Rubber Bonded Abrasives Market Size (2025 – 2030)

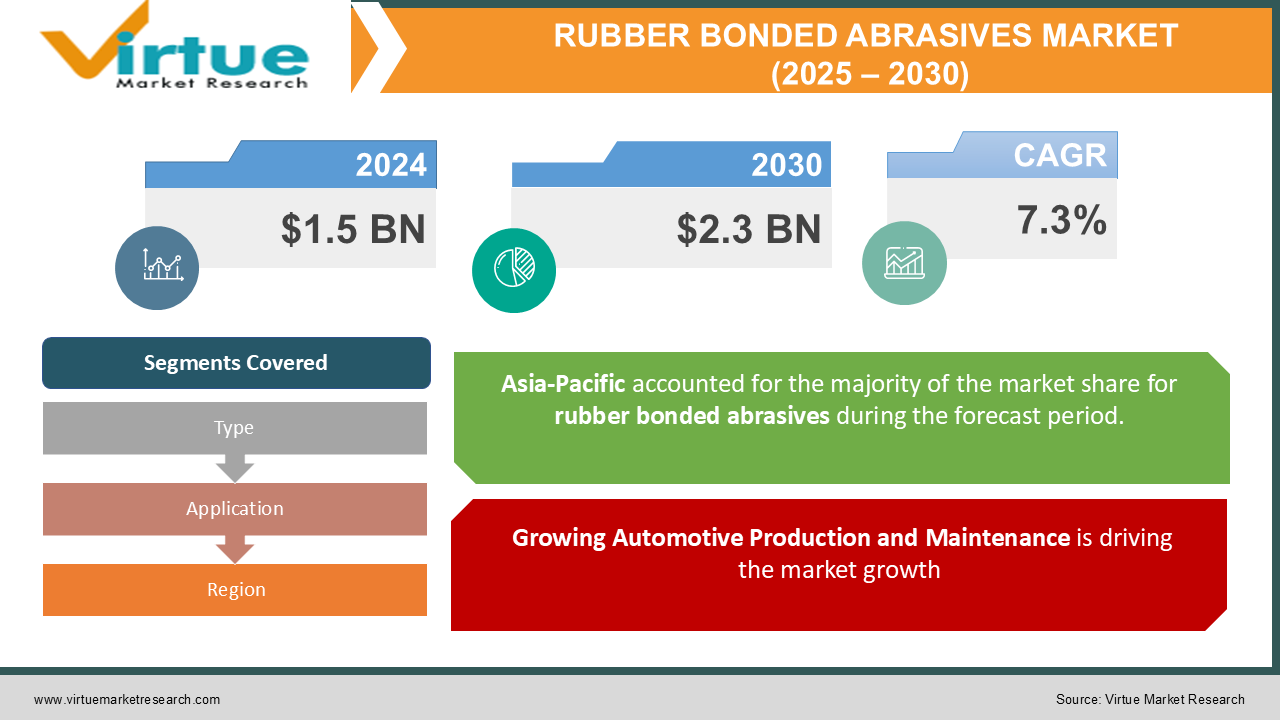

The Global Rubber Bonded Abrasives Market was valued at USD 1.5 billion in 2024 and is projected to reach USD 2.3 billion by 2030, growing at a CAGR of 7.3% during the forecast period.

Rubber bonded abrasives are crucial in surface finishing and grinding applications across various industries, offering flexibility, precision, and durability.

The market is driven by the growing demand from automotive, electronics, and heavy industries due to the need for high-performance grinding tools. Innovations in synthetic rubber formulations, which enhance the durability and efficiency of abrasives, are further propelling market growth.

Key Market Insights

Synthetic rubber-based abrasives dominated the market, accounting for 62% of the revenue share in 2024, owing to their superior performance and durability.

Automotive applications held the largest share in 2024, driven by increasing demand for grinding and finishing solutions in manufacturing and maintenance processes.

The Asia-Pacific region emerged as the largest market, contributing to over 40% of the global revenue, fueled by robust industrialization and growing automotive production.

Rising adoption of precision grinding tools in the electronics sector is a key trend driving demand. Environmental regulations promoting sustainable manufacturing processes are encouraging the use of eco-friendly rubber bonded abrasives. Advances in nanotechnology are leading to the development of abrasives with enhanced performance and lifespan. The e-commerce sector is facilitating market penetration, especially in emerging economies, by offering accessibility and a diverse product portfolio.

Global Rubber Bonded Abrasives Market Drivers

1. Growing Automotive Production and Maintenance is driving the market growth

The automotive industry serves as a major consumer of rubber bonded abrasives, which are indispensable for grinding, polishing, and finishing various components. The global surge in electric vehicle (EV) production and the industry's shift towards lightweight materials like aluminum and composites have significantly increased the demand for high-performance abrasives. These lightweight materials necessitate precision grinding tools capable of achieving intricate shapes and fine finishes, driving substantial market growth. Moreover, the aftermarket services sector, encompassing repair and maintenance operations, contributes significantly to the demand for abrasives, as these tools are essential for restoring and maintaining vehicle components.

2. Rising Demand in Electronics Manufacturing is driving the market growth

The electronics industry relies heavily on rubber bonded abrasives for precision grinding and polishing of delicate components. With the growing adoption of advanced electronic devices and miniaturization trends, the need for high-precision abrasives is increasing.

The rapid expansion of semiconductor manufacturing, driven by innovations in IoT, AI, and 5G technologies, is another significant driver for the market. Rubber bonded abrasives are preferred in semiconductor processing due to their ability to provide smooth and precise finishes without causing damage.

3. Advancements in Abrasive Materials and Manufacturing Processes is driving the market growth

Technological advancements in rubber formulations and abrasive materials are enhancing the efficiency, lifespan, and environmental sustainability of rubber bonded abrasives. Innovations in synthetic rubbers and additives are enabling manufacturers to produce abrasives with higher heat resistance and improved grinding performance.

Furthermore, automation in manufacturing processes is increasing production efficiency, reducing costs, and enabling customization of abrasive tools to meet specific industrial requirements.

Global Rubber Bonded Abrasives Market Challenges and Restraints

1. Volatility in Raw Material Prices is restricting the market growth

The cost of raw materials, such as natural and synthetic rubber, significantly influences the production costs of rubber bonded abrasives. These raw material prices are subject to fluctuations driven by various factors, including supply-demand imbalances in the global market, geopolitical tensions that disrupt supply chains, and increasingly stringent environmental regulations. For instance, fluctuations in crude oil prices directly impact the cost of petrochemical-based synthetic rubbers, a key component in many abrasive products. This dependence on crude oil creates significant volatility in raw material costs, making it challenging for manufacturers to accurately predict and manage their production expenses.

2. Stringent Environmental Regulations is restricting the market growth

The manufacturing and disposal of rubber bonded abrasives involve environmental concerns, such as emissions of volatile organic compounds (VOCs) and non-biodegradable waste. Governments worldwide are imposing stringent regulations to curb environmental pollution, requiring manufacturers to adopt eco-friendly materials and processes. Compliance with these regulations often entails additional costs, which can impact profitability, particularly for small and medium-sized enterprises (SMEs).

Market OpportunitiesThe Global Rubber Bonded Abrasives Market presents substantial growth opportunities driven by technological advancements and increasing demand across various end-use industries. The automotive industry, undergoing a significant transition to electric vehicles (EVs), is creating new demand for specialized abrasives to process lightweight and high-strength materials. Innovations in EV battery manufacturing also necessitate precision grinding tools, further expanding market opportunities. The electronics sector, fueled by the proliferation of consumer electronics and the expansion of semiconductor manufacturing, is driving the demand for ultra-precision abrasives. Emerging trends like wearable devices and foldable displays are creating niche applications for rubber bonded abrasives. The focus on environmentally friendly manufacturing processes is encouraging the development of eco-friendly rubber bonded abrasives. The use of bio-based rubber and water-based bonding systems aligns with global sustainability goals and offers a competitive edge to manufacturers. Rapid industrialization and urbanization in regions like Asia-Pacific, Latin America, and the Middle East & Africa are boosting the adoption of rubber bonded abrasives. Investments in infrastructure development and manufacturing facilities are creating new growth avenues. The growing popularity of online sales channels is enabling manufacturers to reach a broader customer base, particularly in remote and underserved markets. Customized product offerings and direct-to-consumer strategies are further enhancing market penetration.

RUBBER BONDED ABRASIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.3% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Company, Saint-Gobain Abrasives, Tyrolit Group, Pferd Inc., Asahi Diamond Industrial Co., Ltd., Carborundum Universal Limited, Fujimi Incorporated, Schaffner Manufacturing Company, Inc., Sankyo-Rikagaku Co., Ltd., Buffalo Abrasives Inc. |

Rubber Bonded Abrasives Market Segmentation - By Type

-

Natural Rubber

-

Synthetic Rubber

The synthetic rubber segment dominated the market in 2024, capturing over 62% of the total revenue share. This dominance can be attributed to the inherent advantages offered by synthetic rubbers. Compared to natural rubber, synthetic rubbers exhibit superior durability, exceptional resistance to heat and various chemicals, and offer consistent performance across a wide range of applications and environmental conditions. These properties make them highly suitable for demanding industrial applications where reliability and longevity are critical. Synthetic rubbers find widespread use in the manufacturing of tires, automotive components, industrial belts, hoses, and various other products that require high performance and resilience in challenging operating environments.

Rubber Bonded Abrasives Market Segmentation - By Application

-

Heavy Industries

-

Automotive

-

Electronics

-

Others

The automotive sector emerged as the dominant end-user segment in 2024, commanding the largest market share. This significant market share is attributed to the substantial demand for grinding and polishing tools throughout the automotive manufacturing, repair, and maintenance processes. Rubber bonded abrasives play a pivotal role in various automotive applications, including the finishing of metal components, the removal of surface imperfections, and the preparation of surfaces for subsequent processes such as painting or coating. The increasing production of automobiles globally, coupled with the growing focus on vehicle aesthetics and performance, has fueled the demand for high-quality grinding and polishing tools, solidifying the automotive sector's position as the leading end-user of rubber bonded abrasives.

Rubber Bonded Abrasives Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific emerged as the largest market, contributing over 40% of the global revenue in 2024. The region's dominance is attributed to rapid industrialization, robust automotive production, and growing investments in electronics manufacturing. China and India are key contributors, with significant demand for abrasives in infrastructure development, automotive production, and heavy industries. The presence of low-cost manufacturing facilities and a strong export network further support the region's growth.

COVID-19 Impact Analysis

The COVID-19 pandemic had a multifaceted impact on the rubber bonded abrasives market. Disruptions in global supply chains, factory shutdowns, and a decline in overall industrial activity initially led to a significant decrease in demand. However, the pandemic also spurred increased demand in certain sectors, such as healthcare, where precision abrasives were crucial for manufacturing medical devices and equipment. Additionally, the surge in demand for electronics, particularly those related to remote work and online learning, also fueled a need for specialized abrasives. Post-pandemic, the market is experiencing a strong recovery, driven by the resumption of industrial activities across various sectors. Investments in automation and advanced manufacturing technologies are further boosting demand for high-performance abrasives. The pandemic has also highlighted the importance of resilient supply chains, leading to a greater emphasis on localizing production and reducing reliance on globalized supply networks. Moreover, the increasing adoption of digital solutions, such as online platforms for sales and customer service, is streamlining market operations and expanding market reach. These factors, combined with the ongoing growth of end-use industries like automotive and construction, are expected to drive significant growth in the rubber bonded abrasives market in the coming years.

Latest Trends/Developments

The rubber bonded abrasives market is witnessing several key trends. Manufacturers are increasingly focusing on developing eco-friendly abrasives by utilizing bio-based rubber and non-toxic bonding agents to comply with environmental regulations and cater to growing consumer preferences for sustainable products. Advancements in nanotechnology are enabling the production of abrasives with enhanced performance characteristics, such as higher wear resistance and extended lifespan. The adoption of Industry 4.0 technologies, including automation and real-time monitoring, is streamlining manufacturing processes, improving efficiency, and driving down production costs. Furthermore, the rising demand for application-specific abrasives is driving manufacturers to offer customized solutions tailored to meet unique industrial requirements. The integration of digital tools, such as online configurators and virtual product trials, is enhancing customer engagement, expanding market reach, and facilitating informed purchasing decisions. These trends are collectively shaping the future of the rubber bonded abrasives market, driving innovation and ensuring continued growth in the years to come.

Key Players

-

3M Company

-

Saint-Gobain Abrasives

-

Tyrolit Group

-

Pferd Inc.

-

Asahi Diamond Industrial Co., Ltd.

-

Carborundum Universal Limited

-

Fujimi Incorporated

-

Schaffner Manufacturing Company, Inc.

-

Sankyo-Rikagaku Co., Ltd.

-

Buffalo Abrasives Inc.

Chapter 1. Rubber Bonded Abrasives Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Rubber Bonded Abrasives Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Rubber Bonded Abrasives Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Rubber Bonded Abrasives Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Rubber Bonded Abrasives Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Rubber Bonded Abrasives Market – By Type

6.1 Introduction/Key Findings

6.2 Natural Rubber

6.3 Synthetic Rubber

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Rubber Bonded Abrasives Market – By Application

7.1 Introduction/Key Findings

7.2 Heavy Industries

7.3 Automotive

7.4 Electronics

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Rubber Bonded Abrasives Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Rubber Bonded Abrasives Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 3M Company

9.2 Saint-Gobain Abrasives

9.3 Tyrolit Group

9.4 Pferd Inc.

9.5 Asahi Diamond Industrial Co., Ltd.

9.6 Carborundum Universal Limited

9.7 Fujimi Incorporated

9.8 Schaffner Manufacturing Company, Inc.

9.9 Sankyo-Rikagaku Co., Ltd.

9.10 Buffalo Abrasives Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 1.5 billion in 2024 and is projected to reach USD 2.3 billion by 2030, growing at a CAGR of 7.3%.

Key drivers include growing automotive production, rising demand in electronics manufacturing, and advancements in abrasive materials and processes.

Segments include Type (Natural Rubber, Synthetic Rubber) and Application (Heavy Industries, Automotive, Electronics, Others).

Asia-Pacific dominates the market, contributing over 40% of the global revenue, driven by robust industrialization and automotive production.

Major players include 3M Company, Saint-Gobain Abrasives, Tyrolit Group, Pferd Inc., and Asahi Diamond Industrial Co., Ltd.