Rig and Oil Field Market Size (2025-2030)

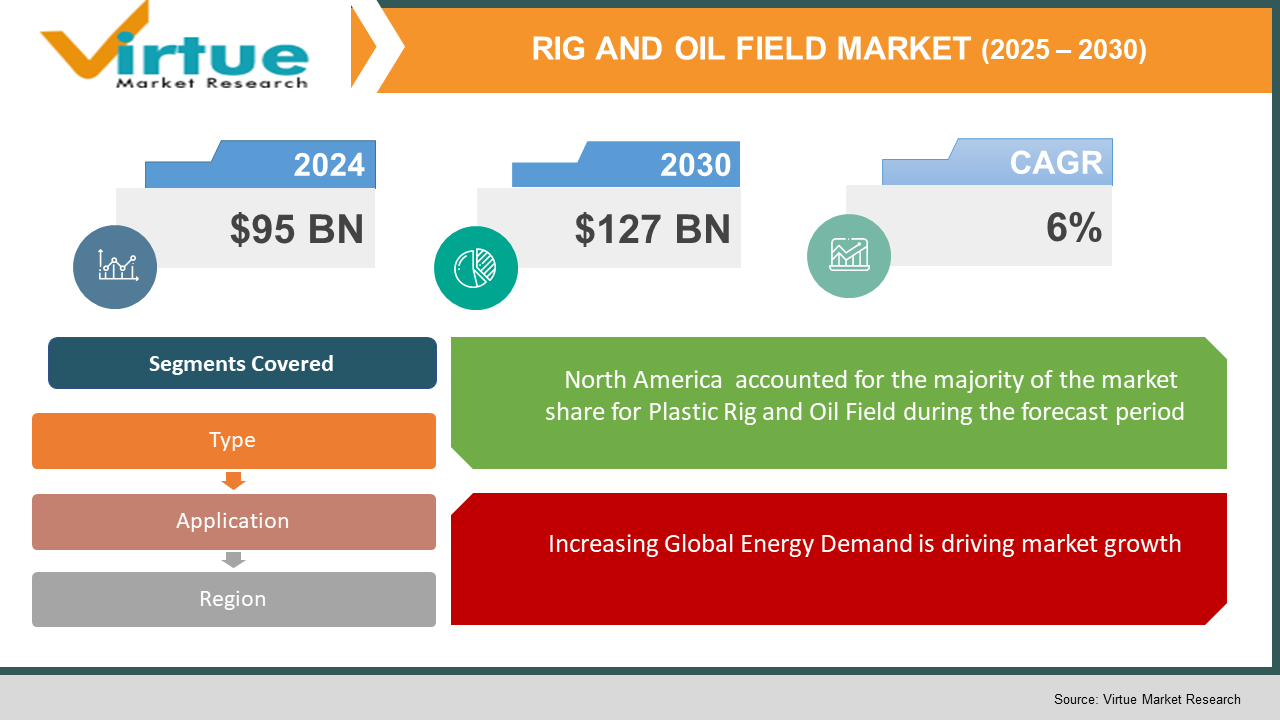

The Global Rig and Oil Field Market was valued at USD 95 billion in 2024 and will grow at a CAGR of 6% from 2025 to 2030. The market is expected to reach USD 127 billion by 2030.

The Rig and Oil Field Market involves services and equipment related to the extraction of oil and gas from beneath the earth’s surface, including drilling rigs, oil field services, and related technologies. The sector has experienced steady growth due to the increasing global demand for energy, rising exploration activities, and advancements in drilling technology. The market is being propelled by investments in offshore and onshore drilling, alongside the need for enhanced oil recovery. Additionally, the demand for new rigs and services is fueled by growing oil consumption across industries, including automotive, manufacturing, and chemicals.

Key Market Insights:

- The North American region holds the largest market share in the Rig and Oil Field Market, owing to the high number of oil exploration and production activities, particularly in the United States and Canada.

- Onshore oil and gas exploration continues to dominate the market in terms of revenue generation, accounting for nearly 60% of the market share due to its comparatively lower operational costs and higher availability of oil reserves.

- The offshore oil field market is expected to grow at a faster pace than onshore markets, as more companies invest in deepwater and ultra-deepwater drilling projects, which are driving a need for advanced technology and higher investments.

Global Rig and Oil Field Market Drivers:

Increasing Global Energy Demand is driving market growth:

The global energy demand has been consistently rising due to factors such as population growth, urbanization, and industrialization. As economies expand, the need for oil and gas resources increases, driving the demand for rigs and oil field services. Countries across the world are increasing their investments in exploration and production (E&P) activities to meet the rising consumption of oil, especially in developing regions. Moreover, the transportation, petrochemical, and manufacturing industries, which rely heavily on oil and gas, are significantly contributing to this demand. As a result, exploration and drilling activities are expanding across both onshore and offshore locations, providing a boost to the rig and oil field market.

Technological Advancements in Drilling is driving market growth:

Technological innovation is a major driver in the Rig and Oil Field Market. Advancements such as directional drilling, hydraulic fracturing, and automation technologies have increased the efficiency and cost-effectiveness of oil extraction. New techniques allow for more precise drilling, the ability to reach deeper and more challenging reserves, and lower operational costs, which makes exploration in harsh environments more feasible.

Investment in Offshore and Unconventional Resources is driving market growth:

As conventional onshore reserves are being depleted, there has been a surge in investments for offshore drilling and unconventional oil extraction, such as shale oil and oil sands. Offshore oil fields, especially in regions like the North Sea, Gulf of Mexico, and offshore Brazil, are expected to experience substantial growth. These areas contain some of the largest untapped reserves, but their development requires more advanced and costly technology due to the challenges posed by deepwater drilling.

Global Rig and Oil Field Market Challenges and Restraints:

Environmental Concerns and Regulatory Pressure is restricting market growth:

Environmental concerns are one of the primary restraints facing the Rig and Oil Field Market. Oil exploration activities, particularly in offshore and sensitive land areas, often have adverse environmental impacts, such as oil spills, habitat destruction, and pollution. These concerns have prompted governments and international organizations to impose stringent regulations and environmental protection standards. Compliance with these regulations can be costly, and failure to do so can lead to penalties and project delays.

Volatility in Oil Prices is restricting market growth:

The Rig and Oil Field Market is highly sensitive to fluctuations in global oil prices. When oil prices are high, there is a surge in exploration and drilling activities, as companies seek to maximize profits from increased oil demand. However, when oil prices fall, exploration and production activities often slow down, leading to reduced demand for rigs and oil field services. Price volatility can result in project delays, reduced investment in exploration, and overall market uncertainty.

Market Opportunities:

The Rig and Oil Field Market presents numerous opportunities for growth in the coming years. One of the primary opportunities lies in the increasing shift toward offshore drilling, especially as countries with significant offshore reserves, like Brazil, Norway, and Mexico, ramp up their exploration efforts. Deepwater and ultra-deepwater drilling technologies will continue to evolve, opening up previously inaccessible reserves and driving demand for specialized rigs and services. The growth of offshore wind energy, while still in its early stages, is also seen as a complementary industry that could benefit from shared technology and infrastructure between the offshore oil and gas and wind sectors. Another opportunity lies in the growing demand for unconventional oil sources, particularly shale oil and oil sands. With the rise of hydraulic fracturing and horizontal drilling techniques, companies are able to access vast reserves of oil and gas previously deemed unfeasible to extract. As countries like the U.S. and Canada continue to expand their shale oil production, the demand for advanced drilling services and technologies will grow. Additionally, the oil field services market offers opportunities in automation, digitalization, and data analytics. The integration of AI, machine learning, and Internet of Things (IoT) technologies into drilling operations promises to streamline processes, enhance predictive maintenance, and reduce costs. Oil field service providers who are early adopters of these technologies will be able to offer more efficient solutions, creating a competitive advantage in the market. Lastly, the push for decarbonization has prompted oil and gas companies to invest in cleaner technologies and more sustainable practices, such as carbon capture and storage (CCS). This market shift presents an opportunity for companies that provide solutions for energy transition and emissions reduction to enter the Rig and Oil Field Market and provide technologies that mitigate the environmental impact of oil extraction.

RIG AND OIL FIELD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024- 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Schlumberger, Halliburton, Baker Hughes, National Oilwell Varco, Transocean, Weatherford International, TechnipFMC, Saipem |

Rig and Oil Field Market Segmentation:

Rig and Oil Field Market Segmentation By Type:

- Drilling Rigs

- Production Rigs

- Workover Rigs

- Oilfield Services

- Oilfield Equipment

- Well Completion and Support Services

Drilling rigs are the most dominant segment in the Rig and Oil Field Market. They are the primary tool used to drill holes in the earth to extract oil and gas. With the increased demand for oil extraction, drilling rigs have become critical, and the growth of onshore and offshore drilling activities significantly contributes to their dominance in the market. The demand for advanced drilling rigs that can operate in deeper water and challenging conditions continues to grow, further solidifying their leading position in the market.

Rig and Oil Field Market Segmentation By application:

- Onshore Oilfield

- Offshore Oilfield

The onshore oilfield segment dominates the market due to the higher availability of oil reserves and the comparatively lower cost of exploration and drilling operations. Onshore drilling remains the preferred method for oil exploration due to its established infrastructure, lower costs, and ease of accessibility to the reserves. Although offshore drilling is growing, onshore oilfields remain the dominant application for rig and oil field services.

Regional Segmentation:

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

North America is the dominant region in the Rig and Oil Field Market, primarily due to the significant oil and gas reserves in the United States, particularly in shale oil fields such as those in Texas and North Dakota. The U.S. is one of the largest producers of oil globally, and its extensive exploration and production activities drive demand for rigs and oil field services. Additionally, Canada’s oil sands in Alberta are a major contributor to the regional market. The region’s established infrastructure, investment in advanced drilling technologies, and large number of active oil and gas rigs make North America the leader in this market.

COVID-19 Impact Analysis on the Rig and Oil Field Market:

The COVID-19 pandemic had a significant impact on the Rig and Oil Field Market, primarily due to the sharp decline in global oil demand as a result of lockdowns, travel restrictions, and economic slowdowns. Oil prices plummeted to historic lows during the early phases of the pandemic, leading to reduced investments in exploration and drilling activities. Many oil companies were forced to halt or delay projects due to the uncertain economic environment and the financial strain caused by the downturn in oil prices. However, the market has gradually rebounded as oil prices recovered with the global easing of pandemic restrictions and the resumption of industrial activities. The long-term impact of COVID-19 on the market has led to increased focus on cost-efficiency, automation, and digitalization in oil field operations, as companies seek to optimize their operations in a volatile market. The pandemic also accelerated the shift toward more sustainable and environmentally conscious practices, with companies investing in cleaner energy solutions to prepare for a post-pandemic world where renewable energy may play a more prominent role.

Latest Trends/Developments:

Several key trends are currently shaping the Rig and Oil Field Market. Automation and digitalization are at the forefront of the industry's transformation, with companies increasingly adopting technologies such as AI, IoT, and big data analytics to optimize drilling operations, improve predictive maintenance, and enhance overall efficiency. Digital twin technologies are also being used to simulate real-world drilling operations, allowing for better decision-making and cost reductions. There is also a growing emphasis on environmentally sustainable practices. Many oil companies are investing in carbon capture and storage (CCS) technologies and working to reduce their carbon footprint in line with global decarbonization efforts. The push for cleaner energy and environmental responsibility is leading to innovations in more efficient drilling techniques, such as the development of hybrid and electric rigs. Additionally, offshore oil and gas exploration is seeing significant advancements, with new technologies enabling deeper, safer, and more efficient extraction from challenging environments.

Key Players:

- Schlumberger

- Halliburton

- Baker Hughes

- National Oilwell Varco

- Transocean

- Weatherford International

- TechnipFMC

- Saipem

Chapter 1. RIG AND OIL FIELD MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. RIG AND OIL FIELD MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. RIG AND OIL FIELD MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. RIG AND OIL FIELD MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. RIG AND OIL FIELD MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. RIG AND OIL FIELD MARKET – By Type

6.1 Introduction/Key Findings

6.2 Drilling Rigs

6.3 Production Rigs

6.4 Workover Rigs

6.5 Oilfield Services

6.6 Oilfield Equipment

6.7 Well Completion and Support Services

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. RIG AND OIL FIELD MARKET – By Application

7.1 Introduction/Key Findings

7.2 Onshore Oilfield

7.3 Offshore Oilfield

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. RIG AND OIL FIELD MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. RIG AND OIL FIELD MARKET– Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

9.1 Schlumberger

9.2 Halliburton

9.3 Baker Hughes

9.4 National Oilwell Varco

9.5 Transocean

9.6 Weatherford International

9.7 TechnipFMC

9.8 Saipem

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Rig and Oil Field Market was valued at USD 95 billion in 2024 and is projected to reach USD 127 billion by 2030, growing at a CAGR of 6%.

Drivers include increasing global energy demand, technological advancements in drilling, and investment in offshore and unconventional oil sources.

Segments include drilling rigs, production rigs, oil field services, and equipment, with applications in both onshore and offshore oilfields

North America is the dominant region, driven by the significant oil reserves and active oil exploration activities in the United States and Canada.

Leading players include Schlumberger, Halliburton, Baker Hughes, and Transocean.