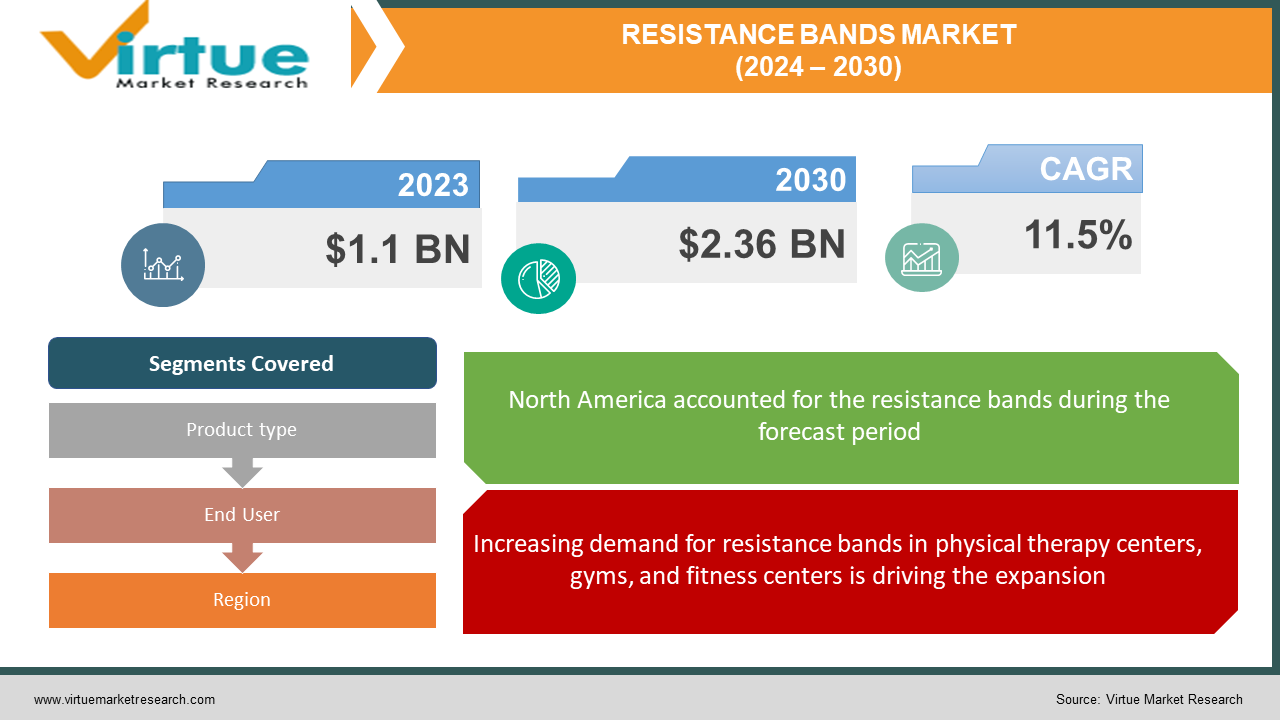

Resistance Bands Market Size (2024 – 2030)

The global resistance band market was valued at USD 1.1 billion in 2023 and is projected to reach a market size of USD 2.36 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 11.5%.

In the fitness industry, a resistance band is a thick, strong, and elastic band made up of rubber or similar material to make muscles stronger. During the exercise, resistance bands are used to add resistance or tension, which makes movement difficult, leading you to engage more muscle and build your strength. Elderly people as well as those undergoing rehabilitation use resistance bands to improve muscle strength, size, and function. In 2022, the US had around 31,000 health clubs. Resistance bands are used by beginner to advanced athletes working out at home or in the gym. Physical therapists use resistance bands to condition the patient's body against fractures, fall risk, and degenerative injuries. Estimates suggest that there will be around 50516 physical therapy centers in the US in 2023. The resistance band market is growing with increasing awareness of the health benefits of strength training exercises among people.

Key Market Insights:

In terms of regional dynamics, North America continues to dominate the resistance band market with the largest market share. The United States holds a major market share due to the increasing obese population and the prevalence of chronic diseases like cardiac disorders. The region is facing significant demand for gyms, fitness centers, and physical therapy centers, as well as individuals.

Another region for the resistance band market is Asia-Pacific, which has the fastest growth rate. India and China collectively hold dominance over the market. Raising income, raising health awareness, and a huge population boosting the economy like India are some of the key drivers for the market. China had around 85,149 fitness clubs by the end of December 2022. It was observed that 30% of Indians have upgraded their fitness routine with the use of advanced fitness apps and devices, which include smart resistance bands. China, India, and Japan are showing huge demand for home fitness equipment, including resistance bands. Rapid urbanization, an increasing lifestyle, and the promotion of fitness programs like Yoga Day are driving growth in the region.

Market Drivers:

Increasing demand for resistance bands in physical therapy centers, gyms, and fitness centers is driving the expansion.

The resistance bands market is experiencing significant growth due to the increasing demand and growing physical therapy centers, gyms, and fitness centers in the region. The market demand is increasing, as they are frequently used in physical therapy, particularly by patients recovering from fractures or muscular injuries or those going under cardiac rehabilitation, to gradually regrow their strength. These resistance bands are ideal for strength training in gyms and fitness centers. According to the IRHSA, in 2023, there will be around 82.7 million consumers of health facilities in the US. FitPass announced plans to expand in India in 2023, adding up to 2,000 gyms and fitness centers.

Growing awareness of fitness and strength training has boosted the demand for resistance bands.

The rise of awareness among people about fitness, health, and strength training resulted in more and more people working out from home or in parks. The increase in fitness activities among working people who work from home has increased market demand for resistance bands. Post-COVID-19, 31% of people are doing strength training and exercises from home after the pandemic. Resistance bands have also become increasingly popular among people due to being inexpensive, easy to store, and easy to use compared to other fitness equipment at home.

Growing government support for fitness and sports programs.

The expansion of the resistance band market is supported by the government and various organizations around the world, which are taking the initiative to promote fitness and exercise. The World Health Organization (WHO) has established the Sport for Health Program to promote participation in sports and advance health for all. The demand for resistance bands is expected to grow in response to government initiatives taken to encourage people to engage in physical activities like cardiac training, muscle building, and other sports.

Market Restraints and Challenges:

Resistance bands may result in injuries if used incorrectly.

One of the key challenges facing the resistance band market is the injuries caused by wrong use. The resistance band may cause serious injury to the user if the band breaks or the user is snapped by one of the ends of the stretched band. Injuries caused by the tension of the resistance bands can be dangerous. Users can be harmed while exercising with the tensioned resistance band, and components of the product like rubber tubes or handles break, snapping back to the user. Another scenario could be the user falling while wearing legs and a band breaking. This hinders the growth of the resistance band market.

Alternative exercise equipment and methods are one of the restraints on the resistance band market.

The growth of the market is also affected by the competition from alternative exercise products available on the market. Strength training has around 35% of the market share in the fitness equipment industry, while more than 60% is from the cardiovascular segment. Resistance bands are affordable and easy to use, but they are also less durable compared to free weights, weight machines, and other exercise equipment. The less durability of the product may change the minds of buyers, and shift to another equipment. Some people may prefer free weights or gyms due to limited awareness about the effectiveness of resistance bands, which may hinder the growth of the market.

Market Opportunities:

The use of technology and R&D in material science to develop advanced resistance bands with enhanced properties can open new markets and applications.

In recent years, the technology of resistance bands has seen rapid advancements, leading to an increased variety of resistance bands available. Smart resistance bands equipped with body sensors and Bluetooth connectivity are developed to provide a thorough analytical workout experience. Increasing investment in R&D in material science to develop enhanced band materials in response to rising market demand may expand the resistance band market in the future.

RESISTANCE BANDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.5% |

|

Segments Covered |

By Product type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Performance Health, LLC, Black Mountain Products, Inc., Bodylastic International, Inc., Xtreme Bands, Decathlon SA, Fitness Anywhere LLC, Wacces, ProSource, Fit Simplify, Zaj Fit |

Resistance Band Market Segmentation: By Product Type

-

Loop Bands

-

Tube Bands

-

Mini Bands

-

Therapy Bands

-

Figure 8 Bands

The market for these bands is driven by the increasing demand for versatile and portable fitness equipment. While loop resistance bands and tube resistance bands dominate the market share due to their broad applications, mini bands, and therapy bands have a dedicated customer base seeking specific functionalities. The figure 8 bands carve a niche in upper-body workouts. The overall demand for these resistance bands is on the rise, fuelled by a growing fitness-conscious population and the convenience they offer in various workout scenarios.

Resistance Band Market Segmentation: By End User

-

Individuals

-

Health and Sports Clubs

-

Others

The resistance band market is dominated by health and sports clubs, which account for more than 70% of the market share, followed by individual users, who contribute 29% of the market share. Resistance bands are used by health clubs and gyms for yoga and strength training. Additionally, rehabilitation centers use resistance bands for physical therapy, to improve muscle and bone strength, and for body conditioning against fractures and injuries. Being portable and easy to use makes it a preferable choice for individual users. Sports clubs and athletes use resistance bands for mobility training, muscle toning, and strengthening.

The demand for the resistance band market is likely to speed up with the growth of fitness awareness and people's shift towards healthy lifestyles. The resistance band market has seen a huge increase since the COVID-19 pandemic when people started to train and work from home. The increase in lifestyle and development in emerging economies has also paved the way for resistance band market growth.

Resistance Band Market Segmentation: By Region

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region, which includes economies like China, India, and Japan, is the fastest-growing region for the resistance band market. On the other hand, the North American region owns the largest market share, mostly contributed by the United States due to the many fitness and health clubs in the region. The International Health, Racquet, and Sports Club Association (IHRSA) estimates that one in five Americans is a member of at least one health club or studio. The rising number of chronic disease patients and the change in people's preferences towards home fitness are key drivers in the growth of the resistance band market in North America.

China had around 85,149 gyms in 2023, including 45,529 fitness studios and 39,620 gyms. There will be around 17391 physiotherapy centers in India by the end of December 2023. The rising awareness about fitness and health, government health programs, and boosting the economy are driving growth in the Asia-Pacific region.

COVID-19 Impact Analysis on the Global Resistance Bands Market:

Due to the COVID-19 pandemic, the resistance band market experienced a significant impact, resulting in decreased growth. The market faced huge challenges due to supply chain disruptions and temporary manufacturing facility closures, which dropped income by 32.45% in 2020. The closure of gyms, fitness clubs, rehabilitation centers, and public parks led to a shift in people's preference for home workouts. The closure of retail stores affected people's shopping experiences. Further, the demand for resistance bands increased post-pandemic when the number of people working from home increased. Additionally, resistance bands being easy to use, portable, and inexpensive made them favorable for home workouts, driving market growth.

Latest Trends/Developments:

The integration of digital technologies is revolutionizing the development of resistance bands. The advent of smart resistance bands equipped with Bluetooth transmitters and motion sensors has augmented product sales in recent years. FitFlex introduced re-adjustable resistance bands in January 2023. The user can monitor their full body with analytics using these smart resistance bands. They can track their stretching and flexing performances. Smart resistance bands offer real-time feedback, progress-tracking analytics, and integration with fitness apps. FlexPro launched a mobile fitness application to integrate with its resistance bands in March 2023. PowerStrength introduced resistance equipped with smart sensors in April 2023. These new technological developments in the resistance band market will drive growth and open new market opportunities.

Key Players:

-

Performance Health, LLC

-

Black Mountain Products, Inc.

-

Bodylastic International, Inc.

-

Xtreme Bands

-

Decathlon SA

-

Fitness Anywhere LLC

-

Wacces

-

ProSource

-

Fit Simplify

-

Zaj Fit

In April 2024, Target Corporation will unveil an ambitious wellness expansion with over 1,000 new health-conscious products across categories. Target is offering products starting at $1.99, which will be available in its stores in 50 states and the District of Columbia. The Blogilates category will include different types of resistance bands for users.

Chapter 1. RESISTANCE BAND MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. RESISTANCE BAND MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. RESISTANCE BAND MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. RESISTANCE BAND MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. RESISTANCE BAND MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. RESISTANCE BAND MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Loop Bands

6.3 Tube Bands

6.4 Mini Bands

6.5 Therapy Bands

6.6 Figure 8 Bands

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. RESISTANCE BAND MARKET – By End User

7.1 Introduction/Key Findings

7.2 Individuals

7.3 Health and Sports Clubs

7.4 Others

7.5 Y-O-Y Growth trend Analysis By End User

7.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. RESISTANCE BAND MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Product Type

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Product Type

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Product Type

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Product Type

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. RESISTANCE BAND MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Performance Health, LLC

9.2 Black Mountain Products, Inc.

9.3 Bodylastic International, Inc.

9.4 Xtreme Bands

9.5 Decathlon SA

9.6 Fitness Anywhere LLC

9.7 Wacces

9.8 ProSource

9.9 Fit Simplify

9.10 Zaj Fit

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global resistance band market was valued at USD 1.1 billion and is projected to reach a market size of USD 2.36 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 11.5%.

Key drivers include the increasing number of fitness clubs, growing awareness of health and fitness, and government support for health and fitness programs, which are driving growth in the market.

Resistance bands like Loop Bands, Tube Bands, Therapy Bands, Mini Bands, and Fitness 8 Bands are prominently used in the market.

North America holds the largest dominant position in the resistance bands market, while Asia-Pacific is the fastest-growing region in the resistance bands market.

Performance Health, LLC; Black Mountain Products, Inc.; Bodylastic International, Inc.; and Xtreme Bands are some of the key players in the global resistance band market.