Recycled Copper Market Size (2025 – 2030)

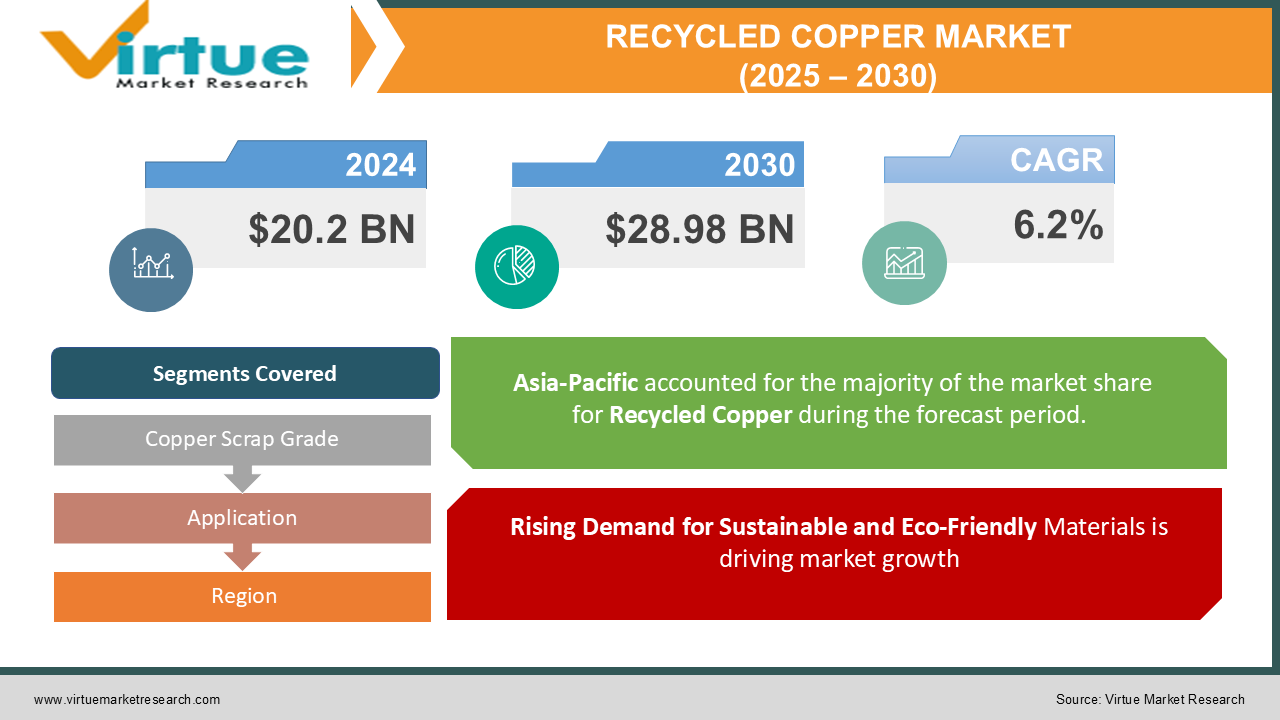

The Global Recycled Copper Market was valued at USD 20.2 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2030. By 2030, the market is expected to reach USD 28.98 billion.

Recycled copper refers to the reprocessing of scrap copper into usable forms for applications across industries such as construction, electrical, electronics, and automotive. The increasing focus on sustainability, coupled with rising demand for copper in green energy solutions, is driving growth in this market. Recycled copper is widely recognized for its environmental benefits, including reduced energy consumption and lower carbon emissions, compared to primary copper production.

Key Market Insights

-

Recycled copper constituted more than 30% of the global copper supply in 2024, reflecting its importance in meeting the growing demand for the metal in industrial applications.

-

Energy transition trends, including the use of electric vehicles (EVs) and renewable energy systems, are driving the market. EVs, for example, need about 83 kg of copper per vehicle, and the demand for recycled copper is increasingly being met.

-

China is the global leader for both recycled copper production and consumption. It had extensive manufacturing and electronics sectors.

Global Recycled Copper Market Drivers

Rising Demand for Sustainable and Eco-Friendly Materials is driving market growth:

Industry is, therefore, hampered by the growing awareness of environmental concerns such as the diminishing availability of resources and greenhouse gases. Recycling copper consumes a minimum of 85% less energy compared to the extraction of primary copper. Thus, the extracted amount leads to reduced carbon emissions and it remains the preferred material in industries targeted in 'green solutions'. Moreover, the global push toward circular economies, where materials are reused and recycled to minimize waste, is further boosting the demand for recycled copper. Governments worldwide are implementing policies and subsidies to promote the use of recycled materials, creating a favorable environment for market growth.

Expanding Applications in Green Technologies is driving market growth:

The transition to green technologies, such as renewable energy systems and electric vehicles (EVs), is a major driver for the recycled copper market. The best thing is that copper finds great application in solar panels, wind turbines, and energy storage systems because it possesses excellent conductivity and durability. Considering the rapid growth of 30% a year in renewable energy installations, demand for the material-copper along with its recyclate-is set to increase in great numbers. On the other hand, over 10 million electric vehicles sold globally in 2024 continue to rely upon copper for battery construction, wiring, and charging infrastructure. Recycled copper becomes the cheapest and most environmentally friendly source of this niche market. Recycling copper is the only economically viable way of extracting it that is becoming attractive to industries.

Economic Benefits of Recycling Copper is driving market growth:

The process is less capital-intensive than primary extraction, which involves enormous mining and ore processing. In this respect, costs are especially helpful for developing economies that can now reduce their reliance on imported raw materials. Furthermore, recycling creates employment along the value chain from collection and sorting to processing and manufacturing. As the industries realize more and more opportunities for monetary and environmental savings through the use of recycled copper, the industry is expected to gain continued growth momentum.

Global Recycled Copper Market Challenges and Restraints

Quality Variations and Contamination Issues is restricting market growth:

The quality of the final product is one of the major issues with the recycled copper market. The scrap copper often contains impurities such as lead, zinc, and iron, which may lower its performance and limit its applications. Coatings, adhesives, and mixed materials add further complexity to the recycling process, necessitating the use of sophisticated technologies for proper separation and purification. There are also supply chain issues of scrap copper in terms of quantity and quality that create difficulties for manufacturers in fulfilling the growing demand. The resolution of these issues involves substantial investment in R&D and technological innovation, which can act as a restraint for smaller players.

Regulatory and Logistical Barriers is restricting market growth:

Although recycled copper is gaining momentum globally, regulatory and logistical challenges in the market restrict its growth. Harsh export and import regulations on scrap materials, mainly in Europe and Asia, always affect the supply chain. China's restriction of importing lower-grade scrap materials to the country forces exporters to find alternative markets for their products. The logistics and storing of scrap copper are also not easy because of its bulkiness and theft-vulnerability. These factors contribute to increased costs and can impact the profitability of recycling operations, particularly in emerging markets.

Market Opportunities

The recycled copper market is quite substantial in growth prospects, especially concerning global sustainability and renewable energy trends. There will be substantial demand for copper arising from the rise of electric vehicles and growth of renewable energy infrastructure. Given the fact that the performance is as good but environmental cost is cheaper, applications are expected to soar in such segments. Other breakthroughs in recycling technologies, like chemical recycling and AI-driven sorting systems, also improve efficiency and output quality. This will help manufacturers to fulfill growing demand. Other emerging markets, such as those in Asia-Pacific, Latin America, and Africa, are adopting recycled materials in order to cut costs and boost resource efficiency. Strategic collaborations between governments, industries, and technology providers can accelerate the adoption of recycled copper further, unlocking new revenue streams for market players.

RECYCLED COPPER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Copper Scrap Grade, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Aurubis AG, Umicore, Sims Metal Management, European Metal Recycling (EMR), Schnitzer Steel Industries, OmniSource Corporation, Kuusakoski Group, Dowa Holdings Co., Ltd., Hindalco Industries, JX Nippon Mining & Metals |

Recycled Copper Market Segmentation - By Copper Scrap Grade

-

Bare Bright Copper

-

No. 1 Copper

-

No. 2 Copper

-

Others

Bare bright copper is the most dominant segment, accounting for over 40% of the market share in 2024. This high-purity copper is preferred for applications in electrical wiring and high-conductivity components due to its superior quality and performance.

Recycled Copper Market Segmentation - By Application

-

Construction

-

Electrical and Electronics

-

Automotive and Transportation

-

Industrial Machinery

-

Others

The construction sector dominates the application segment, holding approximately 45% of the market share. Copper's durability and excellent conductivity make it indispensable for wiring, plumbing, and HVAC systems in residential, commercial, and industrial buildings.

Recycled Copper Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific leads the global recycled copper market, accounting for over 50% of the total revenue in 2024. The region's dominance is driven by China's extensive manufacturing base and strong demand for copper in electronics, construction, and automotive sectors. Additionally, countries like India and Japan are investing heavily in recycling infrastructure to reduce dependence on imported raw materials. Government initiatives promoting circular economies and sustainable practices further boost the market in this region. Asia-Pacific's competitive edge lies in its large-scale production capabilities and access to abundant scrap material, ensuring a steady supply of recycled copper.

COVID-19 Impact Analysis on the Recycled Copper Market

The COVID-19 pandemic had both positive and negative effects on the market for recycled copper. At the beginning, it was quite tough for the industry as there were disruptions in the supply chain, labor shortages, and lockdowns, which significantly reduced scrap collection and processing activities. Such an impact would subsequently affect industries reliant on recycled copper, resulting in material shortages and delays in production. The copper recycling industry is highly dependent on efficient logistics and workforce availability. The sector was, therefore, badly affected during the peak of the pandemic. However, the market rebounded strongly in the post-pandemic period. The recovery was driven by an increase in demand for copper, especially for renewable energy projects and infrastructure development. With the economies beginning to stabilize, governments on several fronts stressed much more on sustainable development, and thus there was the greater requirement for copper in new technologies such as solar power, wind energy, and electric vehicles. The pandemic made the world realize sustainability without any alternatives but to look at recycled materials as a cost-effective and environmentally friendly way rather than using virgin copper. Government stimulus packages also played an important role in achieving rapid growth for the market. Several of these included green infrastructure and sustainable development provisions, which further enhanced demand in the recycled copper market. Policy changes introduced such conditions, which helped the recycled copper market advance long-term growth. Overall, while the pandemic initially posed challenges, it ultimately highlighted the importance of sustainability, positioning the recycled copper industry for future growth and greater integration into a circular economy.

Latest Trends/Developments

A significant shift is underway in the recycled copper market, driven by this change in technology and consumer preference, increasingly turning towards sustainable practices. One of the notable changes includes the use of artificial intelligence and machine learning in sorting systems. In addition to making processes more efficient, AI and machine learning push down contamination levels in the scrap copper, which improves the quality of the recyclable material. Chemical recycling methods are also gaining ground, and it is now possible to extract high-purity copper from complex waste streams that were previously difficult to process. The other important trend is the adoption of blockchain technology in supply chain management. Blockchain provides transparency and traceability, which gives stakeholders confidence in the origin and handling of recycled copper. This innovation fosters trust and accountability, which is very important for sustainable industries. It is also observed that the market is experiencing more collaborations between manufacturers and recycling firms. Such partnerships ensure a constant supply of good-quality recycled copper, thereby making it possible for industries to maintain material availability while working towards sustainability. With this increased demand, these collaborations will build up the recycling ecosystem, bringing in the prospects of sustainable market growth over a long-term cycle. The innovations in the process of recycling, the circular economy initiative, and sustainable practices as an overall business practice are what shape the future for the recycled copper market. These advancements will not only improve the efficiency and quality of recycling but also play a pivotal role in reducing environmental impact and supporting global efforts to conserve natural resources.

Key Players

-

Aurubis AG

-

Umicore

-

Sims Metal Management

-

European Metal Recycling (EMR)

-

Schnitzer Steel Industries

-

OmniSource Corporation

-

Kuusakoski Group

-

Dowa Holdings Co., Ltd.

-

Hindalco Industries

-

JX Nippon Mining & Metals

Chapter 1. Recycled Copper Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Recycled Copper Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Recycled Copper Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Recycled Copper Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Recycled Copper Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Recycled Copper Market – By Copper Scrap Grade

6.1 Introduction/Key Findings

6.2 Bare Bright Copper

6.3 No. 1 Copper

6.4 No. 2 Copper

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Copper Scrap Grade

6.7 Absolute $ Opportunity Analysis By Copper Scrap Grade, 2025-2030

Chapter 7. Recycled Copper Market – By Application

7.1 Introduction/Key Findings

7.2 Construction

7.3 Electrical and Electronics

7.4 Automotive and Transportation

7.5 Industrial Machinery

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Recycled Copper Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Copper Scrap Grade

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Copper Scrap Grade

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Copper Scrap Grade

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Copper Scrap Grade

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Copper Scrap Grade

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Recycled Copper Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Aurubis AG

9.2 Umicore

9.3 Sims Metal Management

9.4 European Metal Recycling (EMR)

9.5 Schnitzer Steel Industries

9.6 OmniSource Corporation

9.7 Kuusakoski Group

9.8 Dowa Holdings Co., Ltd.

9.9 Hindalco Industries

9.10 JX Nippon Mining & Metals

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Recycled Copper Market was valued at USD 20.2 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2030. By 2030, the market is expected to reach USD 28.98 billion.

Key drivers include rising demand for sustainable materials, expanding applications in green technologies, and the economic benefits of recycling copper.

The market is segmented by copper scarp grade (bare bright copper, No. 1 copper, No. 2 copper) and application (construction, electrical and electronics, automotive, industrial machinery).

Asia-Pacific is the dominant region, accounting for over 50% of the market share, driven by robust demand and extensive manufacturing capabilities.

Leading players include Aurubis AG, Umicore, Sims Metal Management, European Metal Recycling, and Hindalco Industries.