Router Market Size (2024 – 2030)

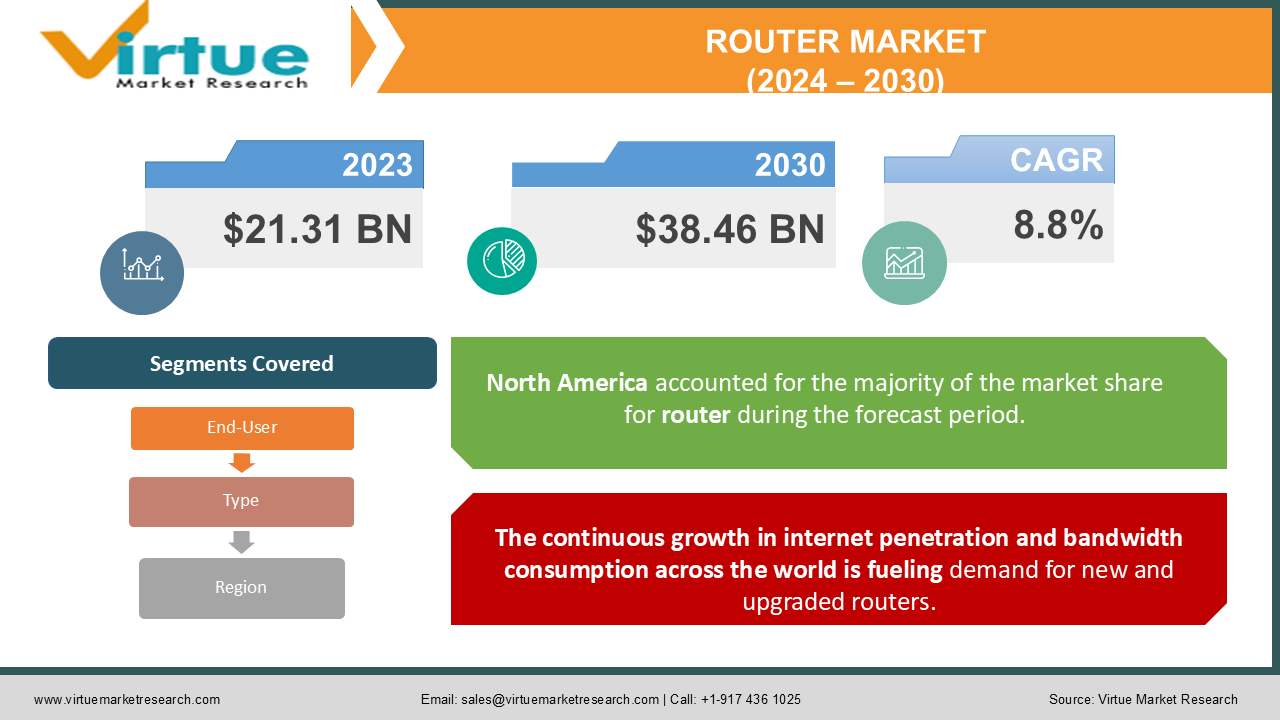

The router market was valued at USD 21.31 billion in 2023 and is projected to reach a market size of USD 38.46 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.8%.

The global router market refers to the industry for high-speed networking devices that forward data packets between computer networks. Routers connect multiple devices and networks, enabling the flow of data across intranets and the internet. Key segments of the router market include wired routers, wireless routers, and mobile routers. The router market has witnessed steady growth in recent years, driven by the expanding internet economy, rising internet penetration and usage around the world, an increasing number of connected devices per household, remote working trends, and the introduction of advanced connectivity technologies like 5G and Wi-Fi 6. Key vendors in the competitive router market include Cisco, Huawei, Nokia, Juniper Networks, TP-Link, D-Link, NETGEAR, Belkin, and others. Cisco leads in enterprise routers, while TP-Link, NETGEAR, and D-Link control the consumer SOHO segment. New product development is focused on advanced capabilities like higher throughput (multi-gigabit), enhanced security, wired/wireless integration, mesh networking, and supporting new connectivity technologies like 5G, Wi-Fi 6, and SD-WAN. Emerging trends in the router market include cloud-managed routers, AI-driven mesh systems, connected home routers integrated with IoT technology, open-source router firmware like OpenWrt, and the growing adoption of software-defined wide area network (SD-WAN) routers.

Key Market Insights:

The router market has grown steadily in recent years, underpinned by strong demand for both consumer and enterprise-grade routers. Wired and routers for homes and small businesses (SOHO segment) represent the largest product segment, accounting for around 55% of total router revenues. Geographically, North America leads with around 30% of the router market share, followed by Asia-Pacific and Europe. APAC is, however, the fastest-growing region. The competitive landscape is dominated by brands like Cisco, Huawei, Nokia, Juniper Networks, NETGEAR, D-Link, Linksys, TP-Link, Asus, and Belkin. Growth drivers include rising internet usage fueled by remote work, education, and entertainment; the growth of connected devices per household; the adoption of gigabit internet plans; and the integration of new technologies like WiFi 6, 5G, and mesh systems. Increased network security risks are boosting demand for advanced security features like firewalls, VPNs, malware protection, parental controls, and app-based visibility and control. There is a rising preference for cloud-managed routers and WiFi systems among enterprises and service providers to enable simplified wide-area management and troubleshooting.

Router Market Drivers:

The continuous growth in internet penetration and bandwidth consumption across the world is fueling demand for new and upgraded routers.

The continuous increase in global internet penetration, along with the explosion of bandwidth consumption among both consumers and businesses, is a pivotal driver shaping growth opportunities in the router market. Internet penetration rates continue to rise steadily worldwide. Developing nations are driving most of this growth, with Asia having the most internet users at around 2 billion. Several factors account for surging bandwidth consumption: an increase in subscribers to high-speed broadband plans like fiber and cable, rising online video viewing, the growth of Internet of Things devices, the use of bandwidth-intensive apps, and the adoption of gigabit internet services, triggering demand for advanced gigabit-capable routers. 5G and WiFi 6 will further accelerate bandwidth usage. 5G's ultra-low latency, ultra-high speeds, and ability to concurrently connect massive devices will expand use cases. WiFi 6 improves spectrum efficiency and allows efficient handling of dense environments with its OFDMA and MU-MIMO capabilities.

The massive shift to remote work, education, and entertainment due to the COVID-19 pandemic has highlighted the essential role of the home router.

The COVID-19 pandemic triggered massive remote work and distance learning adoption across the world. This has spotlighted the importance of home internet connectivity and driven router sales and upgrades. With office closures and lockdowns, remote work surged dramatically. According to Global Workplace Analytics, over 80% of enterprises facilitated remote work during the pandemic. Many will continue the hybrid remote work model's long-term. These monumental shifts to work and learn from home have made a reliable home internet connection vital. Routers play a crucial role in enabling smooth video conferencing, online learning, access to the cloud, and other remote work and study essentials. 61% of US households had at least one remote worker during the pandemic. Two-thirds reported degrading internet performance as entire families simultaneously used bandwidth-heavy apps, driving router upgrades. WiFi congestion due to multiple family members on video calls and idle IoT devices led many households to upgrade to mesh systems providing full home coverage. Higher-priced WiFi 6 routers were also purchased for faster throughput. Enterprise demand also climbed as small businesses quickly pivoted to remote work. Advancements like cloud management, Zero Trust firmware, WPA3 security, and remote browser-based setup became appealing to enable secure remote employee connectivity via routers. With the remote lifestyle likely persisting, families are continuing to invest in reliable connectivity. Gaming and streaming also benefit from router investments when families spend more leisure time at home post-pandemic.

Router Market Restraints and Challenges:

The global router market is intensely competitive, with a few large vendors dominating the landscape.

The global router market, especially the high-volume consumer/SOHO segment, is intensely competitive, with a handful of dominant brands competing aggressively on price to grab market share. This price pressure poses profitability challenges for vendors. Companies like TP-Link, Netgear, Asus, D-Link, and Linksys compete head-to-head for the home and small office router market, relying heavily on discounted pricing and promotions. This focus on undercutting each other has led to a steady erosion in average selling prices (ASPs) of these devices over the years. While affordable pricing helps expand the overall market size, shrinking profit margins are concerning for major players like Netgear and Linksys. This makes investing in R&D and marketing for next-gen products more challenging.

The continuous wireless technology evolutions witnessed roughly every 3 years risk quickly rendering CPE terminals outdated or incompatible.

With new generations of routers launching rapidly, the window for vendors to fully benefit from R&D expenditures on a product before making the next upgrade shrinks. Frequent product refreshes mean having to lock in supply forecasts on components and manage inventories of the current generation closely to avoid excess stock as its successor arrives. This complicates planning and ties up working capital in device inventories that are at high risk of becoming obsolete. Managing distributions and channel partners adds further complexity for coordinated transitions. Consumers get frustrated when their expensive routers reach end-of-support within 2–3 years, necessitating new purchases. This induces a reluctance to invest in premium routers, instead opting for base models, knowing they will soon be outdated. The fast pace of change in underlying WiFi and broadband technologies keeps router product lifecycles short. This poses obstacles for vendors related to managing R&D budgets, inventories, and customer expectations. Developing routers focused on longevity could help address these challenges.

Router Market Opportunities:

New standards like Wi-Fi 6 and 6E deliver drastically faster speeds, handle dense device congestion effectively, and drastically reduce latency. This tangible performance gap makes upgrades compelling. Consumers now see "Wi-Fi 6" advertised for new electronics. This awareness combined with real-world improvements will motivate adoption beyond tech enthusiasts. Older routers struggle with large homes, dead zones, and numerous devices. Mesh solutions solve these pains. Expect manufacturers to bundle features and prioritize user friendliness for broad appeal. With an increasing number of IoT devices in homes, network-level security is more crucial than ever. Integrating powerful threat detection, automated updates, and accessible controls turns routers into home security gatekeepers. Instead of simple website blocking, expect AI-driven approaches to understanding the type of content consumed (not merely site addresses), limiting excessive gaming time, etc. This appeals to modern parenting challenges. Partnerships with software vendors offering VPN solutions, network security training, or simplified device management tailored for small businesses could differentiate router manufacturers.

ROUTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.8% |

|

Segments Covered |

By End-User, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Huawei, ZTE, Netgear, TP-Link, ASUS, D-Link, Linksys, Cisco |

Router Market Segmentation: By Type

-

Wireless Routers

-

Wired Routers

-

Mobile Routers

Wireless routers hold the largest market share of around 50–60% in 2023, driven by household penetration and their general-use nature. They're a necessity for connecting devices in most homes and offices. With wireless routers, it is possible to connect a variety of devices to the internet without using physical wires because of their adaptability, simplicity, and ease of use. Mobile routers are the fastest-growing category. Mobile routers have become more and more popular due to the growing need for mobile connections, remote work, virtual learning, and on-the-go internet access. These routers are perfect for travel, outdoor activities, and places with inadequate wired connectivity since they provide users with the freedom to access the internet via cellular networks from anywhere.

Router Market Segmentation: By End-User

-

BFSI

-

IT and Telecom

-

Education

-

Healthcare

-

Others

The BFSI segment has the largest market share. Financial institutions use technology to improve the efficiency of processes including lending, investing, receiving payments, and transfers. The accessibility and ease of use of digital and mobile banking services will benefit customers. The healthcare industry is the fastest-growing end-user. The healthcare industry is growing quickly due to several factors, including population growth, aging populations, technological improvements, and rising healthcare costs. Further expansion in the industry is being driven by recent events like the COVID-19 pandemic, which have brought attention to the significance of digital health technologies, telemedicine, and healthcare infrastructure.

Router Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America has the largest market, with a rough share of 35% in 2023. This stems from advanced telecommunications infrastructure supporting the rapid adoption of technology, a large number of households and businesses prioritizing robust high-speed connectivity, and growth in smart home technology fueling demand for powerful, compatible routers. Europe claims a considerable segment of the market, around 30%. Factors shaping this include widespread availability of broadband across both urban and rural areas, high income levels encouraging technology investments and network upgrades, and government initiatives promoting smart infrastructure further bolstering the market. Asia-Pacific, with a share of around 20%, is the fastest-growing market. Growth is attributed to increased demand for internet coverage in both urban and rural areas, fueled by rapid urbanization and economic growth across the region. Latin America presents promising growth possibilities while currently trailing other regions in terms of market size. Improved affordability of network equipment, a growing tech-savvy population, and a focus on extending internet access are key drivers. The Middle East and Africa (MEA) represents an emerging market with significant potential for expansion. Government initiatives aimed at increasing broadband access and the adoption of smart manufacturing processes present opportunities for router deployment.

COVID-19 Impact Analysis on the Router Market.

The COVID-19 pandemic and the ensuing lockdowns had a mixed effect on the router market, posing challenges as well as opportunities for vendors. On the bad side, early in the epidemic, supply chain interruptions brought on by plant closures in China and other Asian nations limited router output. Manpower shortages and logistical snags also caused manufacturing to slow down. The inability to satisfy the surge in demand was hampered by the supply shortage. The lack of certain components, such as chips, made supplies more difficult. Furthermore, several homes and businesses decided to put off buying routers and other non-essential technological investments due to the unpredictability of the economy. During lockdowns, small office closures also decreased demand in the near term. Consumer spending on mesh networks and home router upgrades for dependable Wi-Fi coverage surged in response to the rise in remote work and distance learning. Home networks experienced a surge in load as more family members moved in. SMB router sales surged as a result of their pressing networking requirements to provide remote workforce connectivity rapidly. To safeguard and maximize extended home internet usage, there was an increase in demand for more sophisticated router capabilities, including firewalls, VPNs, parental controls, and Wi-Fi administration. As customers upgraded plans to enhance home internet speeds and bandwidth, carriers noticed an increase in sales of broadband routers.

Latest Trends/ Developments:

New router models are rapidly adopting both the WiFi 6 standard and the forthcoming WiFi 6E standard. WiFi 6 offers quicker speeds, a better spectrum economy, and the ability to manage congested situations effectively. The new 6GHz band is supported by WiFi 6E, which improves performance even more. WiFi 6 routers will be in demand as users upgrade their gadgets. To offer smooth WiFi coverage in large areas, such as multi-story residences, mesh router systems are becoming more common. They enable simple setup and variable node placement. Mesh router variants are available from well-known manufacturers, including Linksys, Eero, Orbi, and Google Nest. Another upcoming technology is AI-driven self-optimizing mesh systems. Add-on modules or integrated 5G radios are being used by high-end consumer and business routers to incorporate 5G capabilities. This makes it possible to use 5G for failover or primary connectivity. More hybrid 4G/5G routers will appear as 5G coverage grows. Cloud-based monitoring, management, and optimization of network routers are gaining traction in the enterprise segment. Centralized cloud platforms allow IT teams to control remote branch and campus routers from a single dashboard, improving efficiency. Cisco Meraki and TP-Link Omada are the leading options.

Key Players:

-

Huawei

-

ZTE

-

Netgear

-

TP-Link

-

ASUS

-

D-Link

-

Linksys

-

Cisco

Chapter 1. Router Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Router Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Router Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Router Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Router Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Router Market – By End-Users

6.1 Introduction/Key Findings

6.2 BFSI

6.3 IT and Telecom

6.4 Education

6.5 Healthcare

6.6 Othersq

6.7 Y-O-Y Growth trend Analysis By End-Users/End User

6.8 Absolute $ Opportunity Analysis By End-Users/End User , 2024-2030

Chapter 7. Router Market – By Type

7.1 Introduction/Key Findings

7.2 Wireless Routers

7.3 Wired Routers

7.4 Mobile Routers

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Router Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-Users

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-Users

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-Users

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-Users

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-Users

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Router Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Huawei

9.2 ZTE

9.3 Netgear

9.4 TP-Link

9.5 ASUS

9.6 D-Link

9.7 Linksys

9.8 Cisco

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The continuous growth in internet penetration and bandwidth consumption and the shift towards remote work are the major drivers in this market.

Intense competition and incompatibility are the major concerns in the market.

Huawei, ZTE, Nokia, Ericsson, Netgear, TP-Link, ASUS, and D-Link are the major players.

North America currently holds the largest market share, estimated at around 35%.

Asia-Pacific exhibits the fastest growth, driven by its increasing population and expanding economy.