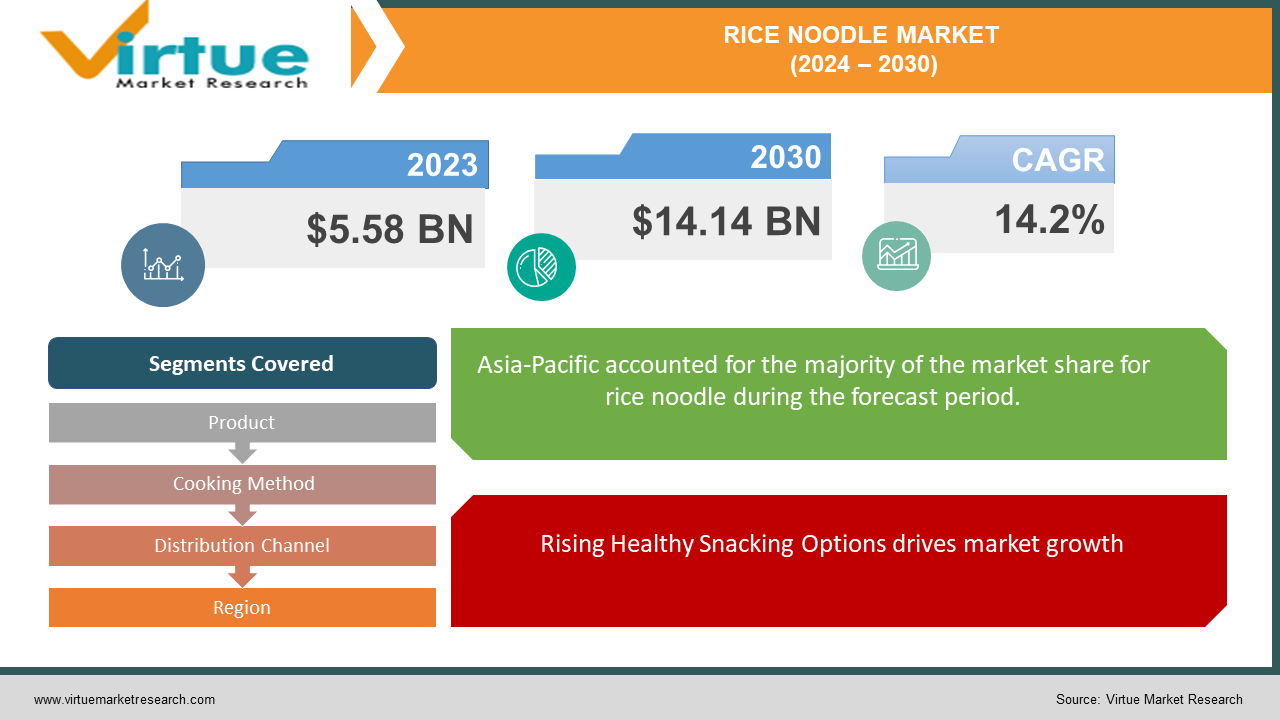

Rice Noodle Market Size (2024 – 2030)

The Rice Noodle Market was valued at USD 5.58 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 14.14 billion by 2030, growing at a CAGR of 14.2%.

Rice noodles, also known simply as rice noodles, comprise rice flour and water as their primary constituents. Occasionally, additional ingredients such as tapioca or cornstarch are incorporated to enhance translucency or augment the gelatinous and chewy consistency of the noodles. Predominantly featured in the culinary traditions of China, India, and Southeast Asia, rice noodles are accessible in fresh, frozen, or dried forms, presenting diverse shapes, thicknesses, and textures. Fresh variants, however, exhibit high perishability, often with a limited shelf life spanning just a few days. Their adaptability allows for harmonious integration with an array of ingredients, spices, and sauces, bolstering their culinary acclaim. Notably, their gluten-free nature, owing to the absence of wheat flour, constitutes a substantial advantage, rendering them suitable for individuals with gluten intolerance and celiac disease. Moreover, rice noodles offer a health-conscious substitute for conventional yellow egg noodles, thus appealing particularly to vegans and vegetarians.

Key Market Insights:

The burgeoning appreciation for Asian cuisine significantly contributes to the market's expansion. Rice noodles have garnered considerable acclaim on international fronts. Their availability in diverse shapes, along with commendable texture attributes in fresh, frozen, and dried forms, caters to individuals across diverse age groups and ethnic backgrounds.

Rice Noodle Market Drivers:

Rising Healthy Snacking Options drives market growth

The burgeoning global workforce, characterized by fast-paced lifestyles and packed agendas, is driving the surge in demand for convenient, gluten-free meals and snacks. In response, numerous enterprises are launching gluten-free offerings, including rice noodles, expanding beyond traditional bakery fare like biscuits, pastries, pasta, and cakes. Moreover, the escalating purchasing power of consumers, coupled with the expanding accessibility of products through online platforms, is expected to bolster the outlook of the rice noodles market in the foreseeable future.

Increasing government policies drives market growth.

Anticipated government policies and incentives, alongside favorable regulations, are poised to propel the expansion of the rice noodle market in the near term. As consumers' disposable income escalates, bolstered by enhanced spending power, the market is primed to thrive with rice noodles. A notable driver of market growth is its inherent gluten-free nature, owing to the absence of wheat flour, rendering it ideal for individuals grappling with gluten intolerance and celiac disease.

Rice Noodle Market Restraints and Challenges:

The frequent and substantial consumption of noodles is perceived as inefficient, attributed to their preparation techniques involving excessive preservatives, artificial colors, and flavorings. This is anticipated to restrain the rapid growth of the instant noodles market. Furthermore, the deficiency of essential nutrients within noodles may impede market expansion.

Rice Noodle Market Opportunities:

In recent years, the rice noodle industry has witnessed remarkable growth, a trend projected to persist in the foreseeable future. This trajectory is propelled by heightened investments in research and development endeavors, the influx of new market entrants, continuous product innovation, technological advancements, efficient resource utilization, and intensified competition driving expansion across regional markets and customer demographics.

RICE NOODLE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.2% |

|

Segments Covered |

By Product, Cooking Method, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Acecook Vietnam, Campbell Soup Company, Nissin Foods, AKASH YOG HEALTH PRODUCTS PVT. LTD., Leong Guan Food Manufacturer, YUMMY NOODLES, Thaitan Foods International, Maruchan Ajinomoto India Private Limited, Jiangxi Golden Agriculture Biotech , Thai Preserved Food Factory |

Rice Noodle Market Segmentation: By Product

-

Vermicelli

-

Stick

-

Wide

-

Others

Rice stick noodles have dominated the market, commanding the highest revenue share. Renowned for their adaptability, these noodles are tailored to suit regional palates across various countries. They serve as key ingredients in a plethora of dishes, including Ka Teu, char kway teow, Mohinga, Pancit Bihon, Bihun, Khao Poon, Asam Laksa, Khao Soi, and Bánh cuốn. Additionally, brown rice-derived products have gained popularity for their perceived health benefits, owing to the inclusion of rice bran and germ, enhancing the nutritional value of the noodles.

Conversely, the vermicelli rice noodles segment is poised to witness the swiftest Compound Annual Growth Rate (CAGR). Renowned for their delicate texture, vermicelli noodles are favored for their quick cooking properties, often featuring stir-fries, salads, and soups. They hold a prominent place as a breakfast staple in numerous Chinese provinces. Moreover, there is a burgeoning trend towards blended rice vermicelli noodles, incorporating a mixture of rice and other grains. These offerings boast a healthier nutrient profile and are esteemed for their digestive benefits.

Rice Noodle Market Segmentation: By Cooking Method

-

Instant

-

Conventional

Traditional rice noodles have secured the largest market share. Their versatility allows for the incorporation of a diverse array of ingredients, affording flexibility in shaping the taste and flavor profile of dishes. Given their simplistic preparation method involving drying or freezing, these noodles typically contain minimal to no preservatives, rendering them suitable for regular consumption without adverse health effects.

In contrast, the instant noodles segment is anticipated to witness rapid growth in the forecast period. Tailored to accommodate fast-paced lifestyles, instant noodles offer convenience as they can be swiftly prepared and consumed on the go, with many requiring less than 5 minutes for preparation. Manufacturers have been investing in Research and Development to engineer healthier iterations of these products, free from artificial additives. Available in a myriad of flavors, instant noodles present consumers with a wide range of alternatives to suit their preferences.

Rice Noodle Market Segmentation: By Distribution Channel

-

Hypermarkets and Supermarkets

-

Convenience Stores

-

Online Sale

-

Direct to Consumer (D2C)

Hypermarkets and supermarkets have captured the largest revenue share in the market. The availability of rice noodles in these establishments is propelled by the growing population of Asian immigrants worldwide. Given that rice noodles are a dietary staple in many Asian cultures, their consumption remains substantial. The essential nature of these products renders them suitable for inclusion in the inventory of all hypermarkets and supermarkets.

Conversely, the online segment is poised for the most rapid growth in the forecast period. This surge is attributed to the heightened reliance on online platforms during the COVID-19 pandemic, necessitating social distancing measures. Additionally, online platforms offer a plethora of options without the need for extensive travel between physical stores, catering to the evolving preferences of consumers.

Rice Noodle Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region commands the largest share of the global rice noodle market. With significant consumer bases in countries like Japan, China, and Indonesia, among others, coupled with increasing awareness about the benefits of rice noodles in other regions, the Asia-Pacific market is poised for robust growth.

In contrast, North America is forecasted to experience the most rapid growth rate. This expansion is propelled by the proliferation of Asian restaurants and the migration of Asian populations to countries such as Canada, the United States, and Mexico. Moreover, the appeal of instant rice noodles is attracting many Americans, offering a convenient dietary option due to its ease of preparation.

COVID-19 Pandemic: Impact Analysis

The enduring preference for products made from natural ingredients, catalyzed by factors such as the COVID-19 pandemic, has spurred a significant upsurge in the global market. This surge offers substantial growth prospects for the rice noodles market segment on a global scale, especially within the domain of functional foods and beverages. As a result, the industry heavily depends on seasonal labor, a substantial portion of which comprises migrant workers. The emergence of the COVID-19 pandemic has profoundly affected these workers, potentially subjecting them to heightened health risks. For instance, substandard temporary housing arrangements and difficulties in adhering to social distancing guidelines may amplify health hazards among this workforce.

Latest Trends/ Developments:

-

In March 2024, Lotus Foods, a prominent purveyor of heirloom and organic rice, expanded its Organic Asian Rice Noodle Line by introducing two upgraded variations of Pad Thai Rice Noodles, available in both traditional and brown rice options.

-

In September 2023, Asia Rice Noodles inaugurated a new fast-casual Chinese eatery in Greenpoint, joining the burgeoning array of casual Asian dining options in North Brooklyn, alongside popular establishments like Milu, Nan Xiang Express, and Oh Dumplings. Concurrently, numerous rice noodle brands are innovating with flavors and seasonings to meet the evolving preferences of consumers.

-

Additionally, in August 2023, Ten Seconds Yunnan Rice Noodle debuted a new outlet at Pearlridge Center in Hawaii. Their noodle menu boasts a diverse selection of offerings, including golden hot and sour soup, pork bone soup, vegetarian tomato soup, Szechuan mala spicy soup, and more. Notably, these noodles are crafted from rice flour, ensuring they are gluten-free.

Key Players:

These are the top 10 players in the Rice Noodle Market: -

-

Acecook Vietnam

-

Campbell Soup Company

-

Nissin Foods,

-

AKASH YOG HEALTH PRODUCTS PVT. LTD.

-

Leong Guan Food Manufacturer

-

YUMMY NOODLES

-

Thaitan Foods International

-

Maruchan Ajinomoto India Private Limited

-

Jiangxi Golden Agriculture Biotech

-

Thai Preserved Food Factory

Chapter 1. Rice Noodle Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Rice Noodle Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Rice Noodle Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Rice Noodle Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Rice Noodle Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Rice Noodle Market – By Product

6.1 Introduction/Key Findings

6.2 Vermicelli

6.3 Stick

6.4 Wide

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Rice Noodle Market – By Cooking Method

7.1 Introduction/Key Findings

7.2 Instant

7.3 Conventional

7.4 Y-O-Y Growth trend Analysis By Cooking Method

7.5 Absolute $ Opportunity Analysis By Cooking Method, 2024-2030

Chapter 8. Rice Noodle Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Hypermarkets and Supermarkets

8.3 Convenience Stores

8.4 Online Sale

8.5 Direct to Consumer (D2C)

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Rice Noodle Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Cooking Method

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Cooking Method

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Cooking Method

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Cooking Method

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Cooking Method

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Rice Noodle Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Acecook Vietnam

10.2 Campbell Soup Company

10.3 Nissin Foods,

10.4 AKASH YOG HEALTH PRODUCTS PVT. LTD.

10.5 Leong Guan Food Manufacturer

10.6 YUMMY NOODLES

10.7 Thaitan Foods International

10.8 Maruchan Ajinomoto India Private Limited

10.9 Jiangxi Golden Agriculture Biotech

10.10 Thai Preserved Food Factory

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The burgeoning global workforce, characterized by fast-paced lifestyles and packed agendas, is driving the surge in demand for convenient, gluten-free meals and snacks. In response, numerous enterprises are launching gluten-free offerings, including rice noodles, expanding beyond traditional bakery fare like biscuits, pastries, pasta, and cakes.

The top players operating in the Rice Noodle Market are - Acecook Vietnam, Campbell Soup Company, Nissin Foods, AKASH YOG HEALTH PRODUCTS PVT. LTD., Leong Guan Food Manufacturer, YUMMY NOODLES, Thaitan Foods International, Maruchan Ajinomoto India Private Limited, Jiangxi Golden Agriculture Biotech, Thai Preserved Food Factory.

The enduring preference for products made from natural ingredients, catalyzed by factors such as the COVID-19 pandemic, has spurred a significant upsurge in the global market. This surge offers substantial growth prospects for the rice noodles market segment on a global scale, especially within the domain of functional foods and beverages.

This trajectory is propelled by heightened investments in research and development endeavors, the influx of new market entrants, continuous product innovation, technological advancements, efficient resource utilization, and intensified competition driving expansion across regional markets and customer demographics.

North America is forecasted to experience the most rapid growth rate. This expansion is propelled by the proliferation of Asian restaurants and the migration of Asian populations to countries such as Canada, the United States, and Mexico. Moreover, the appeal of instant rice noodles is attracting many Americans, offering a convenient dietary option due to its ease of preparation.