Research Satellite Market Size (2024-2030)

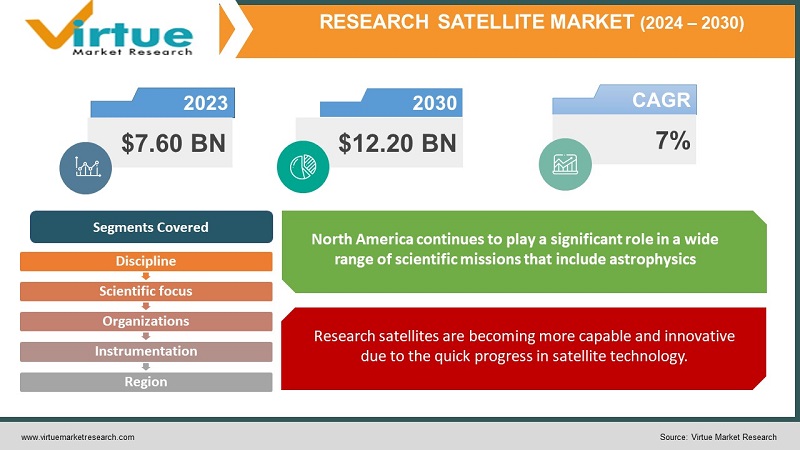

The Research Satellite Market was valued at USD 7.60 Billion in 2023 and is projected to reach a market size of USD 12.20 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7%.

A research satellite, also called a scientific satellite, is a kind of man-made satellite that is intended and furnished especially for carrying out scientific experiments and study in orbit. Launched into orbit, these satellites collect data and conduct experiments that increase scientific understanding across a range of disciplines. Studying the Earth, the solar system, or the larger universe is a common function for research satellites. Research satellites are primarily used for scientific experiments and studies. Studying the planet's atmosphere, seas, and land as well as investigating celestial bodies and distant galaxies are a few examples of this. Conversely, regular satellites can be used for a variety of tasks like navigation, communication, or non-scientific Earth monitoring.

Key Market Insights:

Scientific exploration is becoming more and more important, and government, corporate, and international organisations are working together more often. These factors are propelling the market for research satellites. With a rise in demand for data to support sustainable development goals, earth observation satellites are essential for monitoring and analysing environmental changes, natural disasters, and climate change. Furthermore, the scientific community is enthralled with the exploration of celestial bodies and the universe through space telescopes, which propels investments in state-of-the-art instrumentation and satellite missions. A noticeable trend in the market's evolution is the miniaturisation of satellites; small satellite constellations and CubeSats provide affordable options for research. Furthermore, the way that research satellite initiatives are being implemented is changing due to the growing participation of commercial companies. This is encouraging competition and creativity in the search for novel scientific findings. Research satellites are positioned as essential instruments for expanding our knowledge of Earth and space thanks to the market's trajectory, which shows a dynamic interaction between scientific discovery, technological innovation, and a variety of stakeholders.

Research Satellite Market Drivers:

One of the main factors propelling the market for research satellites is the growing need for fast and accurate Earth observation data.

A vital role in monitoring and researching many facets of the Earth, such as climate patterns, environmental changes, natural disasters, and urban development, is played by satellites fitted with cutting-edge sensors and image equipment. For the purpose of formulating policies, responding to disasters, and making educated decisions, industries, governments, and environmental agencies depend on this data. The need for high-resolution, real-time Earth observation data is driving investments in satellite missions centred on environmental monitoring and sustainability as concerns about climate change grow.

Research satellites are becoming more capable and innovative due to the quick progress in satellite technology.

Smaller, more affordable satellites that are capable of specialised missions have been made possible by miniaturisation, enhanced propulsion systems, and the development of increasingly complex and efficient instrumentation. A growing number of people are using CubeSats, for instance, because of their versatility and affordability when it comes to achieving particular research goals. Additionally, improvements in power sources and propulsion systems lead to longer mission lifetimes and better manoeuvrability, which enable satellites to carry out more thorough scientific research and explore a larger range of orbits.

The market for research satellites is largely driven by the cooperative nature of space exploration.

International collaborations are being formed by governments, space agencies, and academic institutes more frequently in order to combine resources, exchange knowledge, and work together to solve difficult scientific problems. Through the sharing of development, launch, and data costs, collaborative missions make it possible to conduct more extensive and ambitious research initiatives. This tendency encourages a worldwide approach to space exploration and study, bringing together a variety of viewpoints and specialties to address urgent scientific issues, ranging from comprehending the climate of Earth to venturing into the outer reaches of space. International cooperation fosters diplomatic and technological cooperation in the space sector in addition to improving the scientific output of satellite missions.

Research Satellite Market Restraints:

The high cost of developing and launching satellites is a major barrier to the market for research satellites.

Development costs are high because of the need to design and construct complex scientific equipment, guarantee satellite system dependability, and fulfil the strict specifications for space missions. The expense of sending satellites into orbit also adds a substantial financial burden, especially when using rockets with the required payload capacity. Due to the high upfront cost, there may be fewer options for space-based research, particularly for smaller research organisations or nations with constrained funding for space exploration.

One significant barrier to the growth of the research satellite market is the restricted number of launch options and restricted access to space.

There is frequently more demand for launches than there are launch windows and launch vehicles available. Project costs can rise and mission timelines can be affected by delays in acquiring launch slots. Further limiting the alternatives for placing research satellites are strict laws and overcrowding in popular orbits like low Earth orbit (LEO). Securing timely and affordable access to space remains a difficulty, especially for smaller satellites and organisations looking to participate in scientific research missions, as interest in space exploration develops and more entities enter the market. There are ongoing efforts to ease these limits, including the establishment of specialised small satellite launch services and reduced regulatory procedures.

RESEARCH SATTELITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Discipline, Scientific focus, Organizations, Instrumentation , and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lockheed Martin Corporation, Airbus SE, Northrop Grumman Corporation, The Boeing Company, Thales Group, Ball Aerospace, Maxar Technologies, L3Harris Technologies, ISRO (Indian Space Research Organisation), SpaceX (Space Exploration Technologies Corp.) |

Research Satellite Market Segmentation

Research Satellite Market Segmentation: By Discipline

- Astrophysics

- Climate and Environmental

Climate and environmental research satellites have been the fastest-growing segment due to increased worldwide awareness of climate change and the growing need for real-time data to monitor and alleviate environmental concerns. This market is growing quickly because of the high demand for earth observation satellites, as those in the Copernicus programme. At the same time that the climate and environmental segment is expanding quickly, the astrophysics segment is still holding a sizable portion of the market thanks to its focus on space telescopes and observatories, such as the James Webb Space Telescope. Large astrophysical missions' track record of success and recognition adds to the segment's ongoing importance in the larger research satellite market.

Research Satellite Market Segmentation: By Scientific focus

- Earth observation Satellite

- Space telescope

The market for real-time data on climate, environmental changes, and natural disasters is driving the fastest-growing segment, which is earth observation satellites. Initiatives like the Copernicus programme serve as prime examples of these satellites, which are essential for controlling and keeping an eye on Earth's resources. However, the market is still dominated by space telescopes, such the Hubble Space Telescope and the soon-to-be James Webb Space Telescope. The lasting significance of space telescopes within the research satellite industry has been cemented by their capacity to see into the depths of the universe, taking stunning photographs and conducting ground-breaking astronomical research.

Research Satellite Market Segmentation: By Organizations

- Government

- Commercial

The commercial satellite industry is expanding at the highest rate due to a number of factors, including increased competition, a rise in private sector involvement, and developments in miniaturisation technologies, which are especially helpful in the construction of small satellites like CubeSats. As space agencies throughout the world continue to lead important scientific and exploratory missions, the market category with the biggest share is the government satellite market. These government-backed projects include a wide range of goals, from planetary exploration and astrophysics research to Earth observation and climate monitoring. They are frequently larger in scope and funding.

Research Satellite Market Segmentation: By Instrumentation

- Imaging

- Spectroscopy

- Radiation detectors

Since satellites with sophisticated cameras and sensors are widely used to capture high-resolution visual and multispectral imagery, the imaging satellite category has the biggest market share. Numerous scientific applications, environmental monitoring, and Earth observation all depend heavily on these satellites. Because of improvements in spectrometry technology and the growing need for in-depth analyses of the composition of celestial bodies, the fastest-growing segment in the meantime is spectroscopic satellites. For planetary research, astrophysics, and environmental monitoring, spectroscopy satellites offer invaluable data. Radiation detectors may have a more niche use and a lesser market share than imaging satellites, despite being crucial for researching cosmic radiation and space conditions.

Research Satellite Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- South-America

- Middle East and Africa

- Europe

The research satellite market is characterised by a globally dispersed landscape with significant regional participation. North America continues to play a significant role in a wide range of scientific missions that include astrophysics, Earth monitoring, and planetary exploration. This region is led by the United States, with NASA at the head. Environmental monitoring and Earth observation are prioritised in Europe by the European Space Agency (ESA) and donations from various European nations. With major accomplishments in astrophysics, lunar exploration, and Earth observation, the Asia-Pacific region—especially China and India—showcases rapid expansion in space programmes. While the Middle East and Africa, represented by the United Arab Emirates, have entered the space industry with launches devoted to Earth observation and communication, Latin America, led by Brazil, is involved in satellite programmes centred on environmental monitoring. Governmental spending, technology advancements, and international cooperation all influence regional dynamics, which in turn reflect different goals for space exploration and study.

Research Satellite Market COVID-19 Impact Analysis:

Numerous factors have affected the research satellite market as a result of the COVID-19 outbreak. The pandemic highlighted the significance of Earth observation and environmental monitoring, even though some parts were disrupted. For example, delays in satellite launches and mission schedules caused by lockdowns and operational challenges. Research satellites' adaptability and resilience were brought to light by the growing need for real-time data to address pandemic-related issues, such as tracking environmental changes and assisting with disaster response. Furthermore, data-driven decision-making and remote sensing applications gained momentum due to the pandemic, highlighting the market's importance in tackling global issues. The crisis, in spite of temporary impediments, served as a reminder of the vital role research satellites play in supplying vital data for understanding science, tracking climate change, and building societal resilience. The necessity of ongoing innovation and cooperation in the research satellite industry has been underlined by the long-term effects.

Latest Trends/ Developments:

- In the research satellite industry, private businesses—especially those based in the US—kept becoming more and more significant. Businesses such as SpaceX have launched satellites for a range of uses, such as Earth monitoring and scientific research.

- The James Webb Space Telescope (JWST) was one of the new spaces telescopes whose launch and deployment were anticipated. It was anticipated that the JWST's cutting-edge capabilities will transform astrophysical observations and greatly increase our knowledge of the cosmos.

Key Players:

- Lockheed Martin Corporation

- Airbus SE

- Northrop Grumman Corporation

- The Boeing Company

- Thales Group

- Ball Aerospace

- Maxar Technologies

- L3Harris Technologies

- ISRO (Indian Space Research Organisation)

- SpaceX (Space Exploration Technologies Corp.)

Chapter 1. Global Research Satellite Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Research Satellite Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Research Satellite Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Research Satellite Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Research Satellite Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Research Satellite Market– By Discipline

6.1. Introduction/Key Findings

6.2. Astrophysics

6.3. Climate and Environmental

6.4. Y-O-Y Growth trend Analysis By Discipline

6.5. Absolute $ Opportunity Analysis By Discipline , 2024-2030

Chapter 7. Global Research Satellite Market– By Scientific focus

7.1. Introduction/Key Findings

7.2. Earth observation Satellite

7.3. Space telescope

7.4. Y-O-Y Growth trend Analysis By Scientific focus

7.5. Absolute $ Opportunity Analysis By Scientific focus , 2024-2030

Chapter 8. Global Research Satellite Market– By Organizations

8.1. Introduction/Key Findings

8.2. Government

8.3. Commercial

8.4. Y-O-Y Growth trend Analysis Organizations

8.5. Absolute $ Opportunity Analysis Organizations , 2024-2030

Chapter 9. Global Research Satellite Market– By Instrumentation

9.1. Introduction/Key Findings

9.2. Imaging

9.3. Spectroscopy

9.4. Radiation detectors

9.5. Y-O-Y Growth trend Analysis Instrumentation

9.6. Absolute $ Opportunity Analysis Instrumentation , 2024-2030

Chapter 10. Global Research Satellite Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Discipline

10.1.3. By Scientific focus

10.1.4. By Instrumentation

10.1.5. Organizations

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Discipline

10.2.3. By Scientific focus

10.2.4. By Instrumentation

10.2.5. Organizations

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Discipline

10.3.3. By Scientific focus

10.3.4. By Instrumentation

10.3.5. Organizations

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Discipline

10.4.3. By Scientific focus

10.4.4. By Instrumentation

10.4.5. Organizations

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Discipline

10.5.3. By Scientific focus

10.5.4. By Instrumentation

10.5.5. Organizations

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Research Satellite Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Lockheed Martin Corporation

11.2. Airbus SE

11.3. Northrop Grumman Corporation

11.4. The Boeing Company

11.5. Thales Group

11.6. Ball Aerospace

11.7. Maxar Technologies

11.8. L3Harris Technologies

11.9. ISRO (Indian Space Research Organisation)

11.10. SpaceX (Space Exploration Technologies Corp.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Research Satellite Market was valued at USD 7.60 Billion in 2023

Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7%.

One of the main factors propelling the market for research satellites is the growing need for fast and accurate Earth observation data.

The high cost of developing and launching satellites is a major barrier to the market for research satellites

. Astrophysics and Climate and Environmental are the segments.