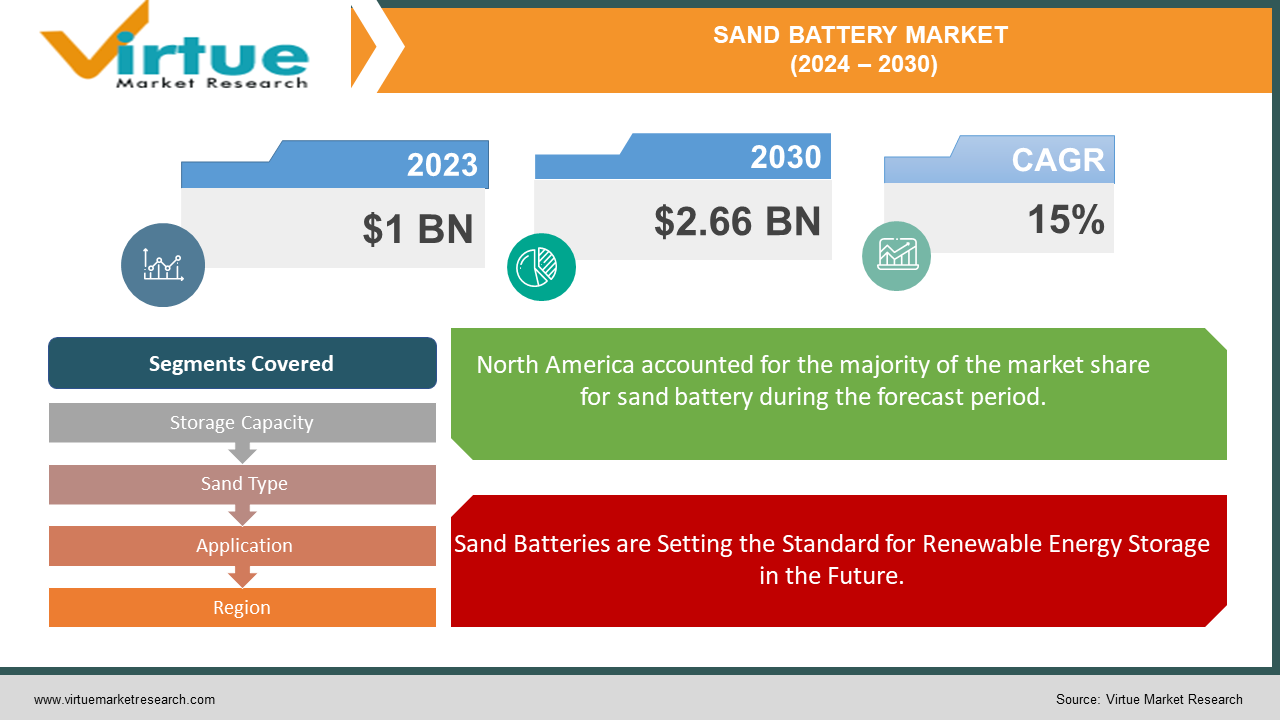

Sand Battery Market Size (2024 – 2030)

The Global Sand Battery Market was valued at USD 1 billion in 2023 and is projected to reach a market size of USD 2.66 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 15% between 2024 and 2030.

The global energy landscape is undergoing a significant transformation, driven by the urgent need for sustainable and reliable energy sources. While renewable energy sources like solar and wind are gaining traction, their intermittent nature poses a challenge to grid stability. This is where sand batteries emerge as a game-changer. Sand batteries are a novel thermal energy storage technology that utilizes sand or similar materials to store excess heat from renewable sources. This stored heat can then be used to generate electricity or provide thermal energy for heating purposes, even during periods of low renewable energy production. The global sand battery market is in its nascent stage, with the first commercial project recently launched in Finland. However, this innovative technology holds immense potential to revolutionize the energy storage sector by offering several advantages over conventional battery storage solutions. This introduction provides a brief overview of sand batteries, highlighting their role in addressing the challenges of renewable energy integration. It piques the reader's interest by mentioning the market's newness and the potential it holds for the future of energy storage.

Key Market Insights:

Environmental Sustainability of Sand batteries utilizes abundant and sustainable materials like silica sand, reducing environmental impact.

Government Support in regions such as North America, Europe, and Asia Pacific are implementing supportive policies and incentives for clean energy initiatives, potentially benefiting sand battery development.

Technological Advancements in ongoing research aim to enhance sand battery performance through the exploration of alternative materials and optimization of heat transfer processes.

Renewable Energy Integration of 60% in Sand batteries plays a crucial role in ensuring grid stability as solar and wind energy penetration increases.

Cost-effectiveness 20% in Sand batteries offers a cost-competitive solution for large-scale energy storage compared to traditional lithium-ion batteries.

Global Sand Battery Market Drivers:

Sand Batteries are Setting the Standard for Renewable Energy Storage in the Future.

The global shift towards renewable energy sources, such as solar and wind, underscores the critical need for efficient long-duration energy storage solutions. Sand batteries are emerging as a compelling alternative to traditional lithium-ion batteries, offering a cost-effective and environmentally friendly option for large-scale energy storage. Unlike lithium-ion batteries, which are associated with high costs and significant environmental concerns, sand batteries leverage abundant and inexpensive raw materials, making them an attractive solution for the sustainable energy sector. The integration of sand batteries with renewable energy systems ensures a stable and reliable power supply, even during periods of low energy production, thereby enhancing the overall efficiency and viability of renewable energy projects. This synergy between renewable energy and sand batteries is expected to drive significant market growth, as it addresses both economic and environmental challenges associated with energy storage. As the demand for renewable energy continues to surge sand batteries are poised to play a pivotal role in the transition towards a more sustainable and resilient energy infrastructure, marking a significant advancement in the quest for cleaner energy solutions.

Enhancing Grid Stability with Sand Batteries is a Solution for Renewable Energy Integration.

The growing penetration of renewable energy sources, such as solar and wind, poses a significant challenge to grid stability due to their intermittent nature. Sand batteries present an innovative solution to this problem by storing excess energy produced during peak renewable generation periods and releasing it during times of high demand. This capability not only ensures a stable and reliable power supply but also optimizes the utilization of renewable energy, reducing reliance on fossil fuels and enhancing overall grid efficiency. By addressing the inherent variability of renewable energy sources, sand batteries provide a crucial buffer that mitigates the risks of power outages and fluctuations, thereby maintaining a consistent energy flow. This technology is particularly beneficial in regions with high renewable energy adoption, where grid stability is a paramount concern. As the global energy landscape continues to evolve towards sustainable practices, the ability of sand batteries to support grid reliability will drive significant market growth. Their cost-effectiveness, coupled with minimal environmental impact, positions sand batteries as a key component in the future of energy storage solutions, ensuring a resilient and sustainable power infrastructure capable of meeting the demands of modern energy consumption.

Global Sand Battery Market Restraints and Challenges:

The global sand battery market, despite its potential, faces several critical restraints and challenges that hinder its widespread adoption. One major obstacle is the early-stage nature of the technology, which brings uncertainties regarding its long-term performance, durability, and efficiency. These uncertainties can discourage investment and slow the pace of development. Additionally, the high costs associated with research and development, along with the initial setup of sand battery systems, can be prohibitive, especially for regions with limited financial resources. Integrating sand batteries into existing energy grids presents logistical and technical challenges, requiring substantial modifications and advanced engineering solutions. While sand itself is abundant and inexpensive, the technology to effectively utilize it for energy storage involves complex and costly materials and processes. Regulatory hurdles and a lack of standardized policies for emerging energy storage technologies further complicate the market landscape. Environmental concerns, although less severe than those associated with traditional batteries, still exist, particularly regarding the sourcing and processing of sand and other raw materials. Moreover, competition from more established energy storage technologies, such as lithium-ion batteries, which benefit from economies of scale and well-established supply chains, presents a significant barrier. Overcoming these challenges is essential for sand batteries to achieve their full market potential and contribute effectively to global energy storage needs.

Global Sand Battery Market Opportunities:

The global sand battery market presents numerous opportunities driven by the increasing need for sustainable energy storage solutions. As the adoption of renewable energy sources such as solar and wind accelerates, the demand for efficient, long-duration storage systems becomes critical. Sand batteries offer a promising alternative due to their cost-effectiveness, environmental friendliness, and the abundance of sand as a raw material. This positions them as a viable solution for large-scale energy storage, capable of addressing the intermittency of renewable energy and ensuring grid stability. Technological advancements and ongoing research are expected to enhance the efficiency and scalability of sand batteries, making them more competitive with established storage technologies like lithium-ion batteries. Additionally, supportive government policies and incentives aimed at promoting renewable energy and innovative storage solutions can further propel market growth. The push for decarbonization and the transition towards a more sustainable energy infrastructure creates a favorable environment for sand batteries. Emerging markets, particularly in regions with abundant renewable energy resources and growing energy needs, present significant opportunities for deployment. By leveraging these opportunities, sand batteries can play a crucial role in the global shift towards cleaner energy, providing reliable and sustainable storage solutions that support the broader goals of energy security and environmental preservation.

SAND BATTERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Storage Capacity, Sand Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

EnergyX, Sila Nanotechnologies, Ambri, Energy Vault, ESS Inc., Heliogen |

Global Sand Battery Market Segmentation: By Storage Capacity

-

Low Capacity (Up to 10 MWh)

-

Medium Capacity (10-50 M.Wh)

-

High Capacity (Above 50 MWh)

The Global Sand Battery Market is Segmented by Storage Capacity, Medium Capacity (10-50 M.Wh) had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The global sand battery market is still in its early stages, with the first commercial project launching only recently, leaving insufficient historical data to predict its future dominance definitively. As the technology matures, new applications favoring various storage capacities may emerge, especially in large-scale grid integration projects that could drive demand for high-capacity segments. The current adoption of different capacities depends significantly on existing grid infrastructure, with medium capacities more easily integrated into current systems. Presently, the 10-50 MWh range leads the market due to its versatility, balancing capacity, and cost-effectiveness for applications such as industrial facilities and regional grid balancing. This medium-capacity is perceived as less risky compared to larger-scale projects, which might be seen as too ambitious given the nascent technology. Companies tend to prefer medium-sized projects initially to test and validate sand battery technology before scaling up. While medium capacity currently holds a leading position due to these factors, it's uncertain if it will dominate throughout the forecast period. Market dynamics are likely to shift as technology advances and new applications develop, potentially favoring different capacities in the future as the infrastructure evolves and more data becomes available.

Global Sand Battery Market Segmentation: By Sand Type

-

Silica Sand

-

Alternative Materials

The Global Sand Battery Market is Segmented by Sand Type, Silica Sand had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Silica sand stands out as the most readily available and cost-effective material for sand batteries, significantly lowering the costs of building and operating these systems compared to rarer or more expensive alternatives. Extensive research and development on silica sand have established its thermal properties and behavior within sand battery prototypes, ensuring a reliable and well-understood performance. This familiarity translates into lower technical risk when integrating silica sand into existing designs, as companies can leverage existing knowledge and infrastructure. While research into alternative materials like olivine or ceramic composites continues, these options face significant challenges. Limited availability of these materials could drive up costs and impede scalability, and their development stages are earlier, necessitating further testing and optimization before they can be widely adopted. Consequently, silica sand is poised to maintain its dominant position in the sand battery market due to its abundance, proven performance, and lower technical risk. However, as research progresses, alternative materials with potentially higher efficiency or faster charging rates could emerge as viable options in the long term, potentially shifting market dynamics and enhancing the overall effectiveness of sand battery technology.

Global Sand Battery Market Segmentation: By Application

-

Grid-Connected Energy Storage

-

Industrial Process Heat Storage

-

District Heating Systems

The Global Sand Battery Market is Segmented by Application, Industrial Process Heat Storage had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Industries requiring consistent thermal energy might initially adopt sand batteries for heat storage, potentially securing a significant market share for industrial applications. These batteries can store excess heat generated during industrial processes, enhancing energy efficiency and reducing reliance on fossil fuels. However, the focus on renewable energy integration suggests that grid-connected energy storage could become a stronger market driver in the long term, possibly surpassing industrial applications. While industrial heat storage may be more readily deployable due to existing infrastructure, grid-connected and district heating applications could mature faster than anticipated, impacting market share. The relative dominance of these applications will depend on various factors, including government regulations that promote renewable energy and industrial energy efficiency, as well as technological advancements in grid integration and control systems for sand batteries. Additionally, the specific energy consumption patterns and economic considerations of different industries will influence adoption rates. Thus, while industrial heat storage has a compelling case for early adoption, grid-connected storage, and district heating also have the potential to become crucial segments. The evolving market dynamics will reflect the interplay of these factors, determining the future landscape of sand battery applications.

Global Sand Battery Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Sand Battery Market is Segmented by Region, North America had the largest market share last year and is poised to maintain its dominance throughout the forecast period. In the emerging sand battery market, North American governments, particularly the US, are actively promoting renewable energy and grid modernization projects, incentivizing early adoption of sand battery technology. With a well-developed grid infrastructure and a wealth of technological expertise from established research institutions and companies, North America is poised to be a leader in sand battery development and deployment. However, the global landscape is dynamic, and other regions with strong commitments to renewable energy, such as Europe and Asia Pacific, are equally motivated to invest in sand battery technology. While North America may prioritize grid-connected storage due to its infrastructure, regions with higher industrial energy consumption could focus on industrial process heat storage. Government incentives in Europe and the Asia Pacific could accelerate adoption and challenge North American dominance. Success in early commercial projects, regional energy policies, and the cost competitiveness of sand batteries will also influence adoption rates worldwide. Consequently, while North America has a strong foothold in the early market, the global sand battery market is expected to become more geographically diverse, with Europe and the Asia Pacific emerging as significant contenders alongside North America.

COVID-19 Impact Analysis on the Global Sand Battery Market.

The global sand battery market, still in its early stages, experienced indirect impacts from the COVID-19 pandemic. Supply chain disruptions caused by lockdowns and travel restrictions may have delayed access to critical materials or components necessary for prototype development or pilot projects. Governments and companies might have temporarily shifted resources away from research and development of emerging technologies like sand batteries to address immediate pandemic response needs. Additionally, economic uncertainty could have made investors more cautious about funding new and unproven technologies, potentially slowing private investment in sand battery development. However, amidst these challenges, there are potential long-term benefits. The pandemic's impact on energy markets could underscore the importance of grid stability and energy independence, increasing interest in long-duration energy storage solutions like sand batteries. Government stimulus packages promoting clean energy initiatives in the recovery phase could further support the development and deployment of sand batteries. Thus, while COVID-19 posed short-term obstacles, the long-term outlook for the sand battery market appears promising, given its potential to contribute to a more resilient and sustainable energy future in the post-pandemic era.

Latest Trends/ Developments:

The global sand battery market is witnessing an exciting infancy marked by recent developments that hint at a promising future. The successful launch of the first commercial sand battery project in Finland in 2023 has demonstrated the real-world potential of this technology, showcasing its capability to contribute to the clean energy transition. Ongoing research into alternative materials like olivine suggests the possibility of higher efficiency, further enhancing the appeal of sand batteries. Moreover, companies are exploring applications beyond grid-connected storage, with pilot projects emerging for industrial process heat storage and district heating, highlighting the versatility of sand batteries in various energy systems. The momentum is bolstered by government support for renewable energy initiatives across regions such as North America, Europe, and Asia Pacific, fostering optimism for wider adoption in the coming years. With these advancements and supportive policies, the sand battery market is poised for significant growth, offering a promising solution to meet the evolving energy storage needs in the global push towards a sustainable future.

Key Players:

-

EnergyX

-

Sila Nanotechnologies

-

Ambri

-

Energy Vault

-

ESS Inc.

-

Heliogen

Chapter 1. Sand Battery Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sand Battery Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sand Battery Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sand Battery Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sand Battery Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sand Battery Market – By Storage Capacity

6.1 Introduction/Key Findings

6.2 Low Capacity (Up to 10 MWh)

6.3 Medium Capacity (10-50 M.Wh)

6.4 High Capacity (Above 50 MWh)

6.5 Y-O-Y Growth trend Analysis By Storage Capacity

6.6 Absolute $ Opportunity Analysis By Storage Capacity, 2024-2030

Chapter 7. Sand Battery Market – By Sand Type

7.1 Introduction/Key Findings

7.2 Silica Sand

7.3 Alternative Materials

7.4 Y-O-Y Growth trend Analysis By Sand Type

7.5 Absolute $ Opportunity Analysis By Sand Type, 2024-2030

Chapter 8. Sand Battery Market – By Application

8.1 Introduction/Key Findings

8.2 Grid-Connected Energy Storage

8.3 Industrial Process Heat Storage

8.4 District Heating Systems

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Sand Battery Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Storage Capacity

9.1.3 By Sand Type

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Storage Capacity

9.2.3 By Sand Type

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Storage Capacity

9.3.3 By Sand Type

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Storage Capacity

9.4.3 By Sand Type

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Storage Capacity

9.5.3 By Sand Type

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Sand Battery Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 EnergyX

10.2 Sila Nanotechnologies

10.3 Ambri

10.4 Energy Vault

10.5 ESS Inc.

10.6 Heliogen

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Sand Battery market is expected to be valued at US$ 1 billion.

Through 2030, the global Sand Battery market is expected to grow at a CAGR of 15%.

By 2030, the global Sand Battery is expected to grow to a value of US$ 2.66 billion.

North America is predicted to lead the market globally for Sand Battery.

The global Sand Battery has segments like Application, Sand type, storage capacity, and Region.