Regenerated Fibers Market Size (2024 – 2030)

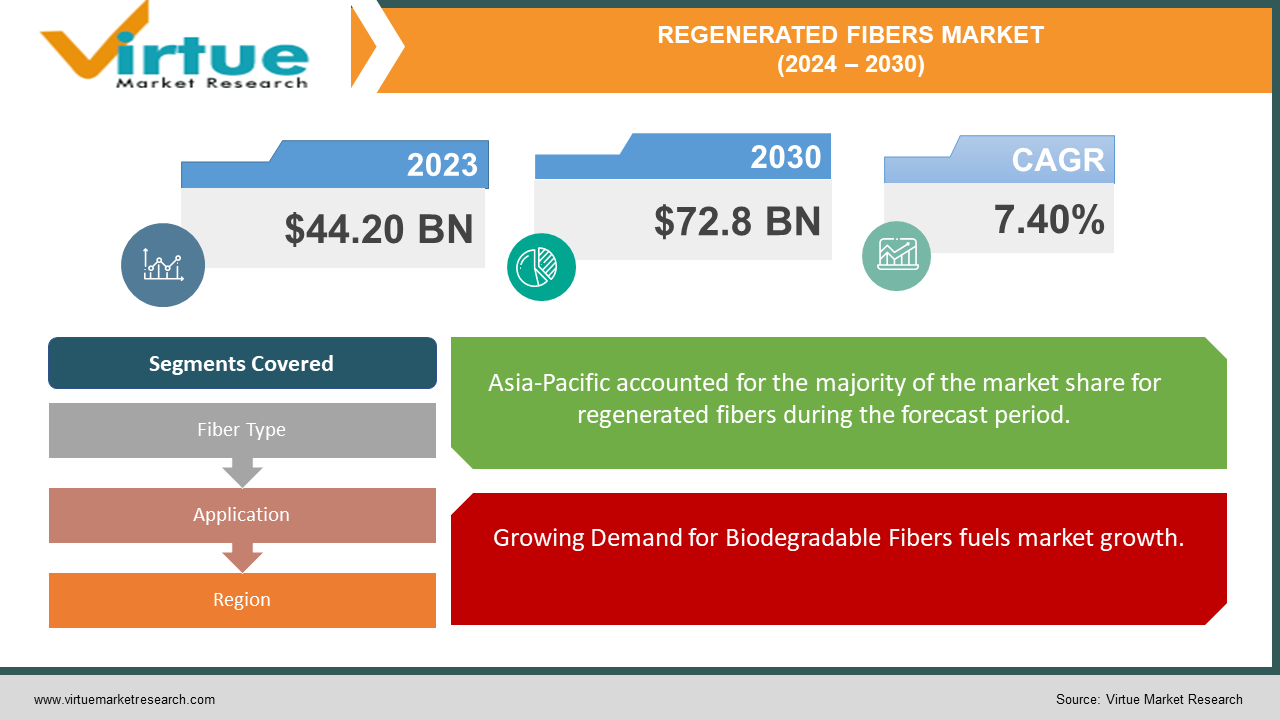

The Global Regenerated Fibers Market was valued at USD 44.20 billion in 2023 and is projected to reach a market size of USD 72.8 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.40%.

Regenerated fibers are synthetic fibers made from natural materials, mostly cellulose. This environmentally friendly manufacturing process involves breaking down cellulose from sources such as wood pulp or plant fibers and then recycling it into thread-like structures. One of the most commonly used fibers is rayon, appreciated for its softness, breathability, and versatility. Another famous example is Lyocell fiber, known for its strength, hygroscopicity, and biodegradability. These fibers offer an alternative to synthetic fibers such as polyester because they are derived from renewable resources and require less energy and water to produce. Regenerated Fibers are used in many sectors such as fashion, home textiles, and medical textiles. Their ability to utilize natural fibers while providing superior performance properties has made them increasingly popular in the search for the best and environmentally friendly solution. As consumers demand more sustainable products, Regenerated Fibers will play an important role in shaping the future of the textile industry.

Key Market Insights:

Asia-Pacific region has the largest and had almost USD 16 billion of total market share in 2023 and is expected to show a CAGR of 8.73%.Governments and regulatory bodies are implementing policies and initiatives to promote sustainability in the textile industry. This includes regulations on waste management, chemical usage, and environmental standards, which are driving the adoption of regenerated fibers among manufacturers seeking to comply with regulations and meet consumer expectations.Collaboration between stakeholders across the supply chain is driving innovation and market growth in the regenerated fibers industry. Partnerships between fiber producers, textile manufacturers, brands, and retailers are facilitating the development of sustainable products and supply chain transparency, meeting the growing demand for eco-friendly textiles.

Regenerated Fibers Market Drivers:

Growing Demand for Biodegradable Fibers fuels market growth.

As concerns about plastic pollution and microplastics in the environment grow, demand for biodegradable alternatives is increasing in industry, including textiles. Regenerated Fibers such as lyocell and modal are biodegradable and will not harm the environment over time. These properties make them attractive for applications where sustainability and biodegradability are important, such as clothing, home textiles, and non-woven materials. The demand for Regenerated Fibers is expected to continue growing due to consumer preferences and regulatory efforts to reduce plastic waste.

Technological Advancements in Fiber Production accelerates the market growth.

Technological advancement has improved the production process of regenerated fibers, improving their quality, performance, and cost. Innovations in spinning technology, chemical processing, and recycling technologies have led to the development of regenerated fibers with superior properties such as improved strength, durability, and dyeability. Additionally, technological advances enable the production of regenerated fibers from many food products, including agricultural and post-waste products, adding further direction to their applications and evidence. Continued research and innovation in fiber technology are expected to drive further growth and competitiveness in the regenerated fibers market.

Shift Towards Circular Economy will drive the Regenerated Fibers market forward.

The concept of circular economy, which refers to the reuse and recycling of resources to reduce waste, is gaining worldwide attention. Regenerated fibers fit well in this way because they can be recycled and reused many times without losing their quality. This reduces dependence on virgin resources and reduces the carbon footprint of the textile industry. Manufacturers and brands are increasingly adding recycled and recyclable materials to their products to support the transition to a circular economy, driving demand for newly regenerated fibers.

Regenerated Fibers Market Restraints and Challenges:

Cost and Price Volatility restrain the market growth.

One of the primary challenges faced by the regenerated fiber market is the costs associated with production. Despite the benefits of regenerated fibers, manufacturing processes often require specialized equipment and chemical treatment, resulting in higher production costs compared to synthetic materials. Additionally, the price of raw materials such as wood pulp or cotton liners may also fluctuate, affecting the overall cost of fiber products. Fluctuations in energy prices and exchange rates further increase price uncertainty. Therefore, companies will have difficulty maintaining competitive prices, and restricted market entry, especially in price-sensitive markets.

Performance Limitations prove to be a challenge in the Regenerated Fibers Market.

While regenerated fibers exhibit desirable properties such as softness, breathability, and biodegradability, they may also have limited performance compared to synthetic fibers. For instance, some regenerated fibers, such as viscose, may have lower tensile strength and abrasion resistance, making them less favorable for applications requiring high durability, such as heavy-duty textiles or outdoor gear. Moreover, certain regenerated fibers may have limited color fastness or be prone to pilling, affecting their aesthetic appeal and longevity. Addressing these performance limitations through research and innovation remains a challenge for the industry to broaden the application scope of regenerated fibers

Competition from Natural and Synthetic Fibers hinders market growth.

The Regenerated Fiber Market faces competition between natural fibers (such as cotton, wool, and silk) and synthetic fibers (such as polyester, nylon, and acrylic). Natural fibers are valued for their properties, biodegradability, and perceived sustainability; This leads to competition for regenerated fibers, especially in niche markets such as luxury clothing and home textiles. Synthetic fibers, on the other hand, offer the best features such as strength, durability, and color fastness at a competitive price. Additionally, advances in synthetic fiber technologies, such as the use of polyester and bio-based polymers, have increased competition in regenerated fibers. To stand out, regenerated fiber manufacturers must continue to innovate to improve product performance, durability, and performance of regenerated fiber products.

Regenerated Fibers Market Opportunities:

The Global Regenerated Fibers Market has seen an increase in opportunities due to increasing consumer awareness and demand for sustainable textile solutions. As environmental concerns become more evident, fibers obtained from renewable resources and processes with low environmental impact are becoming more preferred. Regenerated Fibers such as rayon and lyocell are alternatives to synthetic fibers that provide softness, breathability, and biodegradability while reducing reliance on limited resources. Markets exist in industries where regenerated fibers are valued for their versatility and good environmental properties, including fashion, home textiles, non-woven applications, and industrial sectors. By capitalizing on these opportunities and meeting changing customer preferences, companies can grow and succeed in the Global Regenerated Fibers Market.

REGENERATED FIBERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.40% |

|

Segments Covered |

By Fiber Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Aquafil SpA, Nakoda Textile, Polyfiber Industries, China Bambro Textile, Tencel (Lenzing AG), Birla Cellulose (Aditya Birla Group), Mitsubishi Rayon, FibreZone India, JELU-WERK, Shandilya Fabric |

Regenerated Fibers Market Segmentation - by Fiber Type

-

Rayon

-

Lyocell

-

Modal

-

Viscose

-

Others

In 2023, based on the Fiber Type, Rayon hold the largest market share with over 60% of the market. Rayon's dominance in the global regenerated fibers market stems from its versatility, cost-effectiveness, established market presence, and substantial production capacity. Renowned for its ability to mimic the characteristics of natural fibers like silk, cotton, or wool, rayon finds application across diverse industries, from fashion to home textiles and industrial products. Its lower production costs compared to other regenerated fibers make it a good choice for companies looking to commercialize and develop the fiber. Rayon has a good business position and production capacity globally and is widely recognized and accepted by customers and manufacturers, further integrating its work into regenerated fibers.

Regenerated Fibers Market Segmentation - by Application

-

Apparel

-

Home Textiles

-

Non-Woven Products

-

Industrial and Technical Textiles

-

Others

In 2023, based on the Application, Apparel holds a significant portion of the market share and is expected to grow at an 8.6% CAGR during the forecast period. Apparel covers a wide range of clothing products, including wearables, dresses, sportswear, and accessories, where regenerated fibers are commonly used. In practice, regenerated fibers such as rayon, lyocell, and modal are preferred due to their softness, drape, breathability, and versatility. These fibers offer a great alternative to modern synthetic materials and meet the growing consumer demand for environmentally friendly clothing solutions. In addition, the importance given by the fashion industry to sustainable development and awareness of environmental issues has encouraged the management of regenerated fibers in clothing. As a result, apparel remains the leading application segment within the global regenerated fibers market, commanding a significant share of the overall demand.

Regenerated Fibers Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023 based on Region, Asia-Pacific has the largest market share, with over 36% market share. Asia Pacific emerges as the dominating region in the global regenerated fibers market due to its status as a manufacturing powerhouse, particularly in textiles and apparel. Countries such as China, India, and Indonesia have abundant raw materials, skilled workers, and developed infrastructure required for the production of regenerated fibers according to domestic and international demand. Additionally, the region's competitive production costs make it an attractive location for manufacturers looking for cost-effective solutions. As environmental awareness increases, the growing textile industry in the Asia-Pacific region is increasingly adopting sustainable practices, leading to the adoption of regenerated fibers as an environmentally friendly alternative to synthetic products. Government measures further support this diversity with regulations and policies that encourage the development of the textile industry. Overall, Asia Pacific's dominance in the regenerated fibers industry is due to its production capacity, cost-effectiveness, environmental concerns, and supportive regulatory environment.

In North America, stringent environmental regulations and growing user awareness propel demand for sustainable textile solutions, fueling the adoption of regenerated fibers across different sectors. In Europe, a strong emphasis on sustainability and eco-conscious consumer preferences accelerated the market for regenerated fibers, particularly in fashion and home textiles. In South America, the market is influenced by economic factors, with countries like Brazil and Argentina emerging as key consumers of regenerated fibers for apparel and non-woven applications. In the Middle East and Africa, the market is characterized by a growing textile industry, increasing urbanization, and government initiatives promoting sustainable practices, fueling demand for regenerated fibers across various applications.

While Asia-Pacific leads the Global Regenerated Fibers market, other regions such as North America and Europe are experiencing rapid growth and present huge opportunities for Regenerated Fibers market vendors.

COVID-19 Impact Analysis on the Global Regenerated Fibers Market:

The COVID-19 pandemic significantly impacted the Global Regenerated Fibers Market, leading to disruptions in supply chains, demand fluctuations, and shifts in consumer behavior. During the pandemic, lockdown measures and restrictions on movement disrupted production operations and distribution channels, leading to supply chain disruptions and delays in raw material procurement. Decreased consumer spending and shifts in purchasing patterns also resulted in fluctuations in demand for regenerated fibers, particularly in sectors like the fashion and home textiles sectors. However, the pandemic also highlighted the significance of sustainability and eco-friendly products, fueling increased interest in regenerated fibers among environmentally conscious consumers. As the world gradually recovers from the pandemic, the regenerated fibers market is expected to rebound, driven by continued demand for sustainable textile solutions/services and recovery in key industries.

Latest Trends/ Developments:

In the Global Regenerated Fibers Market, several trends and developments are shaping the industry's course. One notable trend is the growing demand for sustainable and eco-friendly textile solutions, accelerated by increasing environmental awareness among consumers and regulatory initiatives promoting sustainability. As a result, there is a growing preference for regenerated fibers derived from renewable sources and manufactured using eco-friendly processes, such as lyocell and modal. Another trend is the integration of technological advancements in fiber production, leading to the development of innovative fibers with improved performance characteristics and sustainability credentials. Moreover, the fashion industry's focus on circularity and the upcycling of materials has led to the emergence of regenerated fibers made from recycled post-consumer waste, further fueling sustainability efforts in the textile industry. Overall, these trends underscore the industry's commitment to sustainability and innovation in meeting ever-evolving consumer needs for greener textile alternatives.

Key Players:

-

Aquafil SpA

-

Nakoda Textile

-

Polyfiber Industries

-

China Bambro Textile

-

Tencel (Lenzing AG)

-

Birla Cellulose (Aditya Birla Group)

-

Mitsubishi Rayon

-

FibreZone India

-

JELU-WERK

-

Shandilya Fabric

Chapter 1. Regenerated Fibers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Regenerated Fibers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Regenerated Fibers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Regenerated Fibers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Regenerated Fibers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Regenerated Fibers Market – By Fiber Type

6.1 Introduction/Key Findings

6.2 Rayon

6.3 Lyocell

6.4 Modal

6.5 Viscose

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Fiber Type

6.8 Absolute $ Opportunity Analysis By Fiber Type, 2024-2030

Chapter 7. Regenerated Fibers Market – By Application

7.1 Introduction/Key Findings

7.2 Apparel

7.3 Home Textiles

7.4 Non-Woven Products

7.5 Industrial and Technical Textiles

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Regenerated Fibers Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Fiber Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Fiber Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Fiber Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Fiber Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Fiber Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Regenerated Fibers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Aquafil SpA

9.2 Nakoda Textile

9.3 Polyfiber Industries

9.4 China Bambro Textile

9.5 Tencel (Lenzing AG)

9.6 Birla Cellulose (Aditya Birla Group)

9.7 Mitsubishi Rayon

9.8 FibreZone India

9.9 JELU-WERK

9.10 Shandilya Fabric

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Regenerated Fibers Market was valued at USD 44.20 billion in 2023 and is projected to reach a market size of USD 72.8 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.40%.

The segments under the Global Regenerated Fibers Market by Fiber Type are Rayon, Lyocell, Modal, Viscose, and Others.

Asia-Pacific is the dominant region in the Global Regenerated Fibers Market.

Aquafil SpA, Nakoda Textile, Polyfiber Industries, China Bambro Textile, Tencel (Lenzing AG), Shandilya Fabric, FibreZone India etc.

The COVID-19 pandemic significantly impacted the Global Regenerated Fibers Market, leading to disruptions in supply chains, demand fluctuations, and shifts in consumer behavior. During the pandemic, lockdown measures and restrictions on movement disrupted production operations and distribution channels, leading to supply chain disruptions and delays in raw material procurement. Decreased consumer spending and shifts in purchasing patterns also resulted in fluctuations in demand for regenerated fibers, particularly in sectors like the fashion and home textiles sectors.