Rotogravure Printing Inks Market Size (2024 – 2030)

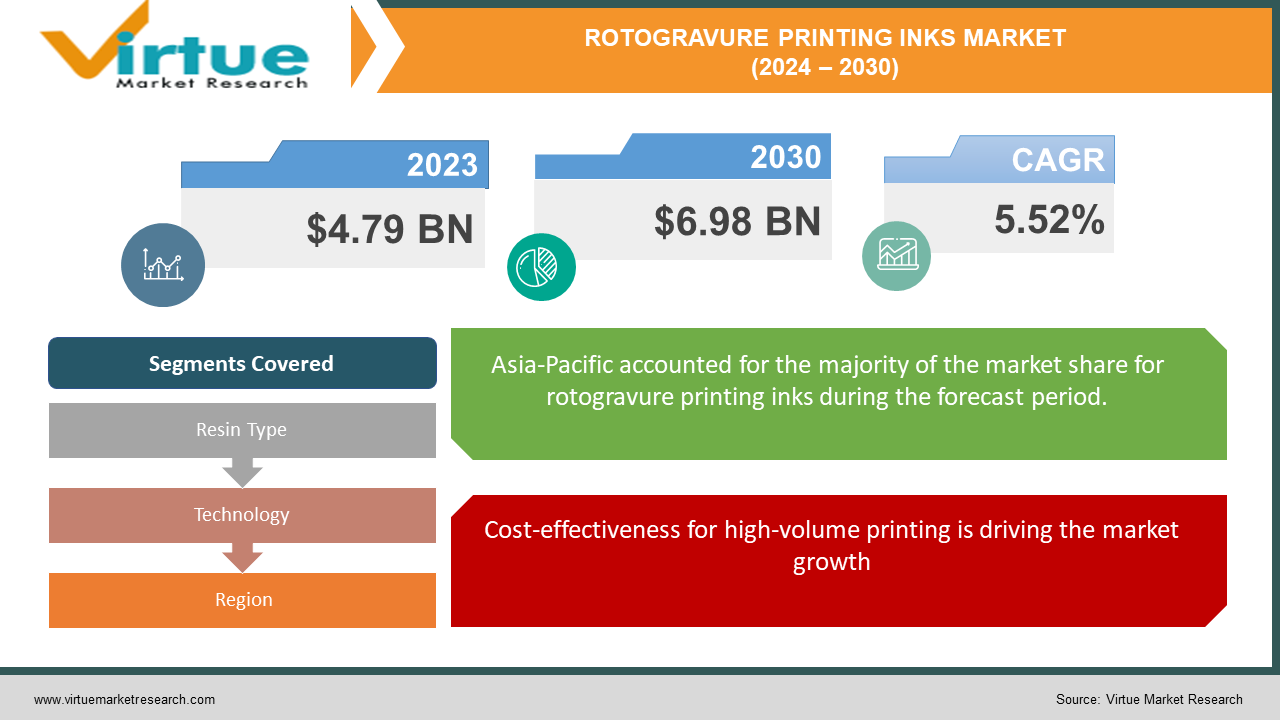

The Global Rotogravure Printing Inks Market was valued at USD 4.79 billion in 2023 and will grow at a CAGR of 5.52% from 2024 to 2030. The market is expected to reach USD 6.98 billion by 2030.

The Rotogravure Printing Inks Market caters to the specific ink needs of rotogravure printing, a technique known for its high-quality visuals and mass production capabilities. This market encompasses various ink formulations based on resin types (like nitrocellulose) and curing technologies (mostly solvent-based currently). It serves a wide range of industries, with packaging (especially for food and e-commerce) being the dominant segment. While facing challenges from environmental regulations and competition from other printing technologies, the market is driven by factors like cost-effectiveness for long print runs, rising demand for premium packaging, and rotogravure's ability to print on diverse substrates.

Key Market Insights:

Asia Pacific with a 32.4% market share currently holds the largest market share due to the booming packaging and publication industries.

Rising demand for high-quality packaging with superior aesthetics, particularly in the Asia Pacific region.

The European region is expected to witness the fastest growth due to the established printing industry.

Integration of automation, Artificial Intelligence (AI), and color management systems is streamlining the printing process, minimizing waste, and maximizing production efficiency.

Global Rotogravure Printing Inks Market Drivers:

Cost-effectiveness for high-volume printing is driving the market growth

Rotogravure printing truly shines when it comes to large print orders. Unlike offset printing, which requires replacing printing plates for each print run, rotogravure uses engraved cylinders that can produce millions of high-quality impressions. This translates to significant cost savings per unit as the initial investment in cylinder creation is spread across a vast number of prints. Furthermore, the engraved cells on the cylinders hold ink more consistently compared to offset plates, resulting in unmatched uniformity throughout the entire print run. This combination of long-lasting cylinders and exceptional print quality makes rotogravure the ideal choice for manufacturers requiring millions of identical, visually striking packaging materials or publications.

E-commerce boom is driving the market growth

The explosion of e-commerce has fundamentally altered the landscape of product packaging. Unlike brick-and-mortar stores where products can rely on physical shelf presence to grab attention, online retail demands packaging that stands out on a crowded virtual screen. This has fueled the use of rotogravure inks for flexible packaging. With their ability to produce vibrant, high-definition visuals, rotogravure inks help brands create eye-catching designs that entice customers to click and purchase. Furthermore, rotogravure printing excels at detailed reproduction, allowing for clear and informative product information on the packaging itself. This is crucial in the online world where consumers can't physically inspect the product before buying. By offering both captivating visuals and essential details, rotogravure inks empower brands to leverage their packaging as a powerful marketing tool within the competitive realm of online shopping.

The versatility of rotogravure printing is driving the market growth

Rotogravure printing's versatility is a major advantage, making it a one-stop shop for a vast array of printing needs. Unlike some printing methods limited to specific materials, rotogravure inks can seamlessly adapt to various substrates. This includes paper for high-quality magazines, catalogs, and even luxury packaging. But its true strength lies in the ability to print on flexible packaging films used for everything from food and beverage pouches to chip bags and laundry detergent containers. Rotogravure inks excel on these plastic films, delivering sharp visuals and vibrant colors that capture consumer attention on store shelves or online marketplaces. Furthermore, rotogravure can handle metal foils used for premium packaging applications, allowing brands to create luxurious effects with metallic finishes and intricate designs. This unmatched versatility empowers businesses across various industries to leverage the exceptional quality and visual appeal of rotogravure printing for their specific packaging and printing needs.

Global Rotogravure Printing Inks Market challenges and restraints:

Stringent Environmental Regulations are restricting the market growth

Environmental regulations are a double-edged sword for the rotogravure ink market. Stricter laws limit the use of volatile organic compounds (VOCs) and other harmful chemicals that were once common in these inks. While this is crucial for protecting air quality and human health, it compels ink manufacturers to reformulate their products. This can be a complex challenge, as achieving the desired print quality and performance often relies on those very VOCs. The reformulation process requires significant research and development to create new inks that meet environmental standards while delivering the high resolution and durability expected in rotogravure printing. This ongoing dance between performance and environmental responsibility is an obstacle for the industry, but also an opportunity for innovation in ink technology.

High Initial Investment is restricting the market growth

The high initial investment for rotogravure printing presses throws a steep hurdle in front of new businesses and smaller players. Unlike some digital printing technologies with lower entry points, rotogravure presses are complex machines with multiple printing stations, engraving cylinders, and drying systems. Each component contributes to the hefty price tag, which can easily reach millions depending on the press's capabilities. This financial barrier effectively limits the market to established businesses with the capital to invest or those handling high-volume printing jobs where the press's efficiency pays off over time. The high upfront cost also discourages experimentation with new applications, potentially hindering the exploration of rotogravure's full potential in niche markets. While used presses offer a more affordable option, they come with the risk of breakdowns and limitations on features. This situation creates a cycle where smaller businesses are shut out, limiting market growth and innovation.

Market Opportunities:

The Rotogravure Printing Inks market possesses exciting opportunities despite the challenges. Firstly, the growing demand for high-quality packaging, particularly in the Asia-Pacific region, fuels the need for rotogravure inks. These inks deliver exceptional visual appeal, vibrant colors, and detailed graphics, perfect for capturing consumer attention on store shelves. Secondly, advancements in ink technology are opening doors. Eco-friendly, water-based, and UV-cured inks are gaining traction, addressing environmental concerns and expanding the range of suitable substrates. Thirdly, a focus on specialty applications like security printing and functional inks with anti-counterfeiting or tamper-evident properties presents a niche market with high-profit margins. Furthermore, rotogravure's ability to handle high-volume printing efficiently positions it well for the growing market for customized and personalized packaging. Finally, the development of faster and more cost-effective rotogravure cylinder engraving techniques could entice businesses currently priced out of the technology, potentially leading to market expansion. By capitalizing on these opportunities and addressing the challenges, the Rotogravure Printing Inks market can ensure its continued growth and relevance in the ever-evolving printing landscape.

ROTOGRAVURE PRINTING INKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.52% |

|

Segments Covered |

By Resin Type, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Flint Group, DIC Corporation, Toyo Ink SC Holdings, Sakata Inx Corporation, Siegwerk Druckfarben, PPG Industries, BASF SE,hubergroup GmbH, Teijin Limited, Kansai Paint |

Rotogravure Printing Inks Market Segmentation - By Resin Type

-

Nitrocellulose

-

Polyamide

-

Polyurethane

-

Acrylic

While nitrocellulose currently holds the dominant position in the rotogravure printing ink market, there's a misconception that acrylic resins reign supreme. In reality, nitrocellulose remains the most widely used resin type due to its versatility, affordability, and ability to deliver good printing performance. However, the market is witnessing a shift with polyamides and polyurethanes gaining traction. Polyamides offer superior chemical resistance and durability, while polyurethanes boast excellent flexibility and high-gloss finishes. These advancements cater to the evolving needs of the industry, particularly for demanding applications and specialty packaging. While acrylic resins do have a presence, their market share is smaller compared to nitrocellulose.

Rotogravure Printing Inks Market Segmentation - By Technology

-

Solvent-Based

-

Water-Based

-

UV-Curable

-

Electron Beam Curable

The most dominant curing technology in the Rotogravure Printing Inks Market is currently Solvent-Based inks. These inks offer several advantages including fast drying times, vibrant colors, and good adhesion to various substrates. However, their dominance is facing challenges due to environmental regulations on solvent emissions. As a result, the market is witnessing a shift towards more eco-friendly alternatives like Water-Based inks. While water-based inks offer lower environmental impact, they can sometimes lack the print quality and speed of solvent-based inks. UV-Curable and Electron Beam Curable inks are also gaining traction due to their fast curing times and high durability, but their adoption is currently limited by higher costs and specific curing equipment requirement

Rotogravure Printing Inks Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

While all regions contribute to the Rotogravure Printing Inks market, the Asia-Pacific (APAC) currently holds the dominant position. This is driven by several factors. Firstly, the booming economies and surging populations in this region led to a significant increase in demand for packaged goods. Rotogravure printing inks excel at creating high-quality, visually attractive packaging that grabs attention on store shelves. Secondly, stricter environmental regulations in developed regions like Europe push manufacturers towards eco-friendly printing solutions, which aligns well with the advancements in water-based and UV-cured rotogravure inks being developed in the APAC region. Finally, the presence of established printing industries and a growing middle class with rising disposable income further fuels the demand for rotogravure printed goods in the APAC region, solidifying its dominance in the global market.

COVID-19 Impact Analysis on the Global Rotogravure Printing Inks Market

The COVID-19 pandemic delivered a significant blow to the Global Rotogravure Printing Inks Market. Lockdowns and economic downturns led to a decline in demand for various consumer goods, heavily impacting industries that rely on rotogravure printing for packaging, such as food and beverage, apparel, and luxury goods. Production slowdowns and supply chain disruptions further hampered the market. Additionally, with a shift towards e-commerce and a focus on essential goods, demand for traditionally rotogravure-printed items like magazines and catalogs plummeted. However, the market showed signs of resilience. The rise in online shopping fueled the need for attractive packaging, creating a niche for rotogravure inks in high-quality flexible packaging for e-commerce products. Moreover, the growing demand for essential goods like food and hygiene products, which often utilize rotogravure printing for packaging, provided some stability to the market. As economies recover and consumer spending rebounds, the rotogravure printing ink market is expected to experience a gradual upswing, with the potential for long-term growth driven by its advantages in high-volume printing and premium packaging.

Latest trends/Developments

The Rotogravure Printing Inks market is undergoing a fascinating transformation driven by sustainability concerns, technological advancements, and market demands. A key trend is the development of eco-friendly inks. Manufacturers are replacing solvent-based inks with water-based and UV-cured alternatives that significantly reduce Volatile Organic Compounds (VOC) emissions, improving air quality and worker safety. This aligns with stricter environmental regulations and growing consumer preference for sustainable products.

Another exciting development is the convergence of digital and conventional printing techniques. Integration of automation, Artificial Intelligence (AI), and color management systems is streamlining the printing process, minimizing waste, and maximizing production efficiency. Nanotechnology is also making its mark with nanoparticles incorporated into inks to enhance print quality, durability, and resistance to factors like UV light and moisture. This extends the lifespan of printed packaging and promotes sustainable practices by reducing the need for frequent reprinting.

Furthermore, the market is witnessing a growing demand for specialty inks. Security printing with anti-counterfeiting properties caters to the need for brand protection and product authentication in a globalized market. Functional inks with properties like barrier protection or tamper-evident features are also gaining traction, offering unique functionalities for specialized packaging applications. Finally, advancements in cylinder engraving techniques are on the horizon. Faster and more cost-effective engraving processes could entice businesses previously priced out of rotogravure printing, potentially leading to significant market expansion. In conclusion, the Rotogravure Printing Inks market is embracing innovation to address environmental concerns, improve efficiency, and cater to niche market demands, ensuring its continued relevance in the ever-evolving printing landscape.

Key Players:

-

Flint Group

-

DIC Corporation

-

Toyo Ink SC Holdings

-

Sakata Inx Corporation

-

Siegwerk Druckfarben

-

PPG Industries

-

BASF SE

-

hubergroup GmbH

-

Teijin Limited

-

Kansai Paint

Chapter 1. Rotogravure Printing Inks Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Rotogravure Printing Inks Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Rotogravure Printing Inks Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Rotogravure Printing Inks Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Rotogravure Printing Inks Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Rotogravure Printing Inks Market – By Resin Type

6.1 Introduction/Key Findings

6.2 Nitrocellulose

6.3 Polyamide

6.4 Polyurethane

6.5 Acrylic

6.6 Y-O-Y Growth trend Analysis By Resin Type

6.7 Absolute $ Opportunity Analysis By Resin Type, 2024-2030

Chapter 7. Rotogravure Printing Inks Market – By Technology

7.1 Introduction/Key Findings

7.2 Solvent-Based

7.3 Water-Based

7.4 UV-Curable

7.5 Electron Beam Curable

7.6 Y-O-Y Growth trend Analysis By Technology

7.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Rotogravure Printing Inks Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Resin Type

8.1.3 By Technology

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Resin Type

8.2.3 By Technology

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Resin Type

8.3.3 By Technology

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Resin Type

8.4.3 By Technology

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Resin Type

8.5.3 By Technology

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Rotogravure Printing Inks Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Flint Group

9.2 DIC Corporation

9.3 Toyo Ink SC Holdings

9.4 Sakata Inx Corporation

9.5 Siegwerk Druckfarben

9.6 PPG Industries

9.7 BASF SE

9.8 hubergroup GmbH

9.9 Teijin Limited

9.10 Kansai Paint

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Rotogravure Printing Inks Market was valued at USD 4.79 billion in 2023 and will grow at a CAGR of 5.52% from 2024 to 2030. The market is expected to reach USD 6.98 billion by 2030.

Cost-effectiveness for high-volume printing and the versatility of rotogravure printing are the reasons that are driving the market.

Based on technology it is divided into four segments – Solvent-Based, Water-Based, UV-curable, Electron Beam Curable

Asia Pacific is the most dominant region for the Rotogravure Printing Inks Market.

PPG Industries, BASF SE, hubergroup GmbH, Teijin Limited, Kansai Paint