Seafood Physical & Chemical Detection Market Size (2024 – 2030)

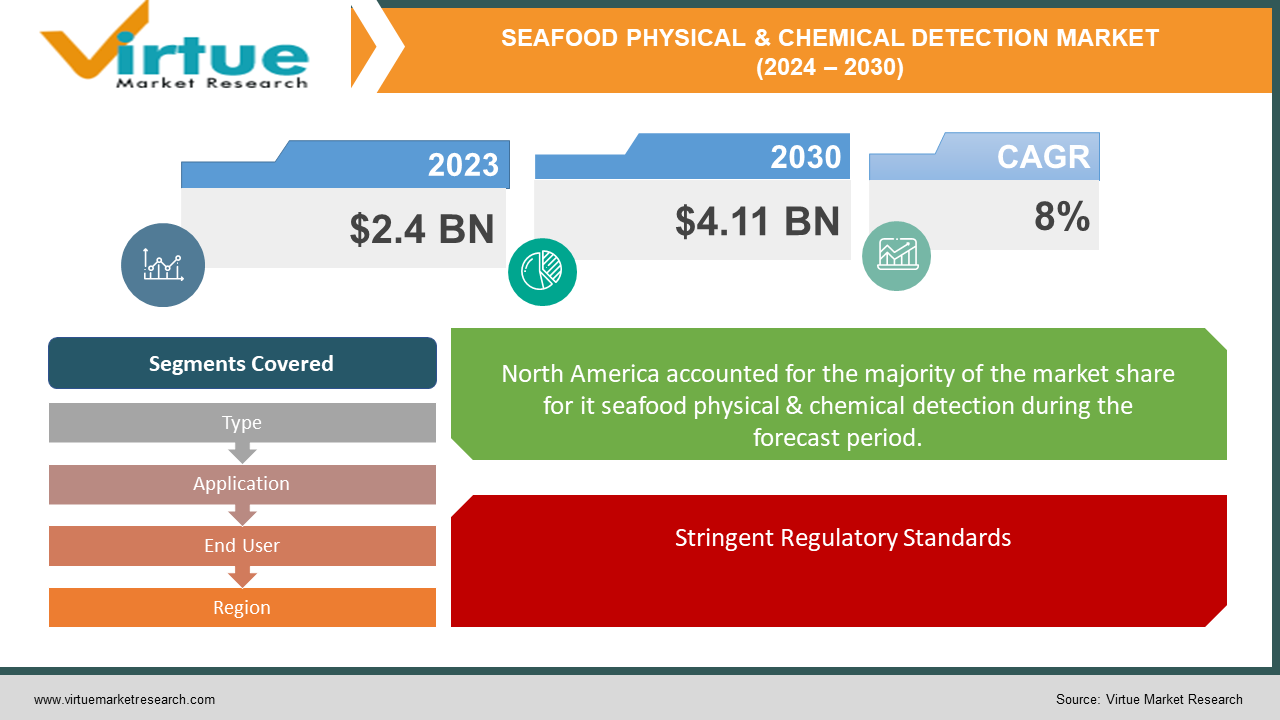

The Global Seafood Physical & Chemical Detection Market, valued at USD 2.4 billion in 2023, is projected to achieve a market size of USD 4.11 billion by 2030. This growth trajectory anticipates a compound annual growth rate (CAGR) of 8% from 2024 to 2030.

The Seafood Physical & Chemical Detection Market is defined as the array of technologies and methodologies employed to assess the quality, safety, and authenticity of seafood products through physical and chemical analysis. This burgeoning market is driven by increasing global concerns about food safety, stringent regulatory requirements, and the rising incidence of food fraud and contamination. Innovations in detection technologies, such as advanced spectroscopy, chromatography, and biosensors, are at the forefront, enhancing the precision and speed of identifying contaminants, adulterants, and nutritional profiles in seafood. The market is further bolstered by the growing consumer demand for transparency and traceability in food supply chains, spurred by heightened awareness of health risks associated with seafood consumption. Key players in this industry are investing in research and development to create more sophisticated and user-friendly detection systems, catering to a wide range of stakeholders including regulatory agencies, seafood processors, and retailers. Regionally, North America and Europe are leading the charge due to their robust regulatory frameworks and technological advancements, while Asia-Pacific is rapidly emerging as a significant market owing to its vast seafood production and export activities. As the seafood industry continues to expand and global trade intensifies, the importance of reliable detection methods becomes paramount, ensuring that seafood products meet safety standards and maintain consumer trust. The future of the Seafood Physical & Chemical Detection Market looks promising, with ongoing technological innovations and increasing collaboration among industry players aiming to safeguard public health and ensure the integrity of the global seafood supply chain.

Key Market Insights:

Asia-Pacific is the fastest-growing region in the Seafood Physical & Chemical Detection Market, driven by the increasing seafood consumption and stringent regulatory standards in countries like China, Japan, and South Korea.

North America and Europe also hold significant market shares due to advanced seafood processing industries and strict food safety regulations.

There is a growing demand for portable and handheld detection devices that provide on-site and quick testing solutions for physical and chemical parameters.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in detection systems is enabling real-time data analysis and predictive maintenance, thus reducing the risk of contamination and ensuring higher safety standards.

The enforcement of stringent regulations by bodies such as the European Food Safety Authority (EFSA), Food and Drug Administration (FDA) in the U.S., and China Food and Drug Administration (CFDA) is propelling the market growth.

Quality Control applications dominate the market, accounting for over 50% of the total market share in 2023. This includes ensuring the freshness, nutritional content, and absence of contaminants in seafood.

Global Seafood Physical & Chemical Detection Market Drivers:

Stringent Regulatory Standards:

Governments and international bodies have established rigorous regulations to ensure the safety and quality of seafood products. Compliance with these standards necessitates advanced physical and chemical detection methods to identify contaminants, pathogens, and chemical residues, thereby driving the demand for sophisticated testing solutions in the industry.

Technological Advancements in Detection Methods:

Continuous innovations and advancements in detection technologies have significantly enhanced the accuracy, speed, and reliability of seafood testing. Cutting-edge methods such as mass spectrometry, chromatography, and biosensors are becoming more accessible and cost-effective, facilitating their widespread adoption. This technological progress is a pivotal driver in the expansion of the seafood physical and chemical detection market.

Challenges in the Global Seafood Physical & Chemical Detection Market:

The implementation of sophisticated physical and chemical detection technologies often requires significant financial investment.

This includes the cost of high-end equipment, ongoing maintenance, and specialized personnel training. These expenses can be prohibitive for small and medium-sized enterprises (SMEs) in the seafood industry, limiting their ability to adopt these technologies. Consequently, the market may face slower growth as these SMEs struggle to meet stringent safety and quality standards without affordable access to advanced detection methods.

The seafood industry operates under a complex web of international, national, and regional regulations aimed at ensuring food safety and quality.

These regulations can vary significantly between different markets, creating challenges for companies that operate globally. The need to comply with diverse regulatory requirements can increase the operational burden and cost for seafood companies, making it difficult to standardize detection processes. This regulatory variability can hinder market expansion and create barriers for new entrants, thereby restraining the overall growth of the Seafood Physical & Chemical Detection Market.

Opportunities in the Global Seafood Physical & Chemical Detection Market:

The seafood physical and chemical detection market presents a significant opportunity to enhance food safety and quality assurance.

With increasing consumer awareness about food safety, there is a growing demand for comprehensive testing methods that ensure the detection of contaminants, pathogens, and chemical residues in seafood products. This market segment can leverage advanced technologies, such as high-performance liquid chromatography (HPLC) and mass spectrometry, to provide accurate and reliable testing results. By addressing stringent regulatory standards and meeting the expectations of health-conscious consumers, companies in this market can establish themselves as trusted providers of food safety solutions, thereby driving market growth and expanding their client base.

SEAFOOD PHYSICAL & CHEMICAL DETECTION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Type, Applications, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Eurofins Scientific, Intertek Group, SGS SA, Bureau Veritas, ALS Limited, Thermo Fisher Scientific, Neogen Corporation, Romer Labs, QIMA (formerly AsiaInspection), Randox Laboratories, PerkinElmer Inc., Merck KGaA, Agilent Technologies, Bio-Rad Laboratories, Shimadzu Corporation |

Global Seafood Physical & Chemical Detection Market Segmentation: By Type

-

Physical Detection

-

Chemical Detection

The chemical detection segment is poised as the fastest-growing within the Global Seafood Physical & Chemical Detection Market, driven by technological advancements, increased health consciousness among consumers, and stringent regulatory frameworks targeting chemical contaminants in seafood. Despite this rapid growth, the physical detection segment maintains the highest market share, reflecting its critical role in identifying physical contaminants such as parasites, foreign bodies, and physical defects. With physical detection methods accounting for approximately 55% of the market share in 2023 and anticipated to grow at a CAGR of 6.5% through 2030, their importance remains evident. Meanwhile, chemical detection, representing about 45% of the market share, is projected to expand at a CAGR of 7.8%, underscoring the growing emphasis on chemical safety and regulatory compliance in the seafood industry. Together, these segments underscore the evolving landscape of seafood safety, driven by advancements and regulatory demands.

Global Seafood Physical & Chemical Detection Market Segmentation: By Applications

-

Quality Control

-

Safety Testing

-

Regulatory Compliance

The fastest-growing segment within the global Seafood Physical & Chemical Detection Market is safety testing, projected to expand at a remarkable CAGR of 8.5% from 2023 to 2028. This surge underscores the industry's escalating emphasis on detecting harmful substances like heavy metals, toxins, and pathogens to ensure consumer safety. Concurrently, quality control stands as the highest market share holder, constituting approximately 45% of the market in 2023. This segment's critical role in maintaining stringent quality standards and compliance with regulatory requirements underscores its dominance. Regulatory compliance, representing 20% of the market, is essential for enabling seafood producers to meet national and international standards, thereby facilitating access to global markets. Together, these applications drive the robust growth of the Seafood Physical & Chemical Detection Market, propelled by advancements in detection technologies and heightened consumer awareness about food safety.

Global Seafood Physical & Chemical Detection Market Segmentation: By End User

-

Testing Laboratories

-

Seafood Processing Companies

-

Government Agencies

-

Research Institutes

The highest segment in the global seafood physical and chemical detection market is quality control, commanding a substantial market share due to its pivotal role in maintaining product integrity and meeting stringent quality standards. Quality control measures encompass monitoring factors such as freshness and texture, crucial for ensuring seafood products meet consumer expectations from catch to table. Concurrently, the fastest-growing segment is safety testing, driven by increasing concerns over contaminants like heavy metals and toxins in seafood. This segment employs advanced detection technologies to ensure seafood safety, bolstering consumer confidence and regulatory compliance. Regulatory compliance, another significant segment, ensures adherence to global and regional standards, safeguarding market access and mitigating legal risks for seafood producers. With robust technological advancements and heightened awareness of food safety, the seafood detection market is poised for sustained growth, meeting the evolving demands of consumers and regulatory bodies alike.

Global Seafood Physical & Chemical Detection Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

The highest market share in the global seafood physical and chemical detection market belongs to North America and Europe, driven by stringent regulatory standards and advanced seafood processing industries. These regions prioritize the implementation of cutting-edge detection technologies, including X-ray imaging and chromatography, to ensure compliance with rigorous quality and safety measures. Meanwhile, Asia Pacific emerges as the fastest-growing segment, propelled by expanding aquaculture activities and increasing consumer awareness about seafood safety. Countries like China and Japan lead in seafood production and consumption, fostering robust demand for innovative detection solutions. South America and Middle East and Africa also show significant growth potential, fueled by improving food safety regulations and investments in detection infrastructure. This diverse regional landscape underscores a global commitment to enhancing seafood quality control through comprehensive physical and chemical detection methodologies.

Impact of COVID-19 on the Global Seafood Physical & Chemical Detection Market:

The COVID-19 pandemic has significantly impacted the Seafood Physical & Chemical Detection Market, presenting both challenges and opportunities across its various segments. As global supply chains faced disruptions and consumer behavior shifted towards increased health consciousness, the demand for stringent quality control and safety measures in seafood surged. Physical detection methods, such as visual inspection and texture analysis, saw heightened adoption as consumers prioritized safety assurance. Conversely, chemical detection technologies, including chromatography and spectroscopy, experienced fluctuations due to supply chain disruptions and reduced operational capacities in testing laboratories. Regional variations were notable, with stricter regulatory frameworks in some markets leading to increased investments in detection technologies to meet compliance standards. Key players in the market swiftly adapted by enhancing remote monitoring capabilities and investing in R&D to innovate contactless detection solutions, anticipating a long-term shift towards automation and digitalization post-pandemic. The market also witnessed a rise in collaborative efforts between industry stakeholders and regulatory bodies to streamline safety protocols and ensure uninterrupted supply chains. Looking ahead, as economies recover and consumer confidence stabilizes, the Seafood Physical & Chemical Detection Market is poised for steady growth driven by sustained investments in technology and heightened awareness of food safety measures among consumers worldwide.

Latest Trends and Developments:

The global Seafood Physical & Chemical Detection Market is seeing a transformative period, driven by the integration of cutting-edge innovations and increased administrative examination. The most recent patterns emphasize a worldview move towards more advanced discovery techniques, mixing progressed spectrometry, chromatography, and biosensor innovations to guarantee unparalleled precision in recognizing contaminants and guaranteeing fish quality. Advancements like versatile discovery gadgets and real-time observing frameworks are becoming progressively predominant, advertising consistent, on-site examination capabilities that improve supply chain straightforwardness and security. The showcase is additionally seeing a surge within the selection of AI and machine learning calculations, which are revolutionizing information investigation by giving prescient experiences and computerizing complex discovery forms. This mechanical movement is complemented by a developing accentuation on maintainability and traceability, with partners contributing to eco-friendly location arrangements that minimize natural effects. Besides, exacting universal nourishment security directions are compelling fish makers and processors to embrace more thorough testing conventions, in this manner driving showcase development. These advancements are not as it were upgrading buyer certainty in fish items but are also opening modern roads for showcase players to distinguish themselves through quality affirmation and compliance greatness. Generally, the worldwide Fish Physical & Chemical Discovery Advertise is balanced for strong development, fueled by mechanical progressions and an unflinching commitment to nourishment security and quality.

Global Seafood Physical & Chemical Detection Market Key Players:

-

Eurofins Scientific

-

Intertek Group

-

SGS SA

-

Bureau Veritas

-

ALS Limited

-

Thermo Fisher Scientific

-

Neogen Corporation

-

Romer Labs

-

QIMA (formerly AsiaInspection)

-

Randox Laboratories

-

PerkinElmer Inc.

-

Merck KGaA

-

Agilent Technologies

-

Bio-Rad Laboratories

-

Shimadzu Corporation

Chapter 1. Seafood Physical & Chemical Detection Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Seafood Physical & Chemical Detection Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Seafood Physical & Chemical Detection Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Seafood Physical & Chemical Detection Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Seafood Physical & Chemical Detection Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Seafood Physical & Chemical Detection Market – By Type

6.1 Introduction/Key Findings

6.2 Physical Detection

6.3 Chemical Detection

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Seafood Physical & Chemical Detection Market – By End-use

7.1 Introduction/Key Findings

7.2 Testing Laboratories

7.3 Seafood Processing Companies

7.4 Government Agencies

7.5 Research Institutes

7.6 Y-O-Y Growth trend Analysis By End-use

7.7 Absolute $ Opportunity Analysis By End-use, 2024-2030

Chapter 8. Seafood Physical & Chemical Detection Market – By Application

8.1 Introduction/Key Findings

8.2 Quality Control

8.3 Safety Testing

8.4 Regulatory Compliance

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Seafood Physical & Chemical Detection Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End-use

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End-use

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End-use

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End-use

9.4.4 By End-use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End-use

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Seafood Physical & Chemical Detection Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Eurofins Scientific

10.2 Intertek Group

10.3 SGS SA

10.4 Bureau Veritas

10.5 ALS Limited

10.6 Thermo Fisher Scientific

10.7 Neogen Corporation

10.8 Romer Labs

10.9 QIMA (formerly AsiaInspection)

10.10 Randox Laboratories

10.11 PerkinElmer Inc.

10.12 Merck KGaA

10.13 Agilent Technologies

10.14 Bio-Rad Laboratories

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Seafood Physical & Chemical Detection Market was estimated to be worth USD 2.4 billion in 2023 and is projected to reach a value of USD 4.11 billion by the end of 2030, growing at a fast CAGR of 8 % during the forecast period 2024-2030.

The Segments under the Global Seafood Physical & Chemical Detection Market by type are Physical Detection, and Chemical Detection.

Some of the top industry players in the Seafood Physical & Chemical Detection Market are Eurofins Scientific, Intertek Group, SGS SA, Bureau Veritas, ALS Limited, Thermo Fisher Scientific, Neogen Corporation, Romer Labs, QIMA (formerly AsiaInspection), Randox Laboratories, PerkinElmer Inc., Merck KGaA, Agilent Technologies, Bio-Rad Laboratories, Shimadzu Corporation.

The Global Seafood Physical & Chemical Detection Market is segmented based on type, applications, End-user, and region.

The Quality Control sector is the most common end-user of the Global Seafood Physical & Chemical Detection Market.