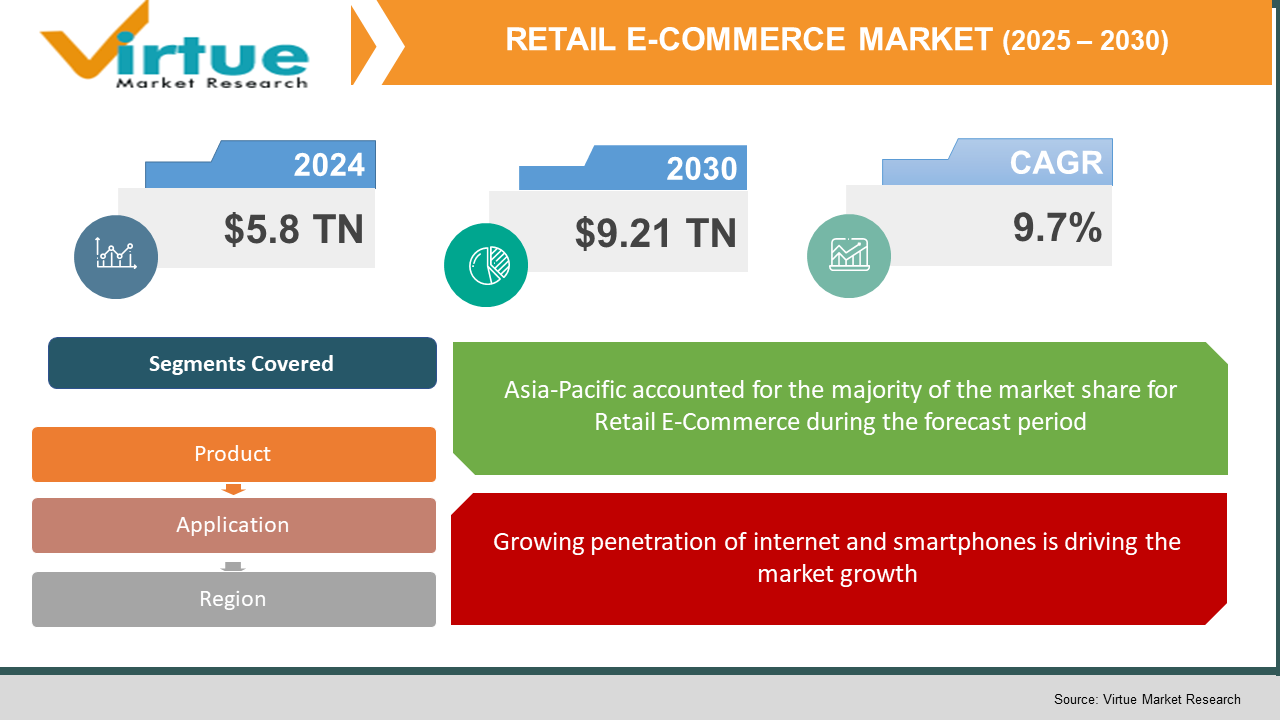

Retail E-Commerce Market size (2025-2030)

The Global Retail E-Commerce Market was valued at USD 5.8 trillion in 2024 and will grow at a CAGR of 9.7% from 2025 to 2030. The market is expected to reach USD 9.21 trillion by 2030.

The Retail E-Commerce Market refers to the digital commerce segment where businesses and consumers buy and sell products over the internet through online platforms. This market includes both business-to-consumer (B2C) and consumer-to-consumer (C2C) transactions, covering a wide range of product categories like electronics, fashion, home goods, beauty products, and more. The rapid expansion of this market has been fueled by increasing internet penetration, widespread adoption of smartphones, improved logistics infrastructure, and the proliferation of digital payment methods. Additionally, the market benefits from shifting consumer preferences towards convenience, variety, and competitive pricing available through online platforms. Personalized marketing, data-driven decision-making, and artificial intelligence integration are playing a pivotal role in optimizing customer experience and boosting conversion rates. As e-commerce platforms evolve, incorporating features like live commerce, social commerce, and augmented reality, the market is likely to witness accelerated growth across both developed and emerging economies. The ongoing digital transformation of the retail sector, supported by increased investor interest, is expected to reinforce the long-term viability of the Retail E-Commerce Market, making it one of the most dynamic and competitive sectors in the global economy.

Key market insights:

The fashion and apparel segment held 28% of the total market share in 2024, driven by rising fast fashion trends and influencer marketing.

Mobile commerce (m-commerce) contributed to 54% of global retail e-commerce sales in 2024 due to the growing use of smartphones for shopping.

North America and Asia-Pacific together accounted for over 65% of total e-commerce revenue in 2024, owing to advanced digital infrastructure and high consumer spending.

Online grocery sales grew by 21% year-over-year in 2024, fueled by convenience-seeking urban households and improvements in last-mile delivery.

Cross-border e-commerce transactions increased by 17% in 2024, as consumers sought international brands and better product variety.

Small and medium-sized enterprises (SMEs) made up nearly 38% of sellers on major platforms like Amazon, Alibaba, and Flipkart in 2024.

AI-powered recommendation engines improved average order values by 12% in 2024 across leading e-commerce platforms.

The average cart abandonment rate in 2024 remained at 68%, prompting platforms to invest in better UX design and remarketing strategies.

Global Retail E-Commerce Market Drivers

Growing penetration of internet and smartphones is driving the market growth

One of the primary forces driving the global retail e-commerce market is the widespread availability and affordability of internet services and smartphones. In recent years, there has been a notable increase in global internet penetration, especially in emerging economies across Asia, Africa, and Latin America. Alongside this, smartphones have become significantly more accessible, both in terms of pricing and distribution. As consumers gain access to reliable internet connections and mobile devices, they are increasingly turning to online platforms for their retail needs. This has particularly resonated with younger, tech-savvy demographics that prioritize convenience, speed, and user experience. Mobile-friendly websites and dedicated apps have further simplified the online shopping process, allowing users to browse, compare, and purchase items with just a few taps. Additionally, the growing availability of digital wallets and mobile payment options has streamlined the checkout process, reducing friction and encouraging repeat purchases. The synergy between internet access and smartphone usage has been instrumental in bringing rural and underserved populations into the e-commerce fold, significantly expanding the addressable market. Over the 2025 to 2030 forecast period, this trend is expected to continue as telecom infrastructure improves, 5G networks become more prevalent, and smartphone technology advances, further bridging the digital divide and creating a robust foundation for the expansion of retail e-commerce worldwide.

Shift in consumer behavior and preference is driving the market growth

The evolution of consumer behavior and preferences has become a pivotal driver for the retail e-commerce market. Shoppers across the globe are increasingly prioritizing convenience, variety, and personalized experiences over traditional in-store retail. This change has been influenced by factors such as urbanization, busier lifestyles, and technological familiarity. Online shopping offers consumers the ability to browse thousands of products from various categories, compare prices instantly, read customer reviews, and have products delivered directly to their doorstep, all without leaving their homes. These advantages have created a paradigm shift in purchasing behavior. Moreover, the personalization capabilities of e-commerce platforms, enabled through artificial intelligence and data analytics, allow retailers to tailor product recommendations, promotional offers, and content according to individual preferences. Another factor contributing to this shift is the growing trust in online transactions, supported by secure payment gateways, easy return policies, and transparent customer service. Additionally, the rise of social commerce—where consumers shop directly through social media platforms—has blurred the lines between content consumption and purchasing, making online shopping a more integrated and engaging experience. As these behavioral trends deepen, they will continue to stimulate growth and shape the future of the retail e-commerce ecosystem during the forecast period.

Advancements in logistics and supply chain systems is driving the market growth

Logistics and supply chain improvements have significantly bolstered the retail e-commerce market by addressing one of its core challenges: the timely and cost-effective delivery of goods. Initially, long delivery times and unreliable service deterred many consumers from online shopping. However, with the development of advanced warehousing strategies, real-time inventory management, last-mile delivery innovations, and integrated logistics platforms, e-commerce players are now able to meet rising consumer expectations for speed and reliability. Companies are investing in regional fulfillment centers, automated sorting systems, and drone or electric vehicle deliveries to reduce delivery times and costs. Some platforms have introduced same-day or next-day delivery as a standard feature, especially in urban areas, thereby improving customer satisfaction. Additionally, the integration of AI and machine learning in demand forecasting, route optimization, and resource planning has streamlined the entire supply chain process. Returns management, another key logistical component, has also improved through the implementation of easy pickup and replacement systems, enhancing the overall customer experience. Third-party logistics providers (3PLs) and partnerships with local courier networks have also helped smaller sellers expand their geographic reach. Over the 2025 to 2030 period, these logistical advancements will continue to play a critical role in supporting the scalability and efficiency of e-commerce operations, particularly as global order volumes increase and customer expectations evolve further.

Global Retail E-Commerce Market Challenges and Restraints

Cybersecurity and data privacy issues is restricting the market growth

As the retail e-commerce sector becomes increasingly reliant on data-driven operations, cybersecurity and privacy concerns have become prominent challenges. This makes them lucrative targets for cybercriminals, who employ tactics such as phishing attacks, data breaches, and ransomware to exploit vulnerabilities. The introduction of stringent data privacy regulations such as the General Data Protection Regulation (GDPR) in Europe and other regional frameworks has made compliance more complex and resource-intensive. Smaller e-commerce players, in particular, may find it difficult to implement and maintain robust security protocols due to limited technical expertise or budget constraints. Additionally, evolving cyber threats require constant monitoring, threat intelligence, and regular security updates, adding operational burden. The increasing use of third-party integrations, plugins, and APIs also introduces new vulnerabilities into e-commerce systems. Despite growing investments in firewalls, encryption, and multi-factor authentication, the risk of data compromise remains significant. As the industry grows, companies must proactively prioritize cybersecurity infrastructure and implement transparent data practices to ensure long-term consumer confidence and regulatory compliance.

Rising competition and customer acquisition costs is restricting the market growth

The rapid expansion of the retail e-commerce market has attracted a multitude of players, both large and small, intensifying competition and significantly raising customer acquisition costs. As new businesses flood the market, especially through platforms like Shopify or Amazon, it becomes increasingly difficult for brands to differentiate themselves and secure customer loyalty. Paid advertising on platforms like Google and social media has become more expensive due to auction-based pricing and high demand, thereby increasing the cost per acquisition (CPA) for each new customer. In addition, consumers today have access to multiple choices and tend to compare products across various platforms before making a decision, which further dilutes brand visibility. This forces e-commerce companies to invest heavily in search engine optimization (SEO), influencer partnerships, promotional discounts, and loyalty programs just to remain competitive. Even with these efforts, customer retention remains challenging due to the availability of alternative sellers offering similar products at competitive prices. Smaller brands may struggle to sustain high marketing expenses without compromising profit margins, while large players often dominate search results and marketplace rankings through budget leverage and advanced analytics. Over the forecast period, this challenge is expected to persist, requiring retailers to find more sustainable, organic ways of engaging and retaining customers through content, community-building, and enhanced customer experiences.

Market Opportunities

The global retail e-commerce market presents a wide array of growth opportunities driven by evolving technologies, demographic shifts, and expanding geographic reach. One of the most promising areas lies in the continued digitization of small and medium-sized businesses, especially in emerging markets. Governments and international organizations are increasingly offering digital literacy programs, subsidies, and infrastructure improvements that help local vendors establish online storefronts. This digital inclusion not only benefits the vendors but also broadens the product variety and price competitiveness for consumers. Another significant opportunity exists in personalization and artificial intelligence. By leveraging AI, retailers can deliver highly customized experiences, automate customer support, and optimize inventory management, leading to higher conversion rates and improved margins. The integration of immersive technologies such as augmented reality (AR) and virtual reality (VR) also opens up new possibilities in product demonstration and customer engagement, particularly in fashion, furniture, and automotive retail. Social commerce continues to emerge as a powerful channel, allowing retailers to tap into influencer communities and real-time engagement to drive sales. Voice-assisted shopping through smart speakers and IoT devices is another innovation shaping future purchasing behavior. Additionally, the continued expansion of mobile payments and fintech innovations, particularly in unbanked regions, ensures that previously underserved populations can now participate in e-commerce activities. Cross-border trade also offers a lucrative opportunity as platforms invest in localization, currency conversion, and international logistics to facilitate global shopping experiences. Lastly, sustainability-focused consumers are creating demand for eco-friendly packaging, ethical sourcing, and carbon-neutral delivery options, allowing brands to differentiate themselves and build loyalty. Collectively, these opportunities point to a robust and adaptable retail e-commerce market that is well-positioned for long-term growth from 2025 to 2030.

RETAIL E-COMMERCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.7% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amazon, Alibaba, Walmart, JD.com, and eBay. |

Retail E-Commerce Market Segmentation

Retail E-Commerce Market segmentation By Product:

• Electronics and Media

• Fashion and Apparel

• Beauty and Personal Care

• Food and Groceries

• Furniture and Home Decor

• Toys, DIY, and Hobbies

• Others

Fashion and apparel emerged as the most dominant segment in 2024 and are expected to retain their leading position through 2030. The segment benefits from a combination of visual appeal, fast product turnover, and consumer preference for browsing and comparing styles online. E-commerce platforms enable users to explore thousands of clothing items, accessories, and footwear options from both global and local brands. The ability to access size guides, read reviews, and take advantage of flexible return policies further enhances the online shopping experience for fashion products. Seasonal sales, influencer promotions, and personalized recommendations also drive higher engagement and purchase frequency. These factors collectively make fashion a top-performing e-commerce category globally.

Retail E-Commerce Market segmentation By Application:

• Business-to-Consumer (B2C)

• Business-to-Business (B2B)

• Consumer-to-Consumer (C2C)

The Business-to-Consumer (B2C) segment is the largest application segment in the retail e-commerce market and will continue to dominate through 2030. It encompasses direct transactions between online retailers and individual consumers across a wide range of product categories. The B2C model benefits from user-friendly interfaces, targeted advertising, and extensive use of mobile apps, which have revolutionized the shopping experience. Consumers are drawn to the convenience, product variety, competitive pricing, and home delivery features offered by B2C platforms. Additionally, personalization technologies and secure payment methods contribute to growing consumer trust and repeat purchases. The segment's scalability and adaptability to new trends make it a cornerstone of the e-commerce landscape.

Retail E-Commerce Market Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific is the dominant region in the global retail e-commerce market and is anticipated to maintain its leadership through 2030. The region’s dominance can be attributed to its vast and digitally engaged population, rising disposable income, and strong mobile internet penetration. Countries like China, India, South Korea, and Indonesia have shown tremendous growth in online retail activity, supported by well-established e-commerce platforms and favorable government policies. China alone accounts for a significant portion of global e-commerce sales, driven by platforms like Alibaba and JD.com, which offer seamless shopping experiences, robust logistics networks, and innovative features like livestream shopping. India is witnessing similar momentum, with increasing rural internet adoption and the rise of vernacular content drawing millions of new users into the e-commerce ecosystem. Moreover, the region has embraced digital payment systems and fintech solutions at a rapid pace, enabling secure and instant transactions. Cultural factors such as high consumer responsiveness to discounts, festival-based shopping, and loyalty programs also enhance e-commerce traction in the region. Additionally, Asia-Pacific continues to be a hotspot for venture capital investment in retail tech startups, further driving innovation and competition. As internet infrastructure improves and more businesses transition online, the region will remain a focal point of growth and innovation in the retail e-commerce sector.

COVID-19 Impact Analysis on the Retail E-Commerce Market

The COVID-19 pandemic had a profound and transformative effect on the global retail e-commerce market. As lockdowns, mobility restrictions, and social distancing measures were implemented across the globe, consumers increasingly turned to online platforms for their shopping needs. This shift accelerated digital adoption, pushing both consumers and retailers to adapt rapidly to e-commerce environments. Essential categories such as groceries, health products, and home supplies experienced unprecedented surges in online demand, leading to temporary stockouts and fulfillment delays. At the same time, non-essential categories like fashion and luxury goods initially faced slowdowns but recovered quickly as consumers adjusted to remote work and lifestyle changes. The pandemic forced many brick-and-mortar retailers to establish or enhance their online presence, thereby expanding the overall market base. Logistics providers adapted by increasing last-mile delivery capacity, introducing contactless delivery, and investing in health safety protocols. Payment methods also saw a transition, with contactless and digital wallet usage rising sharply due to hygiene concerns. The crisis highlighted the importance of supply chain resilience and digital infrastructure, prompting retailers to invest in technology and automation. Moreover, consumer expectations for speed, transparency, and flexibility were reshaped during this period. As a result, even post-pandemic, many of the changes in consumer behavior, such as frequent online shopping and comfort with digital payments, have persisted. The pandemic served as a catalyst, advancing the growth of the retail e-commerce market by several years and reinforcing the channel’s importance as a permanent and essential component of the global retail landscape.

Latest trends/Developments

The retail e-commerce market is currently witnessing a wave of innovative trends and technological developments that are reshaping the way businesses interact with consumers. One of the most notable trends is the rise of social commerce, where platforms like Instagram, TikTok, and Facebook integrate shopping capabilities directly within social feeds, enabling seamless transitions from content to purchase. This method leverages influencer marketing and visual storytelling to drive conversions. Another significant development is the growing use of artificial intelligence and machine learning for personalized shopping experiences, demand forecasting, and automated customer service through chatbots. Augmented reality is gaining traction as a tool that allows consumers to virtually try on clothing, preview furniture placement, or test beauty products, thereby reducing return rates and increasing purchase confidence. The emergence of voice commerce is also influencing shopping habits, as consumers use smart speakers and virtual assistants to reorder products and receive recommendations. Additionally, sustainability has become a key concern, with retailers investing in eco-friendly packaging, carbon-neutral shipping, and ethical sourcing to attract environmentally conscious consumers. Cross-border commerce is also evolving, supported by improved translation services, currency conversion tools, and localized marketing strategies. Buy now, pay later (BNPL) solutions are growing in popularity, especially among younger shoppers seeking financial flexibility. Meanwhile, drone and autonomous vehicle delivery experiments are laying the groundwork for faster and more efficient last-mile logistics. These trends, driven by a combination of consumer expectations, competitive pressures, and technological advancements, are expected to shape the next phase of growth and innovation in the retail e-commerce sector.

Key Players:

- Amazon

- Alibaba

- Walmart

- JD.com

- eBay

- Shopify

- Rakuten

- Zalando

- Flipkart

- MercadoLibre

Chapter 1. Retail E-Commerce Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Application

1.5. Secondary Application

Chapter 2. RETAIL E-COMMERCE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. RETAIL E-COMMERCE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. RETAIL E-COMMERCE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Retail E-Commerce of Suppliers

4.5.2. Bargaining Risk Analytics s of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. RETAIL E-COMMERCE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. RETAIL E-COMMERCE MARKET – By Product

6.1 Introduction/Key Findings

6.2 Electronics and Media

6.3 Fashion and Apparel

6.4 Beauty and Personal Care

6.5 Food and Groceries

6.6 Furniture and Home Décor

6.7 Toys, DIY, and Hobbies

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Product

6.10 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. RETAIL E-COMMERCE MARKET – By Application

7.1 Introduction/Key Findings

7.2 Business-to-Consumer (B2C)

7.3 Business-to-Business (B2B)

7.4 Consumer-to-Consumer (C2C)

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. RETAIL E-COMMERCE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. RETAIL E-COMMERCE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Amazon

9.2 Alibaba

9.3 Walmart

9.4 JD.com

9.5 EBay

9.6 Shopify

9.7 Rakuten

9.8 Zalando

9.9 Flipkart

9.10 MercadoLibre

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 5.8 trillion in 2024 and is projected to reach USD 9.21 trillion by 2030.

Key drivers include internet and smartphone penetration, changing consumer behavior, and supply chain advancements

The market is segmented by product types like fashion and electronics, and applications such as B2C, B2B, and C2C.

Asia-Pacific is the dominant region, led by high digital adoption and large e-commerce user bases.

Leading players include Amazon, Alibaba, Walmart, JD.com, and eBay.