Robotics as a Service Market Size (2023 – 2030)

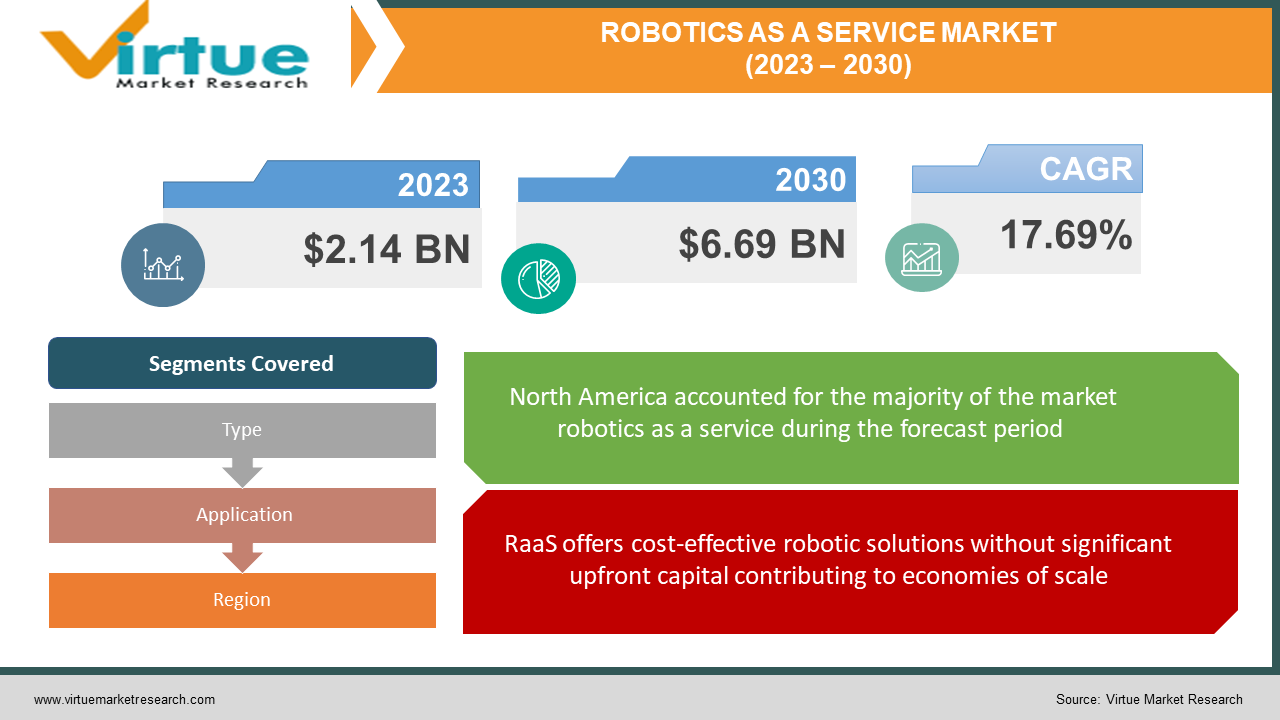

The Global Robotics as a Service (RaaS) Market is valued at USD 2.14 billion in 2023 and is projected to reach a market size of USD 6.69 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 17.69%.

The Robotics as a Service (RaaS) industry has undergone a significant transformation over time, with a growing demand for automation and robotics across diverse sectors. Initially, it was a niche market, primarily catering to specialized industrial applications. However, as technology advanced and businesses sought cost-effective and flexible automation solutions, the RaaS landscape expanded. Today, it encompasses a wide range of industries, including manufacturing, healthcare, logistics, and more. Looking ahead, the RaaS market is poised for continued growth, driven by innovations like AI integration and collaborative robots, offering industries newfound efficiency and adaptability in an increasingly automated world.

Key Market Insights:

Initially centered on specialized industrial applications, the RaaS landscape has diversified significantly. Manufacturing leads the way, with robots deployed in tasks like assembly and quality control. However, healthcare is also a major player, using robots in surgery and patient care. Geographically, North America held the largest market share in 2022, thanks to high adoption rates in manufacturing and healthcare, while Asia-Pacific is expected to witness the fastest growth, especially in countries like China and Japan.

The RaaS market is witnessing transformative trends. Customized robotic solutions tailored to specific industries are on the rise. Integration of artificial intelligence (AI) and machine learning in RaaS robots is becoming prevalent, enhancing adaptability. Collaborative robots (cobots) that can work alongside humans are gaining traction, providing flexibility. The market's expansion beyond traditional sectors is exemplified by robot bartenders and automated farming, showcasing the versatility of RaaS solutions.

These insights illustrate the RaaS market's rapid expansion, driven by technological advancements, diversified industry applications, and the increasing adoption of automation across the globe.

Robotics as a Service Market Drivers:

RaaS offers cost-effective robotic solutions without significant upfront capital contributing to economies of scale.

Robotics as a Service (RaaS) is revolutionizing industries by offering cost-effective robotic solutions without requiring substantial upfront capital investments. This financial flexibility is a game-changer, especially for small and medium-sized enterprises (SMEs), as it allows them to access cutting-edge robotics technology without the burden of heavy initial expenditures. This affordability contributes to economies of scale, enabling a broader range of businesses to embrace automation and enhance their competitiveness in the market.

The subscription-based model allows businesses to scale their robotic deployments providing flexibility in adapting to changing market conditions.

The subscription-based RaaS model is a boon for businesses seeking scalability and adaptability in their robotic deployments. Unlike traditional robot procurement, RaaS allows companies to easily adjust the number and type of robots they utilize to meet evolving market demands. This flexibility enables businesses to efficiently respond to changing production needs, ensuring that their operations remain agile and responsive to market conditions.

Robots improve operational efficiency leading to reduced errors and increased productivity therefore increasing the demand.

Robots, a core component of RaaS, are proven to enhance operational efficiency. Their precision, consistency, and ability to perform repetitive tasks tirelessly result in reduced errors and increased productivity. This operational excellence not only leads to cost savings but also drives up demand for RaaS as businesses recognize the tangible benefits of improved efficiency in terms of both quality and quantity of output.

Robotics as a Service Market Opportunities:

Healthcare Expansion presents significant growth opportunities for RaaS.

The healthcare sector presents a fertile ground for Robotics as a Service (RaaS) to flourish. With increasing demands for precision and efficiency in medical procedures and patient care, RaaS offers advanced robotic solutions. These robots can assist in surgeries, manage patient logistics, and even conduct diagnostics, all of which contribute to improved healthcare outcomes. As the healthcare industry continues to embrace automation to enhance patient care, RaaS providers have a substantial opportunity to cater to this evolving demand, potentially revolutionizing healthcare delivery and patient experiences.

Construction Automation tasks are creating a promising avenue for RaaS providers.

The construction industry is undergoing a significant transformation through automation, offering a promising avenue for RaaS providers. Tasks such as bricklaying, site inspection, and even heavy machinery operations are increasingly being performed by robots. RaaS solutions enable construction companies to access and deploy these specialized robots without the burden of large upfront investments. This opens up opportunities for improved construction efficiency, reduced labor costs, and enhanced safety, making RaaS an attractive option for the construction sector.

Global Expansion opportunity for RaaS into emerging markets with growing demand for automation.

The potential for global expansion is a key opportunity for RaaS providers. Emerging markets, characterized by growing economies and industries, exhibit a rising demand for automation solutions. These markets often lack the infrastructure for large-scale capital investments in robotics, making RaaS an appealing alternative. By expanding into these regions, RaaS providers can tap into new customer bases and contribute to the acceleration of automation adoption worldwide. As industries across the globe increasingly seek efficiency and productivity gains, RaaS has the potential to play a pivotal role in fulfilling this demand.

ROBOTICS AS A SERVICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

17.69% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Adaptec Robotics, Aethon Inc., Blue River Technology, Fetch Robotics, Kuka AG, Locus Robotics, Universal Robots, Yaskawa Electric Corporation |

Robotics as a Service Market Segmentation: By Type

-

Professional Service Robots

-

Personal Service Robots

In 2022, Professional Service Robots held the largest market share. These robots are specialized and designed for specific tasks and industries. They are often used in manufacturing, healthcare, logistics, and other sectors where precision, efficiency, and automation are crucial. The demand for professional service robots is driven by their ability to streamline operations, improve productivity, and reduce costs in various industries, making them the dominant segment in terms of market share.

Moreover, the Personal Service Robots are the fastest-growing segment within the RaaS market. These robots are designed to assist individuals in various everyday tasks, such as cleaning, companionship, and entertainment. The rapid growth of personal service robots can be attributed to their increasing adoption in households, healthcare facilities, and even public spaces. As advancements in artificial intelligence (AI) and robotics make personal service robots more capable and user-friendly, they are gaining popularity among consumers and businesses alike, driving their fast-paced growth within the RaaS market.

Robotics as a Service Market Segmentation: By Application

-

Manufacturing

-

Healthcare

-

Logistics

-

Agriculture

-

Construction

-

Hospitality

-

Others

In 2022, Manufacturing stood as the largest segment by application. Manufacturing industries have been at the forefront of adopting automation and robotics to optimize production processes, enhance precision, and improve overall operational efficiency. Robots are extensively used in tasks like assembly, quality control, and material handling within manufacturing facilities, driving the dominance of this segment in terms of market share.

Moreover, the Healthcare segment is the fastest-growing application within the RaaS market. The healthcare industry is increasingly leveraging robotics for various purposes, including surgical assistance, patient care, and logistics within medical facilities. The demand for robotics in healthcare is fueled by the need for higher precision and safety in medical procedures, as well as the potential to address labor shortages in the sector. As healthcare providers recognize the advantages of incorporating robots into their operations, this segment is experiencing rapid growth.

Robotics as a Service Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, North America held the largest market share of about 28.6% among the other regions. This dominance can be attributed to the widespread adoption of robotics and automation across various industries in North America, particularly in the United States and Canada. The region boasts a mature robotics ecosystem, with a strong presence of RaaS providers, manufacturing companies, and healthcare facilities that utilize robots for various applications. Moreover, the Asia-Pacific region is the fastest-growing market for RaaS. Countries such as China and Japan are leading the way in adopting robotics across diverse industries, including manufacturing, healthcare, and logistics. The Asia-Pacific region benefits from a combination of factors, including a rapidly expanding economy, technological advancements, and a growing demand for automation solutions. As these countries continue to invest in robotics and automation, the RaaS market in Asia-Pacific is expected to experience significant growth.

COVID-19 Impact Analysis on the Global Robotics as a Service Market:

The COVID-19 pandemic significantly affected the Global Robotics as a Service (RaaS) Market in various ways. Supply chain disruptions created delays in robot production and deployment as factories and manufacturing facilities faced shutdowns or reduced operations. However, the healthcare sector saw an accelerated adoption of robotics for tasks such as disinfection, remote monitoring, and medical procedures, boosting demand. The logistics and e-commerce sectors also thrived during the pandemic, leading to increased use of robots for order fulfillment and distribution. While some manufacturing industries struggled with disruptions, essential goods manufacturers invested in automation. The pandemic underscored the importance of resilient supply chains, prompting many companies to explore robotics for business continuity. As economies recovered and adapted to the "new normal," demand for automation solutions surged, reinvigorating interest in RaaS as a means to enhance operational efficiency and adapt to changing market conditions in a post-pandemic world.

Latest Trends/Developments:

The field of Robotics as a Service (RaaS) has continued to evolve with remarkable trends and developments. Integration of artificial intelligence (AI) and machine learning into RaaS robots has gained even more momentum, empowering robots to learn and adapt autonomously, leading to increased efficiency and versatility. Collaborative robots, or cobots, have expanded their presence, aiding human workers in various industries, particularly manufacturing, where they enhance productivity and safety.

Furthermore, customization and modular robotics solutions have become increasingly prevalent, allowing businesses to tailor robots to their specific needs and adapt them for different tasks easily. The rollout of 5G technology has facilitated faster and more reliable communication between robots and control systems, opening up new possibilities for remote monitoring and control. Healthcare robotics initially focused on surgical procedures, have diversified into patient care and medication delivery, further enhancing healthcare services. Lastly, sustainability has taken center stage, with the development of eco-friendly robots that reduce energy consumption and utilize recyclable materials, aligning with the growing global emphasis on sustainability and responsible technology adoption.

Key Players:

-

Adaptec Robotics

-

Aethon Inc.

-

Blue River Technology

-

Fetch Robotics

-

Kuka AG

-

Locus Robotics

-

Universal Robots

-

Yaskawa Electric Corporation

In April 2022, Kraken Robotics Inc. announced the successful completion of a $0.5 million Robotics as a Service (RaaS) contract with the Royal Canadian Navy (RCN) for testing Kraken’s ultra-high resolution survey equipment. The RaaS service offered by Kraken provided the RCN with access to cutting-edge technology, high-resolution seabed data, and cost-effective solutions. This successful contract highlighted the potential for RaaS to enhance naval operations and underwater mapping.

Chapter 1. Robotics as a Service Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Robotics as a Service Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Robotics as a Service Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Robotics as a Service Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Robotics as a Service Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Robotics as a Service Market – By Type

6.1 Introduction/Key Findings

6.2 Professional Service Robots

6.3 Personal Service Robots

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis by By Type, 2023-2030

Chapter 7. Robotics as a Service Market – By Application

7.1 Introduction/Key Findings

7.2 Manufacturing

7.3 Healthcare

7.4 Logistics

7.5 Agriculture

7.6 Construction

7.7 Hospitality

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Robotics as a Service Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By APPLICATION

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By APPLICATION

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By APPLICATION

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By APPLICATION

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By APPLICATION

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Robotics as a Service Market – Company Profiles – (Overview, Robotics as a Service Market Portfolio, Financials, Strategies & Developments)

9.1 Adaptec Robotics

9.2 Aethon Inc.

9.3 Blue River Technology

9.4 Fetch Robotics

9.5 Kuka AG

9.6 Locus Robotics

9.7 Universal Robots

9.8 Yaskawa Electric Corporation

Download Sample

Choose License Type

2500

4250

5250

6900