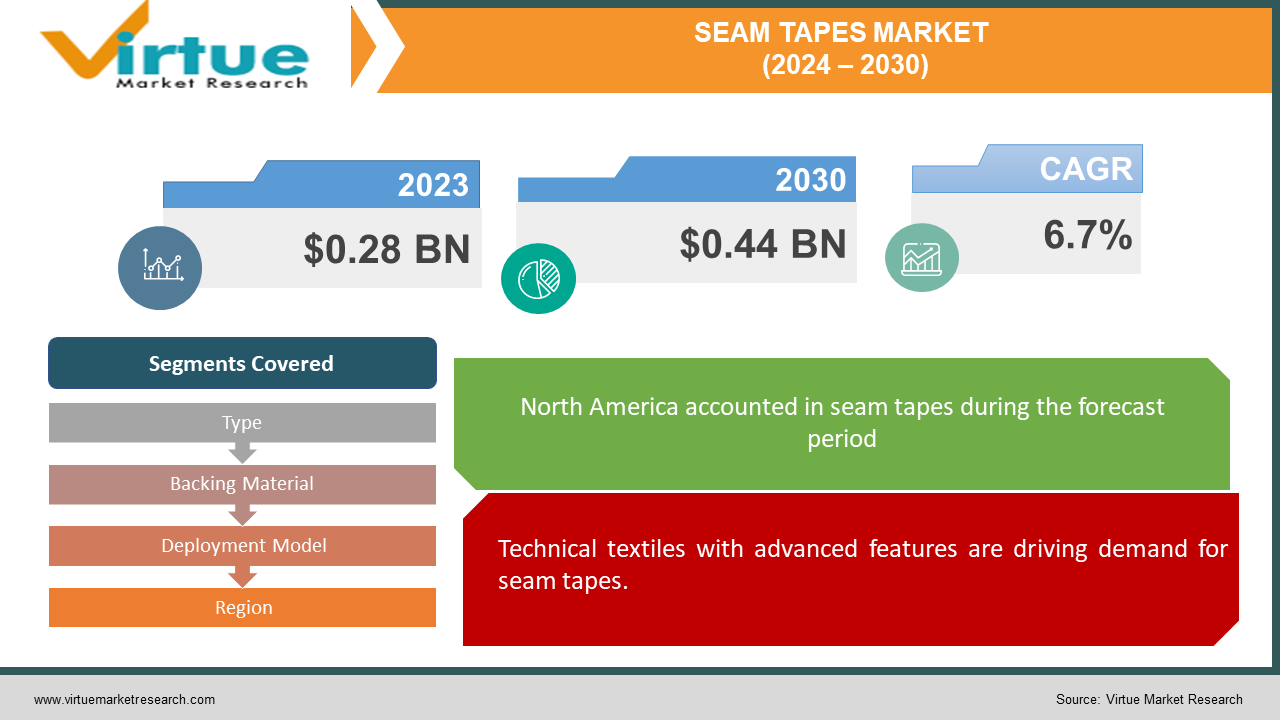

The Seam Tapes Market was valued at USD 0.28 billion in 2023 and is projected to reach a market size of USD 0.44 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.7%.

The seam tapes market is on a roll, driven by the growing demand for clothes and gear that can handle anything you throw at it. Technical textiles with features like waterproofing, windproofing, and breathability are all the rage, and seam tapes are a key ingredient in making them. This trend, along with the growing popularity of outdoor and sports apparel, is fueling the market's growth, especially in regions with rising disposable incomes. Seam tapes aren't just for clothing though, they find uses in footwear, cars, construction, and even packaging. The future looks bright for seam tapes with advancements in textiles and the ever-present need for protective gear.

Key Market Insights:

Seam tapes are the secret ingredient that allows these textiles to perform, making them crucial for outdoor apparel, sportswear, and even some casual wear. This trend, coupled with the booming popularity of active lifestyles and outdoor activities, is fueling significant market growth. As disposable incomes rise in developing economies, the demand for these technical textiles is expected to skyrocket. This presents a golden opportunity for seam tape manufacturers to expand their reach into these new markets.

However, the seam tape industry isn't without its challenges. Fluctuating raw material prices pose a constant threat, potentially squeezing manufacturer margins and impacting the affordability of seam-sealed products for consumers.

Despite this hurdle, the future looks bright for seam tapes. Advancements in textile technology are constantly opening doors for innovation. New materials and production methods are leading to the development of lighter, stronger, and more breathable fabrics, all of which require effective seam-sealing solutions. Seam tapes are poised to remain a vital component in the ever-evolving world of functional textiles.

The Seam Tapes Market Drivers:

Technical textiles with advanced features are driving demand for seam tapes.

Technical textiles with advanced functionalities like waterproofing, breathability, and windproofing are taking center stage. Seam tapes are the secret weapon behind these features, making them essential for creating high-performance sportswear, outdoor apparel, and even some functional casual wear. The surging demand for such clothing directly translates to a growing need for seam tapes.

The growing popularity of outdoor activities and activewear is fueling the seam tapes market.

The ever-increasing popularity of outdoor activities and active lifestyles is a major driver. Consumers are demanding high-performance clothing and gear that can handle any adventure. Seam tapes are crucial for creating these durable and weatherproof products, ensuring comfort and protection during outdoor pursuits.

Rising disposable incomes in developing economies present a lucrative opportunity for seam tape manufacturers.

As disposable incomes rise in developing countries, the demand for functional clothing and outdoor gear is expected to skyrocket. This presents a golden opportunity for seam tape manufacturers to tap into these new markets. As these economies grow, the need for seam tapes to create performance-driven clothing is anticipated to rise as well.

Advancements in textile technology are creating new opportunities for innovative seam tapes.

Innovation in the textile industry is constantly creating new opportunities for seam tapes. New materials and production methods are leading to the development of lighter, stronger, and more breathable fabrics. These advancements require effective seam sealing solutions, further propelling the seam tapes market.

The increasing focus on sustainability is leading to the development of eco-friendly seam tapes.

Consumers are becoming more environmentally conscious, and the demand for sustainable solutions is growing across industries. Manufacturers are developing eco-friendly seam tapes made from recycled materials or with lower environmental footprints. This trend can potentially open up new avenues for the seam tapes market.

The Seam Tapes Market Restraints and Challenges:

The seam tapes market, despite its promising growth trajectory, faces a few challenges that can impede its progress. A major hurdle is the volatility of raw material prices. Seam tapes rely on materials like natural rubber, films, adhesives, and nylon/polyester fabrics. Since most of these are derived from petroleum, their prices fluctuate with the global oil market. This instability can squeeze profit margins for manufacturers and potentially make seam-sealed products less affordable for consumers.

Environmental concerns pose another challenge. Traditional seam tapes often contain harmful chemicals or have non-biodegradable components. This raises environmental red flags, and stricter regulations on these materials could disrupt the market. Manufacturers may need to invest in developing eco-friendly alternatives to stay compliant.

Finally, the seam tapes market is becoming increasingly competitive. As demand grows, so does the competition. Manufacturers need to constantly innovate and develop new, high-performance seam tapes to differentiate themselves. This pressure to stay ahead of the curve can be a challenge, especially for smaller players in the market. Overall, while the seam tapes market enjoys strong tailwinds, navigating these challenges will be crucial for sustained growth.

The Seam Tapes Market Opportunities:

The future of seam tapes is brimming with exciting opportunities. The market is poised to expand beyond its traditional strongholds in apparel and footwear. The rise of technical textiles in construction, automotive, and even medical supplies opens doors for seam tapes to play a crucial role in creating waterproof, windproof, and durable products across various industries. Innovation is another key driver, with advancements in material science leading to the development of new seam tapes boasting improved functionalities like enhanced breathability, higher temperature resistance, or even self-healing properties. These advancements will allow seam tapes to tackle even more demanding applications. Sustainability is also a major area of opportunity. As environmental consciousness grows, manufacturers can develop eco-friendly seam tapes made from recycled materials or with lower environmental footprints, catering to the rising demand for sustainable solutions and potentially becoming a key differentiator in the market. Furthermore, the growing popularity of e-commerce platforms creates new avenues for manufacturers to reach a wider customer base, which can be particularly beneficial for smaller players or those targeting niche markets. Finally, offering customized seam tape solutions tailored to specific customer needs can be a valuable strategy. This could involve customizing features like size, color, or adhesive strength to meet the unique requirements of different applications, ensuring seam tapes remain a vital component in the ever-evolving world of functional textiles.

SEAM TAPES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Type, Backing Material, Deployment Model, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bemis Associates, Season, HiMEL, Gerlinger Industries, Adhesive Films, Toray Industries, Loxy, San Chemicals |

Seam Tapes Market Segmentation: By Type

-

Single-Layered

-

Multi-Layered

When it comes to type, multi-layered seam tapes reign supreme in the market. They offer superior strength, durability, and waterproofing compared to single-layered options, making them ideal for high-performance applications. Interestingly, multi-layered tapes are also expected to be the fastest-growing segment. This is likely driven by the continuous advancements in material science that enhance functionalities like breathability and temperature resistance, opening doors for even more demanding applications.

Seam Tapes Market Segmentation: By Backing Material

-

Polyurethane (PU)

-

Thermoplastic Polyurethane (TPU)

-

Polyamide

The polyurethane (PU) segment is the most dominant in the seam tapes market by backing material. This is due to PU's elasticity, flexibility, and weather resistance, making it ideal for comfortable and long-lasting performance in apparel and footwear. The fastest-growing segment is anticipated to be the Asia Pacific region. This is driven by the increasing demand for functional clothing and outdoor gear in developing economies within this area.

Seam Tapes Market Segmentation: By Deployment Model

-

Apparel

-

Footwear

-

Automotive

-

Construction

-

Packaging

The apparel industry reigns supreme in the seam tapes market By Deployment Model, encompassing a wide range of clothing including sportswear, outdoor gear, outerwear, and even some casual wear. This dominance is fueled by the ever-growing demand for functional clothing with features like waterproofing and breathability. Geographically, the Asia Pacific region is experiencing the fastest growth due to rising disposable incomes and a surge in demand for technical textiles.

Seam Tapes Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The North American market boasts a strong demand for technical textiles and high-performance outdoor gear. Consumers here are brand-savvy and willing to pay a premium for quality and features like waterproofing and breathability in their clothing. This focus on performance fuels the demand for high-quality seam tapes in North America.

A well-developed market, Europe prioritizes both quality and innovation. Manufacturers here focus on developing technically advanced and durable seam tapes. Additionally, strict environmental regulations play a role, in influencing the types of materials used in seam tape production within the region.

Asia Pacific region is the current growth champion. Rising disposable incomes and a surging demand for functional clothing and outdoor gear are propelling the market forward. The presence of major garment manufacturing hubs in Asia Pacific further accelerates market expansion, making it a key area for seam tape manufacturers.

COVID-19 Impact Analysis on the Seam Tapes Market:

The COVID-19 pandemic threw a curveball at the seam tapes market, disrupting its steady growth. Lockdowns and travel restrictions caused havoc on global supply chains, making it difficult to get raw materials and finished seam tapes, leading to shortages and price fluctuations. This wasn't helped by a slump in demand for apparel and footwear, particularly categories that rely heavily on seam tapes like sportswear and outdoor gear. Restrictions on movement and a shift to working from home meant people weren't buying these items as much, further dampening the demand for seam tapes used in them. Production slowdowns due to lockdowns and workforce safety concerns added another layer of difficulty, limiting the overall supply of seam tapes.

However, there were some silver linings amidst the disruption. The surge in demand for personal protective equipment (PPE) during the pandemic provided a temporary boost to the seam tapes market, as coveralls and medical gowns often use them for waterproofing and protection. Additionally, the growth of e-commerce during lockdowns benefitted seam tape manufacturers with a strong online presence, offering an alternative sales channel to offset some of the decline in traditional retail sales. Most importantly, the long-term drivers of the seam tapes market, like the growing demand for functional textiles, remain strong. As economies recover and consumer spending patterns return to normal, the demand for seam tapes is expected to bounce back. While the pandemic undoubtedly caused a temporary setback, the seam tapes market's ability to adapt and the ongoing demand for functional textiles suggest a brighter future ahead.

Latest Trends/ Developments:

The seam tapes market is abuzz with innovation. Sustainability is a major focus, with manufacturers developing eco-friendly seam tapes made from recycled materials or bio-based components to cater to environmentally conscious brands and consumers. The future might even hold smart seam tapes with embedded sensors that can monitor aspects like temperature or strain on clothing, perfect for performance apparel or medical wearables. Self-healing seam tapes are another exciting concept being explored, offering the potential to automatically repair minor tears and extend garment life. Nanotechnology is also on the horizon, with nanoparticles potentially being incorporated into seam tapes to improve water repellency, breathability, or even flame retardancy. Finally, customization is a growing trend, allowing manufacturers to tailor seam tape solutions with specific features like size, color, adhesive strength, or fire resistance to perfectly match the needs of their customers. With these advancements, the seam tapes market is poised for continued growth and exciting new possibilities.

Key Players:

-

Bemis Associates

-

Season

-

HiMEL

-

Gerlinger Industries

-

Adhesive Films

-

Toray Industries

-

Loxy

-

San Chemicals

Chapter 1. Seam Tapes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Seam Tapes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Seam Tapes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Seam Tapes Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Seam Tapes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Seam Tapes Market – By Type

6.1 Introduction/Key Findings

6.2 Single-Layered

6.3 Multi-Layered

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Seam Tapes Market – By Backing Material

7.1 Introduction/Key Findings

7.2 Polyurethane (PU)

7.3 Thermoplastic Polyurethane (TPU)

7.4 Polyamide

7.5 Y-O-Y Growth trend Analysis By Backing Material

7.6 Absolute $ Opportunity Analysis By Backing Material, 2024-2030

Chapter 8. Seam Tapes Market – By Deployment Model

8.1 Introduction/Key Findings

8.2 Apparel

8.3 Footwear

8.4 Automotive

8.5 Construction

8.6 Packaging

8.7 Y-O-Y Growth trend Analysis By Deployment Model

8.8 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 9. Seam Tapes Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Backing Material

9.1.4 By Deployment Model

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Backing Material

9.2.4 By Deployment Model

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Backing Material

9.3.4 By Deployment Model

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Backing Material

9.4.4 By Deployment Model

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Backing Material

9.5.4 By Deployment Model

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Seam Tapes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Bemis Associates

10.2 Season

10.3 HiMEL

10.4 Gerlinger Industries

10.5 Adhesive Films

10.6 Toray Industries

10.7 Loxy

10.8 San Chemicals

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Seam Tapes Market was valued at USD 0.28 billion in 2023 and is projected to reach a market size of USD 0.44 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.7%.

Functional Textiles Revolution, Active Lifestyles and Outdoor Gear Craze, Emerging Economies: A Lucrative Market, Technological Advancements in Textiles, Increased Focus on Sustainability.

Apparel, Footwear, Automotive, Construction, Packaging.

The Asia Pacific region currently reigns supreme in the Seam Tapes Market, driven by rising disposable incomes and a surging demand for functional clothing.

Bemis Associates, Sealon, HiMEL, Gerlinger Industries, Adhesive Films, Toray Industries, Loxy, San Chemicals.