Rotary Indexing Tables Market Size (2024 – 2030)

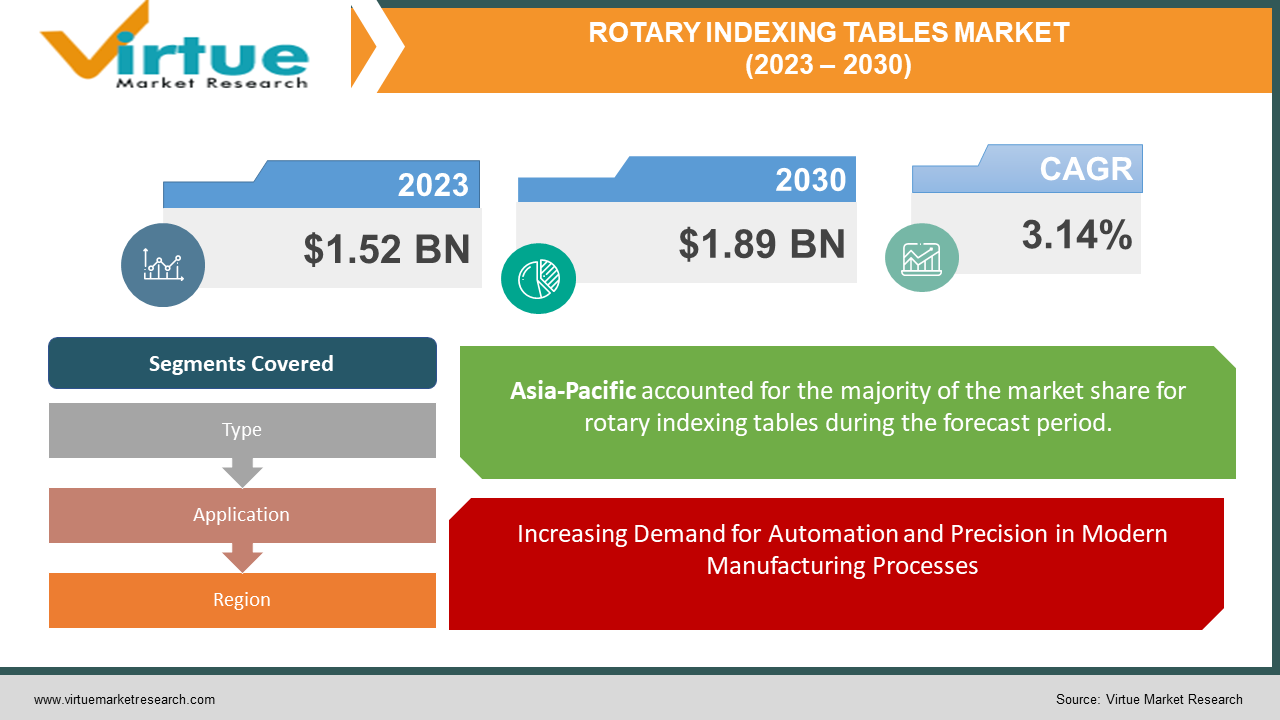

The Global Rotary Indexing Tables Market was valued at USD 1.52 Billion and is projected to reach a market size of USD 1.89 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.14%.

Rotary indexing tables, mechanical devices facilitating precise workpiece rotation for applications demanding accuracy, find widespread use in machining, assembly, welding, inspection, and testing. With horizontal, vertical, and tilting variations, these tables offer increased precision, improved repeatability, and reduced cycle times, thereby enhancing overall productivity. The market is anticipated to grow at a CAGR of 3.14% from 2024 to 2030, fueled by the escalating demand for automation and precision in manufacturing, coupled with the rising popularity of robotics and collaborative robots.

Key Market Insights:

The global surge is primarily propelled by the increasing demand for automation and precision in manufacturing, paralleled by the rising prominence of robotics and collaborative robots (cobots) across industries. In terms of regional dominance, North America emerges as the largest market for rotary indexing tables, closely pursued by Europe and the Asia Pacific. The North American market is anticipated to witness notable growth, with a projected CAGR of 5.2% from 2024 to 2030, driven by a compelling demand for automation solutions within pivotal sectors such as automotive and aerospace. Simultaneously, the European market is forecasted to experience significant growth at a CAGR of 4.8% from 2024 to 2030, buoyed by the widespread integration of Industry 4.0 practices and an increasing emphasis on precision in manufacturing.

Within this competitive market landscape, notable global and regional players, including Rӧhm GmbH, Schunk, AMF Reece, Jergens, and Par-Tech, are pivotal in driving innovation and product development to meet the dynamic needs of customers. The industry is characterized by a constant pursuit of innovation and technological advancements, aligning with the imperative to enhance precision, efficiency, and adaptability in contemporary manufacturing processes. The competitive dynamics are expected to be further shaped by collaborations and strategic partnerships, contributing to the overall growth and dynamism of the rotary indexing tables sector.

Looking ahead, key trends are poised to influence the trajectory of the rotary indexing tables market. The escalating demand for automation and precision in manufacturing is a dominant trend, driven by the critical need for improved productivity, cost reduction, and the production of high-quality products. Moreover, the growing popularity of robotics and collaborative robots (cobots) is exerting a significant impact on the market, with these technologies offering heightened efficiency and reliability in performing repetitive tasks. Rotary indexing tables, playing a pivotal role in providing precise positioning and rotation of workpieces, are well-aligned with the evolving requirements of the manufacturing industry.

Global Rotary Indexing Tables Market Drivers:

Increasing Demand for Automation and Precision in Modern Manufacturing Processes

The manufacturing industry is witnessing a surge in the adoption of automation and precision machining techniques, aiming to enhance productivity, cut costs, and ensure the production of top-quality goods. Rotary indexing tables are pivotal in this trend, providing precise positioning and rotation of workpieces. This not only streamlines manufacturing processes but also addresses the growing need for automation, driving the escalating demand for rotary indexing tables.

The Pervasive Rise of Robotics and Collaborative Robots (Cobots) in Manufacturing.

The popularity of robots and collaborative robots (cobots) is on the rise in manufacturing, thanks to their superior efficiency and reliability in handling repetitive tasks. Rotary indexing tables are increasingly integrated with these robotic systems, offering precise positioning and rotation capabilities. Such integration elevates the efficiency and adaptability of manufacturing processes, underscoring the crucial role of rotary indexing tables in meeting the growing demand fueled by the expanding use of robotics.

The Advent of Industry 4.0 and the Evolution of Rotary Indexing Tables.

The advent of Industry 4.0, marked by the integration of smart technologies in manufacturing, is influencing the evolution of rotary indexing tables. Equipped with sensors and smart features, these tables can communicate seamlessly with other machines and systems on the factory floor. This connectivity enables real-time monitoring, data collection, and predictive maintenance, aligning with the principles of Industry 4.0. As manufacturing environments embrace these advancements, the demand for rotary indexing tables equipped for the future continues to grow.

Surge in Demand for Rotary Indexing Tables in Emerging Markets amid Rapid Industrialization.

Emerging markets, notably China and India, are undergoing rapid industrialization and witnessing a surge in the demand for high-quality manufactured goods. In tandem with this growth, there is an increasing need for automation and precision machining. Rotary indexing tables find themselves in high demand in these regions, as they cater to the rising requirements of efficient manufacturing processes. As manufacturing activities expand in these emerging markets, the adoption of rotary indexing tables becomes integral to meeting the demands of a burgeoning industrial landscape.

Global Rotary Indexing Tables Market Restraints and Challenges:

Navigating the Challenge of High Initial Investment Costs in Rotary Indexing Tables Manufacturing:

Rotary indexing tables, with their intricate mechanical design and reliance on advanced manufacturing techniques, introduce a significant challenge due to the pronounced initial investment costs associated with their production. This financial hurdle can prove particularly formidable for small and medium-sized enterprises (SMEs), necessitating a comprehensive exploration of innovative strategies to achieve cost-effective manufacturing or the development of tailored financing options. Successfully navigating this challenge is paramount for fostering broader accessibility to these precision components in the market.

Managing the Inherent Technical Complexity and Ongoing Maintenance Demands of Rotary Indexing Tables:

The operational intricacies and ongoing maintenance requirements inherent in rotary indexing tables present a multifaceted challenge for manufacturers. This is especially pertinent for those who may lack the requisite technical expertise or familiarity with advanced machining technologies. A proactive approach is imperative, involving the implementation of comprehensive training programs aimed at elevating the technical proficiency of personnel. Additionally, establishing strategic collaborations with service providers becomes crucial to effective maintenance practices, ensuring not only optimal performance but also extending the overall longevity of rotary indexing tables in manufacturing operations.

Global Rotary Indexing Tables Market Opportunities:

Customization and Special Applications for a Distinct Competitive Edge:

The deliberate pursuit of customization and the creation of specialized rotary indexing tables tailored to unique manufacturing processes and applications offer a pathway to establishing a distinct competitive edge. This multifaceted approach involves not only meeting specific product requirements but also seamlessly integrating specialized functionalities, thereby ensuring adaptability to the intricacies of diverse production environments. By prioritizing customization, manufacturers position themselves to cater to the nuanced needs of various industries, fostering heightened client satisfaction, and potentially gaining a commanding position in niche markets where off-the-shelf solutions may fall short.

Strategic Market Expansion into Emerging Territories with Robust Growth Potential:

A forward-looking growth strategy involves the deliberate targeting of emerging markets characterized by burgeoning manufacturing sectors, representing substantial untapped growth potential. This strategic initiative encompasses exploring opportunities in developing regions where there is a palpable and rising demand for automation and precision machining techniques. By methodically expanding into new markets, manufacturers not only diversify their customer base but also position themselves to capitalize on the increasing global appetite for advanced manufacturing solutions. This approach facilitates the establishment of a broader market presence and a resilient market position.

ROTARY INDEXING TABLES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.14% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Rӧhm Gmb, Schunk, AMF Reece, Jergens, Par-Tech, FIBRO GmbH, Kitagawa NorthTech, Sankyo Automation, Motion Index Drives, Weiss North America, DESTACO |

Rotary Indexing Tables Market Segmentation: By Type

-

Horizontal Rotary Indexing Tables

-

Vertical Rotary Indexing Tables

-

Tilting Rotary Indexing Tables

Within the diverse spectrum of the rotary indexing tables market, the predominant segment, characterized by type, is unequivocally the horizontal rotary indexing tables. Renowned for their versatility and widespread applications, horizontal rotary indexing tables play a pivotal role in various industries, providing accurate positioning and movement in a horizontal plane. Their adoption in machining, assembly, and inspection processes solidifies their standing as the largest and most integral segment within the rotary indexing tables market.

Simultaneously, the most rapidly advancing segment in this market is found in tilting rotary indexing tables. The surge in demand for tilting tables underscores an industry trend toward more complex positioning and movement requirements. The adaptability of tilting rotary indexing tables to various angles caters to the evolving needs of manufacturing processes, allowing for enhanced flexibility in applications such as machining, assembly, and specialized positioning tasks. This pronounced growth in the tilting segment reflects the industry's increasing appetite for sophisticated solutions, positioning these tables as indispensable tools in modern manufacturing scenarios.

Rotary Indexing Tables Market Segmentation: By Application

-

Machining

-

Assembly

-

Welding

-

Inspection

-

Testing

In the dynamic landscape of the rotary indexing tables market, the largest segment, as delineated by application, is undeniably within the realm of machining. The application of rotary indexing tables in machining processes plays a pivotal role, providing precise positioning and movement for workpieces during various machining operations. This widespread adoption underscores the critical importance of these tables in enhancing efficiency and precision within the machining sector, making them integral components in modern manufacturing.

Simultaneously, the fastest-growing segment in the rotary indexing tables market is found in inspection applications. As industries increasingly prioritize quality control and adherence to stringent inspection standards, the demand for rotary indexing tables in inspection processes has surged. These tables facilitate meticulous examination and measurement of workpieces, contributing to heightened accuracy and reliability in inspection procedures. The rapid growth of the inspection segment reflects a broader industry trend towards ensuring product quality and compliance, positioning rotary indexing tables as essential tools in advancing inspection capabilities across diverse sectors.

Rotary Indexing Tables Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In the expansive landscape of the rotary indexing tables market, the preeminent segment delineated by region is unequivocally North America. This region has emerged as the largest consumer and adopter of rotary indexing tables, with a robust presence of industries leveraging these precision tools in manufacturing, machining, and assembly applications. The advanced technological infrastructure and a strong emphasis on automation in North American industries contribute to the dominance of this region in the rotary indexing tables market.

Concurrently, the fastest-growing segment in the rotary indexing tables market is observed in Asia-Pacific. This dynamic region, encompassing burgeoning industrial economies such as China and India, has witnessed a significant surge in demand for advanced manufacturing solutions. The rapid industrialization, coupled with a growing emphasis on automation and precision machining, propels the adoption of rotary indexing tables. The Asia-Pacific segment's accelerated growth underscores the region's pivotal role in the global manufacturing landscape, reflecting a compelling shift in manufacturing activities towards this dynamic and expansive part of the world.

COVID-19 Impact Analysis on the Global Rotary Indexing Tables Market:

The onset of the COVID-19 pandemic significantly disrupted the global rotary indexing tables market in the short term, primarily driven by supply chain disruptions. Global supply chains experienced substantial challenges, making it arduous for manufacturers to procure necessary components and materials for rotary indexing table production. This disruption led to delays in manufacturing and delivery times, and in certain instances, shortages of rotary indexing table products. Furthermore, reduced demand ensued as manufacturing facilities faced closures or operated at diminished capacities due to various pandemic-related factors, including a decline in global economic activity, disruptions in supply chains, and the enforcement of social distancing measures.

Despite the initial setbacks, the global rotary indexing tables market is poised for recovery and sustained growth in the long term. Several factors contribute to this optimistic outlook, including the escalating demand for automation and precision in manufacturing. The popularity of robotics and collaborative robots (cobots) is on the rise, along with the adoption of Industry 4.0, characterized by the integration of smart technologies for automated and optimized manufacturing processes. Emerging markets play a pivotal role in the recovery, showcasing increased demand for rotary indexing tables. Additionally, there is a growing need for these tables in inspection and testing applications, particularly within the aerospace and medical device industries.

Latest Trends/Developments:

The surge in demand for automation and precision in manufacturing is steering the industry towards the increased integration of automation technologies. Manufacturers are adopting advanced automation solutions to enhance productivity, trim operational costs, and ensure the production of high-quality goods. In this context, the utilization of rotary indexing tables becomes paramount, offering precise positioning and movement critical for automated manufacturing processes. The trend is indicative of a broader shift towards comprehensive automation strategies in the manufacturing sector.

The growing popularity of robotics and collaborative robots (cobots) is reshaping manufacturing landscapes, driven by the efficiency and reliability they bring to repetitive tasks. Rotary indexing tables play a pivotal role in this paradigm, serving as crucial components in conjunction with robots and cobots. Their ability to provide accurate positioning and rotation of workpieces aligns seamlessly with the needs of automated manufacturing processes. This trend signifies an increasing reliance on collaborative efforts between traditional manufacturing tools and cutting-edge robotic technologies.

The adoption of Industry 4.0, denoting the fourth industrial revolution characterized by smart technologies, is influencing the design and functionality of rotary indexing tables. These tables are increasingly equipped with sensors and other smart technologies, allowing them to communicate with diverse machines and systems on the factory floor. This integration not only facilitates automation and optimization but also contributes to improved efficiency and reduced downtime. The Industry 4.0 trend underscores the industry's commitment to embracing intelligent and interconnected manufacturing processes.

Emerging markets, particularly in China and India, are witnessing a substantial uptick in the demand for rotary indexing tables. This surge is attributed to the rapid industrialization of these regions and an increasing appetite for high-quality manufactured goods. As these economies grow, there is a heightened focus on adopting advanced manufacturing solutions to meet evolving industry standards. The trend highlights the pivotal role that emerging markets are playing in shaping the trajectory of the rotary indexing tables market, as they become key contributors to the global demand landscape.

Key Players:

-

Rӧhm GmbH

-

Schunk

-

AMF Reece

-

Jergens

-

Par-Tech

-

FIBRO GmbH

-

Kitagawa NorthTech

-

Sankyo Automation

-

Motion Index Drives

-

Weiss North America

-

DESTACO

Chapter 1. Rotary Indexing Tables Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Rotary Indexing Tables Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Rotary Indexing Tables Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Rotary Indexing Tables Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Rotary Indexing Tables Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Rotary Indexing Tables Market – By Type

6.1 Introduction/Key Findings

6.2 Horizontal Rotary Indexing Tables

6.3 Vertical Rotary Indexing Tables

6.4 Tilting Rotary Indexing Tables

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Rotary Indexing Tables Market – By Application

7.1 Introduction/Key Findings

7.2 Machining

7.3 Assembly

7.4 Welding

7.5 Inspection

7.6 Testing

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Rotary Indexing Tables Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Rotary Indexing Tables Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Rӧhm GmbH

9.2 Schunk

9.3 AMF Reece

9.4 Jergens

9.5 Par-Tech

9.6 FIBRO GmbH

9.7 Kitagawa NorthTech

9.8 Sankyo Automation

9.9 Motion Index Drives

9.10 Weiss North America

9.11 DESTACO

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Rotary Indexing Tables Market was valued at USD 1.52 Billion and is projected to reach a market size of USD 1.89 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.14%.

The key drivers of the global rotary indexing tables market include the increasing demand for automation and precision in manufacturing, the growing popularity of robotics and collaborative robots (cobots), the adoption of Industry 4.0 technologies, and the rising demand for rotary indexing tables in emerging markets.

Rotary indexing tables are integral for precise positioning and controlled movement in machining, assembly, welding, inspection, and testing applications across diverse industries.

North America currently holds dominance in the global rotary indexing tables market, driven by a robust CAGR of 5.2% from 2024 to 2030, particularly fueled by increased automation demands in industries like automotive and aerospace.

Prominent players in the rotary indexing tables market include Rӧhm GmbH, Schunk, AMF Reece, Jergens, Par-Tech, FIBRO GmbH, Kitagawa NorthTech, Sankyo Automation, Motion Index Drives, Weiss North America, and DESTACO.