Rugged Phones Market Size (2024 – 2030)

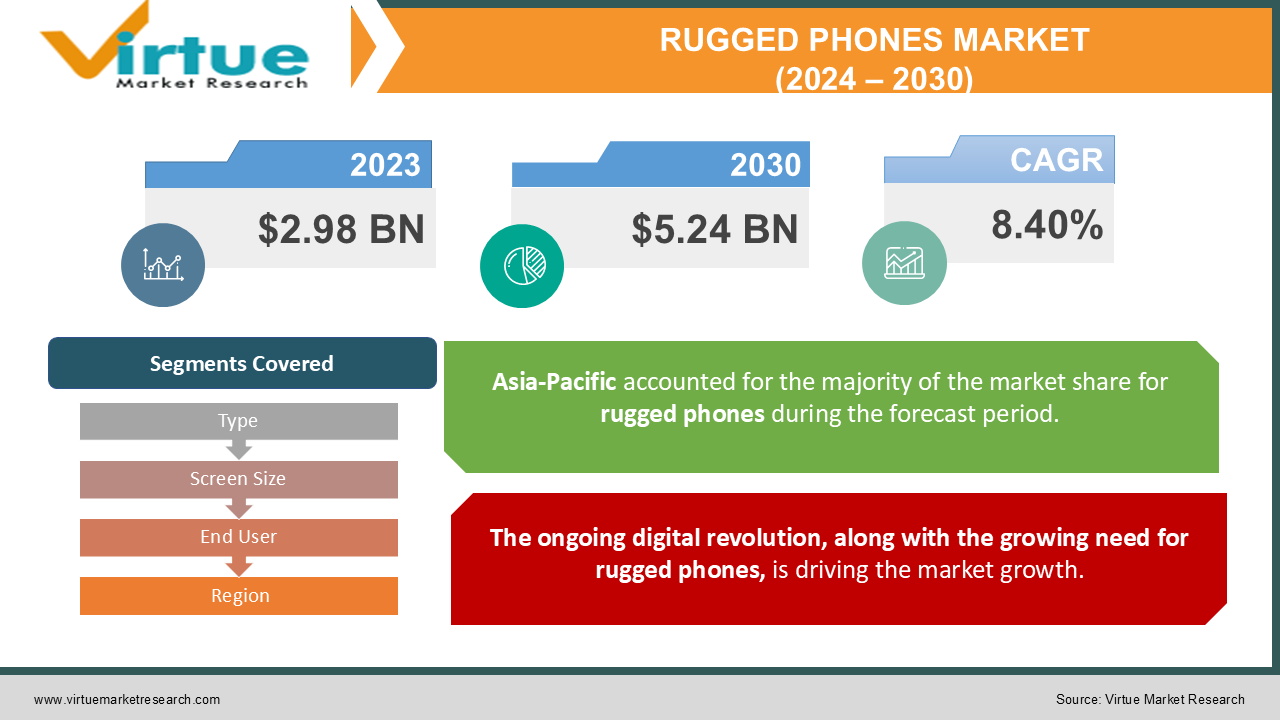

The Global Rugged Phones Market was valued at USD 2.98 billion in 2023 and is projected to reach a market size of USD 5.24 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.40%.

Because of their ability to withstand harsh environments and conditions, rugged phones have become essential tools for outdoor enthusiasts, intrepid travelers, and professionals. working in construction and mining. These phones, known for their shock, water, and dust resistance, and long battery life, are ideal for users who need reliability in harsh conditions where traditional phones are not enough. Many factors support the growth of the mobile phone market. The demand for ruggedized phones is driven by the increasing integration of digital technology, especially in the automation systems associated with smart devices. This demand is in various industrial sectors.

New releases continue to add more value to the scene, while rarer phones are getting amazing new features like artificial intelligence. By adapting to changing industry trends, such as the Internet of Things (IoT), the mobile phone market is poised for long-term growth. Beyond their physical strength, ruggedized phones cope with the demands and dramatic changes of the digital age.

Key Market Insights:

- The latest flagship phones stand out for their robust design, which includes improved displays, reinforced frames, and materials that are resistant to drops, impacts, dust, water, and extreme temperatures. Dedicated to durability, these devices adhere to strict industry standards, such as the military's MIL-STD-810G specification.

- Apart from their physical strength, these unusual earphones feature cutting-edge technology designed to meet certain business requirements. Examples of this include unique sensors, long battery life, powerful processors, and software designed for a variety of industries, including manufacturing, public safety, agriculture, and logistics. The unique display and rugged design of the phones make them an essential device for specialized companies with heavy-duty requirements.

Global Rugged Phones Market Drivers:

The ongoing digital revolution, along with the growing need for rugged phones, is driving the market growth.

The growing number of smartphones with powerful capabilities, their importance in logistics and warehousing services, the growth of real estate and construction, and many applications in the manufacturing sector are expected to contribute and the growth of the world is strong. smartphone market. phone sales. Also, the market is growing due to the continuous digital transformation.

The growing demand for outdoor activities such as hiking, camping, and sports is a major driver of market growth.

Due to the increasing popularity of non-standard phones due to their need for ruggedness, protection from harsh environments, and long battery life, the number of enthusiasts on 'The Outside has exploded. The needs of outdoor sports fans are largely met by rugged phones, which provide a dependable method of communication, navigation, and tracking capabilities in challenging environments. Thus, the growing popularity of adventure sports and outdoor activities, as well as the need for robust and durable mobile devices in remote and outdoor environments, are closely linked to the growing demand for rugged phones.

Global Rugged Phones Market Restraints and Challenges:

Despite promising growth conditions, the mobile phone industry is facing major challenges that could hinder its growth. These difficulties include factors such as poor performance and high cost compared to mainstream models. The growing interest in consumer phones over their disappointing versions may also pose obstacles to the company's expansion. On the other hand, during the forecast period, several popular trends are expected to accelerate the market. Some of the key factors driving the market expansion include the spread of 5G mobile, the introduction of artificial intelligence (AI), the expansion of Industry 4.0, and the improvement of healthcare. The mobile phone market is poised for long-term growth due to the industry's undisputed innovation in mobile phones, demonstrated by the introduction of advanced technologies such as artificial intelligence (AI) and the adoption of technology trends.

Global Rugged Phones Market Opportunities:

There are ample opportunities for rugged phone adoption to grow rapidly in the dynamic markets of South Korea, China, India, Japan, and several other Southeast Asian countries. Due to several factors, including rapid urbanization, increasing disposable income, widespread adoption of smartphones and mobile phones, and government policies encouraging industrial growth, these regions are expected to experience the fastest growth in the years future. In addition, large R&D spending on telecommunications and mobile technology will support the growing mobile industry in the region.

Exciting opportunities are also presented by the growing trend of automation and the general growth of the manufacturing sector. With these features, it is expected that mobile phone manufacturers will have ample opportunities for growth and expansion, which should encourage them to establish their manufacturing facilities in the region soon. The combination of these factors makes the Asia-Pacific region an important area for expansion and a promising future for the mobile industry.

RUGGED PHONES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.40% |

|

Segments Covered |

By Type, Screen Size, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Samsung Electronics Co., Ltd., Zebra Technologies Corporation, Kyocera Corporation, HMD Global Oy, Unitech Electronics Co., Ltd., Sonim Technologies, Inc., Blackview SA, Juniper Systems, Inc., Bullitt Group Ltd. (Cat Phone), Oukitel |

Rugged Phones Market Segmentation: By Type

-

Smartphones

-

Featured Phones

In 2023, Feature phones are both the largest and fastest-growing segment in this market. A strong cell phone, an example of the stability of technology, has been carefully made to withstand the challenges of different climates, with a strong case that protects against shock, dust, water, and other serious problems. These robust devices, made with high-performance and durable materials, demonstrate uninterrupted performance even after experiencing heavy falls or exposure to water, dust, or mud. Most popular in the military and defence sectors, wireless networks find applications in extreme environments such as snowy mountains and deserts, where poor network connectivity requires reliable communication devices. Their importance does not extend to the field of sports, highlighting the great interest and versatility of these devices across various industries where durability and reliability are important.

Cell phones have changed the way we communicate, work, and navigate the world. With their versatile capabilities and ever-changing features, smartphones have become essential companions in our daily lives. The factors that contribute to the growth in their many areas include the advancement of technology, the proliferation of the Internet, and the proliferation of mobile applications that meet different needs. However, in this bright and sophisticated application, there is one famous niche that is gaining ground: the global phone market. As more people engage in outdoor activities, extreme sports, or work in harsh environments, the demand for rugged smartphones designed to withstand those elements has seen an increase. These unique devices offer longevity, extended battery life, and enhanced connectivity, targeting adventurers, outdoor enthusiasts, and professionals in demanding industries such as construction and weapons. As smartphones continue to develop, their impact on the global mobile phone market is poised for significant growth, with the need for stability and reliability facing adverse conditions.

Rugged Phones Market Segmentation: By Screen Size

-

Below 5 Inch,

-

5 Inch to 6 Inch

-

Above 6 Inch

In 2023, The increasing demand for smartphones with displays larger than 6 inches is reshaping the fragile smartphone market. As consumers increasingly demand devices that offer wider screens for a more immersive media experience and productivity, manufacturers are adapting by incorporating powerful features into larger models. This trend is caused by a combination of factors, including the growing number of outdoor activities and sports, while users need durable devices that can withstand harsh environments. In addition, the increase in working in rural areas and the need for reliable communication devices in remote areas has led people to look for phones with large screens and strong power. This change has a great impact on the mobile phone market, driving innovators to create devices that offer a balance between durability, performance, and size, thus meeting changing needs. of today's consumers across different industries and lifestyles.

A 5–6-inch group is both the fastest growing section and the forecast period. This government is due to the increased investment in phones that are frustrated of this size, and the need for phones with large companies such as law enforcement, the military, and the gas industry. The demanding environmental conditions of these companies require a durable device, which is why choose a solid phone 5-6 inches. Also, market growth is driven by the introduction of advanced technologies such as industrial software, robust touchscreens, and long battery life. These developments reflect the evolution of the market and the technological changes required and show the importance of the 5–6-inch market segment in the mobile phone sector.

Rugged Phones Market Segmentation: By End User

-

Industrial

-

Government

-

Commercial

-

Military and Defense

-

Consumer

The Industrial sector is the largest segment of the market. This need is enhanced by the growing need in the industrial environment for strong phones that offer great intelligence, strong power, user-friendly interface, and network development. The increase in mobile phones can be attributed to the growing influence of critical technologies in the industrial sector, including automation, robotics, process control, and Industry 4.0. The business sector is the fastest-growing sector. Many industries are included in this category, such as business, health, hospitality, construction, etc. Smartphones designed to meet the needs of businesses are becoming increasingly popular as businesses across industries embrace digital technology to improve customer service and operational efficiency.

In recent years, the demand for rare cell phones has increased dramatically, due to many factors affecting consumer behavior. The main contributor to this growth is the growing number of outdoor enthusiasts, travelers, and professionals who work in harsh environments and need tools that can withstand harsh conditions. In addition, the rise of extreme sports and outdoor activities has increased the need for durable and reliable smartphones. In addition, the increasing awareness of climate change and environmental concerns has made consumers look for products with a longer life, thus reducing the frequency of replacement and reducing free e-waste. Changing consumer preferences have had a significant impact on the global mobile phone market, prompting designers to innovate and create devices that not only offer long-lasting durability but also combine high-end features available.

Rugged Phones Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on a detailed analysis that breaks down the different regions of the global mobile phone market, North America, which includes the United States, Canada, and Mexico, emerges as the undisputed leader, holding the largest share of the global market. , or 35%. North America's dominance in 2023 is due to the strength of the industry and its commitment to smartphone research and development. The region is ideal for the widespread use of rugged phones because it is home to a wide range of businesses, including oil and gas, healthcare, and transportation. The rapid growth of the market in North America is driven by the widespread use of feature phones and smartphones with advanced features across various industrial sectors. The Asia-Pacific region is expected to experience the fastest growth between 2024 and 2030, driven by the increase in manufacturing and industrial automation and the broader digitalization process. Huge government spending in countries like China and India is fueling the region's expected growth. It is expected that the United States will maintain its leadership position in North America at this time due to the government's plans to support both domestic growth and industrial expansion, which will strengthen the adoption of mobile phones by the country.

COVID-19 Impact Analysis on the Global Rugged Phones Market:

Global lockdowns, extensive travel restrictions, temporary business closures, supply chains, and manufacturing disruptions are all consequences of the COVID-19 pandemic. These developments have positively affected the growth of the telecom infrastructure sector, and the sales and marketing strategies of companies involved in the telecommunications industry have also been positively affected. There is a negative confusion and capacity to produce something, especially for producers from China and other Asia.

These hardships hurt a smaller smaller in the phone area. However, to address the supplier crisis, companies have responded by continuing their restructuring efforts and strengthening relationships with suppliers and marketing partners. These practices are very important in reducing negative effects. Although the outbreak of COVID-19 has resulted in brief business closures, a strategic approach and collaborative approach across the industry have helped mitigate the challenges faced by telcos during this difficult time.

Latest Trends/ Developments:

In recent years, the global mobile phone market has seen an increase in innovation and demand, with a growing need for durable and reliable mobile devices across the home. various activities and outdoor activities. One thing that stands out is the integration of advanced features that are usually found in traditional phones into the more disappointing models, such as cameras with higher resolution, better processing power, and expanded storage capacity. Manufacturers are also working to improve the ruggedness of their devices, using advanced materials and engineering techniques to ensure resistance to water, dust, drops, and extreme temperatures. Additionally, there is an increasing emphasis on customization and versatility, with rugged phones tailored to specific business needs, whether military, construction, or outdoor enthusiasts. Additionally, the rise of 5G technology is poised to revolutionize the mobile phone market, providing faster connectivity and offering new applications and services in remote environments. Overall, these developments indicate a bright future for the global mobile phone market, meeting the changing needs of users across different industries.

Key Players:

-

Samsung Electronics Co., Ltd.

-

Zebra Technologies Corporation

-

Kyocera Corporation

-

HMD Global Oy

-

Unitech Electronics Co., Ltd.

-

Sonim Technologies, Inc.

-

Blackview SA

-

Juniper Systems, Inc.

-

Bullitt Group Ltd. (Cat Phone)

-

Oukitel

-

In February 2023, Kyocera International Inc. expanded its line of military-grade tough devices with the launch of the DuraXV Extreme+ flip phone, which is exclusively sold through Verizon. This was a concrete example of the approach in action.

- In September 2022, Samsung simultaneously debuted the Galaxy Tab Active4 Pro and Galaxy XCovers6 Pro in the United States. The main goal of these product introductions is to provide field workers and frontline staff with equipment that is designed to be resilient in harsh environments and to give them flexibility when things get tough. This deliberate fusion of innovation and user-centered design highlights the dynamic progress of rugged phones, meeting the various needs of professionals working in harsh situations.

Chapter 1. Rugged Phones Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Rugged Phones Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Rugged Phones Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Rugged Phones Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Rugged Phones Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Rugged Phones Market – By Type

6.1 Introduction/Key Findings

6.2 Smartphones

6.3 Featured Phones

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Rugged Phones Market – By End-User

7.1 Introduction/Key Findings

7.2 Industrial

7.3 Government

7.4 Commercial

7.5 Military and Defense

7.6 Consumer

7.7 Y-O-Y Growth trend Analysis By End-User

7.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Rugged Phones Market – By Screen Size

8.1 Introduction/Key Findings

8.2 Below 5 Inch,

8.3 5 Inch to 6 Inch

8.4 Above 6 Inch

8.5 Y-O-Y Growth trend Analysis By Screen Size

8.6 Absolute $ Opportunity Analysis By Screen Size, 2024-2030

Chapter 9. Rugged Phones Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End-User

9.1.4 By Screen Size

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End-User

9.2.4 By Screen Size

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End-User

9.3.4 By Screen Size

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End-User

9.4.4 By Screen Size

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End-User

9.5.4 By Screen Size

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Rugged Phones Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Samsung Electronics Co., Ltd.

10.2 Zebra Technologies Corporation

10.3 Kyocera Corporation

10.4 HMD Global Oy

10.5 Unitech Electronics Co., Ltd.

10.6 Sonim Technologies, Inc.

10.7 Blackview SA

10.8 Juniper Systems, Inc.

10.9 Bullitt Group Ltd. (Cat Phone)

10.10 Oukitel

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Rugged Phones Market was valued at USD 2.98 billion and is projected to reach a market size of USD 5.24 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 8.40%.

The need for rugged phones is primarily being driven by the growing real estate and construction industries, the manufacturing industry, the growing integration of digital technologies, and the need for robust capabilities in logistics and warehousing operations. The increase in popularity of outdoor pursuits like hiking and adventure sports also supports the market's expansion.

Based on Type, the Global Rugged Phones Market is segmented into Smartphones and Featured Phones.

North America is the most dominant region for the Global Rugged Phones Market.

Samsung Electronics Co., Ltd., Zebra Technologies Corporation, Kyocera Corporation, HMD Global Oy, Unitech Electronics Co., Ltd., Sonim Technologies, Inc., Blackview SA, Juniper Systems, Inc., Bullitt Group Ltd. (Cat Phone), Oukitel.