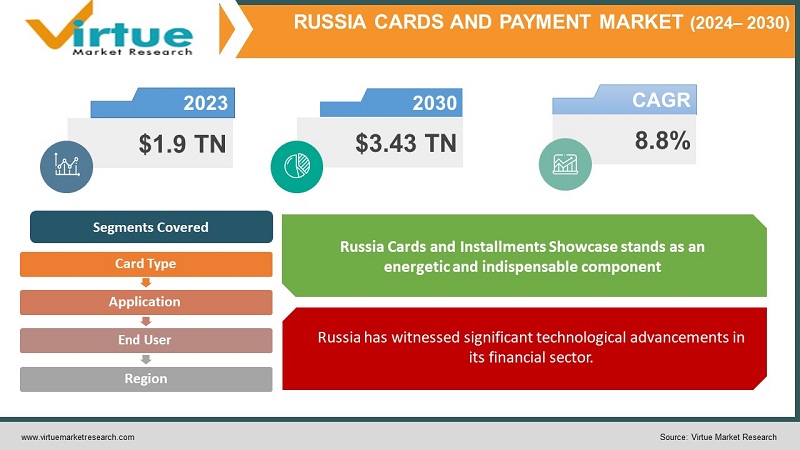

Russia Cards and Payment Market Size (2024-2030)

The Russia Cards and Payment Market was valued at USD 1.9 Trillion and is projected to reach a market size of USD 3.43 Trillion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.8%.

The Russia Cards and Payments Market envelops a wide cluster of budgetary exchanges encouraged by different installment cards, counting credit, charge, and paid ahead-of-time cards, reflecting the nation's advancing money-related scene. In later a long time, this showcase has seen critical development driven by expanding shopper requests for cashless exchanges, upheld by the broad selection of progressed installment innovations. The infiltration of smartphones and the web has reinforced the utilization of computerized wallets and contactless installments, upgrading comfort and security for clients. Russian banks and budgetary education have been essential in this move, advertising imaginative items and administrations to cater to the differing needs of buyers and businesses alike. Administrative back from the government has also played a significant part in cultivating a secure and effective installment environment. Additionally, the rise of e-commerce has assist quickened the request for card installments, as online shopping gets progressively well-known over different socioeconomics. Despite the quick progressions, the showcase proceeds to confront challenges such as extortion and cybersecurity dangers, requiring nonstop changes in security measures and customer instruction.

Key Market Insights:

There's a solid move towards contactless payments in Russia. About 60% of all card exchanges within the nation are presently contactless.

The e-commerce segment in Russia is developing quickly, driving to expanded utilization of cards for online installments.

E-commerce exchanges through cards have developed by around 20% year-on-year.

With the expanding utilization of NFC (Close Field Communication) innovation, contactless exchanges presently account for over 30% of all card installments.

Over 80% of shippers in major cities acknowledge card installments, up from 70% two a long time ago.

Russia Cards and Payment Market Drivers:

Russia has witnessed significant technological advancements in its financial sector.

These innovations have played a pivotal role in transforming the cards and payment market. One of the primary drivers is the widespread adoption of contactless payment technologies. With the introduction of NFC (Near Field Communication) and RFID (Radio-Frequency Identification) technologies, consumers in Russia are increasingly opting for faster and more convenient payment methods. These technologies enable seamless transactions by allowing users to make payments with just a tap of their card or mobile device, reducing the need for physical cash and traditional swipe methods. Additionally, the proliferation of smartphones and the rise of mobile banking apps have further fueled the growth of the cards and payment market. Financial institutions are continually investing in robust and secure mobile payment solutions, making it easier for consumers to manage their finances on the go. The integration of biometric authentication methods, such as fingerprint and facial recognition, has also enhanced the security and convenience of mobile payments, encouraging more people to embrace digital transactions.

The Russian government has played a significant part in driving the development of the cards and installment showcases through different activities and controls.

One of the critical steps taken by the government is the advancement of cashless installments to diminish the shadow economy and make strides in charge collection. The government has executed arrangements that empower businesses to embrace electronic installment strategies, such as advertising charge motivations and appropriations for the establishment of point-of-sale (POS) terminals. Besides, the Central Bank of Russia has been effectively included in making a secure and proficient installment framework. The foundation of the National Installment Card Framework (NSPK) and the presentation of the Mir installment card arrangement have given a solid and autonomous stage for residential exchanges. This move not as it were upgrades the security of installment exchanges but also decreases the reliance on worldwide installment frameworks.

Russia Cards and Payment Market Challenges:

The Russia Cards and Payment Market faces critical challenges due to financial insecurity.

Variances within the national economy, driven by different variables such as worldwide oil costs and worldwide sanctions, make an unstable environment. This capriciousness can lead to diminished customer investing and a cautious approach from businesses, preventing the selection and extension of card and installment administrations. Financial institutions may battle to preserve development in such a turbulent financial climate, affecting by and large showcase advance.

A major challenge is the expanding danger of cybercrime.

As advanced exchanges become more predominant, the chance of extortion and information breaches moreover rises. Cybersecurity issues can disintegrate customers' belief in electronic installment frameworks, driving them to hesitate in utilizing cards for exchanges. The requirement for strong security measures puts extra weight on money-related teach to contribute to progressed innovations, which can be expensive and complex to actualize. Guaranteeing the security of client information while keeping up consistent exchange encounters remains a critical jump for the showcase.

Russia Cards and Payment Market Opportunities:

One exciting opportunity is the quick selection of contactless payment strategies.

With the developing notoriety of portable wallets and contactless cards, Russian shoppers are progressively grasping the comfort and speed of tap-and-go exchanges. This slant presents a brilliant opportunity for installment benefit suppliers and money-related education to create and extend their contactless installment arrangements. By leveraging progressed innovation and user-friendly interfacing, companies can pull in a broader client base, improve the general installment encounter, and drive the advanced change of the installment scene in Russia.

RUSSIA CARDS AND PAYMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.8% |

|

Segments Covered |

By card Type, application, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Russia |

|

Key Companies Profiled |

Sberbank, VTB Bank, Gazprombank, Alfa-Bank, Tinkoff Bank, Russian Standard Bank, Promsvyazbank, Raiffeisenbank Russia, Sovcombank, UniCredit Bank Russia, Bank Otkritie, Rosbank, Citibank Russia, Moscow Credit Bank, Post Bank. |

Russia Cards and Payment Market Segmentation:

Russia Cards and Payment Market Segmentation: By Card Type:

- Debit Cards

- Credit Cards

- Prepaid Cards

Within the dynamic scene of the Russian cards and Payment Market, debit cards have risen as the highest market share segment, commanding approximately 60% of the full market. These cards are favored for their consistent integration with bank accounts, encouraging helpful and secure exchanges over different retail and computerized stages. Concurrently, credit cards speak to the fastest-growing portion, driven by a strong yearly development rate of 12%. This surge is impelled by increased shopper mindfulness, appealing remunerate plans, and the burgeoning e-commerce division, which collectively opens up the offer of credit-based exchanges. In the interim, paid ahead-of-time cards, in spite of the fact that holding a smaller advertise share of almost 10%, are relentlessly picking up footing, especially among more youthful socioeconomics and those looking for adaptable installment arrangements without coordinated bank linkage. As Russia progresses encourage into advanced installment environments, these unmistakable card sorts are forming the advancing scene, catering to different shopper needs and inclinations with upgraded comfort and security highlights.

Russia Cards and Payment Market Segmentation: By Application

- Retail

- Transportation

- Hospitality

- Healthcare

- Utilities

The highest and fastest growing segment inside the Russia Cards and Payment Market is retail, where card-based exchanges dominate both online and in-store buys. This division not as it were commands the biggest showcase share but moreover shows strong development fueled by expanding shopper inclination for cashless exchanges. Taking after closely behind is the transportation section, which has quickly grasped advanced installment arrangements for metro, transport, and taxi administrations. This segment benefits from urbanization patterns and the comfort of contactless installments, driving its quickened development. Within the neighborliness industry, card installments have ended up fundamentally booking housing and feasting, reflecting consistent development driven by both household tourism and universal guests. In the meantime, the healthcare and utilities portions are moreover seeing noteworthy changes with the selection of electronic installment strategies, contributing to the market's generally differing qualities and versatility in Russia's advancing advanced economy.

Russia Cards and Payment Market Segmentation: By End User

- Individuals

- Businesses

The highest market share within the Russia Cards and Payment Market has a place for individuals, who constitute the larger part of card clients, bookkeeping for around 75% of transactions. This portion reflects a far-reaching appropriation of cards among buyers for everyday buys and online exchanges, driven by comfort and upgraded security highlights. Concurrently, the fastest-growing portion inside the advertise is businesses, impelled by expanding digitalization over divisions and a rising request for streamlined budgetary operations. Little and medium endeavors (SMEs) are especially significant in this development, looking for effective installment arrangements that bolster their operational dexterity and budgetary straightforwardness. Together, these elements emphasize a dynamic showcase scene in Russia, characterized by strong customer engagement and extending commerce appropriation of cutting-edge installment innovations.

Russia Cards and Payment Market Segmentation: Regional Analysis:

Generally, the Russia Cards and Installments Showcase stands as an energetic and indispensable component of the country's money-related framework, driving financial development and modernization through its extending and imaginative offerings. Throughout all regions of Russia, Credit cards have risen, driven by consumer inclination for credit offices and conceded installment alternatives. At the same time, the contactless installments, are fueled by the far-reaching appropriation of NFC innovation and expanding buyer requests for secure and proficient exchange strategies. These patterns reflect Russia's energetic move towards advanced installment arrangements, with portable installments moreover picking up force due to smartphone infiltration and the comfort advertised by versatile wallet applications. The administrative environment plays a significant part in forming these advancements, guaranteeing vigorous framework and customer security measures while cultivating development within the installments biological system.

COVID-19 Impact Analysis on the Global Russia Cards and Payment Market:

The COVID-19 pandemic altogether affected the Russian cards and payment market, introducing a period of change and adjustment. As lockdowns and social separating measures took hold, there was an eminent move in shopper behavior towards contactless installments and computerized exchanges. This move was driven by concerns over cleanliness and security, inciting both shoppers and shippers to progressively favor electronic installments over cash. Additionally, the widespread quickened the appropriation of e-commerce stages as shoppers turned to online shopping for regular necessities and products, assist boosting computerized installment volumes. On the other hand, conventional brick-and-mortar retailers confronted uncommon challenges, with numerous receiving computerized installment arrangements to cater to changing customer inclinations and to guarantee trade coherence. Monetary teaching also played a significant part amid this period, centering on upgrading advanced foundations and security measures to suit the surge in online exchanges and to preserve belief in installment frameworks. Looking forward, the Russia cards and installment showcase is anticipated to proceed in its direction towards digitalization, with progressing speculations in innovation and framework pointed at supporting a more versatile and money-related biological system in a post-pandemic world.

Latest Trends/ Developments:

In recent developments within the Russian cards and payment market, several trends are shaping the landscape. One prominent trend is the rapid adoption of contactless payment methods, driven by consumer demand for convenience and hygiene amidst the ongoing pandemic. This shift is bolstered by technological advancements in Near Field Communication (NFC) and widespread infrastructure improvements, making contactless payments more accessible across retail outlets and public transport systems in major cities like Moscow and Saint Petersburg. Moreover, the market is witnessing a surge in mobile payments facilitated by smartphone penetration and the popularity of digital wallets offered by tech giants and financial institutions. This trend is not only enhancing payment convenience but also fostering financial inclusion, particularly in rural areas where traditional banking services may be limited. Another notable development is the rise of biometric authentication in payment systems, which enhances security and user experience by using fingerprints or facial recognition for authorization, thus reducing reliance on PINs or passwords. Furthermore, regulatory initiatives aimed at promoting competition and innovation in the fintech sector are driving collaborations between traditional banks and tech startups, leading to the introduction of innovative payment solutions tailored to diverse consumer preferences. Overall, as Russia's cards and payment market continues to evolve, these trends underline a dynamic shift towards more secure, efficient, and inclusive payment experiences for consumers and businesses alike.

Key Players:

- Sberbank

- VTB Bank

- Gazprombank

- Alfa-Bank

- Tinkoff Bank

- Russian Standard Bank

- Promsvyazbank

- Raiffeisenbank Russia

- Sovcombank

- UniCredit Bank Russia

- Bank Otkritie

- Rosbank

- Citibank Russia

- Moscow Credit Bank

- Post Bank

Chapter 1. Russia Cards and Payment Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Russia Cards and Payment Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Russia Cards and Payment Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Russia Cards and Payment Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Russia Cards and Payment Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Russia Cards and Payment Market– By Card Type

6.1. Introduction/Key Findings

6.2. Debit Cards

6.3. Credit Cards

6.4. Prepaid Cards

6.5. Y-O-Y Growth trend Analysis By Card Type

6.6. Absolute $ Opportunity Analysis By Card Type , 2023-2030

Chapter 7. Russia Cards and Payment Market– By End-User

7.1. Introduction/Key Findings

7.2. Individuals

7.3. Businesses

7.4. Y-O-Y Growth trend Analysis By End-User

7.5. Absolute $ Opportunity Analysis By End-User , 2023-2030

Chapter 8. Russia Cards and Payment Market– By Application

8.1. Introduction/Key Findings

8.2. Retail

8.3. Transportation

8.4. Hospitality

8.5. Healthcare

8.6. Utilities

8.7. Y-O-Y Growth trend Analysis Application

8.8. Absolute $ Opportunity Analysis Application , 2023-2030

Chapter 9. Russia Cards and Payment Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Russia

9.1.1. By Country

9.1.1.1. Russia

9.1.2. By Application

9.1.3. By Card Type

9.1.4. By End-User

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Russia Cards and Payment Market– Company Profiles – (Overview, End-User Portfolio, Financials, Strategies & Developments)

10.1 Sberbank

10.2. VTB Bank

10.3. Gazprombank

10.4. Alfa-Bank

10.5. Tinkoff Bank

10.6. Russian Standard Bank

10.7. Promsvyazbank

10.8. Raiffeisenbank Russia

10.9. Sovcombank

10.10. UniCredit Bank Russia

10.11. Bank Otkritie

10.12. Rosbank

10.13. Citibank Russia

10.14. Moscow Credit Bank

10.15. Post Bank

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Russia Cards and Payment Market was valued at USD 1.9 Trillion and is projected to reach a market size of USD 3.43 Trillion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.8%.

The Segments under the Russia Cards and Payment Market by type are Debit Cards, Credit Cards, and Prepaid Cards.

Some of the top industry players in the Russia Cards and Payment Market are Sberbank, VTB Bank, Gazprombank, Alfa-Bank, Tinkoff Bank, Russian Standard Bank, Promsvyazbank, Raiffeisenbank Russia, Sovcombank, UniCredit Bank Russia, Bank Otkritie, Rosbank, Citibank Russia, Moscow Credit Bank, Post Bank.

The Russia Cards and Payment Market is segmented based on type of card, applications, End-user, and region.

The Individuals sector is the most common end-user of the Russia Cards and Payment Market.