Global Robotics in Additive Manufacturing Market Size (2023 – 2030)

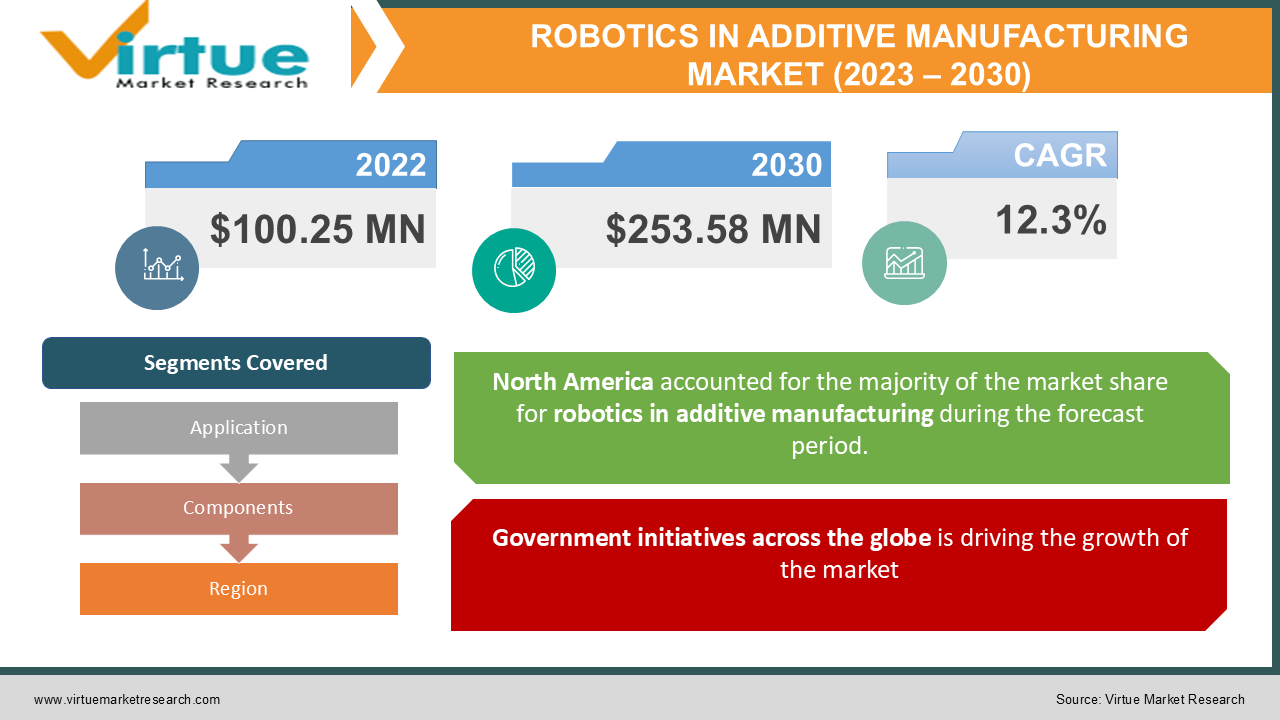

In 2022, the Global Robotics in Additive Manufacturing Market was valued at $100.25 million, and is projected to reach a market size of $253.58 million by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 12.3%. Automation is becoming more prevalent in the electronics industry and Additives are and is majorly driving the growth of the industry.

Industry Overview:

An industrial robotic is a robot machine used for manufacturing. Inadustrial robots are automated, programmable, and capable of movement on three or more axis. Industrial robots are used in more than one industry and application. The elimination of labor-intensive things to do is riding the Industrial robotics market. The expanded demand for robots across various industries is projected as the new technology of industrial robots are cheaper, autonomous, greater mobile, cooperative, and flexible. According to IFR, Worlds Robotics Report 2020, the set up of industrial robots is projected to increase with 584000 installations globally.

With multiplied demand throughout economies, product producers are adopting robots to automate some of the repetitive processes. According to the International Federation of Robotics(IFR), Japan is the world's biggest producer of industrial robots handling over 45% of the international supply.

According to CGTN, China has unveiled its design to end up a global robotics hub by using 2025; China is the usage of medical robots manufactured through Fourier Intelligence, which has exported medical robots throughout 30 international locations and regions. The incredibly superior robots are to be used in major sectors, inclusive of aerospace, mining, automobile, agriculture, and logistics, to fulfill the increasing demand.

Industry 4.0, the most up-to-date industrial revolution, has fueled the improvement of new technologies, like collaborative robots, AI-enabled robots, etc., and has enabled industries to use robots to streamline many processes, make bigger efficiency, and get rid of errors. Increased place of work protection and improved production competencies have in addition driven industries to invest in robotic systems.

According to the facts furnished by using the National Bureau of Statistics, the increase in production extent accelerated from approx. 237000 devices to 363,000 units which is extra than a 50% extend in the year 2021 as compared to 2020.

COVID-19 impact on Robotics in Additive Manufacturing Market:

Furthermore, at some point during the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries have been majorly affected. Manufacturing activities had been halted or restricted. Construction and transportation activities, alongside the furnish chains, had been hampered on a world level. This led to a decline in the manufacturing of industrial robots as properly as their demand in the market, thereby restraining the industrial robotics market growth. Conversely, industries are gradually resuming their ordinary manufacturing and services. This is predicted to re-initiate industrial robotics organizations at their full-scale capacities, which is likely to help the market to recover by the stop of 2021.

MARKET DRIVERS:

Government initiatives across the globe is driving the growth of the market:

The Japanese government has USD 221 million in subsidies as a part of its China exit coverage for Japanese organizations to shift their base to India and different regions. Under its State Guarantee scheme, the authorities of France have extended financial help to assist organizations to overcome their liquidity problems by guaranteeing the repayment of certain eligible loans up to an aggregate quantity of USD 358 billion. Indonesia released two stimulus programs to counter the influence of the COVID-19 pandemic. The first package deal used to be brought in February 2020 totaling US$725 million, and the second package deal was issued in March 2020 totaling US$8 billion. The 2d stimulus package used to be launched to protect the economic system and small- and medium-sized firms (SMEs), especially in the manufacturing sector. To combat the unsafe impact on of COVID-19 on businesses, the Singapore authorities will no longer amplify the items and offerings tax (GST), it will proceed to continue to be at seven percent.

Public-private companies to mitigate the COVID-19 impact is driving the growth of the market:

The Advanced Robotics for Manufacturing (ARM) Institute is a public-private affiliation that strives to improve the competitiveness of manufacturers in the US through collaborations and the improvement of progressive robotics solutions. It is funded by the US Department of Defense. The institute has been referred to for fast and high-impact initiatives in robotics to support the rapid response required for the COVID-19 pandemic. The approved proposals would be funded under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Such stimulating packages inspire companies to strengthen revolutionary solutions. The Government of India has supplied an incentive of Rs 1.45-trillion package by way of extending the production-linked incentive (PLI) scheme to 10 manufacturing sectors with a primary focal point on the vehicle and automobile factors sector.

MARKET RESTRAINTS:

The high cost of Deployment is restraining the growth of the market:

A robotic automation venture can be challenging, mainly for corporations with no prior experience. High capital expenditure is required now not solely for the buy of the robot, but also for integration, programming, and maintenance. In some cases, a custom integration can also be required, which can further pressure up the universal costs. Companies may also not usually have the integral area and infrastructure for the deployment of robots. As SMEs are typically engaged in low-volume production, return on investment (ROI) can be challenging.

ROBOTICS IN ADDITIVE MANUFACTURING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

12.3% |

|

Segments Covered |

By Application, Components, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB (Switzerland), FANUC (Japan), YASKAWA (Japan), KUKA (Germany), Mitsubishi Electric (Japan), Kawasaki Heavy Industries (Japan), Denso Corporation (Japan), NACHI-FUJIKOSHI (Japan), Seiko Epson (Japan), DÜrr (Germany). Apart from these, Rethink Robotics (Germany), Franka Emika (Germany), F&P Robotics (Switzerland) |

This research report on the global Robotics in Additive Manufacturing Market has been segmented and sub-segmented based on application, Components, and region.

Robotics in Additive Manufacturing Market - By Application

-

Automotive

-

Electrical/Electronics

-

Metal/Heavy Machinery

-

Chemical, Rubber, & Plastics

-

Food

-

Others

Based on application, The developing adoption of automation in automotive manufacturing manner and the involvement of AI and digitalization are the primary factors increasing the demand for industrial robots in the care sector.

In the latest automotive industry, the development of robotics science has accelerated to preserve up with the speedy modifications in the automobile industry. A robotics answer simulation and digital commissioning will make use of the most advantages of manufacturing facility automation for OEMs, startups, and suppliers in the present automotive industry.

According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the global income of new cars escalated from 34,321,700 in the first quarter of 2020 to 44,401,850 in the first quarter of 2021. This indicates that the growth in the car industry is hastily increasing.

The rising demand for vehicles is necessitating the want for accelerated production. According to the Alternative Fuel Data Center, United States public and non-public electric automobile (EV) charging infrastructure, the number of EV charging has grown constantly from 106,814 to 128,474 in 2021.

The rising automobile industry in Asia creates widespread possibilities for the world industrial robot market. For instance, China is the world's largest Electric Vehicle market. According to IEA, China recorded total registration of 3.4 million Electric vehicles, which accounted for 51.5% of the international market share.

For instance, Waymo and Jaguar introduced a long-term partnership to develop the world's first top-rate self‑driving electric-powered vehicle.

Robotics in Additive Manufacturing Market - By Components

-

Robotic Arms

-

Robot Accessories

-

End Effectors

-

Controllers

-

Drive Units

-

Vision Systems

-

Sensors

-

Power Supply

-

Others

Based on the Components, the industrial robotics market's component-wise boom fee is predicted to be the best possible for robot accessories such as end-effectors and imaginative and prescient systems. Technological growth has resulted in huge advancements in end-effectors. These traits in end-effectors have been fueled in section with the aid of the need to gain dexterous manipulation in industrial robots for expanded performance, relatively in pick-and-place activities. End-effectors are likely to attain a higher degree of technical complexity in the future as machine studying software and protection aspects are increasingly being merged into the End of Arm Tools (EOAT) themselves, alongside the capacity to adapt to their environment the usage of computing device vision.

Robotics in Additive Manufacturing Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, Association for Advancing Automation (A3), agencies in North America ordered 9,853 robots million in the 2d quarter of 2021, which is an enormous extend in contrast to 2020 with 5,196 sales, main to new job opportunities. Further, according to Robotic Industries Association (RIA), the most imperative driver of the year-to-date extension in industrial robots was an 83% boom in gadgets bought through car OEMs for system automation. Association for Advancing Automation (A3), organizations in North America ordered 9,853 robots million in the second quarter of 2021, which is a vast make bigger in contrast to 2020 with 5,196 sales. According to the Association for Advancing Automation, North America had the most huge sales of 39,708 units, which accounted for USD two billion in 2021, which is 28% extra than in 2020 and 14% greater than their preceding high in 2017. The formation of the “Advanced Manufacturing Partnership (AMP)” is a step undertaken to make the universities and industry. And the federal authorities to invest in growing technologies. This has helped the u. s . acquire a aggressive aspect in the global economy. The robotic density elevated in 2020 from 176 to 255 units 2020 as compared to that of 2017, in accordance with the International Federation of Robotics. Several auto manufacturing firms have invested in new electric power automobile models to beautify the capacity of battery production. Projects like these will power the demand for industrial robots in the coming years.

Robotics in Additive Manufacturing Market - Share by company

Companies like

- ABB (Switzerland)

- FANUC (Japan)

- YASKAWA (Japan)

- KUKA (Germany)

- Mitsubishi Electric (Japan)

- Kawasaki Heavy Industries (Japan)

- Denso Corporation (Japan)

- NACHI-FUJIKOSHI (Japan)

- Seiko Epson (Japan)

- DÜrr (Germany)

Apart from these, Rethink Robotics (Germany), Franka Emika (Germany), F&P Robotics (Switzerland), and others are playing a pivotal role in the market. Recently DHL supply chain invested $15 million in robotic solutions for the supply chain network in the warehouses. Robots help in an easy supply chain network by decreasing long-term costs, increasing productivity, reducing error, and optimizing picking operations.

ABB announced the acquisition of Codian Robotics (Netherlands), a leading provider of delta robots used primarily for high-precision pick and place applications. Codian Robotics' offering includes a hygienic design line, ideal for hygiene-sensitive industries including food and beverage and pharmaceuticals. With the acquisition, ABB is expected to increase its delta robot offerings.

There are various market players which are constantly updating the policies which will enhance the growth of the market.

NOTABLE HAPPENINGS IN THE GLOBAL ROBOTICS IN ADDITIVE MANUFACTURING MARKET IN THE RECENT PAST:

- Product Launch - In Feb 2022, Comau and IUVO are introducing wearable robotics solutions to improve the work efficiency of operators engaged in manually moving loads. The aim is toward well-being by decreasing lower back fatigue.

- Acquisition - In April 2022, Kawasaki Heavy Industries, Ltd. and Sony Group Corporation announced an agreement to establish a new company in order to operate the remote robot platform businesses. The new company will result in the advancement of technological capabilities in building remote robot platforms in which the robots can operate from remote locations primarily.

Chapter 1. Robotics in Additive Manufacturing Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Robotics in Additive Manufacturing Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Robotics in Additive Manufacturing Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Robotics in Additive Manufacturing Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Robotics in Additive Manufacturing Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Robotics in Additive Manufacturing Market – By Application

6.1. Automotive

6.2. Electrical/Electronics

6.3. Metal/Heavy Machinery

6.4. Chemical, Rubber, & Plastics

6.5. Food

6.6. Others

Chapter 7. Robotics in Additive Manufacturing Market – By Components:

7.1. Robotic Arms

7.2. Robot Accessories

7.3. End Effectors

7.4. Controllers

7.5. Drive Units

7.6. Vision Systems

7.7. Sensors

7.8. Power Supply

Chapter 8. Robotics in Additive Manufacturing Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Robotics in Additive Manufacturing Market – key players

9.1. ABB (Switzerland)

9.2. FANUC (Japan)

9.3. YASKAWA (Japan)

9.4. KUKA (Germany)

9.5. Mitsubishi Electric (Japan)

9.6. Kawasaki Heavy Industries (Japan)

9.7. Denso Corporation (Japan)

9.8. NACHI-FUJIKOSHI (Japan)

9.9. Seiko Epson (Japan)

9.10. DÜrr (Germany)

Download Sample

Choose License Type

2500

4250

5250

6900