Savory Ingredients Market Size (2024 – 2030)

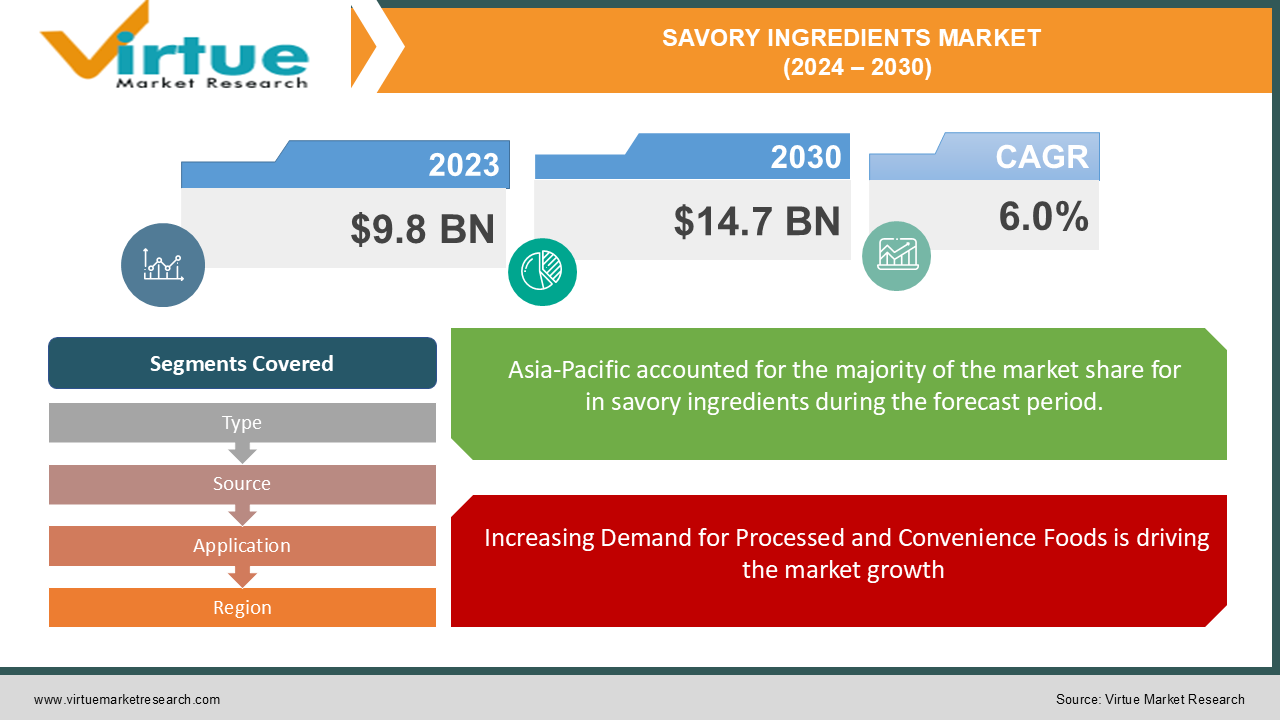

In 2023, the Global Savory Ingredients Market was valued at approximately USD 9.8 billion, and it is expected to grow to USD 14.7 billion by 2030, reflecting a compound annual growth rate (CAGR) of 6.0% during the forecast period.

The Global Savory Ingredients Market has been expanding at a substantial pace due to the growing demand for flavorful and umami-rich ingredients in food products. Savory ingredients are widely used in food processing to enhance taste, provide flavor balance, and improve the overall sensory profile of products. The rising demand for ready-to-eat meals, snacks, and convenience foods, especially in urban areas, is driving the market. Moreover, the growing consumer preference for clean-label and natural ingredients, coupled with advancements in food technology, is expected to propel the market forward. Key players in the industry are focused on expanding their product portfolios to cater to the increasing demand for natural savory ingredients.

Key Market Insights:

-

Yeast extracts dominate the savory ingredients market, contributing more than 35% of the total market revenue, driven by their growing use in processed foods and clean-label products.

-

The natural source segment is expected to witness the highest growth, with a CAGR of 7.5%, as consumers increasingly seek out natural, minimally processed food products.

-

Food and beverage applications remain the largest segment, accounting for over 60% of total market demand, primarily due to the rising consumption of savory snacks, sauces, and soups.

-

Asia-Pacific is the leading region, contributing over 40% of the total market revenue, owing to the increasing demand for processed and packaged foods in countries like China, India, and Japan.

Global Savory Ingredients Market Drivers:

1. Increasing Demand for Processed and Convenience Foods is driving the market growth

The rising global demand for processed and convenience foods is a key driver of the savory ingredients market. As urbanization continues to grow, especially in developing regions, consumers are seeking easy-to-prepare meals that are both flavorful and convenient. Savory ingredients such as yeast extracts, monosodium glutamate (MSG), and hydrolyzed vegetable proteins (HVPs) are widely used in processed food products to enhance their taste, making them more appealing to consumers. Ready-to-eat meals, frozen foods, savory snacks, and soups are among the primary categories driving demand for these ingredients. In particular, the increasing consumption of packaged foods in emerging markets like Asia-Pacific and Latin America is significantly contributing to the market’s growth. Additionally, the trend of consumers opting for more frequent snacking throughout the day is fueling the demand for savory snacks, further driving the use of savory ingredients.

2. Growing Preference for Clean-Label and Natural Ingredients is driving the market growth

The rising consumer awareness of health and wellness has spurred a growing preference for clean-label and natural ingredients in food products. As a result, food manufacturers are increasingly incorporating natural savory ingredients such as yeast extracts and soy protein isolates into their formulations to meet the demand for minimally processed and free-from additives products. Consumers are becoming more conscious of the ingredients in their foods, and they seek products that do not contain artificial additives, preservatives, or synthetic flavor enhancers. Savory ingredients derived from natural sources, such as plant-based extracts and yeast derivatives, are seen as healthier alternatives to traditional flavor enhancers like MSG. This shift towards natural, non-GMO, and organic ingredients is expected to accelerate the growth of the natural savory ingredients segment, providing significant market opportunities for producers who focus on clean-label and natural solutions.

3. Technological Advancements in Food Processing is driving the market growth

Advancements in food processing technologies have played a critical role in the growth of the savory ingredients market. Innovations in fermentation, extraction, and processing techniques have enabled manufacturers to produce more refined, potent, and high-quality savory ingredients. For instance, the development of enzyme-treated yeast extracts has provided food manufacturers with enhanced flavor profiles without the need for artificial flavor enhancers. Additionally, technologies such as Maillard reaction flavoring and enzyme hydrolysis have allowed manufacturers to create more complex and authentic savory flavors, catering to the evolving tastes of consumers. These advancements have also improved the scalability of production, allowing manufacturers to meet the growing global demand for savory ingredients in a more efficient and cost-effective manner.

Global Savory Ingredients Market Challenges and Restraints:

1. Regulatory Constraints on Additive Use is restricting the market growth

One of the major challenges facing the savory ingredients market is the stringent regulatory environment surrounding the use of food additives, particularly in regions like North America and Europe. Many savory ingredients, such as monosodium glutamate (MSG) and hydrolyzed vegetable proteins (HVP), have come under scrutiny due to potential health concerns and consumer apprehension. In some cases, regulatory bodies have imposed limits on the use of certain additives, requiring manufacturers to reformulate products or seek alternative ingredients. These regulations can hinder market growth by limiting the availability and use of traditional savory ingredients in food products. Manufacturers must navigate complex regulatory frameworks to ensure compliance while meeting consumer demand for safe and flavorful foods. The evolving regulatory landscape around food additives presents a challenge for the market, particularly for manufacturers relying heavily on synthetic or processed savory ingredients.

2. Rising Consumer Skepticism Toward Processed Foods is restricting the market growth

The growing awareness of the potential health risks associated with processed foods has led to increased consumer skepticism toward products containing artificial additives and flavor enhancers. Consumers are becoming more conscious of their dietary choices and are actively avoiding foods with ingredients perceived as unhealthy or artificial, such as MSG and chemically processed flavor enhancers. This shift in consumer perception presents a challenge for manufacturers of synthetic savory ingredients, as they face increasing pressure to offer healthier alternatives. Brands must invest in reformulating their products to align with consumer preferences for natural and minimally processed ingredients. Failure to adapt to these changing preferences can result in reduced demand and lost market share for companies relying on synthetic savory ingredients.

Market Opportunities:

The Global Savory Ingredients Market offers significant growth opportunities, particularly in the development and adoption of natural and organic savory ingredients. As consumer preferences shift toward healthier and cleaner food products, companies that focus on producing natural, plant-based, and non-GMO savory ingredients stand to benefit. The demand for yeast extracts, soy protein isolates, and mushroom extracts is expected to grow as food manufacturers seek natural alternatives to traditional synthetic flavor enhancers. Additionally, the increasing demand for savory snacks, sauces, and ready-to-eat meals in emerging markets presents an opportunity for manufacturers to expand their product portfolios and cater to a growing consumer base. The trend toward plant-based diets is also fueling the demand for savory ingredients that can replicate the umami flavors traditionally provided by meat-based products, offering further growth potential for innovative ingredient producers.

SAVORY INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.0% |

|

Segments Covered |

By Type, Source, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kerry Group plc, Givaudan SA, Tate & Lyle PLC, Ajinomoto Co., Inc., Sensient Technologies Corporation, Symrise AG, International Flavors & Fragrances Inc., Angel Yeast Co., Ltd. |

Savory Ingredients Market Segmentation: By Type

-

Yeast Extracts

-

Hydrolyzed Vegetable Proteins (HVP)

-

Monosodium Glutamate (MSG)

-

Nucleotides

-

Others

Yeast extracts hold the largest share in the savory ingredients market, accounting for over 35% of the total revenue. These ingredients are increasingly popular due to their ability to provide a natural umami flavor and their use in clean-label formulations.

Savory Ingredients Market Segmentation: By Source

-

Natural

-

Synthetic

The natural source segment is witnessing significant growth, driven by increasing consumer demand for clean-label and minimally processed ingredients. This segment is expected to grow at a CAGR of 7.5% during the forecast period.

Savory Ingredients Market Segmentation: By Application

-

Food & Beverage

-

Animal Feed

-

Pharmaceuticals

-

Others

The food and beverage application dominates the market, contributing more than 60% of total demand. Savory ingredients are widely used in processed foods, including snacks, sauces, soups, and ready-to-eat meals.

Savory Ingredients Market Segmentation: Regional Segmentation

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific leads the global savory ingredients market, accounting for over 40% of total revenue. This dominance is attributed to the region's growing population, rising disposable income, and increasing demand for processed and packaged foods. Countries like China, India, and Japan are key drivers of this growth, as they continue to experience rapid urbanization and changing dietary habits.

COVID-19 Impact Analysis on Global Savory Ingredients Market

The COVID-19 pandemic had a profound impact on the Global Savory Ingredients Market, both in terms of supply chain disruptions and shifting consumer behavior. During the initial stages of the pandemic, the market experienced challenges related to raw material shortages and manufacturing delays, as global lockdowns and restrictions disrupted production and distribution networks. However, the pandemic also led to an increase in consumer demand for packaged and processed foods, as people spent more time at home and sought convenient meal solutions. This shift in consumer behavior boosted the demand for savory ingredients used in ready-to-eat meals, frozen foods, and snacks. Additionally, the focus on health and wellness during the pandemic further accelerated the trend toward clean-label and natural savory ingredients, as consumers became more conscious of their food choices.

Latest Trends and Developments:

The global savory ingredients market is experiencing significant growth, driven by factors such as changing consumer preferences towards healthier and more flavorful food options, the rise of global cuisines, advancements in food processing technologies, and increasing demand for convenience foods. Key trends include a shift towards natural and organic ingredients, a focus on clean label products, and the development of innovative flavor profiles. The market is also witnessing a surge in demand for savory ingredients in plant-based and vegetarian food products, as consumers seek healthier alternatives to traditional meat-based dishes. Additionally, the growing popularity of ethnic and regional cuisines is driving demand for authentic and diverse flavor profiles, creating opportunities for new and exciting savory ingredient combinations.

Key Players:

-

Kerry Group plc

-

Givaudan SA

-

Tate & Lyle PLC

-

Ajinomoto Co., Inc.

-

Sensient Technologies Corporation

-

Symrise AG

-

International Flavors & Fragrances Inc.

-

Angel Yeast Co., Ltd.

Chapter 1. Savory Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Savory Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Savory Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Savory Ingredients Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Savory Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Savory Ingredients Market – By Type

6.1 Introduction/Key Findings

6.2 Yeast Extracts

6.3 Hydrolyzed Vegetable Proteins (HVP)

6.4 Monosodium Glutamate (MSG)

6.5 Nucleotides

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Savory Ingredients Market – By Source

7.1 Introduction/Key Findings

7.2 Natural

7.3 Synthetic

7.4 Y-O-Y Growth trend Analysis By Source

7.5 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 8. Savory Ingredients Market – By Application

8.1 Introduction/Key Findings

8.2 Food & Beverage

8.3 Animal Feed

8.4 Pharmaceuticals

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Savory Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Source

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Source

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Source

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Source

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Source

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Savory Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Kerry Group plc

10.2 Givaudan SA

10.3 Tate & Lyle PLC

10.4 Ajinomoto Co., Inc.

10.5 Sensient Technologies Corporation

10.6 Symrise AG

10.7 International Flavors & Fragrances Inc.

10.8 Angel Yeast Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Savory Ingredients Market was valued at USD 9.8 billion in 2023 and is projected to reach USD 14.7 billion by 2030, with a CAGR of 6.0%.

Key drivers include the rising demand for processed and convenience foods, growing preference for clean-label and natural ingredients, and technological advancements in food processing.

The market is segmented by type (yeast extracts, HVP, MSG), source (natural, synthetic), and application (food & beverage, animal feed, pharmaceuticals).

Asia-Pacific is the leading region, accounting for over 40% of the total market revenue, driven by the rising demand for processed foods in countries like China and India.

Leading players include Kerry Group, Givaudan, Ajinomoto, Sensient Technologies, and Tate & Lyle.