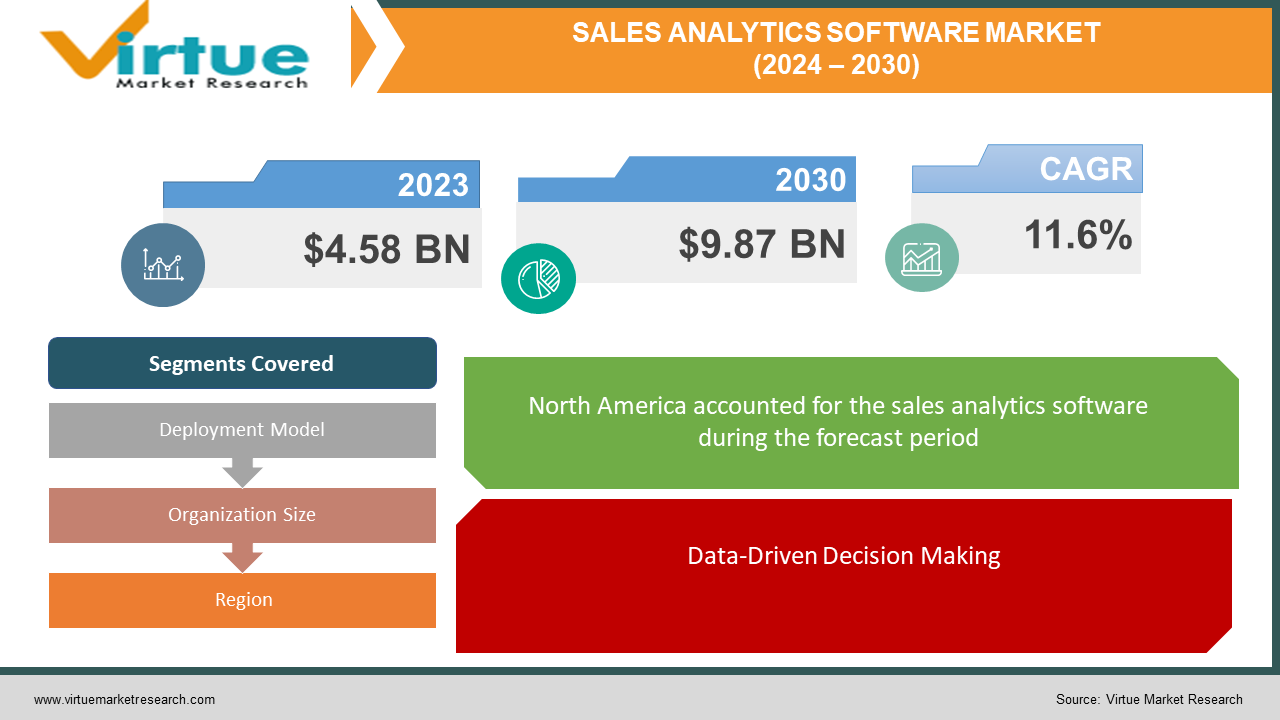

Sales Analytics Software Market Size (2024 – 2030)

The Global Sales Analytics Software Market was valued at USD 4.58 billion in 2023 and will grow at a CAGR of 11.6% from 2024 to 2030. The market is expected to reach USD 9.87 billion by 2030.

Key Market Insights:

This boom is driven by the increasing need for data-driven sales strategies. Businesses leverage these software solutions to analyse vast customer datasets, uncovering hidden patterns and optimizing sales efforts. Cloud adoption fuels accessibility and scalability, making powerful analytics available to all. Additionally, AI integration automates tasks, predicts sales performance, and personalizes interactions, boosting efficiency and revenue. While market research offers varying figures, such as USD 3.4 billion for 2024, the overall trend signifies a robust future. Moreover, the market caters to diverse segments with industry-specific solutions, further propelling its growth.

Global Sales Analytics Software Market Drivers:

Data-Driven Decision Making:

In today's data-driven world, businesses are wielding the power of information to revolutionize their sales strategies. Sales analytics software acts as a key weapon in this arsenal, allowing them to delve into the vast ocean of customer data and unearth hidden gems. By analysing intricate purchase patterns, website behaviour, and past interactions, these tools paint a vivid picture of customer preferences and buying habits. This empowers businesses to move beyond generic campaigns and craft highly targeted approaches. Imagine tailoring product recommendations based on a customer's browsing history or sending personalized birthday offers – sales analytics software makes this a reality. With this granular understanding, businesses can allocate resources more effectively, focusing their efforts on high-potential leads and nurturing existing customer relationships. The result? A significant boost in conversion rates, increased customer satisfaction, and ultimately, a surge in revenue. Sales analytics software doesn't just provide insights; it translates raw data into actionable intelligence, propelling businesses towards a data-driven future.

Cloud Adoption:

Cloud computing is acting as a game-changer for access to sales analytics software. Unlike the past, where hefty upfront costs and complex on-premise setups were roadblocks, cloud platforms offer a breath of fresh air. Subscription fees replace expensive hardware and software licenses, making it easier for businesses to start small and scale as needed. Gone are the days of lengthy installations; cloud-based software is readily available online, minimizing downtime and getting sales teams up and running quickly. Automatic updates handled by the cloud provider ensure access to the latest features and security patches, freeing up internal IT resources. Cloud's inherent scalability allows businesses to easily adjust user licenses and storage as their needs evolve, particularly beneficial for smaller businesses with fluctuating growth. This democratization of access empowers businesses of all sizes to compete on equal footing. They can leverage the same advanced analytics tools to gain customer insights, optimize sales funnels, and ultimately drive revenue growth. As cloud technology matures, the affordability and accessibility of sales analytics software will only become more widespread, enabling businesses to embrace data-driven decision making and flourish in the competitive landscape.

Integration of Artificial Intelligence (AI):

AI is rapidly reshaping the sales landscape, acting as a powerful partner to sales teams. Imagine a world where mundane tasks like data entry and report generation are handled by intelligent machines, freeing up valuable time for sales reps to focus on strategic initiatives. This is the reality with AI-powered sales analytics software. But AI's contributions extend far beyond automation. By analysing vast amounts of customer data, AI can uncover hidden patterns and predict future buying behaviour. This allows businesses to shift from a one-size-fits-all approach to highly personalized interactions. AI can analyse a customer's purchase history, website interactions, and past communications to predict their future needs and preferences. This empowers sales reps to tailor their pitches, recommend relevant products, and offer targeted promotions – all with the goal of exceeding customer expectations. Furthermore, AI can predict potential sales opportunities. By analysing historical data and identifying trends, AI can forecast which leads are most likely to convert, allowing sales teams to prioritize their efforts and focus on the most promising prospects. This not only improves conversion rates but also ensures that sales reps are spending their time on the activities that will yield the highest return. In essence, AI in sales analytics software is not just a time-saving tool; it's a strategic weapon. It empowers businesses to gain a deeper understanding of their customers, personalize interactions, predict future buying behaviour, and ultimately, close more deals and cultivate stronger customer relationships.

Global Sales Analytics Software Market challenges and restraints:

Data Integration and Quality Issues:

Fragmentation reigns supreme in the world of business data. Valuable customer information often gets siloed across various systems like CRMs, marketing platforms, and legacy applications. Merging this scattered data into a unified platform for analysis is a complex and arduous task. Imagine trying to solve a jigsaw puzzle with missing pieces – that's the challenge businesses face. Data quality throws another wrench into the works. Inconsistent formatting, missing entries, and inaccuracies lurk within these data sets. Think of analysing a recipe where key ingredients are missing or measurements are all over the place. The resulting dish would be a disaster, and so too are the insights gleaned from such data. Inaccurate data can lead to skewed results, misleading businesses into making poor decisions that can cripple sales efforts and hinder overall growth.

Security and Privacy Concerns:

In today's data-driven world, the vast treasure trove of customer information businesses gather comes with a significant responsibility - ensuring its security and privacy. Data breaches can be devastating, exposing sensitive details like financial information and purchase history, shattering customer trust, and potentially leading to hefty fines. Adding to the complexity is the ever-evolving landscape of data protection regulations. Stringent measures like the General Data Protection Regulation (GDPR) mandate robust data security practices. Businesses must implement firewalls, encryption techniques, and access controls to safeguard customer data. Additionally, procedures for handling data breaches and transparent communication with customers in case of an incident are crucial. Failing to prioritize data security and comply with regulations can have severe consequences. Legal repercussions, reputational damage, and ultimately, a loss of customer confidence can significantly hinder a business's ability to operate and thrive. Therefore, building a culture of data security and implementing necessary safeguards are not just optional measures; they are essential steps for businesses to navigate the data privacy landscape responsibly.

Lack of Skilled Workforce:

Unlocking the true power of sales analytics software hinges on a skilled workforce. Imagine a powerful microscope handed to someone who can't decipher the intricate details revealed. Similarly, complex data sets require individuals with the expertise to interpret the intricate patterns and translate them into actionable insights. This is where data analysts and data scientists step in. They possess the necessary skills to navigate the complexities of the data, identify trends hidden within the vast information ocean, and unearth valuable insights that would otherwise remain unseen. However, the current landscape faces a crucial hurdle - a shortage of these skilled professionals. This lack of qualified personnel can cripple the effective utilization of sales analytics software. Even with the best tools, businesses struggle to extract the maximum value if they lack the expertise to interpret the data and translate it into concrete actions. In simpler terms, the software becomes an underutilized asset, hindering businesses from reaping the full benefits of data-driven decision making and potentially missing out on crucial opportunities to optimize sales strategies and boost revenue.

Market Opportunities:

The Sales Analytics Software Market is brimming with exciting opportunities. Integration with AI and Machine Learning automates tasks, predicts sales performance, and personalizes interactions at an unprecedented level. Industry-specific solutions cater to unique needs of various sectors like healthcare or retail with tailored metrics and insights. Mobile-first applications empower sales teams with on-the-go data access for real-time decision making. Prescriptive analytics goes beyond just analysing data; it recommends future actions, like suggesting optimal pricing strategies. Finally, data democratization ensures relevant insights are accessible to all stakeholders through user-friendly interfaces, fostering a data-driven culture for informed decision-making across the organization. By capitalizing on these opportunities, the Sales Analytics Software Market is poised for continued growth, empowering businesses to thrive in the competitive landscape.

SALES ANALYTICS SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.6% |

|

Segments Covered |

By Deployment Model, Organization Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Salesforce, Microsoft (Dynamics 365 Sales), Oracle (Oracle Sales Cloud), SAP (SAP S/4HANA Customer Experience), IBM (IBM Cognos Analytics), Looker, Qlik, Tableau, Sisense, Zoho CRM |

Sales Analytics Software Market segmentation - By Deployment Model

-

Cloud-based

-

On-premise

The Sales Analytics Software Market caters to various deployment preferences. Traditional on-premise solutions involve installing the software directly on a company's servers, offering them full control over the data and security. However, this approach requires significant upfront investment in hardware, software licenses, and ongoing IT maintenance. Cloud-based solutions are gaining significant traction due to their inherent advantages. Software is delivered and accessed online, eliminating the need for expensive hardware and complex installations. This translates to lower upfront costs and quicker deployment times, making cloud-based solutions attractive to businesses of all sizes. Additionally, cloud platforms offer inherent scalability, allowing businesses to easily adjust their storage and user capacity as their needs evolve. This flexibility is particularly beneficial for businesses experiencing fluctuating growth. While on-premise solutions offer control, cloud-based options provide a cost-effective, scalable, and readily accessible alternative for harnessing the power of sales analytics.

Sales Analytics Software Market segmentation - By Organization Size

-

Small and Medium-sized Enterprises (SMEs)

-

Large Enterprises

The Sales Analytics Software Market caters to businesses of varying sizes with distinct needs. Small and Medium Enterprises (SMEs) prioritize cost-effectiveness and user-friendliness. Budgetary constraints often steer them towards solutions with simpler interfaces and essential sales analytics functionalities. These features allow them to gain valuable insights into customer behaviour, track sales performance, and make data-driven decisions without overwhelming internal resources. Large enterprises, on the other hand, seek feature-rich solutions with advanced capabilities. Their complex sales operations demand robust analytics tools that can integrate seamlessly with existing enterprise systems like CRMs and marketing automation platforms. Advanced features like predictive analytics and AI-powered insights empower them to delve deeper into customer data, identify emerging trends, and optimize sales strategies for maximum impact. This comprehensive functionality comes at a premium, but large enterprises are willing to invest to gain a competitive edge and drive significant revenue growth.

Sales Analytics Software Market segmentation - Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

The Global Sales Analytics Software Market exhibits diverse regional landscapes. North America reigns supreme as the leader with its well-established IT infrastructure, enthusiastic adoption of cloud solutions, and a hub of major industry players. Europe follows as a mature market, placing increasing emphasis on data privacy regulations like GDPR. Asia Pacific is the region to watch, experiencing explosive growth fuelled by factors like surging internet access, rising disposable income, and government initiatives pushing digital transformation. Latin America and the Middle East & Africa represent emerging markets brimming with potential. These regions boast a young, tech-savvy population, increasing internet usage, and a growing awareness of the value of data-driven decision-making, laying the groundwork for future market expansion. While North America currently holds the top spot, Asia Pacific is anticipated to be the fastest growing region due to its vast potential and ongoing digitalization efforts.

COVID-19 Impact Analysis on the Global Sales Analytics Software Market

The COVID-19 pandemic's impact on the Global Sales Analytics Software Market was a tale of two halves. Initial disruptions caused by lockdowns and business shutdowns led to a temporary slowdown. Cash flow constraints forced companies to delay software investments, while traditional sales methods ground to a halt. However, this initial setback paved the way for long-term growth. The shift to remote work necessitated the adoption of cloud-based solutions, making sales analytics software more accessible than ever. Businesses, facing an uncertain economic landscape, realized the immense value of data-driven decision making. Sales analytics software provided them with crucial customer behaviour insights amidst these dynamic market conditions. This recognition fuelled market growth as companies leveraged the software to optimize remote sales strategies, identify new customer acquisition channels, and predict sales performance in a volatile environment. AI-powered features like sales forecasting and churn prediction became even more critical for navigating the challenges. While the impact may differ across regions, the global market is expected to experience a positive trajectory in the coming years. The pandemic ultimately acted as a catalyst, accelerating the digital transformation of businesses, and solidifying the critical role of data-driven insights in achieving success in the post-pandemic world.

Latest trends/Developments

The Global Sales Analytics Software Market is undergoing a dynamic transformation fuelled by cutting-edge trends. AI integration is leading the charge, with software becoming increasingly intelligent. Imagine AI-powered chatbots personalizing interactions, or software automatically scheduling tasks, all to enhance customer experience and drive sales. Industry-specific solutions are also gaining traction, offering tailored metrics and insights to sectors like healthcare and retail. Prescriptive analytics is another innovation, where software goes beyond analysing data to suggesting future actions, like recommending optimal pricing strategies. Finally, data democratization is ensuring valuable insights are no longer siloed. User-friendly interfaces and mobile access empower everyone across the organization with real-time data, fostering a data-driven culture for informed decision-making at all levels. These advancements position Sales Analytics Software as a powerful tool for businesses to optimize strategies, personalize experiences, and ultimately achieve long-term success.

Key Players:

-

Salesforce

-

Microsoft (Dynamics 365 Sales)

-

Oracle (Oracle Sales Cloud)

-

SAP (SAP S/4HANA Customer Experience)

-

IBM (IBM Cognos Analytics)

-

Looker

-

Qlik

-

Tableau

-

Sisense

-

Zoho CRM

Chapter 1. SALES ANALYTICS SOFTWARE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SALES ANALYTICS SOFTWARE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. SALES ANALYTICS SOFTWARE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. SALES ANALYTICS SOFTWARE MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. SALES ANALYTICS SOFTWARE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SALES ANALYTICS SOFTWARE MARKET – By Deployment Model

6.1 Introduction/Key Findings

6.2 Cloud-based

6.3 On-premise

6.4 Y-O-Y Growth trend Analysis By Deployment Model

6.5 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 7. SALES ANALYTICS SOFTWARE MARKET – By Organization Size

7.1 Introduction/Key Findings

7.2 Small and Medium-sized Enterprises (SMEs)

7.3 Large Enterprises

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 8. SALES ANALYTICS SOFTWARE MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Deployment Model

8.1.3 By Organization Size

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Deployment Model

8.2.3 By Organization Size

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Deployment Model

8.3.3 By Organization Size

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Deployment Model

8.4.3 By Organization Size

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Deployment Model

8.5.3 By Organization Size

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. SALES ANALYTICS SOFTWARE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Salesforce

9.2 Microsoft (Dynamics 365 Sales)

9.3 Oracle (Oracle Sales Cloud)

9.4 SAP (SAP S/4HANA Customer Experience)

9.5 IBM (IBM Cognos Analytics)

9.6 Looker

9.7 Qlik

9.8 Tableau

9.9 Sisense

9.10 Zoho CRM

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Sales Analytics Software Market was valued at USD 4.58 billion in 2023 and will grow at a CAGR of 11.6% from 2024 to 2030. The market is expected to reach USD 9.87 billion by 2030.

Data-Driven Decision Making, Cloud Adoption, Integration of Artificial Intelligence (AI) these are the reasons which is driving the market.

Based on Deployment Model it is divided into two segments – Cloud-based, On-premise.

North America is the most dominant region for the luxury vehicle Market.

Salesforce, Microsoft (Dynamics 365 Sales), Oracle (Oracle Sales Cloud), Looker, SAP (SAP S/4HANA Customer Experience)