Sacral Nerve Stimulation Urinary & Fecal Incontinence Market size (2024-2030)

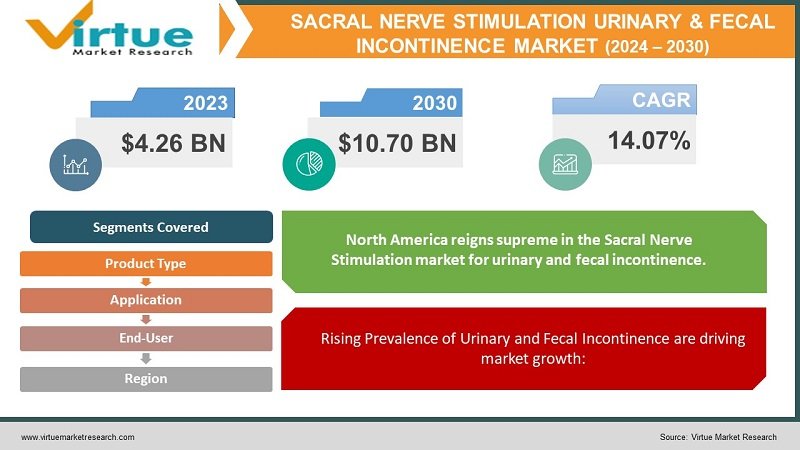

The Global Sacral Nerve Stimulation Urinary & Fecal Incontinence Market was valued at USD 4.26 billion in 2023 and will grow at a CAGR of 14.07% from 2024 to 2030. The market is expected to reach USD 10.70 billion by 2030.

The Sacral Nerve Stimulation Urinary & Fecal Incontinence market focuses on medical devices that use electrical pulses to regulate bladder and bowel function. This minimally invasive treatment option is targeted towards a growing population suffering from incontinence, particularly women and older adults. With a projected CAGR of over 14%, the market is expected to significantly expand by 2030 due to factors like rising incontinence cases and increasing healthcare spending.

Key Market Insights:

Over 13 million adults in the US experience urinary incontinence, with women constituting the majority.

A study suggests the highest prevalence of urinary incontinence in older adult women in Asia (45.1%).

The general 5-year and 7-year success rates for SNS therapy for incontinence are reported to be around 75% and 70%, respectively.

Global Sacral Nerve Stimulation Urinary & Fecal Incontinence Market Drivers:

Rising Prevalence of Urinary and Fecal Incontinence are driving market growth:

A significant driver of the Sacral Nerve Stimulation (SNS) market for urinary and fecal incontinence is the growing demographic of individuals susceptible to these conditions. The aging population is at the forefront of this trend. As people live longer, the natural weakening of pelvic floor muscles and cognitive decline can lead to incontinence issues. However, the story doesn't end there. Childbirth, particularly vaginal delivery, can also damage pelvic floor muscles, increasing the risk of incontinence later in life. Furthermore, various neurological disorders like Parkinson's disease and multiple sclerosis can affect nerve signals to the bladder and bowel, leading to incontinence. Obesity is another contributing factor, as excess weight puts additional strain on the pelvic floor muscles, compromising their ability to control urination and defecation. In essence, the aging population, combined with the rising prevalence of childbirth, neurological disorders, and obesity, creates a perfect storm for an increased demand for incontinence solutions, propelling the growth of the SNS market.

Growing Awareness and Adoption of Minimally Invasive Treatments are driving market growth:

The appeal of Sacral Nerve Stimulation (SNS) for urinary and fecal incontinence lies in its superior patient experience compared to traditional surgical interventions. Unlike surgeries that involve incisions and manipulation of internal organs, SNS is a minimally invasive procedure. This translates to several key benefits for patients. Firstly, the procedure itself is much less disruptive. A small electrode is implanted near the sacral nerves, minimizing tissue trauma and discomfort. Secondly, recovery times are significantly shorter compared to open surgeries. Patients can often return home the same day or the next day after SNS implantation. Furthermore, minimally invasive procedures generally come with less post-operative pain and scarring. Perhaps most importantly, SNS offers success rates comparable to, if not exceeding, some traditional surgeries. Studies report 5-year and 7-year success rates of around 75% and 70% respectively for SNS therapy in incontinence. This combination of minimal invasiveness, faster recovery, and high success rates makes SNS a highly attractive option for patients seeking relief from incontinence.

Expanding Healthcare Infrastructure and Insurance Coverage are driving market growth:

The landscape of Sacral Nerve Stimulation (SNS) therapy is shifting as developing regions experience advancements in healthcare infrastructure and insurance coverage. This translates to a wider patient pool in these regions gaining access to this life-changing treatment for urinary and fecal incontinence. Previously, limited access to specialized medical facilities and financial constraints might have restricted the availability of SNS therapy. However, with growing healthcare investments and expanding insurance coverage, more patients in developing regions can now consider SNS as a viable option. Furthermore, the field of SNS is constantly evolving with technological advancements. Newer, more refined devices with improved battery life and programming options are emerging. Additionally, refinements in surgical techniques for electrode placement are leading to shorter procedures and potentially even less discomfort for patients. These advancements are not only improving the efficacy and safety of SNS therapy but also making it a more appealing option for a wider range of patients. This synergy between improved healthcare access in developing regions and ongoing technological advancements is expected to significantly fuel the growth of the SNS market for urinary and fecal incontinence.

Global Sacral Nerve Stimulation Urinary & Fecal Incontinence Market challenges and restraints:

High Cost is a significant hurdle for Sacral Nerve Stimulation Urinary & Fecal Incontinence:

A significant barrier to wider adoption of Sacral Nerve Stimulation (SNS) for urinary and fecal incontinence is the high initial cost. The financial burden falls on patients due to several factors. First, the implant itself can be expensive, with estimates ranging in the tens of thousands of dollars. Surgical implantation adds another layer of cost, including surgeon fees, hospital charges, and anesthesia. Even with insurance coverage, patients might still face substantial deductibles and co-pays for the procedure. Furthermore, ongoing programming adjustments are necessary to maintain optimal stimulation levels, incurring additional costs over time. This financial strain can act as a major deterrent, especially for patients who may not have adequate insurance coverage or struggle with out-of-pocket expenses. Addressing this challenge through potential cost reductions in device manufacturing, more streamlined surgical procedures, and improved insurance coverage will be crucial for making SNS therapy a more accessible option for a wider range of patients.

Limited Reimbursement are throwing a curveball at Sacral Nerve Stimulation Urinary & Fecal Incontinence market:

Reimbursement policies for Sacral Nerve Stimulation (SNS) therapy pose a significant challenge for wider patient access to this treatment for urinary and fecal incontinence. Inconsistency plagues the landscape, with coverage varying considerably across regions and individual insurance plans. Some regions or plans might have strict criteria for coverage, requiring patients to exhaust all conservative treatment options before qualifying for SNS. These criteria can be time-consuming and frustrating for patients struggling with incontinence. Even more concerning is the possibility of limited or even absent coverage altogether in certain insurance plans. This lack of coverage forces patients to shoulder the entire financial burden of the expensive device, surgery, and ongoing programming adjustments. The consequence of such policies is the potential exclusion of a significant portion of the patient population who could benefit from SNS therapy. To improve access, standardized and more relaxed reimbursement policies across regions and insurance plans are crucial. This would ensure that financial limitations don't prevent patients from receiving this potentially life-changing treatment.

Specialized Treatment are a growing nightmare for Sacral Nerve Stimulation Urinary & Fecal Incontinence:

Sacral Nerve Stimulation (SNS) therapy faces a unique challenge in terms of accessibility due to the specialized expertise required. Unlike many medical procedures, SNS implantation demands skilled surgeons with a deep understanding of neuroanatomy and experience in precise electrode placement. Furthermore, specialized healthcare facilities equipped with the necessary programming tools and aftercare support are essential for successful SNS therapy. Unfortunately, the availability of such trained professionals and specialized centers can be limited, particularly in remote or underserved areas. This creates a situation where patients residing in these areas might have to travel significant distances or forgo this potentially life-changing treatment altogether. To bridge this gap, initiatives focused on expanding training programs for surgeons and establishing more specialized healthcare facilities in geographically diverse locations are crucial. Additionally, advancements in telemedicine could play a role in facilitating remote programming adjustments and consultations, improving access to SNS therapy for patients residing in areas with limited specialist availability.

Market Opportunities:

The Sacral Nerve Stimulation (SNS) market for urinary and fecal incontinence presents a wealth of opportunities for growth, driven by a confluence of demographic and technological trends. The aging population is a key factor, with a rising number of individuals susceptible to incontinence due to weakened pelvic floor muscles and neurological decline. Additionally, childbirth and conditions like obesity further contribute to the market potential. However, minimally invasive SNS therapy offers a compelling alternative to traditional surgeries. Shorter recovery times, less discomfort, and high success rates are fueling patient demand for this treatment option. This is particularly appealing in developing regions where improved healthcare infrastructure and insurance coverage are expanding access to SNS therapy. Technological advancements are another key driver. Newer, more efficient SNS devices with longer battery life and better programming options are constantly emerging. Additionally, refinements in surgical techniques for electrode placement are leading to shorter procedures and potentially less discomfort. These advancements not only improve the efficacy and safety of SNS therapy but also make it a more attractive option for a wider range of patients.

SACRAL NERVE STIMULATION URINARY & FECAL INCONTINENCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.07% |

|

Segments Covered |

By Product Type, application, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Medtronic Plc, Boston Scientific Corporation, Axonics, Inc., Saluda Medical Pty Ltd., Beijing PINS Medical Co., Ltd., Integer Holdings Corporation, LivaNova PLC, Nfrog Therapeutics, Specify Medical, SJM Company |

Sacral Nerve Stimulation Urinary & Fecal Incontinence Market Segmentation

Sacral Nerve Stimulation Urinary & Fecal Incontinence Market Segmentation By Product Type:

- Implantable Pulse Generators

- External Sacral Nerve Stimulation

Within the Sacral Nerve Stimulation market for urinary and fecal incontinence, the most prominent sector is Implantable Pulse Generators (IPGs). These devices act as the heart of the system, residing under the skin and delivering electrical stimulation to the sacral nerves. IPGs dominate the market due to their crucial role in regulating bladder and bowel function. While Leads, the thin wires connecting the IPG to the nerves, are essential for proper stimulation, they are a smaller segment as they rely on the functionality of the IPG. Therefore, advancements and innovations in IPG technology play a major role in driving the overall growth of the Sacral Nerve Stimulation market.

Sacral Nerve Stimulation Urinary & Fecal Incontinence Market Segmentation By Application:

- Urinary Incontinence

- Fecal Incontinence

In the Sacral Nerve Stimulation market for incontinence, Urinary Incontinence currently holds the leading position. This dominance stems from the higher prevalence of urinary incontinence, particularly among women and older adults. Additionally, SNS therapy for urinary incontinence is a well-established and proven treatment option for various types like urge incontinence, making it a more readily adopted solution. While Fecal Incontinence represents a promising area with increasing demand, it's still under development compared to urinary applications. As awareness and research on SNS therapy for fecal incontinence grow, this segment is expected to see significant growth, but for now, Urinary Incontinence remains the more prominent sector.

Sacral Nerve Stimulation Urinary & Fecal Incontinence Market Segmentation By End-User

- Hospitals

- Ambulatory Surgical Centers

- Other End-Users

Hospitals were the leading end users in terms of revenue in 2023, and they are projected to have the highest compound annual growth rate (CAGR) over the forecast period. This is due to their access to specialized healthcare professionals, advanced medical technologies and infrastructure, and robust connections with insurance providers, all of which promote the use of sacral nerve stimulation therapy.

Sacral Nerve Stimulation Urinary & Fecal Incontinence Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Currently, North America reigns supreme in the Sacral Nerve Stimulation market for urinary and fecal incontinence. Established healthcare infrastructure and insurance coverage in North America facilitate patient access to these procedures. Finally, a higher concentration of key market players and research activities in the region further solidifies its leading position. However, with growing awareness, improved healthcare access, and an aging population, regions like Asia and Europe are expected to experience significant market growth in the coming years.

COVID-19 Impact Analysis on the Global Sacral Nerve Stimulation Urinary & Fecal Incontinence Market

The COVID-19 pandemic cast a temporary shadow on the Sacral Nerve Stimulation (SNS) market for urinary and fecal incontinence. The global focus shifted towards managing the pandemic, leading to postponements of elective procedures like SNS implantation. This resulted in a downturn in the market as surgery centers and hospitals prioritized COVID-19 patients. However, this impact was not long-lasting. As the healthcare landscape returned to normalcy, the demand for SNS therapy rebounded. The rising prevalence of incontinence issues, particularly among an aging population, coupled with growing awareness of minimally invasive treatment options like SNS, continues to drive market growth. In some ways, the pandemic might have even spurred a silver lining. Advancements in telemedicine could play a role in facilitating remote consultations and programming adjustments for SNS therapy, potentially improving access for patients in geographically distant areas. Overall, while the initial disruption from COVID-19 was undeniable, the long-term outlook for the SNS market for urinary and fecal incontinence remains positive.

Latest trends/Developments

The Sacral Nerve Stimulation (SNS) market for urinary and fecal incontinence is buzzing with advancements poised to revolutionize patient care and market dynamics. One key trend is the emergence of next-generation implantable pulse generators (IPGs) with extended battery life and more sophisticated programming options. These advancements not only reduce the need for frequent battery replacements but also allow for more personalized and fine-tuned stimulation for optimal therapeutic outcomes. Additionally, refinements in surgical techniques for electrode placement are minimizing procedure times and discomfort for patients, further enhancing the appeal of SNS therapy. Furthermore, the rise of telemedicine holds immense potential for the SNS market. Remote monitoring and programming adjustments via telemedicine consultations could significantly improve patient access to care, especially in regions with limited specialist availability. This would not only improve convenience for patients but also potentially reduce overall healthcare costs. Another exciting development is the exploration of closed-loop SNS systems. These intelligent devices would automatically adjust stimulation parameters based on real-time physiological signals from the patient's body, further optimizing treatment efficacy and potentially reducing programming complexity. However, addressing cost concerns and ensuring wider insurance coverage for SNS therapy remains crucial for sustained market growth. Overall, the SNS market for urinary and fecal incontinence is on an exciting trajectory, with continuous advancements in technology, treatment approaches, and accessibility paving the way for a future where this minimally invasive therapy can provide relief to a wider range of patients suffering from incontinence issues.

Key Players:

- Medtronic Plc

- Boston Scientific Corporation

- Axonics, Inc.

- Saluda Medical Pty Ltd.

- Beijing PINS Medical Co., Ltd.

- Integer Holdings Corporation

- LivaNova PLC

- Nfrog Therapeutics

- Specify Medical

- SJM Company

Chapter 1. GLOBAL SACRAL NERVE STIMULATION URINARY & FECAL INCONTINENCE MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL SACRAL NERVE STIMULATION URINARY & FECAL INCONTINENCE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL SACRAL NERVE STIMULATION URINARY & FECAL INCONTINENCE MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL SACRAL NERVE STIMULATION URINARY & FECAL INCONTINENCE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL SACRAL NERVE STIMULATION URINARY & FECAL INCONTINENCE MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL SACRAL NERVE STIMULATION URINARY & FECAL INCONTINENCE MARKET– BY Product Type

6.1. Introduction/Key Findings

6.2. Implantable Pulse Generators

6.3. External Sacral Nerve Stimulation

6.4. Y-O-Y Growth trend Analysis By Product Type

6.5. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. GLOBAL SACRAL NERVE STIMULATION URINARY & FECAL INCONTINENCE MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Urinary Incontinence

7.3. Fecal Incontinence

7.4. Y-O-Y Growth trend Analysis By APPLICATION

7.5. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL SACRAL NERVE STIMULATION URINARY & FECAL INCONTINENCE MARKET– BY End-User

8.1. Introduction/Key Findings

8.2. Hospitals

8.3. Ambulatory Surgical Centers

8.4. Other End-Users

8.5. Y-O-Y Growth trend Analysis End-User

8.6. Absolute $ Opportunity Analysis End-User , 2024-2030

Chapter 9. GLOBAL SACRAL NERVE STIMULATION URINARY & FECAL INCONTINENCE MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By APPLICATION

9.1.3. By Product Type

9.1.4. By End-User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By APPLICATION

9.2.3. By End-User

9.2.4. By Product Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.1. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By APPLICATION

9.3.3. By Product Type

9.3.4. By End-User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By Product Type

9.4.4. By End-User

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By Product Type

9.5.4. By End-User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL SACRAL NERVE STIMULATION URINARY & FECAL INCONTINENCE MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Medtronic Plc

10.2. Boston Scientific Corporation

10.3. Axonics, Inc.

10.4. Saluda Medical Pty Ltd.

10.5. Beijing PINS Medical Co., Ltd.

10.6. Integer Holdings Corporation

10.7. LivaNova PLC

10.8. Nfrog Therapeutics

10.9. Specify Medical

10.10. SJM Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Sacral Nerve Stimulation Urinary & Fecal Incontinence Market was valued at USD 4.26 billion in 2023 and will grow at a CAGR of 14.07% from 2024 to 2030. The market is expected to reach USD 10.70 billion by 2030.

Rising Prevalence of Urinary and Fecal Incontinence, Growing Awareness and Adoption of Minimally Invasive Treatments, Expanding Healthcare Infrastructure and Insurance Coverage these are the reasons which is driving the market

Based on Application it is divided into two segments – Urinary Incontinence, Fecal Incontinence.

North America is the most dominant region for the luxury vehicle Market.

Medtronic Plc, Boston Scientific Corporation, Axonics, Inc., Saluda Medical Pty Ltd., Beijing PINS Medical Co., Ltd.