Salesforce CRM Document Generation Software Market Size (2024 – 2030)

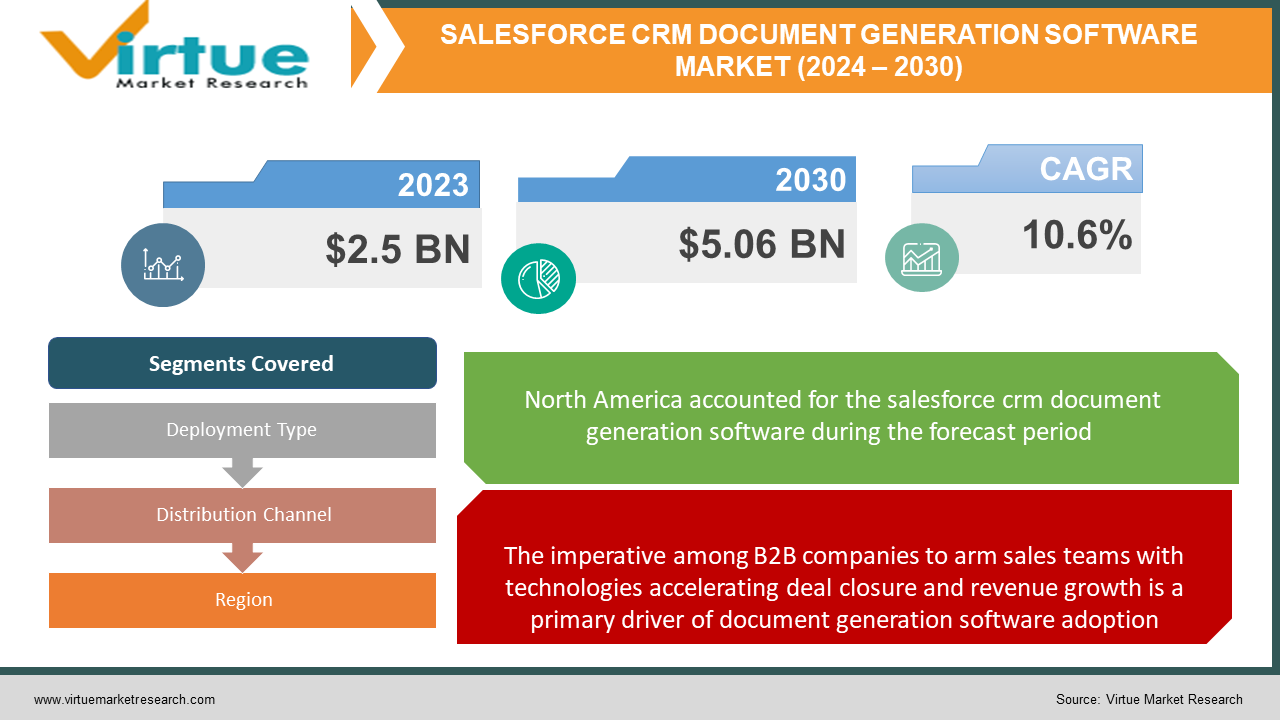

The Salesforce CRM Document Generation Software Market was valued at USD 2.5 Billion in 2023 and is projected to reach a market size of USD 5.06 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.6%.

Salesforce CRM document generation tools allow businesses to automatically create, personalize, and share customized documents from within the Salesforce platform. Rather than manually building documents in external apps, document generation software enables employees to generate contracts, proposals, collateral, and other customer-facing files on demand directly from Salesforce using approved templates and data. Key capabilities of CRM document generation solutions include selecting from pre-built document templates, merging customer data from Salesforce, applying conditional logic and personalization, e-signing readiness, and tracking engagement analytics. Popular use cases span sales and marketing including creating customized quotes, account summaries, renewal offers, targeted email campaigns, and consent/disclosure forms. Integrated document software eliminates fragmented workflows between Salesforce and productivity suites like Office or messaging apps. Sales and service teams can produce compliant, branded docs within seconds, facilitating speedier closure of deals. Marketing gains efficiency by distributing personalized collateral at scale while preserving brand consistency.

Key Market Insights:

Several compelling factors are catalyzing the adoption of document generation tools by Salesforce customers including rising demand for sales productivity software, personalization capabilities leveraging CRM data, and integrating complex document processes natively within Salesforce. Document automation addresses critical pain points around inefficient manual document creation workflows and brand consistency challenges at scale. Core insights driving uptake are increased corporate prioritization of sales productivity software to accelerate revenue growth and enhanced focus on customizing front-office customer interactions using data from CRM and marketing systems. Document generation solutions directly address these imperatives by streamlining the production of compliant, on-brand sales collateral, proposals, contracts, and marketing materials using approved templates and customer data from Salesforce.

Salesforce CRM Document Generation Software Market Drivers:

The imperative among B2B companies to arm sales teams with technologies accelerating deal closure and revenue growth is a primary driver of document generation software adoption.

Document-generating software usage is mostly driven by B2B organizations' urge to provide sales teams with tools that accelerate deal-close and revenue development. It takes a lot of effort to manually create proposals, prices, and personalized collateral. Sales representatives impede transaction progress and become less productive. Solutions for integrated document automation immediately solve this issue. Through the expedited process of document production from Salesforce, which leverages authorized templates and pre-existing client information, sellers may expeditiously generate customized, branded files to propel prospects while upholding brand coherence. Sales teams can close more deals more rapidly when they can easily generate compliant documents like contracts and quotations. In order to optimize and customize information for every customer, document software also combines insights from sales activity and CRM data, enabling relevance at scale. Representatives spend more time strategically interacting with customers and less time on administrative work. According to surveys, sales teams devote more than 60% of their time to non-sales-related tasks. Document software reduces the tedious human labor involved in producing information, allowing representatives to concentrate on high-value tasks like establishing rapport, determining needs, and offering advisory solutions to problems. Integrated document creation technologies offer a reliable return on investment as B2B software budgets move more and more toward facilitating sales efficiency. Automation will be widely used by top sales firms to increase productivity and selling time.

The demand among modern enterprises to deliver tailored digital experiences customized to each customer’s needs, interests, and relationships is also propelling adoption.

The imperative for companies across industries to deliver individualized customer experiences tailored to specific needs, interests, and relationships is a significant driver propelling the adoption of document generation tools within Salesforce deployments. Today's customers expect and value relevant personalized interactions across every touchpoint and channel. They resent generic one-size-fits-all messaging. Manually customizing communication at scale across digital properties, sales collateral, and multi-channel campaigns remains inefficient using traditional methods. Integrating intelligent document creation and distribution directly within Salesforce provides a powerful mechanism to coordinate omnichannel personalization leveraging CRM data.

Salesforce CRM Document Generation Software Market Restraints and Challenges:

One major restraint to the growth of Salesforce CRM document generation software is data security and privacy concerns.

As Salesforce CRM document generation tools have proliferated, concerns around data security and privacy have emerged as a major barrier to adoption. Businesses are rightfully wary of storing sensitive customer information in cloud-based platforms that automatically generate documents. Several factors drive these apprehensions and make overcoming them an ongoing struggle for software vendors. Firstly, high-profile data breaches have put companies on high alert about cyber risks. Large hacks at corporations like Yahoo, Equifax, and Uber underscore how even major tech firms can suffer compromises. This makes businesses skeptical of entrusting customer data to third-party software. Document generation tools integrate tightly with CRM systems to access client names, addresses, account details, and transaction histories when populating templates. A breach could expose this information, damaging customer trust and a company's reputation. Secondly, data privacy regulations like GDPR and CCPA have heightened compliance requirements around handling personal data. Companies face legal penalties if customer information is misused or leaked. Yet Salesforce CRM document generators may transmit data across borders in complex, opaque ways as part of cloud hosting. This amplifies uncertainty around how client data is managed behind the scenes and whether it complies with all applicable privacy laws. Thirdly, generated documents often contain sensitive details like financials, health records, or legal proceedings. Any unauthorized access poses major risks for clients. So companies are justifiably concerned whether document generation vendors have robust controls to prevent insider threats and external attacks. Addressing these worries imposes costs on software providers. They must invest heavily in security measures like encryption, role-based access controls, rigorous testing, and third-party audits. Earning customers' trust also requires being transparent about security practices and compliance through certifications, guarantees, and features like client-side encryption.

Another challenge is integration difficulties with sophisticated CRM systems and other adjacent technologies.

Another major adoption barrier stems from the difficulties of integrating document generation tools into sophisticated customer environments. To maximize value, automating document creation cannot occur in a silo. It requires seamless connectivity with relevant systems and data sources across an enterprise. However, complex CRM implementations and surrounding architectures make this integration a significant undertaking. For starters, Salesforce CRM systems themselves have highly customizable data models, fields, objects, and workflows unique to each business. Document generators need deep integration to leverage the appropriate information for populating customized templates. This necessitates intricate configuration and tuning during implementation to match the tool to the CRM's particular structure. Such integration projects demand IT resources and expertise that not all customers possess. Moreover, companies increasingly augment CRM with dozens of complementary technologies like ERPs, eSignature tools, payment processors, and email systems. The integration burden thus makes automating document generation seem like an expensive, risky IT project to wary business leaders.

Salesforce CRM Document Generation Software Market Opportunities:

One major opportunity spurring the growth of Salesforce CRM document generation is the booming ecosystem surrounding Salesforce itself. As the market-leading CRM, Salesforce now anchors a thriving cloud ecosystem integrating complementary technologies like ERPs, payments, marketing automation, and business intelligence. This creates a built-in demand for automating document workflows within the Salesforce universe. As customers deploy more apps and services around Salesforce, they generate more documents and data sources that need connecting. Document generation vendors with tight Salesforce integration are poised to capitalize on this explosive ecosystem expansion. They can market readiness to connect their solutions with the latest partners like Slack, Tableau, and Apttus to joint customers. Having a foot firmly planted in the Salesforce world gives document generation firms an addressable market of over 150,000 Salesforce customers to target. The broader Salesforce ecosystem's meteoric growth will provide fuel for the document automation space to keep thriving.

SALESFORCE CRM DOCUMENT GENERATION SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.6% |

|

Segments Covered |

By Deployment Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Conga, Nintex, DocuSign, PandaDoc, S-Docs, Formstack Documents, DealHub, Drawloop |

Salesforce CRM Document Generation Software Market Segmentation: By Deployment Type

-

Cloud-Based

-

On-premises

Cloud-based deployment accounts for the dominant share of the market at around 75-80% in 2023. Cloud platforms are the fastest-growing segment as well, with adoption rising at over 20% annually. The flexibility, scalability, and accessibility of cloud-based tools make them attractive to most customers, especially smaller businesses. Leading vendors like Conga, Draw-loop, and Salesforce itself focus on cloud-native SaaS offerings. On-premises deployment represents 20-25% market share currently. This segment will continue shrinking as cloud adoption rises. However, on-premises persist among highly regulated industries like financial services and healthcare that demand total control over data security and systems. Customization needs also lead some large enterprises to on-premises deployments. Cloud-based document generation solutions are the fastest-growing segment within the Salesforce CRM document generation market. This surge is driven by organizations embracing their scalability, ease of implementation, and continuous feature updates.

Salesforce CRM Document Generation Software Market Segmentation: By Distribution Channel

-

Large Enterprises

-

Small and Medium-Sized Enterprises (SMEs)

SMBs represent the largest share at around 60-70% of the market currently. The flexibility and affordability of cloud-based tools make them popular among smaller organizations with more limited budgets. The SMB segment is also the fastest growing at over 25% CAGR as adoption spreads. Large enterprises account for 30-40% market share. While slower growing than SMBs, large enterprises are increasing investments as they scale document automation across departments and global operations. SMBs hold the dominant share of the Salesforce document generation market today given the accessibility of cloud-based offerings. However, steady growth among large enterprises is also propelling market expansion as they adopt tools company-wide. The SMB segment is likely to maintain dominance, but enterprise adoption will continue picking up pace as well.

Salesforce CRM Document Generation Software Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

With a market share of about 40–50% of worldwide revenue, North America holds the largest position. North America is the most developed market since it is Salesforce's home region and has a large early adopter base. Nonetheless, growth is decreasing at a rate of about 15 percent per year in comparison to other regions. With a 25–30% market share, Europe is the second-largest area. In Europe, adoption is growing at a rate of more than 20% CAGR due to initiatives to undergo digital transformation. Asia Pacific is the fastest growing region, with a CAGR of over 25%, but now retains a share of about 15% to 20%. The penetration of document automation is being driven by the rapid adoption of Salesforce in nations like Australia, Japan, and India. With Salesforce making inroads into the region, Latin America accounts for 5–10% of the market share and is growing rapidly at a rate of about 20 percent compound annual growth. Considering Salesforce's relatively new presence, the Middle East and Africa make up less than 5% of the total, yet they are ideal regions for future geographic growth. Although North America continues to lead the industry, as Salesforce expands internationally, long-term growth is moving towards emerging and APAC regions. Global market share is anticipated to gradually equalize in the future.

COVID-19 Impact Analysis on the Salesforce CRM Document Generation Software Market:

The COVID-19 pandemic significantly influenced the Salesforce CRM document generation software market by accelerating demand, spurring feature innovation, and driving new use cases. While causing broader economic uncertainty, the pandemic was a net positive for the growth and maturation of the market. Most crucially, COVID-19 accelerated enterprise adoption of document automation tools. With remote work mandates in place worldwide, companies could no longer rely on in-person processes to manage document creation and signatures. This drives urgency around digitizing workflows through automated generation. Both renewals and new sales of document software spiked during 2020 and 2021 as businesses sought to enable collaboration without physical contact. Vendors saw dramatic spikes in revenue as the pandemic forced digital transformation. COVID also spurred the release of new features tailored specifically for remote work. For instance, tools added integrations with eSignature platforms like DocuSign to digitize contract signing. Support for auto-tagging documents with unique IDs emerged to track versions in distributed settings. Vendors enabled seamless handoffs between document generation systems and collaboration tools like Slack and Microsoft Teams. These enhancements made document software indispensable for remote teams.

Latest Trends/ Developments:

Artificial intelligence and machine learning are being rapidly adopted in document automation tools. Vendors are using AI to enable real-time recommendations and assistance while users create templates and documents. For example, AI can suggest relevant text, images, layouts, and designs as users type. It can also auto-populate fields and background data using context. These innovations drive efficiency and ease for template building. AI additionally empowers capabilities like sentiment analysis to gauge tone and adapt wording for customized, impactful documents. The adoption of neural networks within document generation promises even more intelligent functionality. Another growing focus is enabling consistent document experiences across all customer touchpoints. Vendors are enhancing integrations with marketing automation, customer service, and sales engagement systems. This allows for unified document workflows across channels like email, web, mobile, and in-product experiences. Customers get a seamless, personalized document experience at every brand interaction. Market leaders are also building tighter integration between documents and business intelligence, allowing document messaging to adapt based on customer analytics and predictive models.

Key Players:

-

Conga

-

Nintex

-

DocuSign

-

PandaDoc

-

S-Docs

-

Formstack Documents

-

DealHub

-

Drawloop

Chapter 1. Salesforce CRM Document Generation Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Salesforce CRM Document Generation Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Salesforce CRM Document Generation Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Salesforce CRM Document Generation Software Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Salesforce CRM Document Generation Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Salesforce CRM Document Generation Software Market – By Deployment Type

6.1 Introduction/Key Findings

6.2 Cloud-Based

6.3 On-premises

6.4 Y-O-Y Growth trend Analysis By Deployment Type

6.5 Absolute $ Opportunity Analysis By Deployment Type, 2024-2030

Chapter 7. Salesforce CRM Document Generation Software Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Large Enterprises

7.3 Small and Medium-Sized Enterprises (SMEs)

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Salesforce CRM Document Generation Software Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Deployment Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Deployment Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Deployment Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Deployment Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Deployment Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Salesforce CRM Document Generation Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Conga

9.2 Nintex

9.3 DocuSign

9.4 PandaDoc

9.5 S-Docs

9.6 Formstack Documents

9.7 DealHub

9.8 Drawloop

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

More organizations than ever are adopting CRM (Customer Relationship Management) platforms to manage their interactions with customers and sales processes. Salesforce's leadership in the CRM market means these organizations often seek solutions that integrate seamlessly with their existing Salesforce ecosystem.

Larger, feature-rich document generation solutions can have more substantial setup costs. Businesses need to weigh the costs against potential ROI.

Conga, Nintex, DocuSign, PandaDoc, S-Docs, Formstack Documents

North America currently holds the largest market share, estimated at around 40%.

Asia Pacific exhibits the fastest growth, driven by its increasing population, and expanding economy.