Rotary Batch Mixer Market Size (2024-2030)

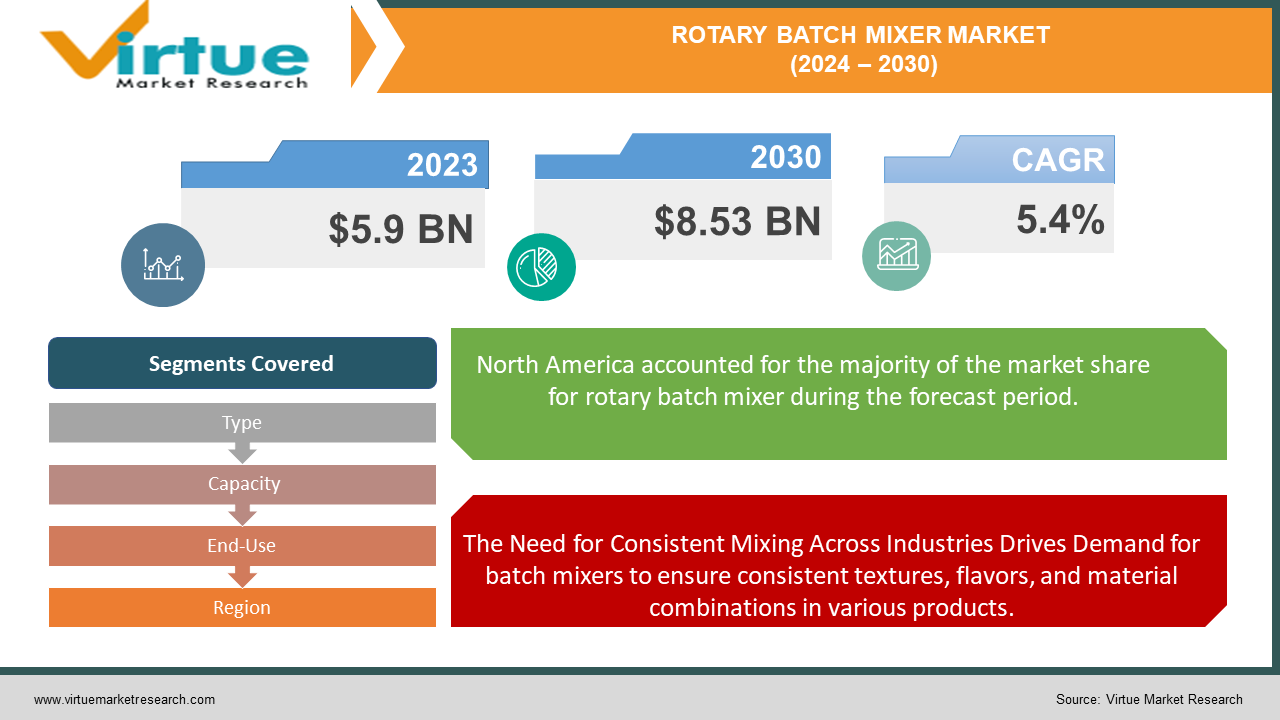

The Rotary Batch Mixer Market was valued at USD 5.9 billion in 2023 and is projected to reach a market size of USD 8.53 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.4%.

The batch mixer and rotary batch mixer market is on a growth trajectory, fueled by the demand for efficient and uniform mixing across various industries. These mixers play a crucial role in ensuring consistent blends of materials for products in food, pharmaceuticals, chemicals, plastics, and more. The market is segmented by mixer type (double cone blenders, ribbon blenders, etc.), capacity, and the specific end-use industry it caters to. The Asia Pacific region is expected to lead the market growth due to rising disposable incomes and increasing demand for processed food.

Key Market Insights:

This market is being shaped by several key trends. Manufacturers are increasingly seeking automation and integration (seamless connection with existing production lines) to boost efficiency. Sustainability is another major focus, with a growing demand for energy-efficient mixer designs that can reduce operational costs in the long run. The future also holds promise for customization, with an anticipated rise in demand for mixers specifically tailored to address the unique needs of different industries and applications.

The Asia Pacific region is expected to be the frontrunner in market growth, driven by factors like rising disposable incomes and an exploding demand for processed food products. This trend highlights the growing importance of this region within the global market.

The Rotary Batch Mixer Market Drivers:

The Need for Consistent Mixing Across Industries Drives Demand for batch mixers to ensure consistent textures, flavors, and material combinations in various products.

The need for efficient and uniform mixing has become a paramount concern across a wide range of industries. From ensuring consistent textures and flavors in processed foods and beverages to achieving precise material combinations in pharmaceuticals, chemicals, and plastics, batch mixers play a critical role. These mixers guarantee consistent product quality by offering a reliable and controlled mixing environment, ensuring that each batch meets the required specifications.

Stricter Regulations Demand Enhanced Quality and Safety, and batch mixers enable manufacturers to meet these requirements by delivering precise and homogenous material blends.

Regulatory bodies are continuously tightening quality and safety standards for manufactured goods. Batch mixers come to the forefront in this scenario as they enable manufacturers to meet these stricter regulations. By providing precise and homogenous blends of materials, batch mixers ensure consistent product quality and minimize the risk of contamination or inconsistencies, ultimately leading to safer products for consumers.

The Booming Processed Food & Beverage Market Demands Efficiency, and batch mixers offer large-scale mixing solutions to meet high-volume production needs.

The global appetite for processed food and beverages is experiencing exponential growth, particularly in developing economies. This surge in demand necessitates efficient and large-scale mixing solutions to meet production requirements. Batch mixers offer a perfect solution for this growing market segment. Their ability to handle large volumes while ensuring consistent mixing makes them ideal for high-volume production of processed foods and beverages, allowing manufacturers to cater to the rising consumer demand.

Manufacturers Prioritize Automation and Integration to streamline production, and batch mixers are evolving to seamlessly connect with existing equipment for increased efficiency.

Manufacturers are increasingly prioritizing automation and integration within their production lines to streamline processes and boost efficiency. In response to this trend, batch mixer designs are evolving to seamlessly connect with existing equipment. This integration allows for smoother production workflows, reduces manual intervention, and minimizes the risk of human error. By enabling automated batch mixing processes, manufacturers can achieve higher production rates and optimize overall efficiency.

The Rotary Batch Mixer Market Restraints and Challenges:

The batch mixer and rotary batch mixer market, despite its growth trajectory, faces some hurdles. A significant challenge is the high initial investment. These mixers, particularly those with advanced features and large capacities, can be quite expensive to acquire and install. This can be a major barrier for smaller companies or those with limited budgets. Additionally, maintaining these mixers requires regular servicing and parts replacement, adding to the operational costs.

Another challenge lies in the limited flexibility some mixers offer. While some models have adjustable capacities, others are designed for specific batch sizes. This inflexibility can be an issue for manufacturers who require production runs with varying volumes. Furthermore, the large footprint of some, especially larger models, can be a challenge for facilities with limited space.

Finally, competition from continuous mixers exists. In specific applications, continuous mixers might offer advantages like faster processing times and potentially lower operational costs. This competition can put pressure on the market share of batch mixers, requiring manufacturers to continuously innovate and differentiate their products.

The Rotary Batch Mixer Market Opportunities:

The batch mixer and rotary batch mixer market isn't just about overcoming challenges, it also brims with exciting opportunities. One key area is the growing demand for customized mixers. As different industries develop specialized needs, manufacturers can offer a wider range of configurations, materials, and capacities to cater to these specific applications. Sustainability is another major theme, with a focus on developing energy-efficient mixer designs. This not only reduces operational costs for manufacturers in the long run, but also caters to the growing demand for eco-friendly solutions. The trend towards automation presents another opportunity. By developing mixers that seamlessly integrate with existing automation systems and Industry 4.0 standards, manufacturers can offer a more comprehensive solution for streamlined production lines. Furthermore, the rise of the processed food and pharmaceutical industries in developing economies is creating a surge in demand for batch mixers. Manufacturers can capitalize on this by expanding their reach into these emerging markets. Finally, providing robust after-sales support, including maintenance programs, readily available spare parts, and technical expertise, can be a key differentiator. By prioritizing customer service and offering comprehensive aftermarket solutions, manufacturers can build stronger relationships with their clients and solidify their position in this ever-evolving market.

ROTARY BATCH MIXER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Type, Capacity, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Munson Machinery Co., Inc., Jongia NV, Gebrüder Lödige Maschinenbau GmbH PROCESS EQUIPMENT Inc., M MISC. Co., Ltd., JWI, Marion Process Solutions, Eirich Maschinenbau GmbH, BHS-Sonthofen GmbH, Romaco Siegling GmbH |

Rotary Batch Mixer Market Segmentation: By Type

-

Double Cone Blenders

-

Ribbon Blenders

-

Tumble Blenders

-

Rotary Batch Mixers

While specific data on dominance might be hard to pinpoint, ribbon blenders are likely a major player in the batch mixer market due to their versatility and effectiveness for dry and semi-dry materials across numerous industries. On the other hand, rotary batch mixers are expected to be the fastest-growing segment. Their ability to handle intensive mixing applications makes them ideal for modern production demands, and their efficiency is likely to drive their rise in popularity.

Rotary Batch Mixer Market Segmentation: By Capacity

-

Up to 500 Liters

-

500 Liters to 1000 Liters

-

Above 1000 Liters

The dominant segment in the Rotary Batch Mixer Market by Capacity is likely the "Above 1000 Liters" sector, catering to large-scale industrial applications. Identifying the fastest-growing segment is more challenging, but it could potentially be the "Up to 500 Liters" sector due to its suitability for small-scale production and R&D applications in industries that are experiencing growth.

Rotary Batch Mixer Market Segmentation: By End-Use

-

Food

-

Pharmaceuticals

-

Chemicals

-

Plastics

-

Cosmetics

The food industry is currently the dominant segment in the batch mixer market due to its extensive use in manufacturing various processed food products. However, the Asia Pacific region is anticipated to be the fastest-growing segment driven by increasing disposable incomes and a surging demand for processed food products.

Rotary Batch Mixer Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America region boasts a well-established manufacturing base and a strong focus on technological advancements. The presence of leading mixer manufacturers and a high demand for efficient mixing solutions in sectors like food, pharmaceuticals, and chemicals contribute to its significant market share. However, stringent regulations and increasing automation might lead to a shift towards more advanced mixer designs.

Europe is another prominent player in the batch mixer market, characterized by a mature industrial sector and a growing emphasis on energy-efficient solutions. The demand for high-quality mixers in the pharmaceutical and chemical industries is particularly strong in this region. However, intense competition and potential economic fluctuations could pose challenges for sustained growth.

Asia-Pacific region is expected to be the fastest-growing market for batch mixers. The burgeoning processed food and beverage industries in developing economies like China and India are driving the demand for efficient mixing solutions. Additionally, rising disposable incomes and increasing urbanization are fuelling market growth. However, concerns about product quality and safety standards in some emerging economies might require manufacturers to adapt their offerings.

COVID-19 Impact Analysis on the Rotary Batch Mixer Market:

The COVID-19 pandemic's impact on the batch mixer market was a double-edged sword. Initial disruptions arose due to lockdowns and travel restrictions. These limitations caused delays in obtaining raw materials and finished mixers, impacting production and delivery schedules. Additionally, a decline in demand emerged from sectors like food service and hospitality as lockdowns and restaurant closures reduced their needs.

However, the pandemic also triggered positive long-term trends. A surge in demand for processed food and beverages as people stocked up on essentials led to a rise in demand for mixers used in food production. Furthermore, the heightened focus on hygiene during the pandemic increased the need for batch mixers in the pharmaceutical and healthcare sectors to produce sanitizers, disinfectants, and other hygiene products. The e-commerce boom for food and other goods also potentially boosted the demand for mixers across various industries as manufacturers scrambled to meet online order demands with efficient production lines.

Latest Trends/ Developments:

The batch mixer market is constantly innovating to meet evolving industry demands. A key trend is the rise of "smart mixers" equipped with sensors, monitoring, and even connectivity features. This allows for real-time control, data collection for optimization, and remote control, aligning with Industry 4.0 standards for improved efficiency. Sustainability is another major focus, with manufacturers developing energy-efficient designs through lighter materials, optimized processes, and features like variable-speed drives to minimize energy consumption. Additionally, customization is on the rise to meet specific needs. A wider range of configurations, materials, and capacities are being offered to ensure optimal mixing performance for each application. Advanced materials and coatings are another area of development, with a focus on wear resistance for abrasive materials, food-grade materials for safe food production, and even antimicrobial coatings for better hygiene. Finally, manufacturers are recognizing the importance of strong after-sales support, offering preventative maintenance programs, readily available spare parts, and technical expertise to keep their customers' equipment running smoothly and minimize downtime. By embracing these trends, batch mixer manufacturers are well-positioned to cater to the ever-changing needs of various industries and ensure the continued growth of this market.

Key Players:

-

Munson Machinery Co., Inc.

-

Jongia NV

-

Gebrüder Lödige Maschinenbau GmbH

-

PROCESS EQUIPMENT Inc.

-

M MISC. Co., Ltd.

-

JWI

-

Marion Process Solutions

-

Eirich Maschinenbau GmbH

-

BHS-Sonthofen GmbH

-

Romaco Siegling GmbH

Chapter 1. Rotary Batch Mixer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Rotary Batch Mixer Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Rotary Batch Mixer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Rotary Batch Mixer Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Rotary Batch Mixer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Rotary Batch Mixer Market – By Type

6.1 Introduction/Key Findings

6.2 Double Cone Blenders

6.3 Ribbon Blenders

6.4 Tumble Blenders

6.5 Rotary Batch Mixers

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Rotary Batch Mixer Market – By Capacity

7.1 Introduction/Key Findings

7.2 Up to 500 Liters

7.3 500 Liters to 1000 Liters

7.4 Above 1000 Liters

7.5 Y-O-Y Growth trend Analysis By Capacity

7.6 Absolute $ Opportunity Analysis By Capacity, 2024-2030

Chapter 8. Rotary Batch Mixer Market – By End-Use

8.1 Introduction/Key Findings

8.2 Food

8.3 Pharmaceuticals

8.4 Chemicals

8.5 Plastics

8.6 Cosmetics

8.7 Y-O-Y Growth trend Analysis By End-Use

8.8 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 9. Rotary Batch Mixer Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Capacity

9.1.4 By By End-Use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Capacity

9.2.4 By End-Use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Capacity

9.3.4 By End-Use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Capacity

9.4.4 By End-Use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Capacity

9.5.4 By End-Use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Rotary Batch Mixer Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Munson Machinery Co., Inc.

10.2 Jongia NV

10.3 Gebrüder Lödige Maschinenbau GmbH

10.4 PROCESS EQUIPMENT Inc.

10.5 M MISC. Co., Ltd.

10.6 JWI

10.7 Marion Process Solutions

10.8 Eirich Maschinenbau GmbH

10.9 BHS-Sonthofen GmbH

10.10 Romaco Siegling GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Rotary Batch Mixer Market was valued at USD 5.9 billion in 2023 and is projected to reach a market size of USD 8.53 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.4%.

Surging Demand for Uniform Mixing Across Diverse Industries, Stringent Regulations Pushing for Enhanced Product Quality and Safety, Exponential Growth of the Processed Food & Beverage Market, Focus on Automation, and Integration for Increased Efficiency.

Double Cone Blenders, Ribbon Blenders, Tumble Blenders, Rotary Batch Mixers.

North America is the most dominant region for the Rotary Batch Mixer Market due to its well-established manufacturing base and strong focus on technological advancements.

Munson Machinery Co., Inc., Jongia NV, Gebrüder Lödige Maschinenbau GmbH, PROCESS EQUIPMENT Inc., M MISC. Co., Ltd., JWI, Marion Process Solutions, Eirich Maschinenbau GmbH, BHS-Sonthofen GmbH, Romaco Siegling GmbH.