Sapphire Market Size (2025-2030)

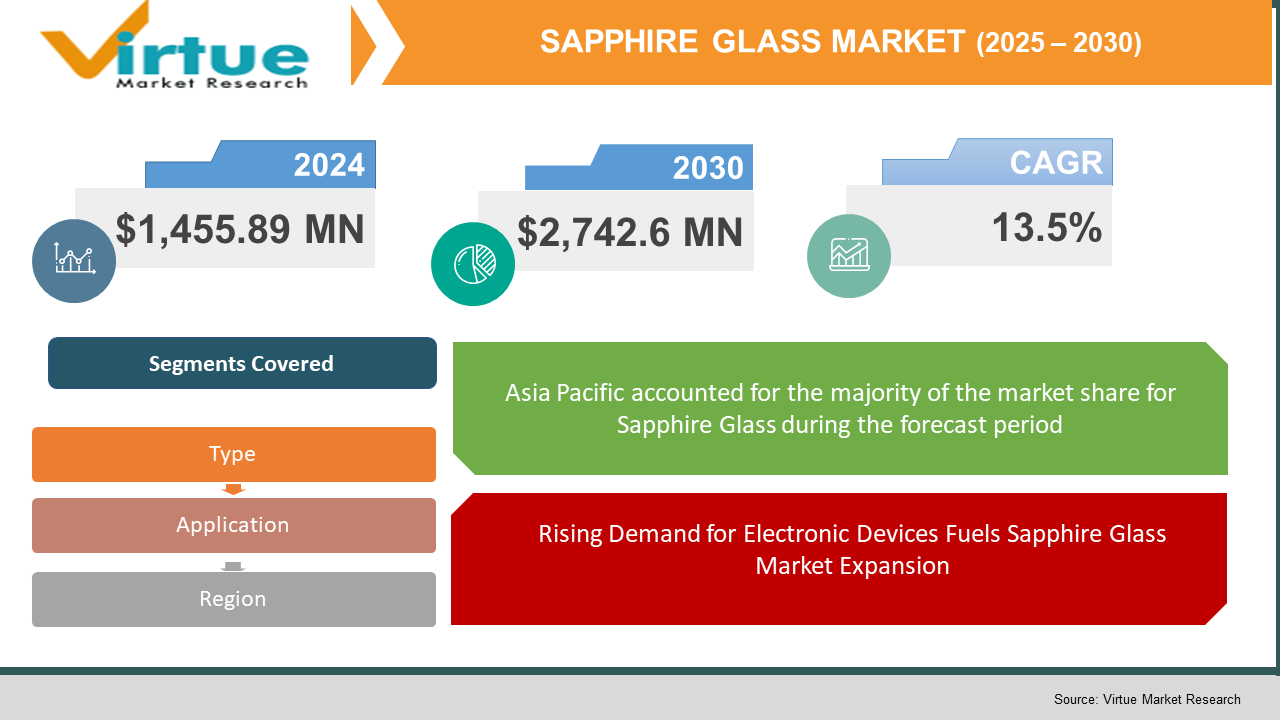

The Sapphire Glass Market was valued at USD 1,455.89 Million in 2024. Over the forecast period of 2025-2030 it is projected to reach USD 2,742.6 Million by 2030, growing at a CAGR of 13.5%.

Sapphire glass is a clear, crystalline ceramic material made from highly purified aluminum oxide, commonly referred to as alumina. Recognized for its cost-efficiency, adaptability, and robust nature, it also demonstrates excellent biocompatibility and superior resistance to physical damage, harsh chemicals, radiation, and extreme thermal conditions. In comparison to conventional glass, sapphire glass provides enhanced optical clarity, reduced birefringence, and greater mechanical strength. Its notable hardness and resilience to chemical degradation and elevated temperatures make it an ideal material for various sectors. Consequently, it finds widespread application in consumer electronics, display panels, optical lenses, wristwatches, medical implants, surgical tools, protective shields, aircraft cockpit windows, sensors, and armored transportation. Furthermore, it is essential in demanding industrial settings—such as the petrochemical sector—where materials are subjected to severe environmental conditions, including intense heat and pressure.

Key Market Insights:

The production of synthetic sapphire generally employs techniques such as the Verneuil process or the Kyropoulos method, both of which enable the formation of large sapphire crystals that can be cut into sheets for commercial applications. This complex manufacturing approach guarantees high material quality while supporting its extensive use across a wide range of industries. With ongoing advancements in fabrication methods, the Sapphire Glass Market is expected to witness significant growth, driven by reduced production costs and improved operational efficiency.

Market expansion is further supported by increasing emphasis on sustainability and environmentally responsible practices. As eco-consciousness rises among consumers, there is growing demand for materials that combine durability with sustainable production. Sapphire glass, known for its long service life and recyclability, aligns well with these expectations. This quality makes it an attractive option for both producers and end-users seeking sustainable solutions. The convergence of environmental responsibility and technological innovation is anticipated to propel the market forward, solidifying sapphire glass as a pivotal material in the evolving landscape of multiple industries.

Owing to its superior scratch resistance and durability, more than 85% of luxury watches globally now feature sapphire crystal displays, especially among high-end Swiss brands.

In the defense and aerospace sectors, sapphire glass is extensively used in missile domes, optical sensor covers, and aircraft cockpit windows because it withstands extreme thermal, pressure, and radiation conditions, offering long-term durability in hostile environments.

Even with advancements in production methods, sapphire glass continues to cost 3 to 10 times more than standard glass. Its inherent brittleness also makes it more prone to cracking during processing, leading to handling complexities and lower manufacturing yields. These factors remain significant challenges in scaling its use across industries.

According to a report, wafer processing for sapphire glass can account for nearly 40% of the total production cost, as the material’s extreme hardness requires diamond-tipped tools and highly specialized equipment for cutting and polishing.

Sapphire Glass Market Drivers:

Extensive Applications Across Diverse Industries Propel Sapphire Glass Market Expansion.

Its exceptional durability, hardness, and optical clarity make it an ideal material for a wide range of components, including protective windows, optical lenses, medical instruments, and advanced sensors used across these industries.

Rising Demand for Electronic Devices Fuels Sapphire Glass Market Expansion.

The growing demand for smartphones, tablets, wearables, and a wide range of electronic devices is significantly contributing to the rising need for sapphire glass. Valued for its superior scratch resistance and extended durability compared to conventional glass, sapphire glass is commonly utilized in components such as display screens, camera lenses, and home buttons.

Rising Demand for Premium Consumer Electronics Accelerates Sapphire Glass Market Growth.

One of the key factors driving this upward trend is the rising demand for wearable technology. These devices require materials that offer high durability and resistance to scratches, as they are subjected to frequent handling and exposure to diverse environmental conditions. Moreover, there is a growing consumer preference for enhanced display performance. Sapphire glass offers exceptional transparency and light transmission, contributing to superior visual clarity and a more refined user experience. Its ability to deliver improved color accuracy, sharpness, and overall image quality makes it particularly suitable for applications where high display performance is essential.

Sapphire Glass Market Restraints and Challenges:

Inherent Fragility and Brittleness Limit Sapphire Glass Market Expansion.

While sapphire glass is widely recognized for its exceptional durability and scratch resistance, it is also inherently more brittle compared to other materials. This brittleness presents significant challenges during handling, processing, and installation, often resulting in higher breakage rates, reduced manufacturing efficiency, and material losses throughout the production process.

Sapphire Glass Market Growth Is Hindered by Competition from Alternative Materials.

The sapphire glass market faces significant competition from alternative materials, including reinforced glasses like Gorilla Glass and synthetic ceramics such as alumina ceramics. These alternatives provide similar levels of hardness, scratch resistance, and optical transparency. However, their key advantage lies in being more cost-effective and easier to produce than sapphire glass. This competitive pressure from alternative materials may constrain the growth potential of sapphire glass in specific applications.

Sapphire Glass Market Opportunities:

Technological Advancements in Production Methods Generate New Market Opportunities.

Recent advancements in manufacturing technologies have enhanced the accessibility and cost-efficiency of sapphire glass production. Techniques such as the Kyropoulos and Czochralski methods have significantly boosted production efficiency, with yield rates for sapphire crystal growth improving by approximately 20% in recent years. These technological improvements enable manufacturers to produce larger and thinner sapphire substrates, expanding their applicability in sectors like optical devices and automotive displays. For instance, GT Advanced Technologies has reported a notable decrease in production costs, allowing the company to supply sapphire glass across various industries, thereby broadening its customer base and driving increased revenue within the sapphire glass market.

SAPPHIRE GLASS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

13.5% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

KYOCERA Corporation, Rubicon Technology, Inc. and Rayotek Scientific Inc. |

Sapphire Glass Market Segmentation:

Sapphire Glass Market Segmentation By Type:

- High Grade Transparency Sapphire Glass

- General Transparency Sapphire Glass

General transparency sapphire glass currently dominates the global sapphire glass market, primarily due to its exceptional optical clarity that facilitates high light transmission. Its broad applicability, coupled with relatively lower production costs, has contributed to its widespread use in smartphone screens, camera lenses, and various electronic displays, thereby driving strong demand.

In contrast, high-grade transparency sapphire glass is predominantly utilized in specialized applications such as LED manufacturing and optoelectronic devices—including optical lenses and laser windows—where superior optical clarity is critical. Additionally, this premium-grade sapphire glass is commonly featured in luxury consumer products like high-end watches, flagship smartphones, and premium optical instruments.

Sapphire Glass Market Segmentation By Application:

- Smartphones

- Optical and Mechanical Instruments

- Watches

- Medical Devices

- Safety Establishments

- Others

Smartphones dominate the global sapphire glass market, largely driven by the rising demand for improved screen protection. The surge in smartphone demand since the COVID-19 pandemic has been driven by the increasing necessity for instant communication, social media interaction, and convenient access to information anytime.

The fastest-growing segment within the market is LED manufacturing, anticipated to experience rapid expansion fueled by the widespread adoption of LED lighting across residential, commercial, automotive, and industrial sectors. This growth is further supported by rising demand for sustainable lighting solutions and stringent energy efficiency regulations.

The optical segment is also witnessing significant growth, propelled by technological advancements such as augmented reality (AR), virtual reality (VR), and 3D sensing. These emerging technologies depend on precision optical components, with sapphire glass delivering superior optical clarity and performance, thereby driving demand in this sector.

Additionally, there has been a notable increase in the luxury goods segment, particularly high-end watches and related accessories. Sapphire glass is widely used for watch crystals due to its scratch resistance, clarity, and aesthetic appeal, which continues to attract discerning customers.

Lastly, sapphire glass maintains extensive use in the industrial sector. Growth in this segment is largely attributed to advancements in manufacturing processes, increased automation, and heightened demand for high-performance materials in industries such as defense and aerospace.

Sapphire Glass Market Segmentation- by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The Asia Pacific region stands as the leading market for sapphire glass. Key factors driving growth in this region include increasing awareness of the benefits of sapphire glass, government initiatives promoting the replacement of traditional lighting with LED solutions, and rapid infrastructure development such as high-rise construction, expanding healthcare facilities, transportation networks, and smart city projects. Additionally, stringent environmental regulations, a strong focus on sustainability, ongoing technological advancements, and the growth of renewable energy plants contribute significantly to the market’s expansion in Asia Pacific.

North America holds a leading position in the global sapphire glass market and is expected to maintain this dominance throughout the forecast period. This leadership is attributed to the widespread adoption of sapphire glass across various end-use industries. Furthermore, the presence of prominent manufacturers in the region continues to support and accelerate market growth.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic outbreak presented considerable challenges to the sapphire glass industry, affecting countries across the globe. The crisis led to travel restrictions, nationwide lockdowns, supply chain interruptions, diminished corporate confidence, and widespread uncertainty, collectively causing delays and temporary halts in sapphire glass production.

Additionally, the implementation of social distancing protocols and lockdown measures resulted in reduced workforce availability, material shortages, and further disruptions throughout the supply chain, leading to decreased manufacturing output. The pandemic also triggered a shift in consumer behavior, with increased reliance on e-commerce and online purchasing. This transition affected traditional distribution channels for sapphire glass products, as many physical retail outlets experienced closures and operational restrictions.

Latest Trends/ Developments:

In 2024, advancements in production efficiency are expected to enable manufacturers to produce larger sapphire wafers with reduced material waste. For example, II-VI Optical Systems has introduced a new production line capable of fabricating wafers up to 300 mm in diameter, surpassing the previous limit of 200 mm. This advancement reduces production costs while enhancing the quality of the final products, consequently boosting the attractiveness of sapphire glass across various industries. Apple incorporates high-grade sapphire glass in its Apple Watch models utilize sapphire glass to improve screen durability and resist scratches. Additionally, the use of sapphire glass is gaining momentum in the defense and medical sectors, where the demand for durable materials for optical lenses and protective covers continues to grow.

Key Players:

These are top 10 players in the Sapphire Glass Market:-

- KYOCERA Corporation

- Rubicon Technology, Inc.

- Rayotek Scientific Inc.

- Crystran Ltd.

- Saint-Gobain Group,

- Monocrystal PLC

- Crystalwise Technology Inc.

- Swiss Jewel Company

- SCHOTT North America Inc. (SCHOTT AG)

- Precision Sapphire Technologies, Ltd

Chapter 1. Sapphire Glass Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. SAPPHIRE GLASS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. SAPPHIRE GLASS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. SAPPHIRE GLASS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. SAPPHIRE GLASS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SAPPHIRE GLASS MARKET – By Type

6.1 Introduction/Key Findings

6.2 High Grade Transparency Sapphire Glass

6.3 General Transparency Sapphire Glass

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. SAPPHIRE GLASS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Smartphones

7.3 Optical and Mechanical Instruments

7.4 Watches

7.5 Medical Devices

7.6 Safety Establishments

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. SAPPHIRE GLASS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. SAPPHIRE GLASS MARKET – Company Profiles – (Overview, Type Type , Portfolio, Financials, Strategies & Developments)

9.1 KYOCERA Corporation

9.2 Rubicon Technology, Inc.

9.3 Rayotek Scientific Inc.

9.4 Crystran Ltd.

9.5 Saint-Gobain Group,

9.6 Monocrystal PLC

9.7 Crystalwise Technology Inc.

9.8 Swiss Jewel Company

9.9 SCHOTT North America Inc. (SCHOTT AG)

9.10 Precision Sapphire Technologies, Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The production of synthetic sapphire generally employs techniques such as the Verneuil process or the Kyropoulos method, both of which enable the formation of large sapphire crystals that can be cut into sheets for commercial applications.

The top players operating in the Sapphire Glass Market are - KYOCERA Corporation, Rubicon Technology, Inc. and Rayotek Scientific Inc.

The outbreak of the COVID-19 pandemic posed significant challenges to the sapphire glass industry, impacting numerous countries worldwide.

Technological Advancements in Production Methods Generate New Market Opportunities.

North America is the fastest-growing region in the Sapphire Glass Market.