Robotic Weeding Machines Market Size (2024 – 2030)

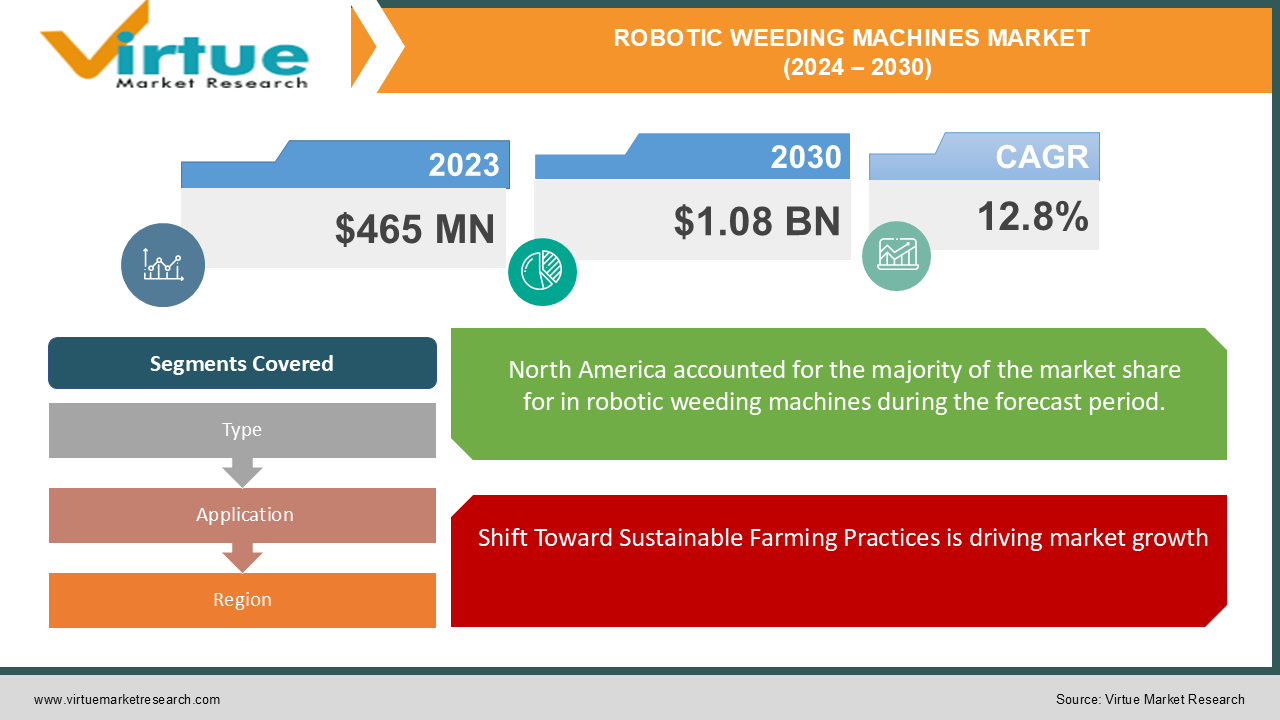

The Global Robotic Weeding Machines Market was valued at USD 465 million in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 12.8% from 2024 to 2030, reaching USD 1.08 billion by 2030.

Robotic weeding machines, also known as autonomous weeders, are technologically advanced agricultural robots designed to eliminate weeds from crops without the need for human intervention. These machines use various technologies such as computer vision, AI, sensors, and GPS to identify and remove weeds accurately, leading to improved crop yield and reduced dependency on chemical herbicides. The increasing focus on sustainable farming practices, labor shortages in agriculture, and advancements in automation are key factors driving the growth of this market.

Key Market Insights

The agriculture sector is facing a significant labor shortage, particularly in developed regions. Robotic weeding machines help mitigate this issue by automating weeding tasks, reducing the need for manual labor, and allowing farmers to manage larger fields with fewer workers. Additionally, the cost of robotics and automation technology has been steadily decreasing, making robotic weeding machines more affordable for a broader range of farmers, including small- and medium-scale agricultural operations.

Governments in various countries are promoting the adoption of sustainable agricultural technologies through subsidies, grants, and tax incentives. These policies are expected to drive the adoption of robotic weeding machines, especially in regions with significant agricultural activity.

The Asia-Pacific region is witnessing increasing adoption of robotic weeding machines due to rapid urbanization, rising food demand, and a shift towards modern farming techniques. Countries like China, India, and Japan are expected to contribute significantly to the growth of the market.

Global Robotic Weeding Machines Market Drivers

Shift Toward Sustainable Farming Practices is driving market growth: With growing concerns over the environmental impact and health hazards associated with chemical herbicides, robotic weeding machines offer a viable alternative by providing a mechanical solution to weed control. This is leading to an increased demand for eco-friendly farming methods. Precision farming techniques are gaining traction worldwide, and robotic weeding machines are a significant part of this trend. They allow farmers to target specific weeds, reducing the overuse of herbicides and promoting environmentally friendly farming practices. The rising awareness of the environmental impact of traditional farming practices, particularly the excessive use of chemical herbicides, is driving the shift toward sustainable agriculture. Farmers are increasingly seeking alternatives that not only protect their crops but also minimize environmental degradation. Robotic weeding machines offer a solution by using mechanical processes to eliminate weeds without relying on chemicals. This reduces soil and water contamination, enhances biodiversity, and helps maintain ecological balance. As more consumers demand organic and eco-friendly food products, farmers are adopting sustainable farming practices, boosting the market for robotic weeding machines.

Labor Shortages in the Agricultural Sector is driving market growth: The agriculture industry, especially in developed countries, is experiencing a significant shortage of labor. The physically demanding nature of farming, combined with the migration of labor to urban areas and other sectors, has created a gap in the workforce. Robotic weeding machines are emerging as a practical solution to address this issue. These machines can operate autonomously, reducing the need for manual labor in the weeding process. By automating this time-consuming task, farmers can increase efficiency, reduce operational costs, and focus labor on more critical tasks. This labor-saving advantage is particularly important for large-scale farming operations.

Advancements in Robotics, AI, and Machine Learning is driving market growth: Advances in machine learning and AI have enhanced the capabilities of robotic weeding machines. These technologies enable the robots to learn and adapt to different field conditions, making them more efficient and reducing the need for manual supervision. Technological advancements in robotics, artificial intelligence (AI), and machine learning have significantly enhanced the functionality of robotic weeding machines. AI-powered vision systems and machine learning algorithms allow these robots to identify and differentiate between crops and weeds with high precision, even in complex field environments. This capability not only improves the accuracy of weed removal but also minimizes damage to crops. Additionally, real-time data collection and analysis enable these machines to adapt to changing field conditions, further improving efficiency. As technology continues to evolve, robotic weeding machines are becoming more sophisticated, autonomous, and user-friendly, contributing to their growing adoption.

Global Robotic Weeding Machines Market Challenges and Restraints

High Initial Costs and Limited Awareness is restricting market growth: Despite the long-term cost savings and efficiency gains offered by robotic weeding machines, their high initial purchase cost can be a barrier to adoption, particularly for small-scale farmers. These machines require a substantial upfront investment in robotics technology, which may not be feasible for all farmers, especially in developing regions. Additionally, many farmers are still unaware of the benefits of robotic weeding machines or lack the technical knowledge to operate and maintain them. This limited awareness and the perception that such machines are only suited for large-scale farming operations could hinder market growth.

Technological Limitations and Field Conditions is restricting market growth: While robotic weeding machines have made significant strides in terms of functionality and efficiency, they still face limitations in certain field conditions. For example, in fields with uneven terrain, dense vegetation, or extreme weather conditions, the performance of these machines may be compromised. The effectiveness of robotic weeding machines also depends on the accuracy of their sensors and vision systems, which can be affected by factors such as lighting, soil conditions, and crop density. Addressing these technological challenges is essential to ensure consistent performance across different agricultural environments.

Market Opportunities

The increasing adoption of precision agriculture techniques presents significant opportunities for the robotic weeding machines market. Precision farming focuses on optimizing crop yields and resource use by using data-driven approaches to monitor field conditions and apply inputs more efficiently. Robotic weeding machines are a key component of precision agriculture, as they allow farmers to target specific areas of the field for weed control, reducing the need for blanket applications of herbicides. As farmers continue to invest in precision farming technologies to improve productivity and sustainability, the demand for robotic weeding machines is expected to grow. Furthermore, the integration of these machines with other precision agriculture tools, such as drones and soil sensors, could unlock new possibilities for smart farming systems.

ROBOTIC WEEDING MACHINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ecorobotix SA, Naïo Technologies, Blue River Technology (John Deere), F. Poulsen Engineering, AgXeed B.V., Robert Bosch GmbH, FarmWise Labs Inc., Vision Robotics Corporation, Energreen Srl, CNH Industrial N.V. |

Robotic Weeding Machines Market Segmentation - By Type

-

Vision-based Weeding Robots

-

Laser-based Weeding Robots

-

Autonomous Sprayers

-

Multi-function Robots

The Vision-based Weeding Robots segment is currently the most dominant product type, accounting for a significant share of the market. These robots utilize advanced computer vision and AI technologies to accurately detect and remove weeds in real time, making them highly efficient and versatile across different crop types. Vision-based robots offer the advantage of precision, as they can target weeds without damaging the surrounding crops.

Robotic Weeding Machines Market Segmentation - By Application

-

Row Crops

-

Horticulture Crops

-

Orchards and Vineyards

-

Greenhouses

In terms of application, the Row Crops segment leads the market, driven by the large-scale cultivation of row crops such as wheat, corn, and soybeans. These crops often face significant weed pressure, making robotic weeding solutions an attractive option for large-scale farmers looking to reduce labor costs and increase productivity.

Robotic Weeding Machines Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America is the dominant region in the global robotic weeding machines market, driven by the rapid adoption of precision agriculture technologies, strong government support, and a well-established farming industry. The United States, in particular, is a key market for robotic weeding machines, with a growing number of large-scale farms adopting these technologies to improve efficiency and sustainability. The presence of leading agricultural technology companies and research institutions in the region also contributes to the development and commercialization of advanced robotic solutions for farming.

COVID-19 Impact Analysis on the Robotic Weeding Machines Market

The COVID-19 pandemic had a mixed impact on the robotic weeding machines market. On the one hand, the disruption of labor markets and the restrictions on the movement of farm workers highlighted the need for automation in agriculture. As a result, many farmers turned to robotic solutions, including weeding machines, to mitigate labor shortages and ensure continuity of operations. On the other hand, supply chain disruptions and economic uncertainty caused delays in the production and delivery of these machines, especially in the early months of the pandemic. Despite these challenges, the market is expected to recover and grow in the post-pandemic period as farmers continue to invest in automation to improve resilience and reduce dependence on manual labor.

Latest Trends/Developments

A major trend in the robotic weeding machines market is the integration of AI and machine learning for enhanced performance. Robotic weeding machines are becoming smarter, with AI algorithms enabling them to learn from past operations and improve their weed detection accuracy over time. This is particularly beneficial for fields with diverse weed species and varying crop types, as the robots can adapt to different environments. As environmental regulations tighten and consumers demand eco-friendly farming practices, robotic weeding machines offer a solution that reduces the need for chemical herbicides. Additionally, the development of multi-function robots that can perform tasks such as planting, harvesting, and monitoring crops, in addition to weeding, is gaining traction in the market.

Key Players

-

Ecorobotix SA

-

Naïo Technologies

-

Blue River Technology (John Deere)

-

F. Poulsen Engineering

-

AgXeed B.V.

-

Robert Bosch GmbH

-

FarmWise Labs Inc.

-

Vision Robotics Corporation

-

Energreen Srl

-

CNH Industrial N.V.

Chapter 1. Robotic Weeding Machines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Robotic Weeding Machines Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Robotic Weeding Machines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Robotic Weeding Machines Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Robotic Weeding Machines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Robotic Weeding Machines Market – By Types

6.1 Introduction/Key Findings

6.2 Vision-based Weeding Robots

6.3 Laser-based Weeding Robots

6.4 Autonomous Sprayers

6.5 Multi-function Robots

6.6 Y-O-Y Growth trend Analysis By Types

6.7 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Robotic Weeding Machines Market – By Application

7.1 Introduction/Key Findings

7.2 Row Crops

7.3 Horticulture Crops

7.4 Orchards and Vineyards

7.5 Greenhouses

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Robotic Weeding Machines Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Robotic Weeding Machines Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Ecorobotix SA

9.2 Naïo Technologies

9.3 Blue River Technology (John Deere)

9.4 F. Poulsen Engineering

9.5 AgXeed B.V.

9.6 Robert Bosch GmbH

9.7 FarmWise Labs Inc.

9.8 Vision Robotics Corporation

9.9 Energreen Srl

9.10 CNH Industrial N.V.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global robotic weeding machines market was valued at USD 465 million in 2023 and is projected to reach USD 1.08 billion by 2030, growing at a CAGR of 12.8%.

Key drivers include the shift towards sustainable farming practices, labor shortages in agriculture, and advancements in robotics, AI, and machine learning.

The market is segmented by product type into vision-based weeding robots, laser-based weeding robots, autonomous sprayers, and multi-function robots. By application, it is segmented into row crops, horticulture crops, orchards and vineyards, and greenhouses.

North America is the dominant region due to the high adoption of precision agriculture technologies and the presence of key agricultural technology companies.

Leading players include Ecorobotix SA, Naïo Technologies, Blue River Technology (John Deere), F. Poulsen Engineering, and FarmWise Labs Inc.