Rigid-Flexible Printed Circuit Board Market Size (2025-2030)

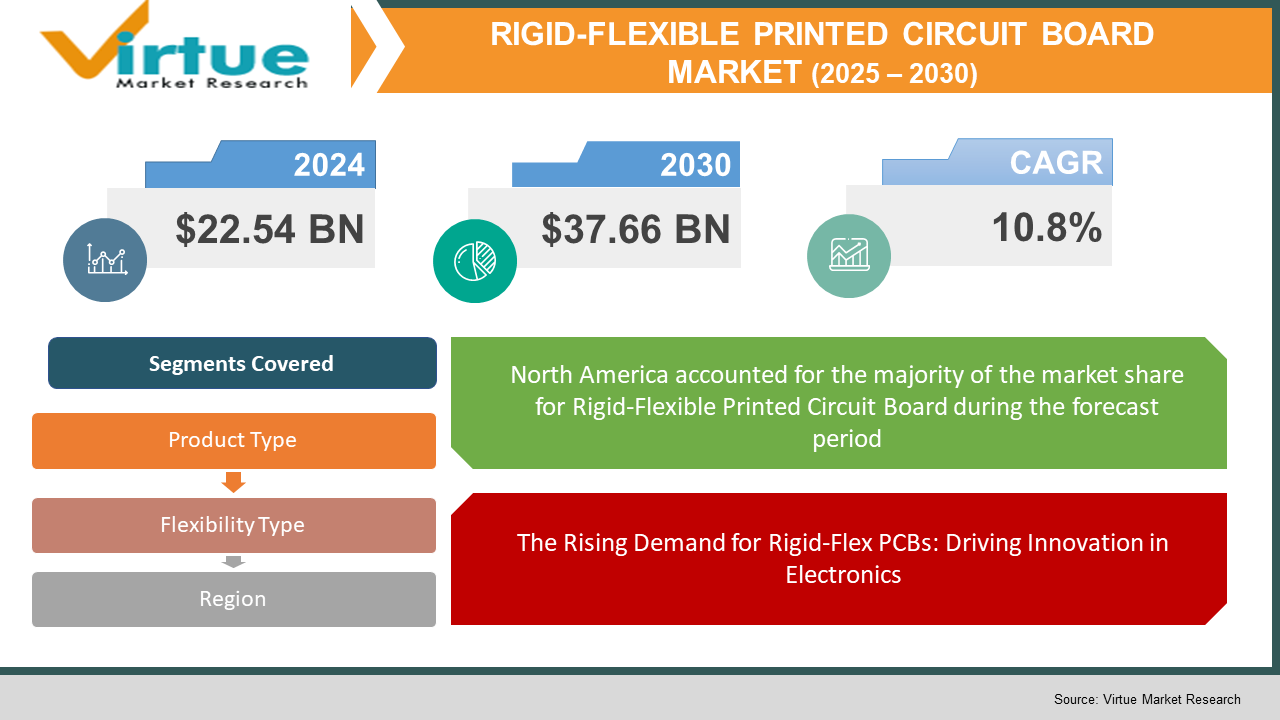

The Rigid-Flexible Printed Circuit Board Market was valued at USD 22.54 billion and is projected to reach a market size of USD 37.66 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 10.8%.

Rigid-flex PCBs are transforming electronics manufacturing by combining the durability of rigid boards with the adaptability of flexible circuits, making them ideal for compact, high-performance electronic devices. The increasing demand for miniaturised components, lightweight designs, and enhanced durability is driving their adoption across various industries. The consumer electronics sector is the largest end-user, with applications in smartphones, wearables, and advanced computing devices. With the rise of 5G technology and IoT-based devices, manufacturers are investing in high-density interconnect (HDI) and multilayer rigid-flex PCB solutions to enhance device performance. Automotive and aerospace industries are integrating rigid-flex PCBs for advanced control systems, infotainment panels, and navigation modules, benefiting from their shock resistance, high reliability, and space-saving capabilities. The healthcare sector is also leveraging rigid-flex circuits in medical implants and diagnostic equipment to enable precision-based functionalities.

Key Market Insights:

- A 2023 IPC survey found that 70% of electronics manufacturers are incorporating rigid-flex PCBs in high-reliability applications, ensuring improved durability and space efficiency.

- According to study the automotive sector is expected to contribute over 25% of the total rigid-flex PCB demand due to increased integration in ADAS, EV battery management, and infotainment systems.

- A McKinsey study (2023) revealed that multilayer rigid-flex PCBs are witnessing a 30% growth in adoption, especially in aerospace, defense, and telecommunications, due to their enhanced signal integrity and reduced weight.

- Statista (2023) reported that over 60% of smartphone manufacturers are shifting to rigid-flex PCB designs to support thinner, lighter, and more efficient devices, reducing production complexity while improving performance.

- Advancements in material technology, including flexible polyimides, liquid crystal polymers (LCPs), and advanced adhesives, are improving signal integrity, heat dissipation, and mechanical strength, making rigid-flex PCBs more efficient and durable.

- Next-generation telecommunications infrastructure, such as 5G and IoT networks, is driving the need for high-density, lightweight, and thermally efficient PCB designs, making rigid-flex solutions increasingly essential.

Rigid-Flexible Printed Circuit Board Market Drivers:

The Rising Demand for Rigid-Flex PCBs: Driving Innovation in Electronics.

The push for smaller, more efficient electronic devices is one of the key drivers of the rigid-flex PCB market. As industries move toward compact and high-density electronic components, rigid-flex PCBs are becoming the preferred choice due to their ability to eliminate bulky connectors, enhance durability, and reduce assembly complexities. In the consumer electronics industry, the need for lightweight and space-saving designs is pushing smartphone, wearable, and laptop manufacturers to integrate rigid-flex PCB technology. These PCBs allow for higher circuit density while reducing signal interference, making them ideal for foldable devices, IoT gadgets, and next-generation smartwatches. Beyond consumer electronics, medical devices and industrial automation are increasingly relying on flex-rigid PCBs for their high reliability and flexibility in compact enclosures. In automotive applications, the shift toward electric vehicles (EVs) and advanced driver assistance systems (ADAS) is fuelling the need for lightweight, vibration-resistant circuit solutions to ensure longevity and safety.

The applications of this technology are being expanded into the aerospace and automotive industries, while demand is being driven by these industries there are also advancements within these industries which fit the PCB market.

The automotive and aerospace sectors are among the fastest-growing markets for rigid-flex PCBs, driven by advancements in vehicle automation, electric mobility, and avionics. Automakers are integrating these PCBs in battery management systems, infotainment displays, and advanced safety modules, ensuring greater performance in harsh environments. In aerospace, rigid-flex PCBs are revolutionizing avionics by providing high-reliability, shock-resistant circuits that are crucial for flight control systems, navigation panels, and satellite communications. Their ability to withstand extreme temperatures and vibrations makes them ideal for mission-critical applications in space exploration and military defence systems. As industries seek lighter, more efficient materials to improve fuel efficiency and enhance operational reliability, rigid-flex PCBs are becoming an integral part of next-generation electronic designs, offering superior durability, design flexibility, and multi-layer integration.

Rigid-Flexible Printed Circuit Board Market Restraints and Challenges:

The implementation of these circuit boards can be complex, and integrating them in the existing technology can be even more cumbersome. there are also additional repair works and maintenance charges which does make this a costly endeavor.

Despite the growing adoption of rigid-flex PCBs, several challenges hinder their widespread implementation. The high manufacturing complexity and cost associated with multilayer rigid-flex designs make them less accessible for small-scale manufacturers and cost-sensitive industries. The fabrication process requires precise design considerations, including accurate layer stacking, controlled impedance, and specialized soldering techniques, which increase development time and production costs. Additionally, rework and repairs in rigid-flex PCBs are more difficult compared to traditional circuit boards, leading to higher material wastage and production inefficiencies. Another challenge is the limited availability of skilled labor and high entry barriers for companies looking to adopt advanced flexible PCB technologies. With miniaturization trends pushing design limits, manufacturers must invest in state-of-the-art fabrication equipment and testing methodologies to ensure quality control, reliability, and compliance with international standards.

Rigid-Flexible Printed Circuit Board Market Opportunities:

The expansion of 5G technology and the Internet of Things (IoT) is creating a significant opportunity for rigid-flex PCBs. As devices become more compact and require high-speed data transmission with minimal signal loss, rigid-flex circuits offer enhanced connectivity, durability, and design flexibility. With the rollout of smart cities, IoT-enabled industrial automation, and connected healthcare solutions, demand for miniaturized, high-performance PCBs is expected to surge. The rapid adoption of electric vehicles (EVs) and advanced driver assistance systems (ADAS) is fuelling the need for lightweight, vibration-resistant PCB solutions. Rigid-flex PCBs are critical for EV battery management, in-car infotainment systems, and radar-based safety sensors, offering high reliability in extreme environments. As governments push for sustainable mobility and automotive electrification, manufacturers investing in automotive-grade rigid-flex PCBs will gain a competitive edge.

RIGID-FLEXIBLE PRINTED CIRCUIT BOARD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10.8% |

|

Segments Covered |

By Product Type, flexible type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nippon Mektron, Ltd., Zhen Ding Technology Holding Limited, TTM Technologies, Inc., Fujikura Ltd., Flexium Interconnect Inc., Unimicron Technology Corp., Sumitomo Electric Industries, Ltd., Shenzhen Kinwong Electronic Co., Ltd., Interflex Co., Ltd., Samsung Electro-Mechanics |

Rigid-Flexible Printed Circuit Board Market Segmentation:

Rigid-Flexible Printed Circuit Board Market Segmentation: By Product Type

- Single-Sided Flex

- Double-Sided Flex

- Multi-Layer Flex

Single-sided flex PCBs are widely used in low-power, lightweight electronic applications, such as wearables, medical sensors, and compact consumer electronics. They feature a single conductive layer on a flexible substrate, making them cost-effective, easy to manufacture, and highly adaptable for bendable or foldable devices. Industries seeking simplified circuitry with high durability prefer single-sided flex PCBs for their affordability and ease of assembly.

Double-sided flex PCBs, featuring conductive layers on both sides of a flexible substrate, offer enhanced electrical performance and higher circuit density. These PCBs are commonly found in automotive control systems, industrial automation equipment, and complex consumer electronics. Multi-layer flex PCBs are designed for high-performance applications that require complex circuit routing, improved signal integrity, and enhanced durability. They are widely adopted in aerospace, medical, and automotive sectors, where electronic components must withstand extreme conditions while maintaining efficiency.

Rigid-Flexible Printed Circuit Board Market Segmentation: By Flexibility Type:

- Static Flex

- Dynamic Flex

Static flex PCBs are designed for applications where the circuit will be bent or flexed only a few times during installation but remains fixed in place afterward. These PCBs are commonly used in consumer electronics, medical devices, and industrial equipment, where a compact form factor and lightweight design are necessary without frequent movement. Static flex PCBs offer high durability, lower manufacturing costs, and better structural stability compared to dynamic flex designs. They are ideal for foldable smartphones, display modules, and automotive control panels, where space-saving and enhanced electrical performance are key requirements.

Dynamic flex PCBs are designed to endure continuous movement, bending, and vibration without compromising functionality. They are widely used in robotics, aerospace systems, medical implants, and wearables, where circuits must remain functional despite constant mechanical stress. These PCBs feature advanced materials with high flex endurance, ensuring longer life cycles and reliable signal integrity.

Rigid-Flexible Printed Circuit Board Market Segmentation: By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

North America holds a significant share of the rigid-flex PCB market, driven by high demand from the aerospace, defence, and consumer electronics industries. The region’s strong focus on advanced semiconductor manufacturing, 5G infrastructure, and electric vehicles (EVs) is accelerating the adoption of rigid-flex PCBs in high-reliability applications. Europe is also experiencing steady growth, with Germany, France, and the UK leading investments in automotive electronics, industrial automation, and healthcare applications. The push for lightweight, durable, and compact electronics in next-generation vehicles and medical devices is driving demand for multi-layer and dynamic flex PCBs in the region.

Asia-Pacific dominates the global rigid-flex PCB market, with China, Japan, South Korea, and Taiwan serving as major manufacturing hubs. The region benefits from a strong electronics supply chain, increasing investments in consumer gadgets, and rapid industrial automation. The growing smartphone, IoT, and automotive electronics sectors are fuelling demand for high-density interconnect (HDI) rigid-flex PCBs. South America and the Middle East & Africa are emerging markets, with rising adoption of automotive electronics, renewable energy systems, and industrial automation.

COVID-19 Impact Analysis on the Rigid-Flexible Printed Circuit Board Market

The COVID-19 pandemic disrupted global electronics supply chains, causing delays in PCB production, component sourcing, and assembly processes. With manufacturing plants operating at reduced capacity, the availability of raw materials and high-end semiconductor components was severely impacted, leading to price fluctuations and production bottlenecks. However, the demand for consumer electronics, medical devices, and automotive electronics surged, driving renewed investment in rigid-flex PCB manufacturing. The pandemic accelerated the adoption of automation and smart manufacturing to ensure continuous production with minimal workforce dependency. As supply chains recovered, manufacturers increased investments in AI-driven PCB design, automated quality inspection, and next-gen flexible circuit technologies, positioning the market for strong post-pandemic growth.

Trends/Developments:

Manufacturers are leveraging AI-powered software for design optimization, defect detection, and material efficiency, reducing production time and costs. Companies like DuPont and Panasonic are investing in high-performance flexible laminates and conductive adhesives to enhance PCB reliability in harsh environments.

Manufacturers are integrating AI and machine learning into PCB design processes to optimize layout, material selection, and defect detection. AI-powered simulation tools are reducing design cycle times and improving production efficiency, leading to higher yields and cost savings in rigid-flex PCB manufacturing.

Key Players:

- Nippon Mektron, Ltd.

- Zhen Ding Technology Holding Limited

- TTM Technologies, Inc.

- Fujikura Ltd.

- Flexium Interconnect Inc.

- Unimicron Technology Corp.

- Sumitomo Electric Industries, Ltd.

- Shenzhen Kinwong Electronic Co., Ltd.

- Interflex Co., Ltd.

- Samsung Electro-Mechanics

Chapter 1. RIGID-FLEXIBLE PRINTED CIRCUIT BOARD MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. RIGID-FLEXIBLE PRINTED CIRCUIT BOARD MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. RIGID-FLEXIBLE PRINTED CIRCUIT BOARD MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. RIGID-FLEXIBLE PRINTED CIRCUIT BOARD MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. RIGID-FLEXIBLE PRINTED CIRCUIT BOARD MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. RIGID-FLEXIBLE PRINTED CIRCUIT BOARD MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Single-Sided Flex

6.3 Double-Sided Flex

6.4 Multi-Layer Flex

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. RIGID-FLEXIBLE PRINTED CIRCUIT BOARD MARKET – By Flexibility Type

7.1 Introduction/Key Findings

7.2 Static Flex

7.3 Dynamic Flex

7.4 Corporate Entities Y-O-Y Growth trend Analysis By Flexibility Type

7.5 Absolute $ Opportunity Analysis By Flexibility Type , 2025-2030

Chapter 8. RIGID-FLEXIBLE PRINTED CIRCUIT BOARD MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Flexibility Type

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Flexibility Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Flexibility Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By Flexibility Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Flexibility Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. RIGID-FLEXIBLE PRINTED CIRCUIT BOARD MARKET – Company Profiles – (Overview, Packaging Product Type Product Type Portfolio, Financials, Strategies & Developments)

9.1 Nippon Mektron, Ltd.

9.2 Zhen Ding Technology Holding Limited

9.3 TTM Technologies, Inc.

9.4 Fujikura Ltd.

9.5 Flexium Interconnect Inc.

9.6 Unimicron Technology Corp.

9.7 Sumitomo Electric Industries, Ltd.

9.8 Shenzhen Kinwong Electronic Co., Ltd.

9.9 Interflex Co., Ltd.

9.10 Samsung Electro-Mechanics

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The increasing demand for miniaturized, lightweight, and high-performance electronic devices is driving growth. Industries such as consumer electronics, automotive, aerospace, and medical are adopting rigid-flex PCBs for their durability, flexibility, and space-saving benefits.

Rigid-flex PCBs are widely used in smartphones, smartwatches, foldable devices, and AR/VR headsets. They enable compact, durable, and high-density circuit designs, making them ideal for next-generation wearable and IoT-enabled devices.

With the rise of electric vehicles (EVs) and advanced driver assistance systems (ADAS), rigid-flex PCBs are used in battery management systems, infotainment displays, and sensor modules due to their vibration resistance, durability, and reliability in extreme conditions.

In aerospace, these PCBs are used in flight control systems, satellite communications, and avionics due to their lightweight and high-reliability characteristics. In medical devices, they enable compact, flexible circuits for implants, diagnostic equipment, and wearable health monitors.

Key trends include AI-driven PCB design automation, advanced material innovations for high-performance applications, and increasing adoption in foldable devices and wearable technology. The shift toward 5G, IoT, and autonomous systems is further driving market expansion.