Residential Solar Energy Storage Market Size (2024-2030)

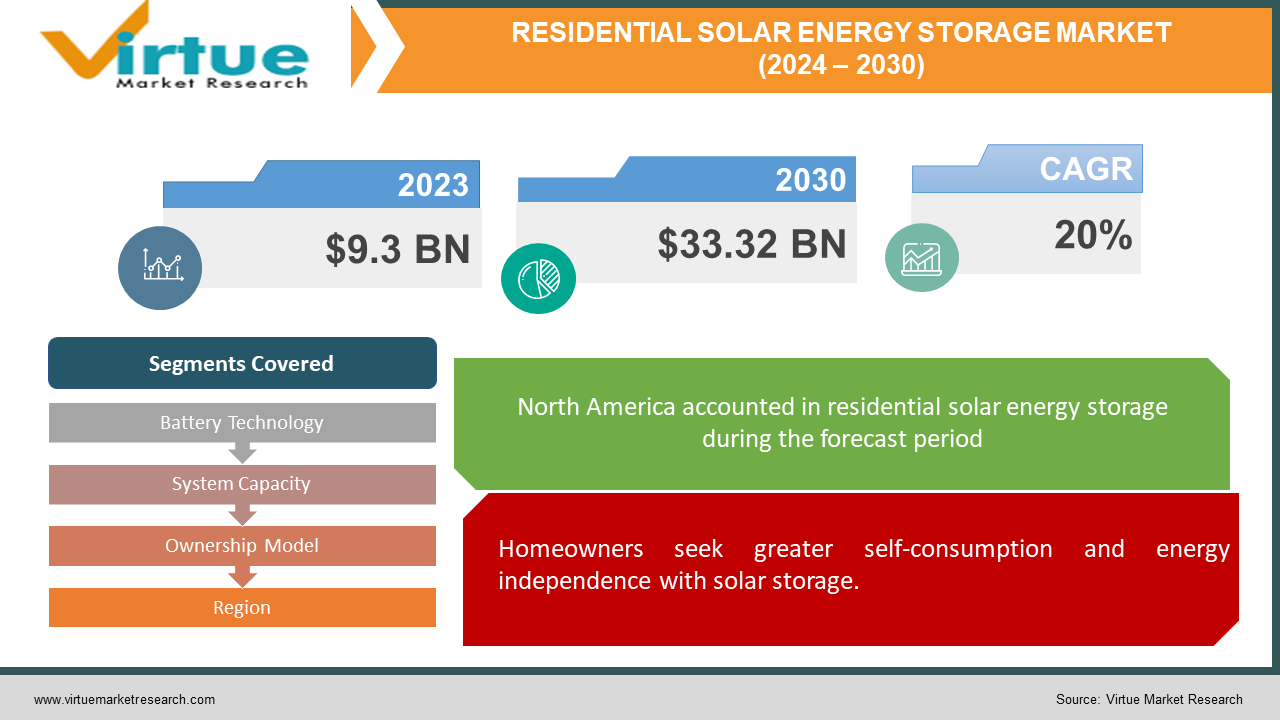

The Residential Solar Energy Storage Market was valued at USD 9.3 billion in 2023 and is projected to reach a market size of USD 33.32 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 20%.

The residential solar energy storage market is thriving. Homeowners are embracing solar panels to generate their clean electricity, and storage systems allow them to use this power even at night. Government incentives are sweetening the deal, making solar storage more attractive. The desire for energy independence and resilience against power outages is another driving force. With people looking to reduce their reliance on the grid and have backup power during extreme weather events, solar storage offers a compelling solution. This trend is expected to continue, making the residential solar energy storage market a bright spot in the energy landscape.

Key Market Insights:

The increasing frequency and severity of extreme weather events are putting a spotlight on the need for backup power solutions. Solar storage provides a reliable and clean alternative during power outages, enhancing home energy security. Advancements in battery technology, particularly lithium-ion batteries, are leading to more efficient, reliable, and affordable storage options, further propelling market growth. Looking ahead, the residential solar energy storage market is expected to see continued expansion. Shifting ownership models, with subscription plans offered by utilities alongside traditional homeowner ownership, are making solar storage more accessible to a wider range of consumers. Additionally, while North America currently holds the top spot due to high solar adoption rates and supportive policies, other regions like Europe and Asia are poised for significant growth, painting a bright picture for the global residential solar energy storage market.

The Residential Solar Energy Storage Market Drivers:

Homeowners seek greater self-consumption and energy independence with solar storage.

Homeowners are increasingly installing solar panels to generate their clean electricity. Solar storage systems allow them to store this excess energy for later use, reducing reliance on the traditional grid and enabling greater self-sufficiency. This trend is driven by a growing desire for energy independence and control over energy costs.

Government incentives like tax credits make solar storage a more attractive investment.

Many governments are recognizing the potential of solar energy storage for a cleaner and more resilient grid. They are providing financial incentives such as tax credits, rebates, and grants to encourage homeowners to adopt solar storage systems. These incentives significantly reduce the upfront cost and make solar storage a more attractive investment.

Increased focus on power outage resilience drives demand for solar backup power.

Extreme weather events are becoming more frequent and severe, leading to power outages that disrupt daily life. Solar storage systems can provide backup power during outages, ensuring continued access to electricity for critical appliances and improving overall home energy security.

Advancements in battery technology led to more affordable and reliable storage solutions.

Advancements in battery technology, particularly lithium-ion batteries, are playing a crucial role in driving market growth. These batteries offer increased efficiency, reliability, and affordability compared to older technologies, making solar storage systems a more viable option for homeowners.

The Residential Solar Energy Storage Market Restraints and Challenges:

The residential solar energy storage market basks in the sunshine of a promising future, but a few clouds still linger on the horizon. Despite a decrease in battery prices, the initial investment for a solar storage system can still be a significant financial hurdle for some homeowners. This initial cost can be a deterrent, especially when compared to the traditional model of relying solely on the grid. Furthermore, public awareness about the financial and environmental benefits of solar storage is still patchy across different regions. In some areas, a knowledge gap exists, and potential users may not be familiar with the technology or its advantages. This lack of understanding can hinder market growth until homeowners become more informed about the cost-saving potential and environmental benefits of generating and storing their clean energy. Adding to these challenges are inconsistent grid integration policies. While some areas have well-established regulations for connecting solar storage systems to the grid, others may have limited or unfavorable policies. This inconsistency creates uncertainty for homeowners considering solar storage, as they may be unsure about the rules and regulations governing their ability to connect to the grid and potentially even sell excess energy back to the utility company. Finally, the environmental impact of lithium-ion battery production and disposal, the current dominant technology in solar storage, raises concerns. By tackling these hurdles, the residential solar energy storage market can truly shine and illuminate a path towards a cleaner and more resilient energy future.

The Residential Solar Energy Storage Market Opportunities:

The future of residential solar energy storage isn't just bright, it's brimming with opportunities. The rise of smart home technology allows seamless integration of solar storage systems, enabling homeowners to optimize energy use based on real-time data and potentially leading to significant cost savings. Utilities are also offering programs that incentivize reduced energy use during peak times, and solar storage allows homeowners to participate by storing excess power and using it during peak hours, earning them additional income. New business models are emerging as well, with subscription options eliminating the upfront cost barrier and attracting a wider customer base. As environmental concerns continue to rise, manufacturers are developing new battery technologies with a reduced environmental footprint, making solar storage even more attractive for eco-conscious consumers. The applications for solar storage are also expanding beyond backup power and self-consumption. These systems can be used for electric vehicle charging, powering appliances during outages, and even providing microgrid capabilities for communities. These exciting opportunities, combined with existing drivers like government incentives and technological advancements, create fertile ground for the future of the residential solar energy storage market.

RESIDENTIAL SOLAR ENERGY STORAGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20% |

|

Segments Covered |

By Battery Technology, System Capacity, Ownership Model, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tesla, Panasonic Holdings Corporation, Sonnen GmbH, VARTA AG, Enphase Energy, LG Energy Solution Ltd, BYD Company Ltd, Delta Electronics, Inc, Huawei Technologies Co., Eaton |

Residential Solar Energy Storage Market Segmentation: By Battery Technology

-

Lithium-ion (Li-ion)

-

Lead-Acid

-

Other Emerging Technologies

Lithium-ion (Li-ion) batteries reign supreme in the residential solar storage market due to their high efficiency, reliability, and declining costs. However, other emerging technologies like flow batteries, sodium-ion batteries, and solid-state batteries are on the horizon and are expected to be the fastest-growing segment in the coming years. These advancements hold promise for even better performance and potentially lower environmental impact.

Residential Solar Energy Storage Market Segmentation: By System Capacity

-

Small Capacity (up to 5 kW)

-

Medium Capacity (5 kW - 10 kW)

-

Large Capacity (above 10 kW)

The most dominant segment in the residential solar energy storage market by system capacity is 'Small Capacity (up to 5 kW)'. This segment caters to self-consumption and backup power needs for smaller appliances. The fastest-growing segment is 'Medium Capacity (5 kW - 10 kW)'. This segment is gaining traction as it can power most household needs during outages and store excess solar energy, appealing to a wider range of homeowners.

Residential Solar Energy Storage Market Segmentation: By Ownership Model

-

Customer-Owned

-

Utility-Owned

-

Third-Party Ownership

The current dominant segment in the residential solar energy storage market by ownership model is 'Customer-Owned'. This model offers homeowners the most control over their energy use and costs. However, 'Third-Party Ownership' is expected to be the fastest-growing segment in the coming years. This subscription-based model eliminates the upfront cost barrier, making solar storage more accessible to a wider range of consumers.

Residential Solar Energy Storage Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Currently, the undisputed leader, North America boasts a strong foundation for solar storage. High adoption rates of solar panels and supportive government incentives, including tax credits and rebates, have fueled rapid growth. This region is expected to maintain its top spot in the coming years, continuing to be a major driver of the global market.

Europe is a strong contender, experiencing significant growth fueled by two key factors. Firstly, rising energy costs are pushing homeowners towards alternative energy sources like solar power. Secondly, ambitious clean energy targets set by European governments are creating a favorable environment for solar storage adoption. With a focus on energy independence and sustainability, Europe is poised to be a major player in the residential solar storage market.

Asia-Pacific region is emerging as a powerhouse in the solar energy sector, and residential solar storage is set to follow suit. A surge in solar panel installations across countries like China, India, and Japan is paving the way for a booming market. Government initiatives promoting clean energy and cost reductions in battery technology are further accelerating growth. The vast size and potential of the Asia-Pacific region make it a key player to watch in the future of residential solar storage.

COVID-19 Impact Analysis on the Residential Solar Energy Storage Market:

The COVID-19 pandemic wasn't all sunshine and roses for the residential solar energy storage market. Lockdowns and travel restrictions disrupted global supply chains for solar panels and batteries, causing delays and price hikes. Labor shortages due to social distancing measures also slowed down installations. Additionally, the economic downturn led some homeowners to put off investments in solar storage due to financial uncertainty.

However, a silver lining emerged. The pandemic's emphasis on staying home highlighted the importance of reliable home energy sources, sparking interest in solar power and backup storage solutions. Furthermore, many governments introduced stimulus packages and extended existing incentives to support the clean energy sector during this challenging time, counteracting the economic downturn's impact.

Latest Trends/ Developments:

The residential solar energy storage market is buzzing with innovation. Artificial intelligence (AI) is being integrated into systems to optimize energy use based on real-time data, helping homeowners maximize self-consumption and potentially lower electricity bills. Virtual Power Plants (VPPs) are creating a new wave of possibilities. By aggregating multiple home solar storage systems, VPPs act as virtual power sources, helping utilities manage the grid and peak demand periods while offering homeowners additional income for participation. Battery safety and responsible disposal are gaining traction as technology matures. Second-life applications for used batteries, like powering electric vehicles or cell towers, are being explored to extend their lifespan and minimize environmental impact. Additionally, seamless integration with smart meters allows for better data collection and energy use monitoring, empowering homeowners to optimize their storage usage. The future looks even brighter with advanced systems designed to function as microgrids, providing backup power and even powering entire communities during outages, offering significant energy independence and resilience. These trends, coupled with ongoing advancements in battery technology, falling costs, and supportive government policies, are paving the way for a transformed residential energy landscape, where solar storage plays a key role in how we generate, store, and consume energy in our homes.

Key Players:

-

Tesla

-

Panasonic Holdings Corporation

-

Sonnen GmbH

-

VARTA AG

-

Enphase Energy

-

LG Energy Solution Ltd

-

BYD Company Ltd

-

Delta Electronics, Inc

-

Huawei Technologies Co.

-

Eaton

Chapter 1. Residential Solar Energy Storage Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Residential Solar Energy Storage Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Residential Solar Energy Storage Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Residential Solar Energy Storage Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Residential Solar Energy Storage Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Residential Solar Energy Storage Market – By Battery Technology

6.1 Introduction/Key Findings

6.2 Lithium-ion (Li-ion)

6.3 Lead-Acid

6.4 Other Emerging Technologies

6.5 Y-O-Y Growth trend Analysis By Battery Technology

6.6 Absolute $ Opportunity Analysis By Battery Technology, 2024-2030

Chapter 7. Residential Solar Energy Storage Market – By System Capacity

7.1 Introduction/Key Findings

7.2 Small Capacity (up to 5 kW)

7.3 Medium Capacity (5 kW - 10 kW)

7.4 Large Capacity (above 10 kW)

7.5 Y-O-Y Growth trend Analysis By System Capacity

7.6 Absolute $ Opportunity Analysis By System Capacity, 2024-2030

Chapter 8. Residential Solar Energy Storage Market – By Ownership Model

8.1 Introduction/Key Findings

8.2 Customer-Owned

8.3 Utility-Owned

8.4 Third-Party Ownership

8.5 Y-O-Y Growth trend Analysis By Ownership Model

8.6 Absolute $ Opportunity Analysis By Ownership Model, 2024-2030

Chapter 9. Residential Solar Energy Storage Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Battery Technology

9.1.3 By System Capacity

9.1.4 By Ownership Model

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Battery Technology

9.2.3 By System Capacity

9.2.4 By Ownership Model

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Battery Technology

9.3.3 By System Capacity

9.3.4 By Ownership Model

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Battery Technology

9.4.3 By System Capacity

9.4.4 By Ownership Model

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Battery Technology

9.5.3 By System Capacity

9.5.4 By Ownership Model

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Residential Solar Energy Storage Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Tesla

10.2 Panasonic Holdings Corporation

10.3 Sonnen GmbH

10.4 VARTA AG

10.5 Enphase Energy

10.6 LG Energy Solution Ltd

10.7 BYD Company Ltd

10.8 Delta Electronics, Inc

10.9 Huawei Technologies Co.

10.10 Eaton

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Residential Solar Energy Storage Market was valued at USD 9.3 billion in 2023 and is projected to reach a market size of USD 33.32 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 20%.

Soaring Demand for Self-Consumption and Energy Independence, Government Incentives and Supportive Policies, Growing Focus on Power Outage Resilience, and Advancements in Battery Technology.

Small Capacity (up to 5 kW), Medium Capacity (5 kW - 10 kW), Large Capacity (above 10 kW).

North America reigns supreme in the Residential Solar Energy Storage Market due to high solar adoption rates and supportive government incentives.

Tesla, Panasonic Holdings Corporation, Sonnen GmbH, VARTA AG, Enphase Energy, LG Energy Solution Ltd, BYD Company Ltd, Delta Electronics, Inc, Huawei Technologies Co., Eaton.