Rice Starch Market Size (2024-2030)

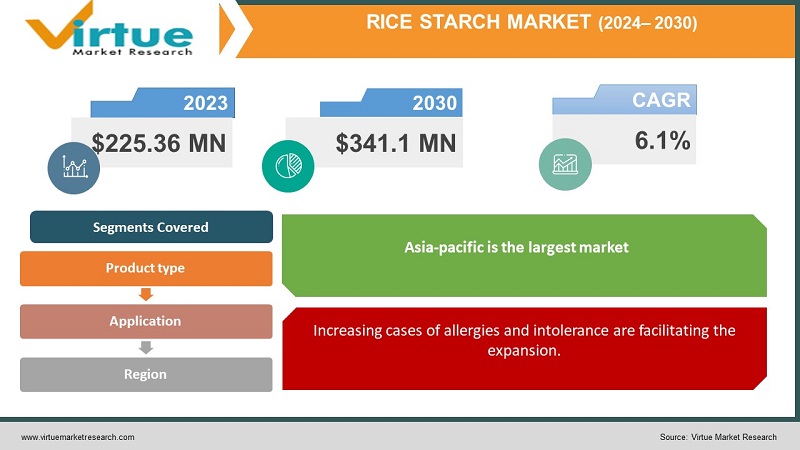

The Rice Starch Market was valued at USD 225.36 Million in 2023 and is projected to reach a market size of USD 341.1 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.1%.

The rice starch market is projected to rise steadily in the coming years, driven by a wave of health-conscious consumers and innovative applications. As people increasingly seek gluten-free and natural ingredients, rice starch emerges as a versatile option. Its naturally gluten-free nature caters to individuals with celiac disease or gluten sensitivity, while its perceived health benefits make it a preferred alternative to corn or potato starch. Beyond catering to dietary needs, rice starch finds uses in various industries. In the food and beverage sector, it adds thickening and texturizing properties to gluten-free bread, pasta, and desserts. Pharmaceuticals leverage its hypoallergenic nature for capsules and coatings. Cosmetics find it valuable for its binding and emollience properties in lotions and makeup. Even industrial applications utilize its adhesive and biodegradable qualities.

Key Market Insights:

The rice starch market offers intriguing opportunities for businesses. Fueled by the health and wellness wave, it sees a surge in gluten-free products like bakery items, pasta, and desserts. Consumers are increasingly aware of allergies and intolerances and find a haven in its hypoallergenic nature, further boosted by its perceived health benefits.

It ventures beyond food, lending its versatility to pharmaceuticals, cosmetics, and even industrial applications. Innovation simmers in improved processing techniques, functional properties like texture and moisture retention, and novel applications constantly bubbling up.

Geographically, Asia, with its rich rice heritage, takes the lead. However, the West isn't far behind, with North America and Europe witnessing their health-driven expansion. Emerging markets with rising incomes and health awareness stand poised for potential growth.

Challenges do exist, like rice price fluctuations impacting production costs and competition from other starches. Organic rice starch also faces supply limitations. But there are many possibilities. Premium products catering to health-conscious consumers, exploring new applications, and emphasizing sustainable practices are just a few ways to tap into the market's promising future.

Rice Starch Market Drivers:

Health and wellness trends are fueling the market.

The gluten-free revolution is a major driver, with individuals seeking alternatives due to celiac disease or gluten sensitivity. Rice starch is a popular option, naturally gluten-free and readily adopted in bread, pasta, and desserts. This trend extends beyond celiac disease, as many consumers perceive rice starch as a healthier choice, further fueling its rise.

Increasing cases of allergies and intolerance are facilitating the expansion.

Concerns about food allergies and intolerances are another powerful driver. Rice starch's hypoallergenic nature makes it a haven for individuals with various allergies, offering a wider range of food options without the risk of reactions. This growing awareness creates a significant market segment for rice starch.

Economic prosperity is accelerating the growth rate.

Rising disposable incomes play a crucial role. As consumers have more spending power, they're willing to invest in premium food and beverage options, often featuring rice starch in gluten-free alternatives. This trend is particularly evident in expanding the middle class across Asia, creating a larger consumer base for these premium products.

Technological advancements are contributing to the success.

Technological advancements are transforming the market. Improved processing methods, including extraction, modification, and refining, create rice starch with enhanced functionality and wider application potential. This opens doors for novel product development in pharmaceuticals, cosmetics, and even bioplastics, pushing the boundaries of rice starch use.

Sustainable initiatives are helping with development.

Sustainability concerns are increasingly important. Rice starch's biodegradability and potential for sustainable production resonate with environmentally conscious consumers, giving it a significant market advantage. Additionally, integrating rice starch waste into the circular economy can further enhance its sustainability appeal, attracting eco-conscious consumers and businesses.

Rice Starch Market Restraints and Challenges:

Price fluctuations can cause hindrances.

Rice, the primary raw material, is subject to volatile price swings due to weather conditions, government policies, and global trade dynamics. These fluctuations impact production costs and profit margins for rice starch manufacturers, creating uncertainty and instability in the market.

Competition from established alternatives is a major issue.

Rice starch faces stiff competition from well-entrenched alternatives like corn and potato starch. These competitors often have lower production costs and established supply chains, making them attractive options for price-sensitive consumers and manufacturers.

Limited organic supply can be another concern.

The demand for organic rice starch is growing rapidly, driven by the increasing popularity of organic food products. However, the supply of organic rice struggles to keep pace with this demand, leading to availability constraints and potentially hindering market expansion in this segment.

Rice Starch Market Opportunities:

While challenges exist, the rice starch market brims with exciting opportunities. Health-conscious consumers crave premium products like gluten-free bakery items or organic cosmetics, offering a lucrative market for innovative rice starch solutions. Beyond food, exploring novel applications in pharmaceuticals, cosmetics, and bioplastics opens doors to vast untapped potential.

Sustainability is key, and rice starch is in demand due to its biodegradable nature and potential for eco-friendly production. Emphasizing these aspects and integrating waste into the circular economy attracts environmentally conscious consumers. Emerging economies with rising incomes present fertile ground for market expansion, requiring tailored products and marketing strategies.

Collaboration unlocks further possibilities. Partnering with farmers, researchers, and retailers fosters innovation, ensures a stable supply chain, and facilitates effective distribution. Digitalization plays a crucial role in reaching customers, understanding their preferences, and guiding product development and marketing efforts.

RICE STARCH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BENEO GmbH, Ingredion Incorporated, AGRANA Beteiligungs-AG, Bangkok Starch Industrial Co., Ltd., Thai Flour Industry Co., Ltd., Herba Ingredients BV., Sanofi, Trulux Pty Ltd., Safimex Jsc. |

Rice Starch Market Segmentation: By Product Type

-

Food-grade Rice Starch

-

Industrial-grade Rice Starch

The most dominant segment in the rice starch market by type is food-grade rice starch, which accounts for the largest share due to its extensive use in gluten-free bakery items, pasta, sauces, and various other food applications. However, the fastest-growing segment is industrial-grade rice starch. Rice grains are used to make a fine white powder known as industrial-grade rice starch. It is utilized in a wide range of sectors, including textiles, cosmetics, medicines, and food & drink. Numerous food products, including infant meals, baked goods, confectionary coatings, dairy products, and organic food items, include rice starch. Cereals, cereal bars, and soups also include it.

Rice Starch Market Segmentation: By Application

-

Food and Beverages

-

Pharmaceuticals

-

Cosmetics

-

Industrial

Among the application sectors of rice starch, food and beverage is the largest growing segment. In this business, rice starch is frequently used to thicken, stabilize, and texturize a variety of culinary items, including sauces, soups, and baked goods. It is a well-liked ingredient because of its capacity to improve the texture and overall sensory experience of meals. It is also GMO-free, gluten-free, and allergy-free. Because it can be produced with a wide variety of amylose/amylopectin ratios, resulting in pastes with varying textures, it is also widely utilized in frozen goods. However, the pharmaceuticals segment is experiencing the fastest growth. The benefits of using pharmaceutical-grade rice starch in the production of drugs include better tablet hardness, better disintegration, and superior flow characteristics. The pharmaceutical sector is anticipated to embrace pharmaceutical-grade rice starch as a result of these considerations.

Rice Starch Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region holds a dominant position in the rice-starch market. This stems from its deep-rooted tradition of rice production and consumption, particularly in countries like China, India, and Southeast Asia. The abundance of raw materials coupled with established processing techniques makes rice starch a readily available and cost-effective ingredient. As disposable incomes rise in the region, further market expansion is anticipated, offering immense potential for businesses looking to tap into a familiar and growing consumer base.

North America is the fastest-growing market, driven by a wave of health-conscious consumers and the rising demand for gluten-free products. With growing awareness of celiac disease and gluten sensitivity, individuals readily adopt rice starch as a safe and versatile alternative. This trend translates into a willingness to pay a premium for gluten-free bakery items, pasta, and desserts made with rice starch, creating a lucrative market for businesses catering to this health-conscious segment.

The European market reflects similar trends to North America, with rising health awareness and a growing demand for gluten-free options. However, stricter regulations here influence product development and market dynamics. This focus on sustainability resonates strongly with European consumers, creating opportunities for rice starch solutions that emphasize eco-friendly practices and responsible sourcing. By catering to this environmentally conscious segment and navigating the regulatory landscape effectively, businesses can find success in this discerning market.

While currently having the smallest market share, the Middle East and Africa region holds the potential for significant future growth. Rising incomes and urbanization are creating fertile ground for exploring new markets and consumer segments. Understanding local dietary preferences and cultural nuances is key for businesses seeking to tap into this potential. Adapting products and marketing strategies to resonate with the unique characteristics of this region can unlock exciting opportunities for future expansion.

COVID-19 Impact Analysis on the Rice Starch Market:

The outbreak of the virus had a mixed impact on the market. Lockdowns and restrictions disrupted rice production and transport, leading to temporary supply shortages and price fluctuations, impacting costs and profitability. Consumers prioritizing essentials over premium options could potentially reduce demand for certain rice starch products. Additionally, the closure of restaurants and cafes decreased bulk rice starch use in food service. However, a silver lining emerged, with home cooking taking center stage. Demand for gluten-free and healthy alternatives, like baking mixes and pasta made with rice starch, potentially saw a rise. The e-commerce boom provided new distribution channels, mitigating physical store limitations. Moreover, the pandemic's health focus could potentially increase interest in natural and organic rice starch options, a trend that could benefit the market in the long run. The overall impact remains complex, varying across segments and products. While some, like gluten-free bakery items, might have thrived, others faced temporary setbacks. As economies recover, the market is expected to regain momentum, driven by pre-existing health and gluten-free trends.

Latest Trends/ Developments:

The rice starch market simmers with exciting trends and developments. Sustainability is being emphasized, with businesses integrating circular economy practices and exploring biodegradable applications like bioplastic packaging. Innovation heats up, driven by nanotechnology advancements and tailored functional modifications. Health and wellness remain key, with organic and clean-label options gaining traction, and rice starch finding new roles in prebiotics and functional foods.

Expansion beckons, with South America and Africa offering fertile ground for tailored products and marketing strategies. E-commerce and digitalization fuel growth by reaching wider audiences and personalizing marketing efforts. Collaboration is key, with partnerships across the value chain and open innovation fostering innovation, ensuring a stable supply, and facilitating effective distribution.

Key Players:

-

BENEO GmbH

-

Ingredion Incorporated

-

AGRANA Beteiligungs-AG

-

Bangkok Starch Industrial Co., Ltd.

-

Thai Flour Industry Co., Ltd.

-

Herba Ingredients BV.

-

Sanofi

-

Trulux Pty Ltd.

-

Safimex Jsc.

Chapter 1. Rice Starch Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Rice Starch Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Rice Starch Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Rice Starch Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Rice Starch Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Rice Starch Market – By Product Type

6.1 Introduction/Key Findings

6.2 Food-grade Rice Starch

6.3 Industrial-grade Rice Starch

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Rice Starch Market – By Application

7.1 Introduction/Key Findings

7.2 Food and Beverages

7.3 Pharmaceuticals

7.4 Cosmetics

7.5 Industrial

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Rice Starch Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Rice Starch Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BENEO GmbH

9.2 Ingredion Incorporated

9.3 AGRANA Beteiligungs-AG

9.4 Bangkok Starch Industrial Co., Ltd.

9.5 Thai Flour Industry Co., Ltd.

9.6 Herba Ingredients BV.

9.7 Sanofi

9.8 Trulux Pty Ltd.

9.9 Safimex Jsc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Rice Starch Market was valued at USD 225.36 Million in 2023 and is projected to reach a market size of USD 341.1 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.1%.

Health and wellness trends, increasing cases of allergies and intolerance, economic prosperity, technological advancements, and sustainable initiatives are the main drivers.

Based on application, the market is segmented into food and beverages, pharmaceuticals, cosmetics, and industrial.

The most dominant region for the rice starch market is Asia-Pacific, fueled by high rice production and consumption, especially in China, India, and Southeast Asia.

BENEO GmbH, Ingredion Incorporated, AGRANA Beteiligungs-AG, Bangkok Starch Industrial Co., Ltd., Thai Flour Industry Co., Ltd., Herba Ingredients BV., Sanofi, Trulux Pty Ltd., and Safimex Jsc. are the major players.