Satellite Spectrum Monitoring Software Market Size (2024 –2030)

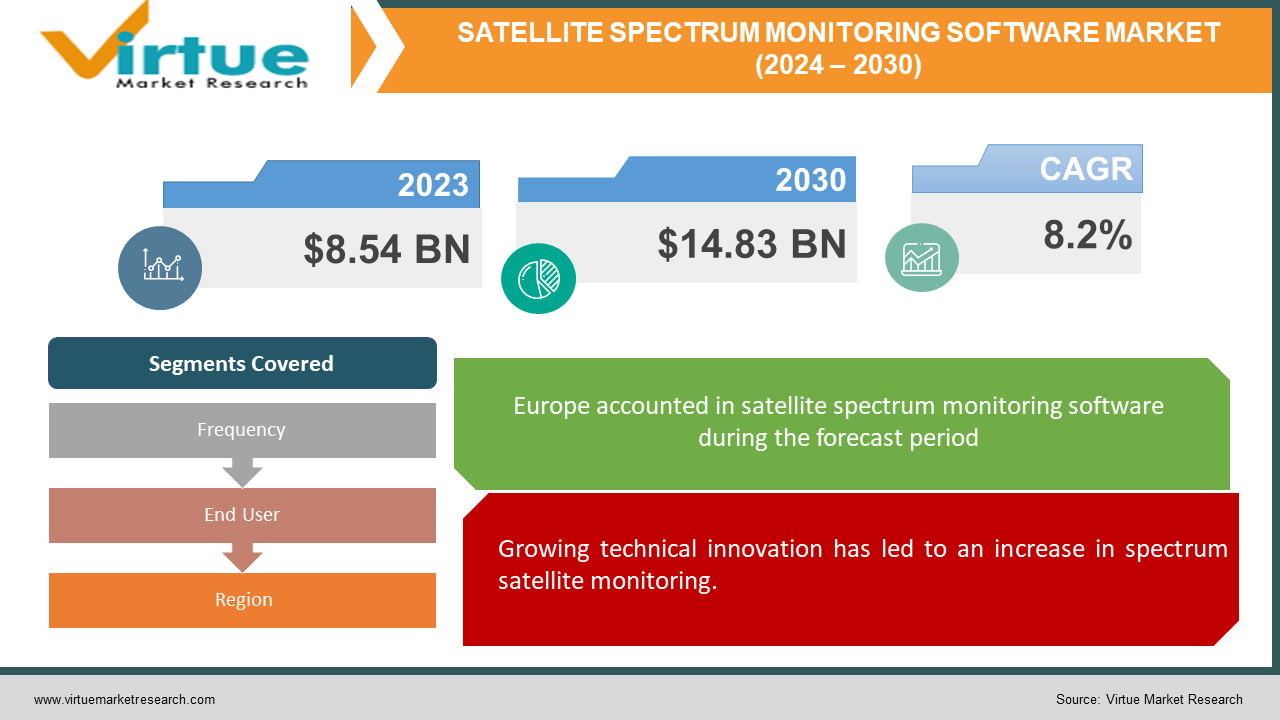

In 2023, The Global satellite Spectrum Monitoring Software Market was valued at USD 8.54 Billion and is projected to reach a market size of USD 14.83 Billion by 2030. Over 2024-2030, the market is projected to grow at a CAGR of 8.2%.

The main goal of satellite spectrum monitoring is to monitor and control the radio frequencies that satellites use. It entails using tools and software to keep an eye on these frequencies and ensure that they are utilized effectively and compliantly. By doing this, companies can maximize the amount of spectrum that is available by locating underutilized frequencies, optimizing the way they assign frequencies, and putting an end to any unlawful use. Satellite-based communication systems and deep space networks particularly benefit from this monitoring. It is employed by the military, government, aerospace, and marine industries, among others. Operators can identify and resolve interference problems through satellite spectrum monitoring, maintaining the dependability and caliber of satellite communication.

Key Market Insights:

Europe emerges as the highest-growing market globally, with a remarkable Compound Annual Growth Rate (CAGR) of 8.68% in the satellite spectrum monitoring sector. Among European nations, France is poised to exhibit the highest growth rate in the satellite spectrum monitoring market, projected at a CAGR of 9.27%.

The satellite spectrum monitoring market is primarily driven by the military industry, which held a dominant share of 28.99% in 2023. The growth of this market segment is propelled by increasing military advancements and the rising demand for satellite spectrum monitoring products and solutions.

New technologies are being introduced globally by numerous organizations, research institutes, and government agencies to improve satellite spectrum monitoring. Vector signal analyzers are highly sought-after tools for spectrum monitoring because they are more efficient than more conventional tools such as spectrum analyzers, direction finders, and antennas.

NASA Goddard Space Flight Center awarded a contract to Calian Group Ltd. for the provision of a third advanced antenna for the agency's very long baseline interferometry (VLBI) global observing system (VGOS). NASA's Space Geodesy Project will use this 12-meter high-performance antenna to support and maintain the global geodetic infrastructure, which includes the VGOS network of antennas and ground stations.

Global Satellite Spectrum Monitoring Software Market Drivers:

Growing technical innovation has led to an increase in spectrum satellite monitoring.

An increasing amount of data is being transmitted via satellite signals as more people use the internet globally. The satellite spectrum is crowded as a result. Tools that track satellite signals are becoming more and more necessary to handle this. There were approximately 5.2 billion internet users worldwide in 2021, and as more gadgets and 5G networks connect to the internet, the need for using different satellite spectrum bands is growing.

The worldwide market for satellite spectrum monitoring software is expanding due to cloud-based satellite spectrum monitoring services.

These days, satellites and cloud computing are being used in a new method of spectrum monitoring. Sensors positioned throughout the environment can transmit data straight to the cloud, negating the need for conventional techniques. After that, the cloud uses strong computing systems to process the data, making it simpler to manage and analyze. This method improves the efficiency of spectrum monitoring while lessening the load on communication networks.

Satellite Spectrum Monitoring Software Market Challenges and Restraints:

Satellite spectrum monitoring concentrates on resolving particular localized monitoring problems. Using this technique, separate monitoring stations can communicate and exchange data to improve efficiency. Each station bases its decisions on information gathered from other monitoring stations. The precision of this data is essential to the best possible operation of the system. Businesses that operate in the global market now have a variety of opportunities to enhance their operations and services.

Satellite Spectrum Monitoring Software Market Opportunities:

A major opportunity exists in the satellite spectrum monitoring software market due to the growing demand for 5G networks and other wireless communication technologies. The emphasis placed by governments on enhancing communication infrastructure, particularly in underserved areas, increases the need for effective spectrum monitoring technologies. To guarantee interference-free operations, technological advancements in satellite systems, such as the deployment of small satellites and broadband constellations, call for the use of sophisticated monitoring tools. More satellite launches for communication and Earth observation are contributing to the growing satellite industry, which increases the demand for efficient spectrum management software. The market is expanding as a result of initiatives to provide global connectivity through high-altitude platforms and satellite internet constellations. These initiatives also provide software developers with chances to innovate and provide specialized solutions that support these ambitious projects. Companies in the satellite spectrum monitoring software market have the chance to create and provide innovative solutions that meet the changing needs of the industry and regulatory requirements as the satellite sector develops and connectivity demands rise.

SATELLITE SPECTRUM MONITORING SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.2% |

|

Segments Covered |

By Frequency, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Anritsu Corporation, Atos, Calian Group Ltd, Clearbox Systems, CRFS Limited, EXFO Inc, Integrasys S.A., Keysight Technologies, Kratos Defense & Security Solutions, Narda Safety Test Solutions |

Global Satellite Spectrum Monitoring Software Market Segmentation: By Frequency

-

Very High Frequency (VHF)

-

Ultra-High Frequency (UHF)

-

Super High Frequency (SHF)

-

Extremely High Frequency (EHF)

It is anticipated that the market for satellite spectrum monitoring software will see rapid growth in the Ultra-High Frequency (UHF) segment. The development of 5G networks, rising wireless connection demand, and increased use of mobile communication technologies are the main factors driving this growth. Due to the UHF category's importance in many different industries and applications, this market is expected to grow significantly. The market for satellite spectrum monitoring software's most important segment can change depending on things like regional preferences, business requirements, and technology developments. The Ultra-High Frequency (UHF) segment is widely regarded as prominent owing to its extensive applications, such as television transmission, mobile communication, and satellite communication.

Global Satellite Spectrum Monitoring Software Market Segmentation: By End User

-

Aerospace

-

Maritime

-

Oil and Gas

-

Military

-

Government

-

Telecom

-

Media and Entertainment

The market for satellite spectrum monitoring software is expanding at the fastest rate in the telecommunications industry. The expansion of 5G networks, the growing need for high-speed data transfer, and the need for dependable communication infrastructure in underserved and rural areas are the main drivers of this growth. At the moment, the market for satellite spectrum monitoring is dominated by the military. The market is expanding due to military innovation and rising demand for intelligence and surveillance via satellite. Optimal data flow is ensured through spectrum monitoring, which also helps identify interference that may affect surveillance capabilities.

Global Satellite Spectrum Monitoring Software Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The market for satellite spectrum monitoring is expanding at the fastest rate in Europe thanks to the presence of important manufacturers like Atos, Integrasys S.A., CRFS Limited, and Sky and Space Company Limited. Positive government policies are also a factor in the growth of the markets in Asia-Pacific and Europe. The market for satellite spectrum monitoring is currently dominated by North America, and this trend is predicted to continue. The emergence of competitive companies that are improving satellite spectrum monitoring technologies is driving the market. The need for monitoring solutions is growing as a result of initiatives like SpaceX's and Amazon's satellite deployments for network and internet services, which are increasing the use of wireless technology and causing congestion in unlicensed spectrum.

COVID-19 Impact on the Global Satellite Spectrum Monitoring Software Market:

The COVID-19 pandemic has presented opportunities as well as challenges for the global market for satellite spectrum monitoring software. The pandemic increased demand for satellite-based communication systems and services even though it slowed satellite manufacturing and launches, disrupted the supply chain for raw materials and components, and caused logistical problems. This covers earth observation, remote sensing, broadband, telemedicine, and tele-education, all of which depend on efficient spectrum management and monitoring. To succeed in the post-pandemic environment, companies operating in this sector must adjust to shifting consumer preferences and take advantage of new developments.

Latest Trend/Development:

The market for satellite spectrum monitoring is going through several noteworthy changes and trends. The growing use of cloud-based spectrum monitoring systems, which enable real-time data collection and analysis across dispersed networks of monitoring stations, is one important trend. The adoption of cloud-based systems improves spectrum monitoring operations' scalability, flexibility, and efficiency. The increasing focus on regional spectrum monitoring, in which separate monitoring stations cooperate and exchange data to maximize spectrum management choices, is another noteworthy trend. This method improves spectrum monitoring's precision and efficacy across various geographic regions. Software-defined radio (SDR) technology is also advancing in the market, allowing for more flexible and agile spectrum monitoring capabilities. Innovation in the satellite spectrum monitoring field is being fueled by the use of SDR solutions for sophisticated system designs, fast prototypes, and spectrum monitoring applications. Finally, there is a noticeable emphasis on resolving spectrum congestion brought on by the spread of satellite constellations and wireless technologies like 5G, which has raised the need for advanced spectrum monitoring software that can effectively manage and optimize spectrum usage.

Key Players:

-

Anritsu Corporation

-

Atos

-

Calian Group Ltd

-

Clearbox Systems

-

CRFS Limited

-

EXFO Inc

-

Integrasys S.A.

-

Keysight Technologies

-

Kratos Defense & Security Solutions

-

Narda Safety Test Solutions

Market News:

-

Building on the 62 units supplied the year before, the German Federal Network Agency for Electricity, Gas, Telecommunications, Post, and Railway inked a contract with Rohde & Schwarz GmbH & Co. in November 2022 to purchase 12 more R&S PR200 portable monitoring receivers. Because of the R&S PR200's superior radio frequency (RF) characteristics, quick signal processing speed, and intuitive design, the regulatory body chose it.

-

National Instruments Corporation and ANDRO, a third-party software provider, partnered in September 2022. The goal of this partnership is to use ANDRO's software-defined radio (SDR) technology for quick prototyping and intricate system design. Thanks to its adaptability, affordability, and widespread use, the SDR, also known as USRP, is a cost-effective solution that is frequently used for a variety of applications, including spectrum monitoring systems, straightforward record-and-playback devices, and even entire cellular networks.

Chapter 1. Satellite Spectrum Monitoring Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Satellite Spectrum Monitoring Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Satellite Spectrum Monitoring Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Satellite Spectrum Monitoring Software Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Satellite Spectrum Monitoring Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Satellite Spectrum Monitoring Software Market – By Frequency

6.1 Introduction/Key Findings

6.2 Very High Frequency (VHF)

6.3 Ultra-High Frequency (UHF)

6.4 Super High Frequency (SHF)

6.5 Extremely High Frequency (EHF)

6.6 Y-O-Y Growth trend Analysis By Frequency

6.7 Absolute $ Opportunity Analysis By Frequency, 2024-2030

Chapter 7. Satellite Spectrum Monitoring Software Market – By End User

7.1 Introduction/Key Findings

7.2 Aerospace

7.3 Maritime

7.4 Oil and Gas

7.5 Military

7.6 Government

7.7 Telecom

7.8 Media and Entertainment

7.9 Y-O-Y Growth trend Analysis By End User

7.10 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Satellite Spectrum Monitoring Software Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Frequency

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Frequency

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Frequency

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Frequency

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Frequency

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Satellite Spectrum Monitoring Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Anritsu Corporation

9.2 Atos

9.3 Calian Group Ltd

9.4 Clearbox Systems

9.5 CRFS Limited

9.6 EXFO Inc

9.7 Integrasys S.A.

9.8 Keysight Technologies

9.9 Kratos Defense & Security Solutions

9.10 Narda Safety Test Solutions

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The field of developing and providing technologies, answers, and services for observing and managing the radio frequency spectrum used by satellites is known as satellite spectrum monitoring.

In 2023, The Global satellite Spectrum Monitoring Software Market was valued at USD 8.54 Billion and is projected to reach a market size of USD 14.83 Billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.2%

Rising technical innovation and Cloud-Based Satellite Spectrum Monitoring Services are the drivers of the Global Satellite Spectrum Monitoring Software Market.

Spectrum Monitoring satellite market may hinder the growth due to accuracy concerns.

Europe is the fastest growing in the Global Satellite Spectrum Monitoring Software Market.