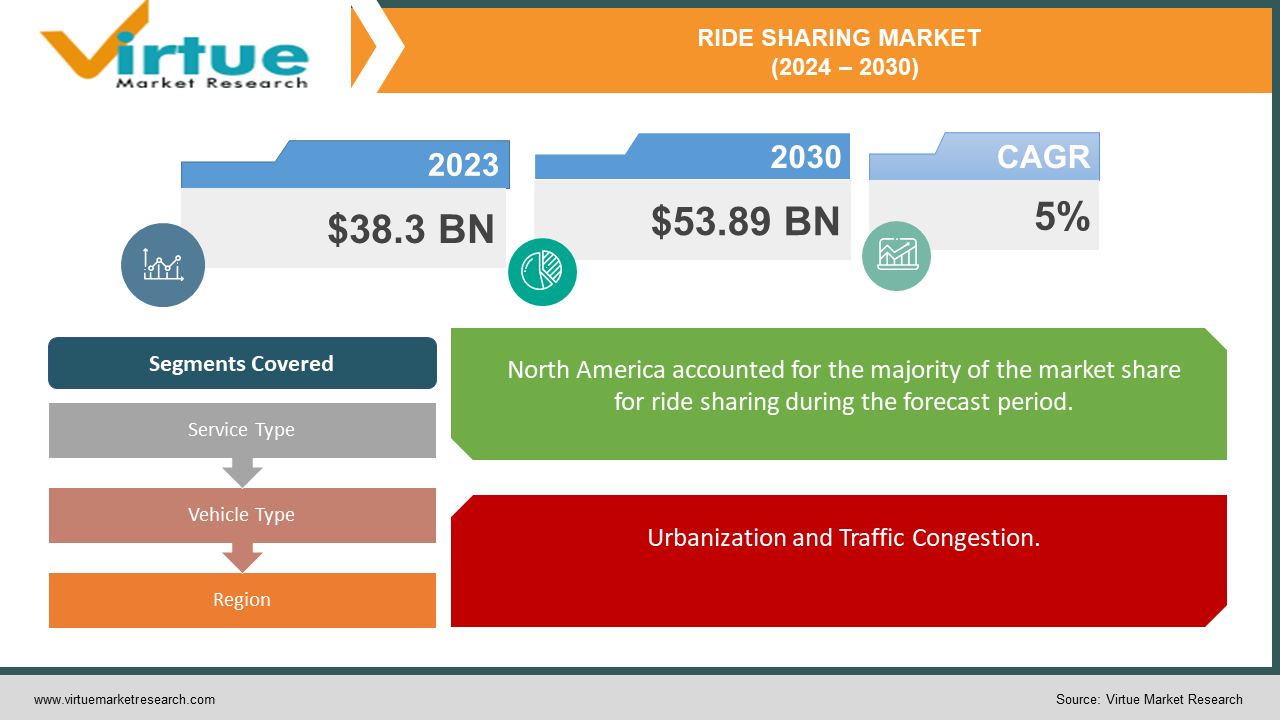

Ride Sharing Market Size (2024 – 2030)

The Global Ride Sharing Market was valued at USD 38.3 billion in 2023 and is projected to reach a market size of USD 53.89 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5% between 2024 and 2030.

The global ride-sharing market has witnessed explosive growth and transformation, revolutionizing urban transportation dynamics over the past decade. Defined by platforms that connect passengers with drivers of vehicles for hire through mobile applications, ride-sharing services have reshaped commuting habits, offering convenience, affordability, and flexibility compared to traditional taxi services. Key players such as Uber Technologies Inc., Lyft Inc., and DiDi Chuxing have led this evolution, leveraging technology to optimize matching algorithms, enhance user experience, and expand service offerings beyond basic transportation. This market expansion has been fueled by increasing smartphone penetration, changing consumer preferences towards on-demand services, and supportive regulatory environments in many regions. Moreover, ride-sharing has also contributed to reducing traffic congestion, lowering carbon emissions, and promoting shared mobility solutions in urban centers worldwide. As competition intensifies and technological advancements continue, the ride-sharing sector remains pivotal in shaping the future of urban transportation, promising further innovation and integration into the broader ecosystem of smart cities and mobility solutions.

Key Market Insights:

Over 70% of ride-sharing trips happen in cities due to high population density and limited parking options, making it a convenient alternative to car ownership.

Millennials, comprising 40% of global users, favor ride-sharing for its tech-savvy convenience and flexible transport options.

Ride-sharing potentially reduces urban traffic congestion by up to 25%, leading to lower vehicle emissions and improved air quality.

Carpooling services make up nearly 20% of all ride-sharing trips globally, reflecting a growing demand for economical and eco-friendly transportation.

Southeast Asia and Latin America show rapid adoption of ride-sharing, contributing to a projected 30% increase in global users by 2027.

More than half of ride-sharing companies are investing in autonomous vehicle technology, which could significantly reshape the industry and user habits in the future.

Global Ride Sharing Market Drivers:

Urbanization and Traffic Congestion.

One of the primary drivers of the global ride-sharing market is the rapid urbanization and increasing traffic congestion in major cities worldwide. As urban populations grow, the number of vehicles on the road rises, leading to significant traffic jams and longer commute times. Ride-sharing services offer a convenient and efficient alternative to car ownership, allowing urban dwellers to navigate congested streets without the hassle of driving and parking. This shift is particularly appealing in densely populated cities where public transportation might be overburdened or insufficient. By providing flexible, on-demand transportation options, ride-sharing companies help alleviate traffic congestion and reduce the need for personal vehicles, contributing to smoother traffic flow and lower emissions. This convenience, coupled with the cost savings associated with not owning a car, makes ride-sharing an attractive option for city residents, fueling the market's growth.

Technological Advancements and Smartphone Penetration.

Technological advancements, particularly in smartphone penetration and app development, have been pivotal in driving the global ride-sharing market. The widespread use of smartphones enables users to easily access ride-sharing services through user-friendly mobile applications. These apps leverage advanced technologies such as GPS for real-time location tracking, secure payment gateways, and sophisticated algorithms to match riders with drivers efficiently. Furthermore, continuous innovations such as ride-pooling options, electric vehicle integration, and improved safety features enhance the user experience and expand the market reach. The seamless, tech-driven interface provided by ride-sharing apps offers a level of convenience and reliability that traditional taxi services often lack. As technology continues to evolve, it is expected to introduce new features and improvements that will further boost the adoption of ride-sharing services globally, catering to the growing demand for smart, efficient urban mobility solutions.

Global Ride Sharing Market Restraints and Challenges:

The global ride-sharing market faces several significant restraints and challenges that could hinder its growth and sustainability. One major challenge is regulatory scrutiny and compliance issues. Many countries and cities have implemented stringent regulations on ride-sharing operations, ranging from driver background checks to vehicle standards and fare controls. Navigating these diverse and often complex regulatory environments can be costly and time-consuming for ride-sharing companies, potentially limiting their ability to expand and operate efficiently. Additionally, ride-sharing services face intense competition from traditional taxi services, public transportation, and emerging mobility solutions like bike-sharing and autonomous vehicles. This competitive landscape requires continuous innovation and significant investment to maintain market share. Furthermore, concerns about passenger safety and data privacy pose serious challenges. High-profile incidents involving ride-sharing drivers have raised questions about the effectiveness of safety measures, while data breaches have highlighted vulnerabilities in protecting user information. Economic factors, such as fluctuating fuel prices and the financial instability of drivers, also impact the market. Drivers often face low wages and uncertain income, leading to high turnover rates and dissatisfaction. These combined challenges necessitate that ride-sharing companies adopt robust strategies to navigate regulatory pressures, ensure safety and privacy, and remain competitive in a rapidly evolving transportation sector.

Global Ride Sharing Market Opportunities:

The global ride-sharing market presents numerous opportunities for growth and innovation, driven by evolving consumer preferences and technological advancements. One significant opportunity lies in the expansion into emerging markets, where rising urbanization and increasing smartphone penetration create a favorable environment for ride-sharing services. These regions, often characterized by inadequate public transportation infrastructure, offer a substantial user base eager for convenient and reliable mobility solutions. Additionally, the integration of electric vehicles (EVs) into ride-sharing fleets represents a promising avenue for reducing carbon emissions and catering to environmentally conscious consumers. Governments worldwide are supporting the shift towards sustainable transportation through incentives and subsidies for EV adoption, making this transition economically viable for ride-sharing companies. Another key opportunity is the enhancement of user experience through AI and machine learning technologies. These advancements can optimize route planning, improve ride-matching efficiency, and personalize services based on user preferences, thereby increasing customer satisfaction and loyalty. Furthermore, the growing trend of multi-modal transportation, combining ride-sharing with other forms of mobility like bike-sharing and public transit, can offer comprehensive and seamless travel solutions. By capitalizing on these opportunities, ride-sharing companies can not only expand their market presence but also contribute to the development of smarter, more sustainable urban transportation systems.

RIDE SHARING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Service Type, Vehicle Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Uber Technologies Inc., Lyft Inc., DiDi Chuxing, Grab Holdings Inc., Ola Cabs (ANI Technologies Pvt. Ltd.), BlaBlaCar, Bolt (Taxify), Gett Inc., Cabify, Via Transportation Inc. |

Global Ride Sharing Market Segmentation: By Service Type

-

E-hailing

-

Car Rental

-

Station-Based Mobility

The Global Ride Sharing Market by Service Type, E-hailing had the largest market share last year and is poised to maintain its dominance throughout the forecast period. E-hailing services have revolutionized urban transportation with their unmatched convenience and user-friendly features. Offering instant access to rides through smartphone apps, e-hailing eliminates the hassle of traditional taxi services by allowing users to hail a ride on demand without pre-booking or waiting at taxi stands. Real-time tracking of drivers and estimated arrival times enhances transparency and peace of mind for users, while upfront fare displays enable cost comparisons and ensure price transparency. With a vast network of drivers, e-hailing services like Uber and Lyft provide broad availability, ensuring quick access to rides even during peak times.Moreover, seamless cashless payment integration further enhances the user experience, making transactions secure and hassle-free. Despite the dominance of e-hailing, the broader ride-sharing market is dynamic. Ride-sharing, including carpooling and shared rides, is growing rapidly, appealing particularly to budget-conscious users and those opting for eco-friendly travel options. Additionally, the rise of micro-mobility solutions such as bike-sharing and scooter rentals presents new alternatives for short-distance travel, potentially diversifying the transportation landscape further.Looking ahead, while e-hailing is poised to maintain its lead due to its convenience and established market presence, ongoing innovations and evolving user preferences could shape shifts in the industry, influencing which modes of transportation gain prominence in the future urban mobility ecosystem.

Global Ride Sharing Market Segmentation: By Vehicle Type

-

Economy Cars

-

Comfort/Premium Cars

-

SUVs and Vans

-

Electric Vehicles (EVs)

The Global Ride Sharing Market by Vehicle Type, Economy Cars had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Economy cars represent the cornerstone of affordability and practicality in the ride-sharing industry, catering to a wide user base sensitive to cost considerations. Their lower fares make ride-sharing accessible to a broader demographic, particularly in regions where price sensitivity is paramount. Beyond affordability, economy cars boast superior fuel efficiency compared to larger vehicles, translating into lower operational costs for ride-sharing companies and potentially more competitive pricing for users. Their compact size enhances urban maneuverability, crucial for navigating congested city streets and finding parking in tight spaces, which aligns with the predominantly urban nature of ride-sharing trips.While alternatives like comfort/premium cars, SUVs, vans, and electric vehicles (EVs) offer niche benefits such as luxury, capacity, or environmental sustainability, they currently face limitations in cost-effectiveness, fuel efficiency, or infrastructure support. However, as ride-sharing evolves, there could be a gradual shift in user preferences towards more comfortable or eco-friendly options, supported by advancements in EV technology and government incentives. These factors may influence the future market dynamics, potentially diversifying vehicle types used in ride-sharing fleets. Nonetheless, economy cars are poised to maintain their dominance in the foreseeable future, driven by their affordability, operational efficiency, and suitability for urban mobility challenges.

Global Ride Sharing Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global Ride Sharing Market by Region, North America had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The Asia-Pacific region stands out as the epicenter of rapid growth in the global ride-sharing market, fueled by several key factors. With a burgeoning urban population, cities across China, India, and Southeast Asia are witnessing escalating demand for convenient and cost-effective transportation solutions, driven by rapid urbanization and inadequate public transportation infrastructure in some areas. High rates of smartphone penetration further facilitate widespread adoption of ride-hailing apps, enabling seamless access to services like Didi Chuxing in China, Ola in India, and Grab in Southeast Asia, which dominate their respective markets.In contrast, North America boasts a mature ride-sharing market, particularly in the United States and Canada, characterized by high user penetration and established service providers like Uber and Lyft. While growth in North America may not match the explosive rates seen in Asia-Pacific, its market remains substantial in terms of user base and revenue generation. Meanwhile, Europe faces slower growth due to stringent regulatory frameworks and robust public transportation systems, which present challenges for ride-sharing expansion.Latin America and Africa emerge as promising markets with significant growth potential, driven by increasing urbanization, improving internet connectivity, and rising consumer demand for flexible transportation options. As these regional dynamics evolve, the global ride-sharing landscape is expected to achieve a more balanced distribution of growth, with Asia-Pacific maintaining its lead while other regions contribute to the market's overall expansion and diversification.

COVID-19 Impact Analysis on the Global Ride Sharing Market.

The COVID-19 pandemic significantly impacted the global ride-sharing market, leading to a sharp decline in demand as lockdowns, travel restrictions, and social distancing measures were implemented worldwide. Ride-sharing services experienced reduced passenger numbers as people avoided non-essential travel and shifted to remote work, diminishing the need for daily commutes. Health and safety concerns also led to increased scrutiny of ride-sharing services, with passengers and drivers alike worried about the risk of virus transmission in confined vehicle spaces. In response, ride-sharing companies had to rapidly adapt by implementing enhanced sanitation protocols, offering protective equipment, and developing contactless payment options to reassure users. Additionally, some companies diversified their services, pivoting to delivery solutions for groceries and essential goods to offset losses from decreased passenger rides. Despite these challenges, the pandemic accelerated the adoption of digital and contactless technologies within the industry, paving the way for future innovations in safety and convenience. As vaccination rates increase and restrictions ease, the ride-sharing market is gradually recovering, with a renewed focus on health standards and flexible mobility options. This period of disruption has underscored the importance of adaptability and resilience in the face of global crises, positioning the industry for a more robust and responsive future.

Latest trends / Developments:

The global ride-sharing market is currently experiencing several noteworthy trends and developments that are shaping its future. One significant trend is the integration of electric vehicles (EVs) into ride-sharing fleets. Companies like Uber and Lyft have announced ambitious plans to transition to fully electric fleets within the next decade, driven by increasing environmental awareness and supportive government policies. Another development is the rise of subscription-based models, where users pay a monthly fee for unlimited rides, providing greater predictability and convenience for frequent riders. Additionally, advancements in artificial intelligence (AI) and machine learning are enhancing the efficiency of ride-sharing platforms, optimizing route planning, and improving the accuracy of estimated arrival times. The growth of multi-modal transportation solutions is also notable, with ride-sharing apps increasingly offering seamless integration with other forms of urban mobility, such as bike-sharing, scooters, and public transit, to provide comprehensive travel options. Moreover, safety and hygiene have become top priorities post-pandemic, leading to the implementation of stricter sanitation protocols and the development of features like in-app health checks. As these trends and developments continue to evolve, they are expected to drive the growth and transformation of the ride-sharing market, catering to the changing needs and preferences of users worldwide.

Key Players:

-

Uber Technologies Inc.

-

Lyft Inc.

-

DiDi Chuxing

-

Grab Holdings Inc.

-

Ola Cabs (ANI Technologies Pvt. Ltd.)

-

BlaBlaCar

-

Bolt (Taxify)

-

Gett Inc.

-

Cabify

-

Via Transportation Inc.

Chapter 1. Ride Sharing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ride Sharing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ride Sharing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ride Sharing Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ride Sharing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ride Sharing Market – By Service Type

6.1 Introduction/Key Findings

6.2 E-hailing

6.3 Car Rental

6.4 Station-Based Mobility

6.5 Y-O-Y Growth trend Analysis By Service Type

6.6 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. Ride Sharing Market – By Vehicle Type

7.1 Introduction/Key Findings

7.2 Economy Cars

7.3 Comfort/Premium Cars

7.4 SUVs and Vans

7.5 Electric Vehicles (EVs)

7.6 Y-O-Y Growth trend Analysis By Vehicle Type

7.7 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 8. Ride Sharing Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Service Type

8.1.3 By Vehicle Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Service Type

8.2.3 By Vehicle Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Service Type

8.3.3 By Vehicle Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Service Type

8.4.3 By Vehicle Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Service Type

8.5.3 By Vehicle Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Ride Sharing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Uber Technologies Inc.

9.2 Lyft Inc.

9.3 DiDi Chuxing

9.4 Grab Holdings Inc.

9.5 Ola Cabs (ANI Technologies Pvt. Ltd.)

9.6 BlaBlaCar

9.7 Bolt (Taxify)

9.8 Gett Inc.

9.9 Cabify

9.10 Via Transportation Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Ride Sharing market is expected to be valued at US$ 38.3 billion.

Through 2030, the Global Ride Sharing market is expected to grow at a CAGR of 5%.

By 2030, the Global Ride Sharing Market is expected to grow to a value of US$ 53.89 billion.

Asia-Pacific is predicted to lead the Global Ride Sharing market.

The Global Ride Sharing Market has segments By service type, vehicle type and Region.