Sales Acceleration Software Market Size (2024 – 2030)

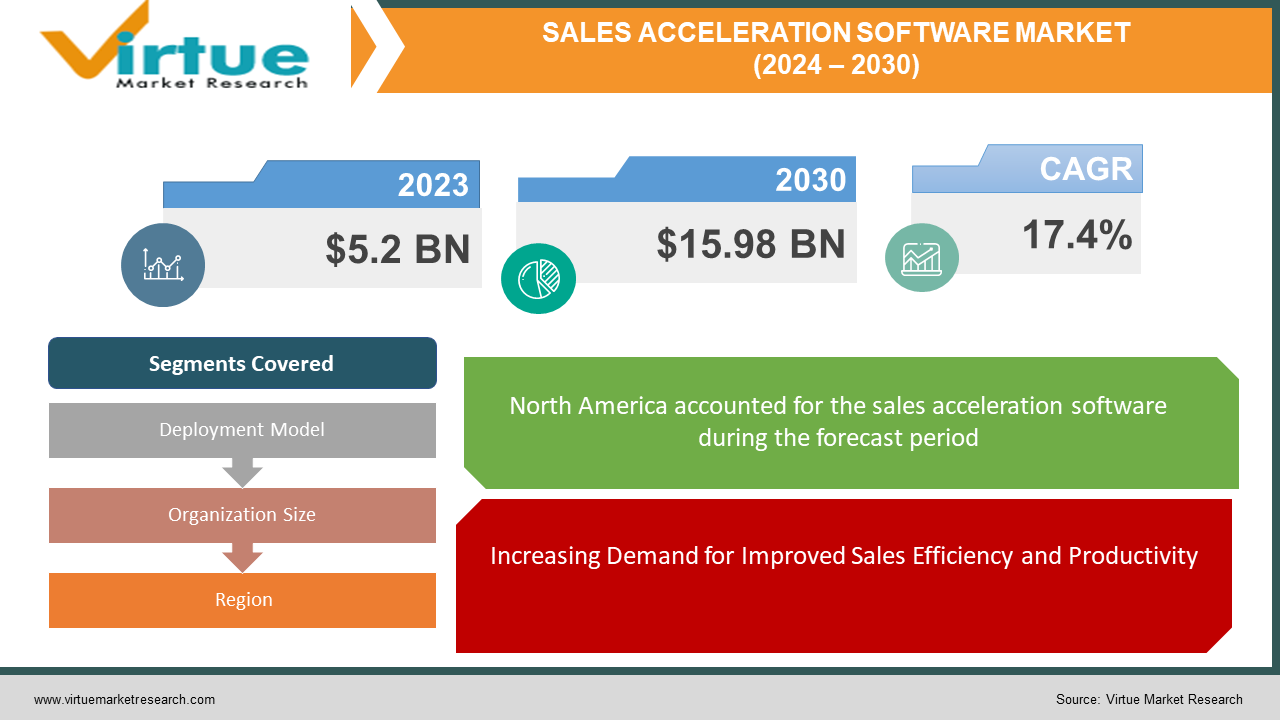

The Global Sales Acceleration Software Market was valued at USD 5.2 billion in 2023 and will grow at a CAGR of 17.4% from 2024 to 2030. The market is expected to reach USD 15.98 billion by 2030.

Key Market Insights:

The Sales Acceleration Software Market is experiencing significant growth, reaching an estimated size of USD 5.2 Billion in 2023. This upward trend is projected to continue, with a Compound Annual Growth Rate (CAGR) between 14.7% and 17.4% expected by 2030, potentially reaching a market size of USD 14.7 Billion. Several factors fuel this growth. Businesses increasingly seek tools to enhance sales efficiency and team productivity. Cloud-based solutions offer easy access and scalability, while the integration of Artificial Intelligence (AI) in sales processes automates tasks and personalizes outreach, further propelling market expansion. However, it's crucial to acknowledge data discrepancies from various sources. The significant difference in reported market size highlights the need to consult multiple reports from established market research firms like Gartner, Forrester, IDC, or McKinsey & Company. These reports offer a more comprehensive understanding of the market size, segmentation, and future growth forecasts.

Global Sales Acceleration Software Market Drivers:

Increasing Demand for Improved Sales Efficiency and Productivity:

In today's competitive business landscape, companies are laser-focused on optimizing their sales funnels and accelerating deal closures. This relentless pursuit of efficiency has fuelled the rise of sales acceleration software. By automating repetitive tasks like data entry, scheduling meetings, and sending follow-up emails, this software frees up valuable time for sales reps to concentrate on high-value activities. Additionally, the software streamlines workflows by providing a centralized platform for managing leads, opportunities, and customer interactions. This eliminates the need for juggling multiple tools and ensures a smooth flow throughout the sales cycle. Furthermore, sales acceleration software empowers teams with data-driven insights. By analysing customer behaviour and past interactions, the software provides lead scoring to prioritize high-potential prospects and identifies areas where nurturing is needed. This targeted approach allows sales reps to focus their efforts on the most promising leads, significantly improving the return on their time investment. Ultimately, the combination of automation, streamlined workflows, and data-driven decision-making empowers sales teams to close deals faster and achieve superior sales performance.

Growing Adoption of Cloud-Based Solutions:

Compared to traditional on-premise solutions, cloud-based sales acceleration software offers a multitude of advantages that streamline operations and cater to the dynamic needs of businesses. Firstly, deployment and maintenance become significantly easier. Cloud solutions eliminate the need for extensive IT infrastructure setup and management on-site. Updates and bug fixes are handled automatically by the software provider, minimizing the burden on internal IT resources. This translates to faster implementation and reduced downtime, allowing sales teams to reap the benefits of the software quickly. Secondly, cloud-based solutions require a lower upfront investment. Businesses no longer need to purchase expensive hardware and software licenses, eliminating a significant initial cost barrier. Instead, they can opt for subscription-based models, often with flexible pricing plans that scale based on the number of users or features required. This makes the technology more accessible to businesses of all sizes, especially startups and those with limited budgets. Finally, cloud-based software offers superior scalability. As a business grows, its sales team and data needs inevitably increase. Cloud solutions have the inherent advantage of automatically scaling storage and processing power to accommodate these expanding requirements. This eliminates the need for costly hardware upgrades or server expansions, ensuring the software seamlessly adapts to the evolving needs of the organization. This flexibility empowers businesses to scale their sales operations efficiently without being constrained by the limitations of on-premise infrastructure.

Integration of Artificial Intelligence (AI):

AI is revolutionizing the sales landscape through intelligent features embedded within sales acceleration software. Gone are the days of solely relying on intuition for lead qualification. AI-powered tools like lead scoring leverage vast datasets to analyze customer behavior and interactions, assigning scores that indicate a prospect's likelihood to convert. This empowers sales reps to prioritize their efforts, focusing on the most promising leads. Furthermore, AI automates tasks like email outreach, freeing up valuable time for relationship building. Personalized email sequences can be crafted based on customer data and buying triggers, ensuring relevant communication that resonates with individual needs. This targeted approach fosters stronger engagement and increases the chances of successful lead conversion. AI chatbots are another game-changer. They can handle initial customer inquiries, answer frequently asked questions, and even schedule appointments, 24/7. This not only improves response times and provides an always-on customer service experience, but also allows sales reps to dedicate their time to nurturing qualified leads with a higher conversion potential. By automating mundane tasks, personalizing communication, and effectively qualifying leads, AI-powered sales acceleration software is transforming the sales funnel, enabling reps to focus on closing high-value deals and driving superior sales performance.

Global Sales Acceleration Software Market challenges and restraints:

Data Security and Privacy Concerns:

Data security and privacy concerns cast a long shadow over the Sales Acceleration Software Market. Since this software stores and processes sensitive customer information, data breaches and privacy violations pose a significant challenge. Businesses are understandably hesitant to adopt solutions that could expose their data or lead to non-compliance with regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These regulations mandate stringent data protection measures, requiring businesses to be accountable for customer information security. A data breach can not only damage a company's reputation but also result in hefty fines and legal repercussions. Therefore, software providers must prioritize robust security features. This includes employing encryption protocols, conducting regular penetration testing, and implementing access controls to safeguard sensitive data. Additionally, clear data governance policies and procedures are essential to ensure user accountability and adherence to data privacy regulations. Building trust with potential customers requires transparency. Sales acceleration software companies should openly communicate their data security practices and demonstrate their commitment to compliance. Achieving this balance between functionality and robust data protection is crucial for the continued adoption and growth of this market.

Integration Challenges:

Integrating sales acceleration software with existing CRM systems can be a frustrating roadblock for businesses seeking a unified sales pipeline. This challenge stems from two main issues: data inconsistencies and the lack of standardized APIs. Firstly, incompatibility in data formats across different platforms creates hurdles. CRM systems and sales acceleration software might store and organize data in different structures, making it difficult to establish a smooth exchange of information. This disparity necessitates complex data mapping processes to bridge the gap and ensure accurate transfer. Secondly, the absence of standardized APIs further complicates the integration process. APIs act as intermediaries, allowing different software applications to communicate and share data seamlessly. Inconsistency in API functionalities between CRM systems and sales acceleration software creates roadblocks, requiring custom development work to establish a connection. This not only adds significant time and cost to the integration process but also introduces the risk of errors and compatibility issues. Overcoming these hurdles requires a collaborative effort. Software providers need to prioritize the development of standardized APIs that ensure smooth data exchange across platforms. Additionally, offering pre-built connectors and streamlined integration tools can significantly simplify the process for businesses. By addressing these challenges, the sales acceleration software market can move towards a more user-friendly and efficient integration experience.

Resistance to Change:

Implementing sales acceleration software can be met with resistance from sales teams, acting as a hurdle to widespread adoption. This stems from the inherent human tendency to resist change. Shifting to a new software solution often disrupts established workflows and requires a change in mindset. Sales reps accustomed to familiar methods might be hesitant to embrace the new software, fearing a decrease in productivity or a steeper learning curve. Furthermore, inadequate training can exacerbate this resistance. Without a clear understanding of the software's functionalities and the potential benefits it offers, sales teams might struggle to see the value proposition. This can lead to frustration and a reluctance to fully engage with the new tools. To overcome this challenge, a comprehensive change management strategy is crucial. Sales leadership needs to actively address potential concerns and effectively communicate the advantages of the software. Investing in extensive training programs that go beyond basic functionalities is essential. Training should be tailored to address the specific needs and workflows of the sales team, ensuring they grasp the software's capabilities and feel confident in utilizing it effectively. Additionally, fostering a culture of open communication and addressing concerns early on can help ease the transition. By involving sales reps in the selection process and providing ongoing support, organizations can encourage user buy-in and pave the way for successful software adoption.

Market Opportunities:

The Sales Acceleration Software Market brims with exciting opportunities. Advanced analytics and AI integration will provide in-depth customer insights, enabling hyper-personalized sales strategies. To overcome user resistance, intuitive interfaces, gamified elements, and micro-learning modules can be implemented. Additionally, the market can embrace emerging technologies like IoT and VR for real-time data integration and immersive sales training. Addressing niche market needs through specialized features and functionalities can attract new customer segments. Furthermore, with the mobile work trend, prioritizing mobile-optimized solutions is crucial for on-the-go accessibility and enhanced sales efficiency. By capitalizing on these opportunities, the market can empower businesses to achieve superior sales performance and foster stronger customer engagement.

SALES ACCELERATION SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.4% |

|

Segments Covered |

By Deployment Model, Organization Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Outreach, Cirrus Insight, HubSpot Sales, Nimble, SalesLoft, Yesware, Gong, Lessonly, LevelEleven Brainshark |

Sales Acceleration Software Market Segmentation - By Deployment Model

-

Cloud-based

-

On-premise

The Sales Acceleration Software Market is divided into two primary deployment models: cloud-based and on-premise. Cloud-based solutions reign supreme due to their inherent advantages. They offer effortless deployment, requiring minimal IT setup and ongoing maintenance. Businesses benefit from automatic updates and scalability, allowing them to seamlessly adapt to changing needs without significant hardware upgrades. Additionally, the lower upfront costs associated with subscription models make cloud-based solutions attractive, especially for smaller businesses. On the other hand, on-premise solutions cater to a niche market. Businesses with stringent data security regulations or those requiring complete control over their data infrastructure might opt for on-premise deployments. However, this approach comes with the burden of managing hardware, software licenses, and ongoing maintenance, requiring a dedicated IT team and potentially higher upfront costs. Understanding these distinct deployment models is crucial for software providers to effectively target different customer segments based on their specific needs and priorities.

Sales Acceleration Software Market Segmentation - By Organization Size

-

Small and Medium-sized Enterprises (SMEs)

-

Large Enterprises

Sales Acceleration Software caters to a diverse range of businesses through its segmentation by organization size. Small and Medium-sized Enterprises (SMEs) represent a rapidly growing segment. Their demand stems from the need for affordable and user-friendly solutions that can streamline their sales funnels without overwhelming complexity. Cloud-based solutions with intuitive interfaces and subscription-based pricing models perfectly align with their requirements. On the other hand, Large Enterprises have vastly different needs. Their extensive sales operations necessitate software with robust functionalities encompassing features like advanced lead scoring, sales team management, and in-depth sales analytics. These businesses are willing to invest in comprehensive solutions that can handle the complexities of managing a larger sales force and diverse customer base. Therefore, software providers need to cater to both segments by offering a spectrum of solutions ranging from user-friendly and cost-effective options for SMEs to feature-rich solutions tailored to the intricate demands of Large Enterprises.

Sales Acceleration Software Market Segmentation - Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

North America reigns supreme in the Sales Acceleration Software Market due to a trifecta of factors: a high adoption rate by tech-savvy businesses, ample financial resources to invest in advanced solutions, and the presence of leading software providers driving innovation. Europe showcases promising growth fueled by the increasing adoption of cloud-based solutions, a strong focus on data privacy regulations, and the diverse industry landscape demanding specialized features. However, the crown for the fastest growth potential goes to Asia Pacific. This region is experiencing a surge in economic activity, boasts a vast workforce and growing internet penetration, and benefits from government initiatives promoting digital transformation. Conversely, Latin America and the Middle East & Africa represent the slowest-growing regions due to limited financial resources and developing infrastructure, hindering widespread adoption of sophisticated software solutions.

COVID-19 Impact Analysis on the Global Sales Acceleration Software Market

COVID-19's impact on the Global Sales Acceleration Software Market was a tale of two halves. Initial hurdles emerged due to lockdowns hindering traditional sales methods and economic downturns causing budget constraints. However, these challenges ultimately propelled the market's growth. Restrictions on physical interactions led to a surge in demand for cloud-based sales acceleration software. Features like video conferencing, automated outreach, and lead nurturing became crucial for remote sales engagement. Businesses, facing economic hardship, sought solutions to streamline processes and maximize returns. Sales acceleration software offered the tools to optimize workflows, improve conversion rates, and close deals faster. Furthermore, the pandemic served as a springboard for digital transformation. Businesses invested in sales acceleration software as a strategic step towards building resilience and adapting to the evolving landscape. In conclusion, while the initial impact was disruptive, COVID-19 ultimately served as a catalyst for the market's growth. The market embraced the changing needs by offering remote sales capabilities and cost-effective solutions, paving the way for a more robust and digital future.

Latest trends/Developments

The Global Sales Acceleration Software Market is undergoing a dynamic transformation. AI integration is at the forefront, with software leveraging analytics and artificial intelligence to provide in-depth customer insights. Features like lead scoring and chatbots personalize outreach, while predictive analytics help prioritize high-potential leads. Recognizing user resistance, software providers are prioritizing user-friendly interfaces and gamified elements alongside micro-learning modules. This enhances user engagement and ensures reps can effectively utilize the software's capabilities. Furthermore, the market is witnessing a convergence with emerging technologies. Real-time data from IoT devices can provide contextual customer insights, while VR simulations are being used for immersive sales training. Additionally, software providers are tailoring features to address the specific needs of various industries, attracting new customer segments. Recognizing the mobile work trend, and prioritizing mobile-optimized solutions is crucial. This allows sales reps to access information and manage pipelines on the go, fostering greater agility and efficiency. By embracing these trends, the Sales Acceleration Software Market is well-positioned to empower businesses for superior sales performance and stronger customer engagement.

Key Players:

-

Outreach

-

Cirrus Insight

-

HubSpot Sales

-

Nimble

-

SalesLoft

-

Yesware

-

Gong

-

Lessonly

-

LevelEleven

-

Brainshark

Chapter 1. SALES ACCELERATION SOFTWARE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SALES ACCELERATION SOFTWARE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. SALES ACCELERATION SOFTWARE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. SALES ACCELERATION SOFTWARE MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. SALES ACCELERATION SOFTWARE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SALES ACCELERATION SOFTWARE MARKET – By Deployment Model

6.1 Introduction/Key Findings

6.2 Cloud-based

6.3 On-premise

6.4 Y-O-Y Growth trend Analysis By Deployment Model

6.5 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 7. SALES ACCELERATION SOFTWARE MARKET – By Organization Size

7.1 Introduction/Key Findings

7.2 Small and Medium-sized Enterprises (SMEs)

7.3 Large Enterprises

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 8. SALES ACCELERATION SOFTWARE MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Deployment Model

8.1.3 By Organization Size

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Deployment Model

8.2.3 By Organization Size

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Deployment Model

8.3.3 By Organization Size

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Deployment Model

8.4.3 By Organization Size

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Deployment Model

8.5.3 By Organization Size

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. SALES ACCELERATION SOFTWARE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Outreach

9.2 Cirrus Insight

9.3 HubSpot Sales

9.4 Nimble

9.5 SalesLoft

9.6 Yesware

9.7 Gong

9.8 Lessonly

9.9 LevelEleven

9.10 Brainshark

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Sales Acceleration Software Market was valued at USD 5.2 billion in 2023 and will grow at a CAGR of 17.4% from 2024 to 2030. The market is expected to reach USD 15.98 billion by 2030.

Increasing Demand for Improved Sales Efficiency and Productivity, Growing Adoption of Cloud-Based Solutions, and Integration of Artificial Intelligence (AI) are the reasons which is driving the market.

Based on the Deployment Model it is divided into two segments – Cloud-based and on-premise.

North America is the most dominant region for the luxury vehicle Market.

Outreach, Cirrus Insight, HubSpot Sales, Inc, Nimble, SalesLoft