Roselle Market Size (2025 – 2030)

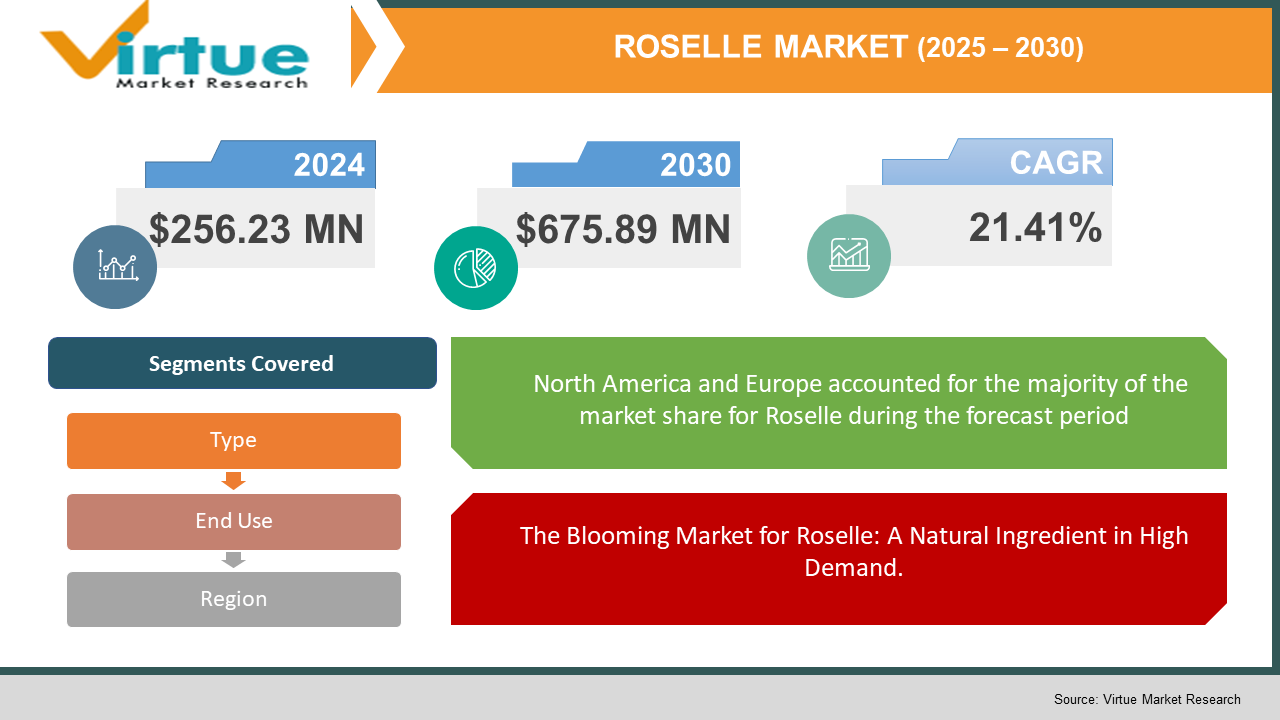

The Roselle Market was valued at USD 256.23 million and is projected to reach a market size of USD 675.89 million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 21.41%.

Roselle is extracted from a flower and is a crop which is used in various products such as food, nutraceuticals, animal feed, etc. It is also known as hibiscus sabdafirra. It also has benefits in making syrup, cake, ice cream and other dairy products. There are two main forms in which Roselle is available, and those are powder and liquid. Because of its properties, it is also considered a key raw material input in organic products and cosmetics. There is a growing trend in the market which has seen people switch to more organic and plant-based products, which has meant that the roselle market is poised to see a great increase in demand.

Key Market Insights:

- Roselle extracts are becoming more and more in demand in the pharmaceutical and nutraceutical industries. The plant's inherent bioactive components make it a useful supplement component that addresses digestion, weight loss, and heart health. Furthermore, because of its anti-ageing and skin-brightening qualities, roselle is increasingly being used in skincare and cosmetics.

- A key market driver is the growing preference for herbal and functional beverages. Roselle-based teas and drinks are gaining popularity due to their potential health benefits, including anti-hypertensive, antioxidant, and anti-inflammatory properties. The shift towards caffeine-free and organic alternatives in the beverage industry is expected to further propel roselle consumption, leading to increased cultivation in regions like Africa, Southeast Asia, and Latin America.

- The roselle market is also being shaped by developments in product development and technological breakthroughs. Businesses are investigating new uses for plant-based colourants, fermented goods, and energy drinks with roselle infusions for the food and beverage sector. Furthermore, partnerships between food processors and agricultural cooperatives are enhancing supply chain effectiveness and guaranteeing product quality.

- In the cosmetic and personal care industry, roselle’s rich vitamin C and antioxidant content make it a valuable ingredient in skincare and haircare formulations. Its ability to promote collagen production, reduce pigmentation, and combat oxidative stress has led to its inclusion in serums, masks, and anti-ageing creams.

- AI-powered precision agriculture techniques are helping farmers optimize roselle cultivation. Machine learning models analyse weather patterns, soil health, and pest risks, enabling data-driven decisions on irrigation, fertilization, and harvesting.

Roselle Market Drivers:

The Blooming Market for Roselle: A Natural Ingredient in High Demand.

As consumers increasingly prioritize health, wellness, and sustainability, Roselle’s natural properties make it an attractive ingredient for a variety of functional and high-value products. Roselle is gaining prominence in the nutraceutical sector due to its rich composition of antioxidants, vitamins, and bioactive compounds. It is widely recognized for its antihypertensive, cholesterol-lowering, and digestive health benefits. With the increasing global focus on natural remedies and preventive healthcare, Roselle extracts are being incorporated into dietary supplements, herbal teas, and functional foods. Consumers looking for plant-based alternatives to synthetic supplements are driving demand for Roselle-based capsules, powders, and wellness drinks. Also, as consumers shift towards eco-friendly and organic products, Roselle’s naturally derived compounds make it an ideal choice for sustainable formulations. Organic and cruelty-free brands are integrating Roselle extracts into haircare, body care, and aromatherapy products, leveraging its soothing, hydrating, and antioxidant properties. The rapid expansion of Roselle’s applications across industries is expected to drive significant market growth in the coming years. Innovations in Roselle-based probiotic drinks, natural food colourants, and cosmeceutical formulations are likely to further increase demand. Moreover, companies are investing in sustainable sourcing and organic certification to cater to the growing eco-conscious consumer base.

As disposable income for consumers has risen sharply, there has been growing interest in the products that use roselle as raw material or as a main input; rising incomes have opened up new markets for consumers.

Increased income levels enable people to spend more on organic items, personal care, and well-being, all of which complement Roselle's advantages. This change in purchasing power has broadened customer demographics and opened up new markets, especially in areas where plant-based, herbal, and functional items are becoming more popular. As disposable incomes rise in developing nations, especially in Asia, Latin America, and Africa, consumers in these regions are gaining access to higher-end herbal, wellness, and organic products that were previously limited to premium markets. The expansion of global e-commerce platforms, international trade, and improved distribution networks has allowed Roselle-based products to penetrate new consumer segments. The growing middle class in countries such as India, China, Brazil, and Indonesia is becoming a key driver for market expansion, as these populations increasingly adopt natural and holistic health products.

Roselle Market Restraints and Challenges:

Supply chains in the Roselle Market are very fragmented, with small farmers still supplying the bulk of the product. There are also regulatory hurdles in some countries.

The Roselle market's supply chain remains highly fragmented, with small-scale farmers accounting for the majority of global production. Countries like Sudan, Nigeria, Thailand, and India are among the leading producers, but most cultivation is done on small farms with limited access to modern agricultural technology, financial support, and efficient logistics. This fragmentation leads to inconsistencies in quality, supply fluctuations, and post-harvest losses. Compounding these supply chain challenges are regulatory hurdles in various countries. Many importing regions, such as the European Union and North America, have strict food safety and organic certification standards that small-scale farmers and suppliers struggle to meet. Compliance with pesticide residue limits, fair-trade practices, and labelling regulations can be costly and time-consuming, making it difficult for farmers to access lucrative international markets.

Roselle Market Opportunities:

Sustainability is becoming a major factor in consumer choices, and AI-driven blockchain solutions are enhancing traceability in the roselle supply chain. AI-powered tracking systems can verify the ethical sourcing of roselle, ensuring fair trade practices and reducing fraud in organic certification. Moreover, AI-driven carbon footprint analysis helps companies measure and reduce their environmental impact, making the roselle industry more sustainable.

ROSELLE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

21.41% |

|

Segments Covered |

By Type, END USE, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Roselle Farms, Guangzhou Runming Tea Co., Ltd, Thai Organic Life, Cultivator Natural Products Pvt. Ltd, Atlantis Arena Sdn Bhd, Rossell India Ltd, Fraser and Neave, Ltd, Buddha Teas, The Tao of Tea LLC, Green Oasis Resources |

Roselle Market Segmentation:

Roselle Market Segmentation: By Type:

- Liquid

- Powder

Liquid Roselle primarily includes herbal extracts, concentrates, and ready-to-drink beverages, such as hibiscus teas, syrups, and wellness shots. It is widely used in the functional beverage, nutraceutical, and cosmetic industries due to its rich antioxidant content and easy incorporation into liquid formulations. On the other hand, Roselle powder is gaining popularity in the food, nutraceutical, and skincare sectors as a versatile and concentrated ingredient. It is used in dietary supplements, superfood blends, natural food colourants, and face masks, offering a longer shelf life and convenient usage.

Roselle Market Segmentation: By End Use:

- Pharmaceuticals

- Nutraceuticals

- Cosmetics

- Food and Beverages

Because of its antihypertensive, antibacterial, and cholesterol-lowering properties, Roselle is becoming more and more popular in the pharmaceutical sector. As a result, it is a crucial component of herbal medications, therapeutic formulations, and functional health supplements. Its bioactive substances, especially flavonoids and polyphenols, are being investigated for their possible use in immunological support, heart health, and diabetes management, opening up new avenues for pharmaceutical applications.

In the nutraceutical and cosmetic industries, Roselle is widely used for its skin-brightening, anti-ageing, and collagen-boosting benefits, making it a sought-after ingredient in serums, face masks, herbal skincare products, and dietary supplements. With the growing demand for plant-based and natural beauty solutions, Roselle extracts are increasingly incorporated into organic and clean-label cosmetics. Meanwhile, in the food and beverage sector, Roselle’s distinct tart flavour and vibrant red colour make it a popular ingredient in herbal teas, flavoured beverages, jams, sauces, and confectionery products.

Roselle Market Segmentation: By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

In North America and Europe, the demand for organic, functional, and plant-based products has fueled significant growth in Roselle-based beverages, nutraceuticals, and cosmetics. The rising popularity of herbal teas, clean-label skincare, and dietary supplements has positioned these regions as key consumers of high-quality Roselle extracts and powders. Additionally, stringent food safety and organic certification standards have encouraged investments in sustainable and fair-trade sourcing from developing regions. Europe, in particular, has seen an increase in hibiscus-infused gourmet teas and botanical beverages, while North America has embraced functional foods and wellness products containing Roselle.

In Asia Pacific, South America, and the Middle East & Africa, the market is driven by both traditional uses and emerging commercial applications. Asia Pacific, led by India, China, and Thailand, is a major producer and consumer of Roselle, with its widespread use in herbal medicine, functional foods, and beauty products. In South America, demand is growing for natural food colourants and plant-based supplements, while the Middle East and Africa continue to be key regions for Roselle cultivation, especially in Sudan and Nigeria, where it is a staple ingredient in traditional drinks and medicinal remedies.

COVID-19 Impact Analysis on the Roselle Market:

The COVID-19 pandemic affected supply and demand dynamics in different regions, which had a varied effect on the Roselle market. The pandemic increased consumer interest in natural, functional, and immune-boosting foods, which helped the Roselle market from a demand standpoint. Sales of hibiscus tea, health beverages, and wellness products grew as a result of Roselle's rise in popularity in the nutraceutical and herbal supplement industries due to its high vitamin C and antioxidant content. Demand for Roselle in dietary supplements and conventional medications was further stimulated by the increased focus on plant-based therapies and preventive healthcare. However, the supply chain faced disruptions, particularly in Roselle-producing countries such as Sudan, Nigeria, India, and Thailand, where small-scale farmers supply the majority of the crop. Travel restrictions, labour shortages, and logistical bottlenecks impacted harvesting, processing, and exports, leading to delays in shipments and price fluctuations.

Trends/Developments:

As a significant player in the Roselle market, Rossell India Ltd has diversified its product offerings to include Roselle-based products. Their expansion into this segment aligns with the growing consumer demand for natural and health-promoting ingredients.

The Tao of Tea LLC Specializing in artisanal teas, The Tao of Tea LLC has incorporated Roselle into its product lineup, offering consumers unique flavour experiences. Their focus on traditional processing methods and authentic taste profiles has distinguished them in the speciality tea market.

Researchers in the pharmaceutical and medical domains are becoming more interested in Roselle's possible therapeutic benefits. Research on its cholesterol-lowering, antibacterial, and anti-inflammatory properties is opening the door for medications and therapeutic formulations based on roselle. There is growing interest in Roselle's possible application in the treatment of lifestyle disorders like diabetes and hypertension.

Key Players:

- Roselle Farms

- Guangzhou Runming Tea Co., Ltd

- Thai Organic Life

- Cultivator Natural Products Pvt. Ltd

- Atlantis Arena Sdn Bhd

- Rossell India Ltd

- Fraser and Neave, Ltd

- Buddha Teas

- The Tao of Tea LLC

- Green Oasis Resources

Chapter 1. ROSELLE MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ROSELLE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. ROSELLE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. ROSELLE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. ROSELLE MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ROSELLE MARKET – By Type

6.1 Introduction/Key Findings

6.2 Liquid

6.3 Powder

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. ROSELLE MARKET – By End Use

7.1 Introduction/Key Findings

7.2 Pharmaceuticals

7.3 Nutraceuticals

7.4 Cosmetics

7.5 Food and Beverages

7.6 Y-O-Y Growth trend Analysis By End Use

7.7 Absolute $ Opportunity Analysis By End Use , 2025-2030

Chapter 8. ROSELLE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End Use

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By End Use

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By End Use

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By End Use

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By End Use

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. ROSELLE MARKET– Company Profiles – (Overview, Packaging Type Portfolio, Financials, Strategies & Developments)

9.1 Roselle Farms

9.2 Guangzhou Runming Tea Co., Ltd

9.3 Thai Organic Life

9.4 Cultivator Natural Products Pvt. Ltd

9.5 Atlantis Arena Sdn Bhd

9.6 Rossell India Ltd

9.7 Fraser and Neave, Ltd

9.8 Buddha Teas

9.9 The Tao of Tea LLC

9.10 Green Oasis Resources

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Roselle (Hibiscus sabdariffa) is a plant used in various industries, including food & beverages, pharmaceuticals, nutraceuticals, and cosmetics. It is commonly consumed as hibiscus tea, used as a natural food colourant, and incorporated into skincare and dietary supplements due to its rich antioxidant and vitamin C content.

The market is growing due to the increasing demand for herbal and functional beverages, organic and natural cosmetics, plant-based supplements, and sustainable products. Additionally, rising disposable incomes and awareness of Roselle’s health benefits, such as heart health and immunity support, are fueling demand.

The Asia Pacific, Africa, North America, and Europe are key regions in the Roselle market. Sudan, Nigeria, Thailand, and India are major producers, while North America and Europe lead in consumption due to the rising trend of herbal teas, nutraceuticals, and clean-label skincare products.

The market faces challenges such as fragmented supply chains, reliance on small-scale farmers, regulatory hurdles, price fluctuations, and inconsistent quality control. Strict organic certification and food safety regulations in some regions also pose barriers to market entry.

AI-powered precision farming, blockchain for supply chain transparency, and advanced extraction techniques are helping improve cultivation, processing efficiency, and product quality. Additionally, e-commerce enables direct-to-consumer sales, expanding market reach.