RTD Canned Cocktails Market Size (2024 – 2030)

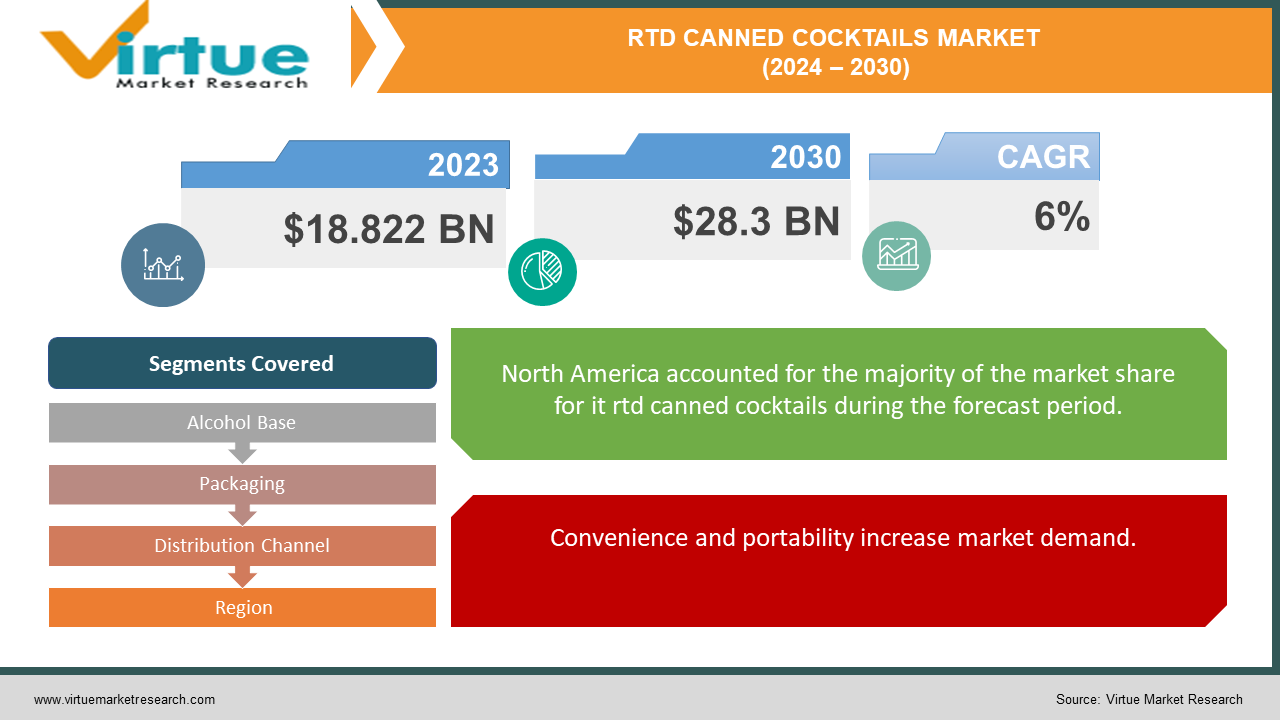

The RTD Canned Cocktails Market was valued at USD 18.822 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 28.3 billion by 2030, growing at a CAGR of 6%.

Sales of RTD canned cocktails are growing due to rising popularity among Gen-Z and millennials. RTD beverages offer more convenience compared to other spirits. Manufacturers are focusing on delivering premium RTD canned cocktails in sweet, tropical fruit, and diverse flavors with a touch of spirit to boost demand.

Key Market Insights:

The increasing demand for flavored drinks with low alcohol content, driven by rising health concerns, is expected to propel the ready-to-drink (RTD) cocktails market over the forecast period. The trend of premiumization, focusing on flavors, taste, quality, and package design, is also anticipated to boost market growth.

The demand for RTD cocktails is increasing due to their convenient and time-saving appeal to consumers who seek a hassle-free way to enjoy a cocktail without traditional preparation. The portability and convenience of RTD cocktails, allowing consumers to carry and consume them anywhere and anytime, are expected to attract a larger consumer base.

RTD Canned Cocktails Market Drivers:

An increase in demand for canned drinks drives market growth.

Consumers prefer ready-to-eat food and beverages for their variety and convenience. The demand for canned drinks has surged due to lockdowns imposed during the pandemic, driving sales. Remote workers, confined to their homes, seek unique drinks, especially those with longer shelf lives. The growing trend of premiumization in the food and beverage industry is pushing producers to offer great-tasting cocktails with diverse options. These factors are expected to drive the growth of the ready-to-drink canned cocktail market.

Convenience and portability increase market demand.

Convenience and portability are crucial, as customers seek high-quality, pre-made cocktail options that are quick and easy to prepare, particularly for at-home and on-the-go scenarios. Additionally, the use of natural ingredients, lower sugar content, and functional additives that align with broader wellness trends, along with unique flavor profiles and premium packaging, attract diverse consumer segments and boost market appeal, thereby strengthening the demand for ready-to-drink cocktails.

RTD Canned Cocktails Market Restraints and Challenges:

Large quantities and unique ingredients hinder market growth.

Ready-to-drink cocktails are typically produced in large quantities and distributed widely, leading to limited variety and customization options. Consumers seeking unique and personalized cocktails may opt to make their own or visit a bar with a broader range of choices. Moreover, ready-to-drink cocktails face competition from traditional cocktails available in bars and restaurants. Many consumers prefer the experience of ordering a freshly made cocktail from a skilled bartender, valuing the craftsmanship and personalized touch that such service provides. The ability to customize cocktails with unique ingredients and flavors often holds more appeal than pre-packaged options.

RTD Canned Cocktails Market Opportunities:

Demand for healthier Ready to Drink creates opportunities.

With the increasing emphasis on health and wellness, there is a growing demand for low-calorie, low-sugar, and healthier ready-to-drink cocktails. Manufacturers are addressing this trend by introducing more health-conscious alternatives to traditional cocktails. Additionally, consumers seek unique and innovative flavors in their ready-to-drink cocktails. Companies are experimenting with various ingredients and flavors to meet this demand and provide an exciting range of options. Furthermore, collaborations between celebrities and ready-to-drink cocktail brands have gained popularity. These partnerships help promote the products and attract consumers who are fans of the celebrities.

RTD CANNED COCKTAILS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Alcohol Base, Packaging, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Anheuser-Busch InBev, Duvel Moortgat USA Ltd., Diageo PLC, Brown-Forman, AB InBev, Manchester Drinks Co., Dulce Vida, S.A.B. de C.V., Novo Fogo, Bacardi Limited |

RTD Canned Cocktails Market Segmentation: By Alcohol Base

-

Wine-based

-

Spirit-based

The spirit-based cocktails segment has dominated the market and is expected to maintain its dominance throughout the forecast period. These cocktails typically contain up to 5% alcohol content, combined with ingredients such as juices, and are available in single-serve packaging with a wide range of flavors. Popular spirits such as vodka, gin, tequila, whiskey, and rum are widely utilized in these cocktails. Spirit-based cocktails have gained popularity among consumers due to their diverse options, which include infused flavors like ginger, rose, and lavender, making them the preferred choice in the alcoholic beverage category.

The wine-based segment is anticipated to sustain market growth during the forecast period due to changing consumer preferences and lifestyle choices. Wine-based RTD cocktails offer several advantages to consumers. They provide convenience, and consistent quality, and are pre-mixed and pre-measured, eliminating the need for additional preparation. This makes them an appealing choice for consumers seeking a quick and hassle-free drinking experience. They provide convenience and ease of consumption, unlike traditional wine, which requires opening a bottle and sometimes decanting. Wine-based RTD cocktails come in pre-mixed and pre-measured portions, eliminating the need for additional preparation, and making them an attractive option for individuals seeking a quick, hassle-free drink.

RTD Canned Cocktails Market Segmentation: By Packaging

-

Cans

-

Bottles

The bottle packaging segment held the largest revenue share, establishing its dominance in the global market. Initially, the concept of RTD cocktails was introduced in bottle packaging, gaining widespread popularity worldwide. However, due to an aluminum shortage in countries like the U.S., there has been a shift toward using glass bottles. This market trend has led to an increased demand for glass bottles in the global RTD cocktails market.

The cans segment is predicted to experience the highest market growth during the forecast period. Cans are perceived as a more sustainable packaging option compared to formats like glass bottles or plastic containers. The aluminum used to produce cans is highly recyclable, and there is a well-established recycling infrastructure for cans in many regions. This aligns with the growing consumer demand for eco-friendly and sustainable products, prompting more brands to transition to cans to meet this expectation.

RTD Canned Cocktails Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience/Grocery Stores

-

Specialist Retailers

-

Online Channels

-

Other Distribution Channels

The hypermarkets/supermarkets segment dominated the market and is expected to maintain its leading position throughout the forecast period due to the strong consumer preference for purchasing grocery products from supermarkets, convenience stores, specialty stores, and grocery stores. Consumers favor hypermarkets/supermarkets for their extensive product choices and convenient shopping experience. Within these retail outlets, grocery stores play a vital role as distribution channels for RTD cocktails.

The online segment is expected to achieve the fastest growth during the forecast period. Online platforms offer a wide range of RTD cocktail options, allowing consumers to explore different flavors, brands, and combinations that may not be readily available in their local stores. This variety expands the choices available to consumers, catering to different tastes and preferences.

RTD Canned Cocktails Market Segmentation- by Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America emerged as the dominant market, a trend expected to continue throughout the forecast period. Market growth in this region is primarily driven by the increasing demand for vodka and whiskey-based beverages. The appeal of these ready-to-drink cocktails lies in their low alcohol content and affordability compared to bar-served drinks, making them attractive to young consumers. In North America, the United States accounted for the largest revenue share, attributed to the rising consumer demand for a wide variety of flavors and a preference for convenient, on-the-go products.

Asia Pacific is poised for significant growth due to increasing demand for premium, convenient, and high-quality cocktails influenced by Western culture. Changing lifestyles and rising alcohol consumption are key factors driving demand for these products. The convenience, combined with lower alcohol content and affordable pricing compared to counterfeit cocktails served in bars, makes RTD cocktails appealing to young consumers in the region.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has had a positive impact on the market, driving increased at-home consumption of alcoholic beverages due to restrictions on in-person dining and socializing. RTD cocktails have gained popularity for their convenience and availability, allowing consumers to enjoy cocktails in the comfort of their homes. Another significant factor contributing to the future growth of the RTD cocktails market is the continuous innovation in products. Manufacturers are introducing new flavors, ingredients, and packaging formats to attract consumers. The availability of a diverse range of options, including low-calorie, organic, and craft cocktails, is expected to further fuel market growth. For example, Diageo Plc launched a line of flavored, low-calorie RTD cocktails under its Ketel One brand in the U.S., featuring vodka blended with botanicals, natural fruits, and sparkling water. The product offers three distinct flavors: Peach & Orange Blossom, Cucumber & Mint, and Grapefruit & Rose.

Latest Trends/ Developments:

In April 2023, Absolut introduced a new line of RTD cocktails featuring flavors such as coffee, strawberry, and passion fruit. Each variant has a 5% ABV and was first launched in the UK in May 2023.

Also in April 2023, Jennifer Lopez debuted 'The House of Delola,' a premium collection of spirit-based and organic RTD cocktails. The range includes Bella Berry Spritz (10.5% ABV), L’Orange Spritz (10.5% ABV), and Paloma Rosa Spritz (11.5% ABV), enriched with fruit flavors and boasting reduced calorie content.

In January 2022, The Coca-Cola Company partnered with Constellation Brands Inc. to introduce FRESCA Mixed in the U.S. market. These full-flavored, spirit-based RTD cocktails aim to appeal to consumers seeking a more robust flavor experience, positioned between refreshing hard seltzers and traditional bar cocktails.

Key Players:

These are top 10 players in the RTD Canned Cocktails Market: -

-

Anheuser-Busch InBev

-

Duvel Moortgat USA Ltd.

-

Diageo PLC

-

Brown-Forman

-

AB InBev

-

Manchester Drinks Co.

-

Dulce Vida

-

S.A.B. de C.V.

-

Novo Fogo

-

Bacardi Limited

Chapter 1. RTD Canned Cocktails Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. RTD Canned Cocktails Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. RTD Canned Cocktails Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. RTD Canned Cocktails Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. RTD Canned Cocktails Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. RTD Canned Cocktails Market – By Alcohol Base

6.1 Introduction/Key Findings

6.2 Wine-based

6.3 Spirit-based

6.4 Y-O-Y Growth trend Analysis By Alcohol Base

6.5 Absolute $ Opportunity Analysis By Alcohol Base, 2024-2030

Chapter 7. RTD Canned Cocktails Market – By Packaging

7.1 Introduction/Key Findings

7.2 Cans

7.3 Bottles

7.4 Y-O-Y Growth trend Analysis By Packaging

7.5 Absolute $ Opportunity Analysis By Packaging, 2024-2030

Chapter 8. RTD Canned Cocktails Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets/Hypermarkets

8.3 Convenience/Grocery Stores

8.4 Specialist Retailers

8.5 Online Channels

8.6 Other Distribution Channels

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. RTD Canned Cocktails Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Alcohol Base

9.1.3 By Packaging

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Alcohol Base

9.2.3 By Packaging

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Alcohol Base

9.3.3 By Packaging

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Alcohol Base

9.4.3 By Packaging

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Alcohol Base

9.5.3 By Packaging

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. RTD Canned Cocktails Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Anheuser-Busch InBev

10.2 Duvel Moortgat USA Ltd.

10.3 Diageo PLC

10.4 Brown-Forman

10.5 AB InBev

10.6 Manchester Drinks Co.

10.7 Dulce Vida

10.8 S.A.B. de C.V.

10.9 Novo Fogo

10.10 Bacardi Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Consumers prefer ready-to-eat food and beverages for their variety and convenience. The demand for canned drinks has surged due to lockdowns imposed during the pandemic, driving sales. Remote workers, confined to their homes, seek unique drinks, especially those with longer shelf lives.

The top players operating in the RTD Canned Cocktails Market are - Anheuser-Busch, InBev, Duvel Moortgat USA Ltd., Diageo PLC, Brown-Forman, AB InBev, Manchester Drinks Co., Dulce Vida, S.A.B. de C.V., Novo Fogo, Bacardi Limited.

The COVID-19 pandemic has had a positive impact on the market, driving increased at-home consumption of alcoholic beverages due to restrictions on in-person dining and socializing.

Collaborations between celebrities and ready-to-drink cocktail brands have gained popularity. These partnerships help promote the products and attract consumers who are fans of the celebrities.

Asia Pacific is poised for significant growth due to increasing demand for premium, convenient, and high-quality cocktails influenced by Western culture. Changing lifestyles and rising alcohol consumption are key factors driving demand for these products.