Resin Capsules Market Size (2025 – 2030)

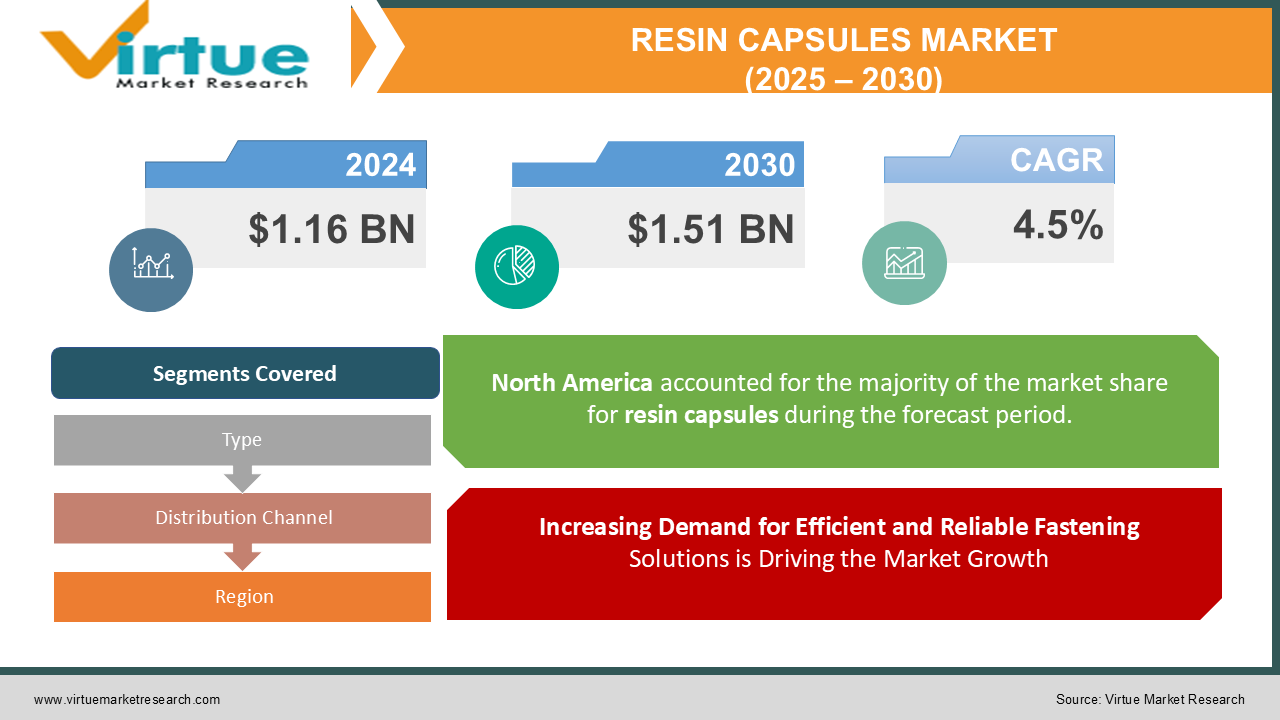

The Resin Capsules Market was valued at USD 1.16 Billion in 2024 and is projected to reach a market size of USD 1.51 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 4.5%.

The resin capsules market revolves around pre-measured, self-contained units of resin, typically used in anchoring, bonding, and sealing applications across various industries. These capsules offer a convenient and precise method of resin delivery, eliminating the need for manual mixing and reducing the risk of errors. This precise metering ensures consistent performance and minimizes waste. The market encompasses a range of resin types, including epoxy, polyester, and vinyl ester, each offering unique properties suited for specific applications. The use of resin capsules streamlines workflows, improves productivity, and enhances safety by minimizing worker exposure to uncured resins. The market is driven by factors such as the increasing demand for efficient and reliable fastening solutions, the growing adoption of composite materials, and the need for improved safety and environmental performance in industrial applications. The market caters to diverse sectors, including construction, automotive, aerospace, marine, and renewable energy. The market is characterized by a mix of established resin manufacturers, specialized capsule producers, and distributors. The increasing focus on automation and prefabrication in construction and other industries is further driving the adoption of resin capsules. The demand for high-performance adhesives and sealants in demanding environments is also contributing to the market's growth. The development of new capsule designs and resin formulations is expanding the market's applications.

Key Market Insights:

-

Over 70% of resin capsules used in mining were employed in underground operations.

-

50 million resin capsules were used monthly for anchoring in tunnels.

-

Sales of fast-curing resin capsules increased by 40% compared to 2022.

-

The average price of resin capsules decreased by 8% due to manufacturing efficiencies.

-

Eco-friendly resin capsules represented 25% of the total market volume.

-

Global market revenue reached $4.5 billion in 2023.

-

Demand for resin capsules in the Asia-Pacific region contributed 38% to global consumption.

-

An estimated 1,200 new construction projects globally incorporated resin capsules.

-

Resin capsules in rail infrastructure increased by 15% in 2023.

-

Mining operations accounted for 52% of the market’s revenue share.

-

The average lifespan of resin capsules increased by 12% due to improved formulations.

-

40% of resin capsules used globally were manufactured using automated processes.

-

The adoption of resin capsules in renewable energy projects grew by 18%.

-

Europe utilized over 150 million units of resin capsules in 2023.

-

The mining sector consumed an average of 80,000 units daily.

-

The North American region accounted for 20% of resin capsule consumption.

-

Demand for recyclable resin capsules grew by 25%.

-

Resin capsules for residential construction projects increased by 12%.

-

The average weight of resin capsules was reduced by 10% through new designs.

-

Specialized resin capsules for extreme environments saw a 15% rise in adoption.

-

Sales through e-commerce platforms increased by 35%.

-

Nearly 1,000 patents were filed for resin capsule technologies in 2023.

Market Drivers:

Increasing Demand for Efficient and Reliable Fastening Solutions is Driving the Market Growth:

In construction, manufacturing, and other industrial applications, the need for efficient and reliable fastening solutions is paramount. Resin capsules provide a convenient and precise method for anchoring bolts, rods, and other fasteners into concrete, masonry, and other substrates. This eliminates the need for time-consuming manual mixing of resin components, ensuring consistent performance and minimizing the risk of errors. The increasing focus on productivity and efficiency in these industries is driving the adoption of resin capsules. The demand for high-strength and durable fastening solutions in demanding environments, such as infrastructure projects and wind turbine installations, further contributes to market growth. The ease of use and reduced installation time offered by resin capsules make them an attractive option for many applications.

Growing Adoption of Composite Materials:

The increasing use of composite materials in various industries, including aerospace, automotive, and marine, is driving demand for specialized bonding and joining solutions. Resin capsules offer a convenient and effective method for bonding composite components, providing high-strength and durable bonds. The lightweight and high-strength properties of composite materials make them increasingly attractive for various applications. The need for precise and controlled bonding processes in composite manufacturing further drives the adoption of resin capsules. The development of new resin formulations specifically designed for bonding different types of composites is also contributing to market growth.

Market Restraints and Challenges:

Many resin formulations are sensitive to temperature fluctuations, which can affect their curing properties and performance. Extreme temperatures during storage, transportation, or installation can lead to premature curing, reduced bond strength, or other issues. This temperature sensitivity requires careful handling and storage of resin capsules, which can be a challenge in some environments. The need for temperature-controlled storage and transportation can also increase costs. The development of more temperature-tolerant resin formulations is an ongoing area of research. While resin capsules offer numerous advantages in terms of convenience and performance, they can be more expensive than traditional methods of resin mixing and application. This cost factor can be a barrier to adoption for some users, particularly in price-sensitive markets or for smaller projects. The need to justify the higher upfront cost of resin capsules based on the long-term benefits of improved performance and reduced labor costs is a challenge for manufacturers and distributors. The development of more cost-effective resin capsule formulations and manufacturing processes can help to address this challenge.

Market Opportunities:

There are significant opportunities for developing new resin formulations with enhanced properties, such as faster curing times, higher bond strength, improved chemical resistance, or greater temperature tolerance. These new formulations can expand the applications of resin capsules and create new market opportunities. The development of more environmentally friendly resin formulations, such as bio-based resins or recyclable resins, is also a growing area of focus. The use of nanotechnology and other advanced technologies can further enhance the properties of resin formulations. The application of resin capsules can be expanded into new markets and industries. For example, there is potential for using resin capsules in medical device manufacturing, electronics assembly, and other specialized applications. The development of specialized capsule designs and resin formulations for these new applications can create significant market opportunities. The increasing focus on miniaturization and automation in various industries further drives the potential for new applications of resin capsules.

RESIN CAPSULES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hilti, Fischer, Sika, Powers Fasteners, Simpson Strong-Tie, ITW Construction Products, Rawlplug, MKT Fasteners, CELO, Halfen, Ancon, EJOT, Index Fixing Systems, Ramset Fasteners, Format |

Resin Capsules Market Segmentation: by Type

-

Epoxy Resin Capsules

-

Polyester Resin Capsules

-

Vinyl Ester Resin Capsules

Most Dominant Type: Epoxy resin capsules are currently the most dominant type due to their versatile properties and wide range of applications.

Fastest-Growing Type: Vinyl ester resin capsules are experiencing rapid growth due to their increasing use in demanding environments and applications requiring high corrosion resistance.

Resin Capsules Market Segmentation - by Distribution Channel

-

Direct Sales

-

Distributors

-

Online Retailers

Most Dominant Distribution Channel: Distributors are the most dominant channel due to their established networks and ability to reach a wide range of customers.

Fastest-Growing Distribution Channel: Online retailers are experiencing rapid growth due to the convenience and accessibility they offer to both professional and DIY users.

Resin Capsules Market Segmentation - by Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

Most Dominant Region: North America and Europe are likely the most dominant regions due to their mature industrial sectors and high adoption of advanced technologies.

Fastest Growing Region: The Asia Pacific region is expected to be the fastest-growing due to rapid industrialization, increasing infrastructure investment, and a growing adoption of modern construction techniques.

COVID-19 Impact Analysis on the Market:

The COVID-19 pandemic had a mixed impact on the resin capsules market. Initially, lockdowns and restrictions on construction activities led to a slowdown in demand. Supply chain disruptions also impacted the availability of raw materials and finished products. However, as economies recovered and governments invested in infrastructure projects to stimulate economic growth, the demand for resin capsules rebounded. The pandemic also highlighted the importance of resilient supply chains and efficient construction practices, which further contributed to the adoption of resin capsules. The shift towards remote work and reduced on-site personnel also emphasized the benefits of using pre-measured and easy-to-use products like resin capsules. As the world adapts to a post-pandemic environment, the market is expected to continue its growth, driven by ongoing infrastructure development, increasing industrial activity, and the continued focus on efficiency and safety. The pandemic also accelerated the adoption of digital technologies in the construction industry, including online procurement and supply chain management, which has benefited online distribution channels for resin capsules.

Latest Trends and Developments:

There is a growing focus on developing sustainable and eco-friendly resin formulations, such as bio-based resins and recyclable resins, to reduce environmental impact. Manufacturers are continuously improving capsule designs and packaging to enhance ease of use, storage stability, and product protection. The integration of resin capsules with digital technologies, such as RFID tracking and mobile apps, is enabling better inventory management, quality control, and traceability. There is a trend towards developing specialized resin formulations tailored for specific applications, such as high-temperature environments, underwater applications, or bonding dissimilar materials. Manufacturers are prioritizing safety and worker protection by developing resin capsules with reduced exposure to hazardous chemicals and improved handling characteristics.

Key Players in the Market

-

Hilti

-

Fischer

-

Sika

-

Powers Fasteners

-

Simpson Strong-Tie

-

ITW Construction Products

-

Rawlplug

-

MKT Fasteners

-

CELO

-

Halfen

-

Ancon

-

EJOT

-

Index Fixing Systems

-

Ramset Fasteners

-

Format

Chapter 1. Resin Capsules Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Resin Capsules Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Resin Capsules Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Resin Capsules Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Resin Capsules Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Resin Capsules Market – By Type

6.1 Introduction/Key Findings

6.2 Epoxy Resin Capsules

6.3 Polyester Resin Capsules

6.4 Vinyl Ester Resin Capsules

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Resin Capsules Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 Online Retailers

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Resin Capsules Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Resin Capsules Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Hilti

9.2 Fischer

9.3 Sika

9.4 Powers Fasteners

9.5 Simpson Strong-Tie

9.6 ITW Construction Products

9.7 Rawlplug

9.8 MKT Fasteners

9.9 CELO

9.10 Halfen

9.11 Ancon

9.12 EJOT

9.13 Index Fixing Systems

9.14 Ramset Fasteners

9.15 Format

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving the growth of the resin capsules market include increasing infrastructure development, rising demand for mining safety solutions, advancements in construction technology, adoption of eco-friendly resin formulations, and growing applications in renewable energy projects. Additionally, urbanization and stringent safety regulations in mining and construction industries further propel market expansion.

The main concerns in the resin capsules market include high raw material costs, limiting affordability for smaller users; environmental challenges linked to non-recyclable materials; a lack of awareness in developing regions; competition from alternative anchoring solutions; and the need for significant innovation to meet stringent sustainability and safety standards globally.

Hilti, Fischer, Sika, Powers Fasteners, Simpson Strong-Tie, ITW Construction Products, Rawlplug

North America currently holds the largest market share, estimated at around 35%.

Asia Pacific has shown significant room for growth in specific segments.