Saturated Acyclic Hydrocarbons Market Size (2024-2030)

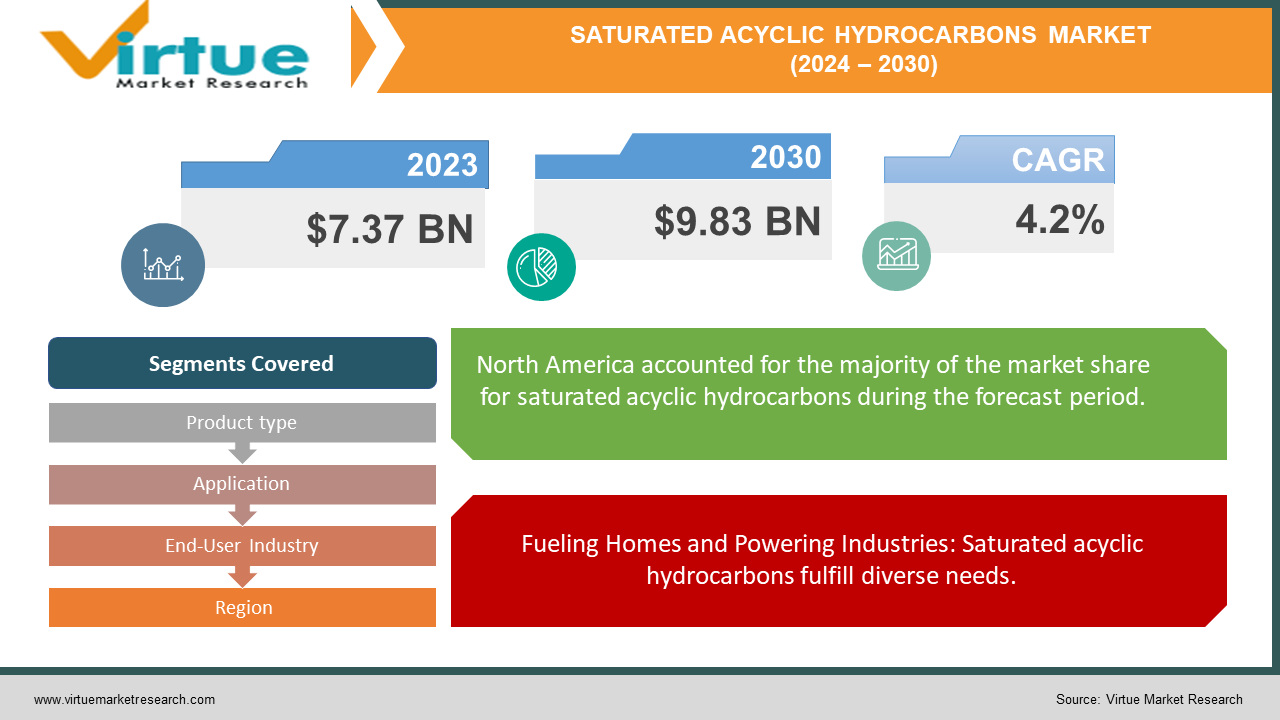

The Saturated Acyclic Hydrocarbons Market was valued at USD 7.37 billion in 2023 and is projected to reach a market size of USD 9.83 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 4.2%.

Saturated acyclic hydrocarbons, also known as alkanes, are fundamental organic compounds used across various industries. These versatile chemicals, including methane and propane, find applications in fuel production, as raw materials for everyday products like plastics, and even as environmentally friendly refrigerants and aerosol propellants. The market for saturated acyclic hydrocarbons is driven by this widespread use, with major players like ExxonMobil and Shell leading production and trade.

Key Market Insights:

Saturated acyclic hydrocarbons, also known as alkanes, are the workhorses of the chemical industry. These fundamental building blocks, including methane and propane, fuel our homes (natural gas), provide the raw materials for everyday products like plastics and detergents, and even keep our food cool as environmentally friendly refrigerants and aerosol propellants. This widespread use translates to a significant market.

The trade of saturated acyclic hydrocarbons is another indicator of their importance. The United States, Canada, and Russia are the major exporters, fulfilling the demands of China, the US (the US is both an exporter and importer), and India. This global trade is expected to continue flourishing due to rising demand in developing economies.

The Saturated Acyclic Hydrocarbons Market Drivers:

Fueling Homes and Powering Industries: Saturated acyclic hydrocarbons fulfill diverse needs.

Saturated acyclic hydrocarbons, or alkanes, are incredibly versatile. They fuel our homes (natural gas), serve as building blocks for countless products (plastics, detergents), and even keep our food cool (refrigerants) – applications that consistently drive market demand.

Energy Demands on the Rise: Growing energy needs drive the market for clean-burning natural gas.

The increasing demand for energy, particularly in developing economies, translates to a rising need for natural gas, a major component of the saturated acyclic hydrocarbons market. As more countries seek cleaner-burning fuels, the market for these hydrocarbons is expected to climb.

Chemical Industry's Building Blocks: The expanding chemical industry fuels market growth.

The chemical industry relies heavily on alkanes as essential raw materials. As this industry continues to expand globally, particularly in developing economies, the demand for saturated acyclic hydrocarbons will rise proportionately.

A Well-Oiled Global Trade Network: The US, Canada, and Russia lead exports, fulfilling demands.

The US, Canada, and Russia are leading exporters, fulfilling the needs of major importers like China, the US (interestingly, the US plays a dual role), and India. This well-established trade network ensures easy access to these vital chemicals and is expected to grow further due to rising global demand.

Potential for Technological Innovation: Advancements could lead to more efficient production.

While not a guaranteed driver, advancements in extraction and processing technologies could lead to more efficient production of saturated acyclic hydrocarbons, potentially reducing costs and making them more competitive in the market. This could also open doors for new applications.

The Saturated Acyclic Hydrocarbons Market Restraints and Challenges:

Despite the significant market driven by diverse applications, saturated acyclic hydrocarbons face hurdles. A major challenge is the growing focus on environmental sustainability. The reliance on natural gas, a key component, is under scrutiny due to greenhouse gas emissions. This could lead to stricter regulations and a push for renewable energy sources, potentially reducing demand in the long run.

Another concern is the finite nature of natural gas reserves. As global demand increases, the long-term availability of these resources becomes uncertain. This can lead to price fluctuations and potential supply chain disruptions. The market itself can be volatile due to factors like geopolitical instability in major producing regions, exploration costs, and global supply and demand dynamics. These price fluctuations create uncertainty for businesses that rely on these chemicals.

Furthermore, the efficiency and cost-effectiveness of production heavily rely on advancements in extraction and processing technologies. A lack of innovation in these areas could hinder the market's ability to compete with more sustainable alternatives. Finally, the negative public perception associated with fossil fuels can create challenges. This can influence consumer behavior and potentially lead to regulations or restrictions on the use of these chemicals.

The Saturated Acyclic Hydrocarbons Market Opportunities:

Despite the challenges posed by environmental concerns, the saturated acyclic hydrocarbons market has room for innovation and growth. A key opportunity lies in developing cleaner production processes. Companies can invest in research and development of technologies that capture and utilize greenhouse gas emissions generated during extraction and processing. Alternatively, exploring methods for extracting these hydrocarbons with a lower environmental footprint can be a game changer.

Furthermore, the market can benefit immensely from the development of bio-based alternatives. Imagine a future where these versatile chemicals are derived from renewable resources like plant matter! Such bio-based options would offer a more sustainable solution, appealing to environmentally conscious consumers and businesses alike. Additionally, research into entirely new applications for saturated acyclic hydrocarbons presents exciting possibilities. Their potential use in capturing and storing carbon emissions or as feedstock for bioplastics could unlock entirely new market segments.

Technological advancements can also play a crucial role in ensuring the long-term viability of the market. By improving resource efficiency, extraction and utilization of natural gas reserves, the primary source of these hydrocarbons, can be optimized. This not only helps mitigate concerns about resource depletion but also has the potential to stabilize prices, creating a more predictable market environment. Finally, focusing on carbon capture and storage technologies offers a way for the industry to directly address its environmental impact.

SATURATED ACYCLIC HYDROCARBONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By Product type, Application, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ExxonMobil, Shell, Chevron, BP, TotalEnergies Gazprom, CNPC, National Iranian Oil Company, ConocoPhillips, Rosneft |

Saturated Acyclic Hydrocarbons Market Segmentation: By Product Type

-

Methane

-

Ethane

-

Propane

-

Butane

-

Higher-chain alkanes

Dominated by its use in natural gas, Methane is the most common and commercially important segment within the Saturated Acyclic Hydrocarbons market by product type. On the other hand, the Propane and Butane segment is anticipated to be the fastest-growing due to increasing demand for clean and efficient refrigerants, particularly as environmental concerns rise.

Saturated Acyclic Hydrocarbons Market Segmentation: By Application

-

Fuel

-

Chemical feedstocks

-

Refrigeration

-

Aerosol propellants

-

Other industrial applications

Currently, the dominant segment by application is likely 'Fuel (natural gas)', as it fulfills a basic need for heating and power generation. However, 'Refrigeration (environmentally friendly propellants)' is expected to be the fastest-growing segment due to the increasing demand for eco-friendly alternatives in appliances and food preservation.

Saturated Acyclic Hydrocarbons Market Segmentation: By End-User Industry

-

Power generation

-

Chemicals & materials

-

Transportation

-

Construction

-

Food & beverage processing

-

Pharmaceuticals & personal care

The Power generation sector is likely the dominant consumer of saturated acyclic hydrocarbons, primarily due to the widespread use of natural gas for electricity production. However, the Chemicals & Materials sector is expected to be the fastest-growing segment driven by the ever-increasing demand for plastics, detergents, and other products that rely on alkanes as raw materials.

Saturated Acyclic Hydrocarbons Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

A major producer and consumer of saturated acyclic hydrocarbons, North America boasts vast natural gas reserves. The US and Canada are leading exporters, catering to domestic demand for power generation and the chemical industry. However, the region is also exploring cleaner alternatives, potentially impacting long-term growth.

Europe relies heavily on imports of saturated acyclic hydrocarbons, particularly natural gas, to meet its energy needs. Russia is a major supplier, but geopolitical tensions can disrupt trade flows. The European focus on renewable energy could lead to a shift away from these hydrocarbons in the long run.

Asia Pacific region is experiencing a significant rise in demand for saturated acyclic hydrocarbons due to rapid industrialization and urbanization. China is a major importer, using these chemicals for power generation and as feedstock for its booming chemical industry. The region is also exploring domestic production to meet its growing needs.

While currently a smaller player, South America has the potential for significant growth in the saturated acyclic hydrocarbons market. Countries like Brazil are exploring their natural gas reserves and could become future exporters. However, infrastructure development and a focus on sustainability will be crucial factors in this region's market growth.

COVID-19 Impact Analysis on the Saturated Acyclic Hydrocarbons Market:

The COVID-19 pandemic delivered a complex blow to the saturated acyclic hydrocarbons market. Lockdowns and travel restrictions drastically reduced demand for transportation fuels, a major application for natural gas, the cornerstone of this market. This sent shockwaves through the industry, causing a significant decline in overall market growth. Global supply chains also faced disruptions, leading to temporary fluctuations in both the price and availability of these hydrocarbons.

The recovery from this pandemic-induced slump has been uneven across different sectors. The chemicals industry, which relies heavily on alkanes as essential raw materials for products like plastics and detergents, saw a faster rebound due to continued demand for these everyday necessities. In contrast, the power generation sector's recovery has been slower. This can be attributed in part to a shift towards renewable energy sources in some regions during the pandemic, as countries re-evaluated their energy priorities.

Looking towards the long term, the pandemic has cast a spotlight on the importance of environmental sustainability. This heightened awareness could lead to a sustained move away from fossil fuels like natural gas, potentially impacting the long-term demand for saturated acyclic hydrocarbons. However, the market could also find opportunities in the increased focus on domestic production and infrastructure development. This push for self-sufficiency could bolster the market by ensuring a more secure and reliable energy supply.

In conclusion, the COVID-19 pandemic caused a temporary disruption to the saturated acyclic hydrocarbons market, with a complex interplay of short-term decline and uneven recovery across sectors. The long-term impact remains to be seen and will depend on several factors, including the pace of economic recovery, the adoption of renewable energy sources, and government policies related to energy security and sustainability. The industry will need to adapt and innovate to navigate this evolving landscape and ensure its future viability.

Latest Trends/ Developments:

The saturated acyclic hydrocarbons market is on the cusp of a significant transformation. A driving force is the focus on cleaner production technologies. Companies are no longer content with the status quo and are actively investing in research and development to reduce their environmental impact. This translates to capturing and utilizing greenhouse gas emissions during extraction and processing or exploring alternative extraction methods with a smaller footprint. Additionally, bio-based alternatives derived from renewable resources like plant matter are gaining significant traction. These alternatives, like bio-methane and bio-propane, offer a more sustainable solution, potentially attracting environmentally conscious consumers and businesses alike.

Furthermore, research into entirely new applications for saturated acyclic hydrocarbons is pushing the boundaries of innovation. Areas like carbon capture and storage (CCS) and bioplastics are particularly exciting. Companies are exploring how these hydrocarbons can be utilized to capture and store carbon emissions, effectively mitigating their environmental impact. On the production side, advancements in technology are playing a crucial role in optimizing resource extraction and utilization. New technologies for more efficient natural gas extraction and processing are being developed, potentially leading to stabilized prices and a more sustainable approach to resource management.

Key Players:

-

ExxonMobil

-

Shell

-

Chevron

-

BP

-

TotalEnergies

-

Gazprom

-

CNPC

-

National Iranian Oil Company

-

ConocoPhillips

-

Rosneft

Chapter 1. Saturated Acyclic Hydrocarbons Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Saturated Acyclic Hydrocarbons Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Saturated Acyclic Hydrocarbons Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Saturated Acyclic Hydrocarbons Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Saturated Acyclic Hydrocarbons Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Saturated Acyclic Hydrocarbons Market – By Product Type

6.1 Introduction/Key Findings

6.2 Methane

6.3 Ethane

6.4 Propane

6.5 Butane

6.6 Higher-chain alkanes

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Saturated Acyclic Hydrocarbons Market – By End-User Industry

7.1 Introduction/Key Findings

7.2 Power generation

7.3 Chemicals & materials

7.4 Transportation

7.5 Construction

7.6 Food & beverage processing

7.7 Pharmaceuticals & personal care

7.8 Y-O-Y Growth trend Analysis By End-User Industry

7.9 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 8. Saturated Acyclic Hydrocarbons Market – By Application

8.1 Introduction/Key Findings

8.2 Fuel

8.3 Chemical feedstocks

8.4 Refrigeration

8.5 Aerosol propellants

8.6 Other industrial applications

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Saturated Acyclic Hydrocarbons Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End-User Industry

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End-User Industry

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End-User Industry

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End-User Industry

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End-User Industry

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Saturated Acyclic Hydrocarbons Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ExxonMobil

10.2 Shell

10.3 Chevron

10.4 BP

10.5 TotalEnergies

10.6 Gazprom

10.7 CNPC

10.8 National Iranian Oil Company

10.9 ConocoPhillips

10.10 Rosneft

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Saturated Acyclic Hydrocarbons Market was valued at USD 7.37 billion in 2023 and is projected to reach a market size of USD 9.83 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 4.2%.

Widespread Applications Across Industries, Growing Energy Needs, Expansion of the Chemical Industry, Global Trade Network, and Technological Advancements.

Power generation, Chemicals & Materials, Transportation, Construction, Food & beverage processing, Pharmaceuticals & personal care.

North America is the most dominant region for the Saturated Acyclic Hydrocarbons Market, thanks to vast natural gas reserves and established production & export infrastructure.

ExxonMobil, Shell, Chevron, BP, TotalEnergies, Gazprom, CNPC, National Iranian Oil Company, ConocoPhillips, Rosneft.