Recycled Carbon Fiber Market Size (2025 – 2030)

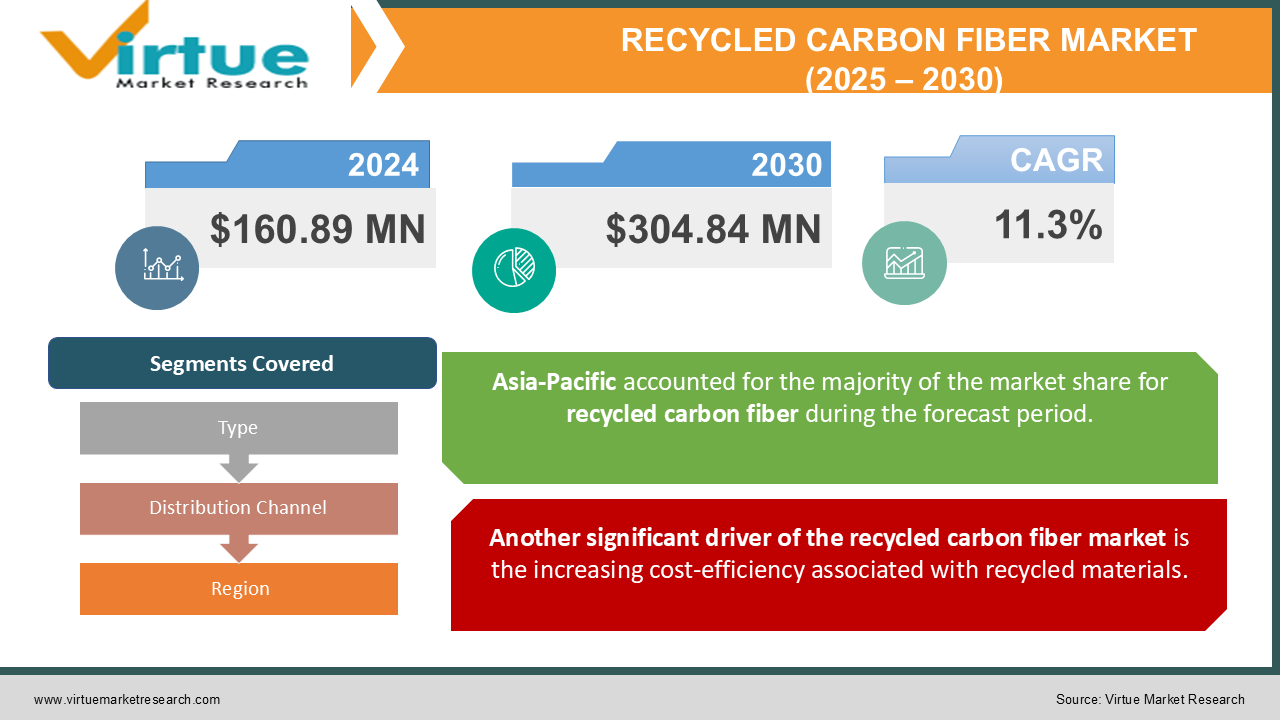

The Recycled Carbon Fiber Market was valued at USD 160.89 Million in 2024 and is projected to reach a market size of USD 304.84 Million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 11.3%.

The recycled carbon fiber market represents a rapidly evolving segment within the broader composite materials industry. As global sustainability initiatives continue to prioritize waste reduction and resource efficiency, recycled carbon fiber has emerged as a critical material offering both environmental and economic benefits. Recycled carbon fiber is derived from end-of-life products or manufacturing scrap, ensuring that valuable carbon material does not go to waste. This process not only reduces landfill contributions but also minimizes the need for virgin carbon fiber, a resource-intensive and costly material to produce. Industries such as automotive, aerospace, construction, and sports equipment manufacturing have increasingly adopted recycled carbon fiber due to its impressive strength-to-weight ratio, affordability compared to virgin alternatives, and its reduced environmental footprint.

Key Market Insights:

Over 12,000 metric tons of recycled carbon fiber were produced worldwide in 2023.

The automotive sector accounted for 37% of the total demand for recycled carbon fiber in 2023.

Around 28% of recycled carbon fiber was utilized in the aerospace and defense industries.

The construction industry contributed to 18% of the market demand for recycled carbon fiber in 2023.

The global adoption of recycled carbon fiber in wind energy applications rose by 22% in 2023.

Approximately 70% of end-users cited cost savings as their primary reason for choosing recycled over virgin carbon fiber.

Non-woven recycled carbon fiber mats accounted for 45% of the product segment demand in 2023.

The aerospace industry reported a 12% reduction in material costs due to the adoption of recycled carbon fiber.

In 2023, 42% of automotive manufacturers used recycled carbon fiber in structural and non-structural applications.

More than 15 countries introduced legislation supporting carbon fiber recycling initiatives in 2023.

Market Drivers:

One of the primary drivers of the recycled carbon fiber market is the growing emphasis on sustainability and the transition toward a circular economy.

As environmental awareness continues to rise, industries worldwide are under increasing pressure to adopt sustainable practices. The traditional manufacturing of carbon fiber, particularly through the production of virgin carbon fiber, is energy-intensive, producing a significant carbon footprint. In contrast, the process of recycling carbon fiber allows for the reuse of valuable materials, reducing the need for raw resources and lowering energy consumption. The integration of recycled carbon fiber into products significantly diminishes waste and supports eco-friendly initiatives, which aligns with global environmental regulations and sustainability goals. As governments across the globe tighten regulations regarding carbon emissions and waste management, industries are being pushed to look for alternatives that reduce environmental impact. The automotive and aerospace industries, in particular, are adopting recycled carbon fiber for its sustainable advantages, contributing to a reduction in overall greenhouse gas emissions.

Another significant driver of the recycled carbon fiber market is the increasing cost-efficiency associated with recycled materials.

The price of virgin carbon fiber can be prohibitively expensive, particularly when compared to other composite materials. The high cost of production is one of the main barriers to its widespread adoption, especially for small and medium-sized enterprises (SMEs) and in industries with price-sensitive products. However, recycled carbon fiber offers a cost-effective alternative, providing similar performance characteristics at a fraction of the cost. The process of recycling carbon fiber is more economical in several ways. First, the raw material cost is significantly lower since it involves reclaiming fiber from end-of-life products, which would otherwise be discarded as waste. Second, recycled carbon fiber reduces the need for new resources, lowering the environmental and economic costs associated with resource extraction. The high cost of producing virgin carbon fiber is primarily due to the energy-intensive processes required for manufacturing, such as the polymerization and curing of the carbon precursor. Recycled carbon fiber eliminates the need for these processes, resulting in lower production costs. As a result, industries such as automotive, construction, and manufacturing are increasingly incorporating recycled carbon fiber into their products, as it allows them to reduce production costs while maintaining high-performance standards.

Market Restraints and Challenges:

Despite the growing adoption and increasing market opportunities for recycled carbon fiber, several challenges and restraints still hinder its widespread usage. One of the most significant barriers is the limited availability of high-quality recycled carbon fiber. Unlike other materials, carbon fiber recycling is not as simple as melting down scrap and repurposing it. The quality of recycled carbon fiber depends heavily on the method used for recovery, with some techniques resulting in lower quality fibers that may not meet the rigorous standards required for high-performance applications, such as in aerospace and automotive manufacturing. The current recycling technologies, including pyrolysis and solvolysis, are still under development, and their ability to produce recycled carbon fiber that matches the mechanical properties of virgin carbon fiber is still a work in progress. Additionally, there is a lack of standardized processes and guidelines for carbon fiber recycling, which creates uncertainty in the quality and consistency of recycled materials. Without clear industry standards, companies may be hesitant to adopt recycled carbon fiber due to concerns about its performance, which can vary depending on the recycling method used and the source of the carbon fiber. Without established quality controls, manufacturers are wary of taking on the risk of using recycled materials in critical applications, such as in aviation or automotive safety components, where failure can have dire consequences. The complexity of recycling carbon fiber also presents logistical challenges. Carbon fiber waste is often spread across different industries and comes in various forms, such as scraps, defective parts, and end-of-life products. The collection, transportation, and processing of this waste can be difficult and costly, particularly for small-scale operations. This complexity further exacerbates the challenges of establishing a viable and efficient recycling ecosystem.

Market Opportunities:

The recycled carbon fiber market presents several lucrative opportunities for growth, driven by technological advancements, expanding industry applications, and increasing regulatory support. One of the key opportunities lies in the ongoing development and optimization of recycling technologies. As the demand for carbon fiber grows and sustainability goals become more pressing, there is an increasing push to improve recycling processes to enhance material recovery, quality, and cost-effectiveness. The development of new and innovative recycling methods, such as direct recycling and solvent-based recycling processes, presents significant opportunities to enhance the efficiency and output of carbon fiber recycling. These innovations will likely lower the cost of producing recycled carbon fiber while improving the material's performance, further expanding its applications. Another opportunity lies in the automotive and aerospace industries, where recycled carbon fiber is gaining traction due to its ability to reduce weight, increase fuel efficiency, and lower production costs. Electric vehicles (EVs), in particular, represent a massive opportunity for carbon fiber. The increasing demand for lightweight and sustainable components in EVs presents a growing market for this material. Furthermore, the construction and sports industries are increasingly looking to integrate recycled carbon fiber into their products. In construction, carbon fiber composites are used for reinforcement, while in sports equipment, lightweight and durable carbon fiber is essential for performance. Recycled carbon fiber offers a viable solution for reducing costs and environmental impact in both sectors. In conclusion, the growing demand for recycled carbon fiber is driven by significant opportunities across a range of industries, particularly as recycling technologies improve and sustainability targets become more stringent. Companies that can innovate in recycling processes and expand their production capacity will be well-positioned to capitalize on these opportunities and lead the way in the adoption of recycled carbon fiber.

RECYCLED CARBON FIBER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

11.3% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Carbon Conversions, Inc., ELG Carbon Fibre Limited, Recitec Recycling, SGL Carbon, Toray Industries, Zoltek, Vartega, Inc., Kureha Corporation, Teijin Limited, U.S. Recycled Carbon Fiber (USRCF), Hexcel Corporation, AMT Composites, Prodrive Composites, BASF SE, Recycled Carbon Fiber, LLC |

Recycled Carbon Fiber Market Segmentation: by Type

-

Chopped Carbon Fiber

-

Continuous Carbon Fiber

-

Milled Carbon Fiber

Among these, continuous carbon fiber is the fastest-growing type in the market. This is primarily because of its application in high-performance industries such as aerospace and automotive, where the demand for recycled materials that can maintain high strength and performance is growing rapidly. As the technology for recycling continuous fibers improves, more manufacturers are able to reuse them in critical applications, making it a dominant force in the market.

Recycled Carbon Fiber Market Segmentation: by Distribution Channel

-

Direct Sales

-

Online Sales Platforms

-

Distributors and Resellers

Among these channels, direct sales remain the most dominant distribution method in the recycled carbon fiber market, especially for high-performance applications that require technical support and customization. However, online platforms are quickly emerging as the fastest-growing channel due to the increasing trend of online sourcing, convenience, and cost-effectiveness for smaller manufacturers and businesses.

Recycled Carbon Fiber Market Segmentation: by Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

Among these, Europe is the most dominant region in terms of market share, thanks to its advanced recycling infrastructure, commitment to sustainability, and high demand for recycled carbon fiber in various industries. However, Asia Pacific is the fastest-growing region, driven by its booming automotive and manufacturing sectors and increasing investments in sustainable practices.

COVID-19 Impact Analysis on the Recycled Carbon Fiber Market:

The COVID-19 pandemic had a significant impact on the global economy, and the recycled carbon fiber market was no exception. The initial stages of the pandemic caused a slowdown in production and supply chain disruptions, affecting industries that rely on recycled carbon fiber. The aerospace and automotive industries, in particular, experienced a decline in demand as global travel restrictions and reduced consumer spending led to a downturn in these sectors. This, in turn, impacted the demand for carbon fiber materials, including recycled carbon fiber. However, as the global economy began to recover, the market for recycled carbon fiber saw a resurgence. The pandemic underscored the importance of sustainability and resource conservation, prompting industries to reconsider their material sourcing strategies. Companies in sectors such as automotive and aerospace began to recognize the potential of recycled carbon fiber as a cost-effective and environmentally friendly alternative to virgin carbon fiber. This shift toward sustainability accelerated the adoption of recycled carbon fiber in the post-pandemic era. Moreover, the increased focus on green recovery and sustainability post-COVID has led to greater governmental support for the recycling industry. Governments worldwide are investing in green technologies and incentivizing industries to adopt recycled materials to meet environmental goals. The demand for electric vehicles, renewable energy, and sustainable infrastructure projects has provided a significant boost to the recycled carbon fiber market, as these sectors prioritize lightweight, durable, and eco-friendly materials. In conclusion, while the COVID-19 pandemic initially posed challenges for the recycled carbon fiber market, the long-term impact has been largely positive. The crisis has accelerated the transition to sustainable practices, leading to an increase in the adoption of recycled carbon fiber across various industries. As industries continue to recover and prioritize sustainability, the market for recycled carbon fiber is expected to grow steadily.

Latest Trends and Developments:

The recycled carbon fiber market has seen several key trends and developments in recent years, driven by advancements in recycling technology, increasing demand for sustainable materials, and changing consumer preferences. One of the most prominent trends is the growing focus on improving recycling technologies. New methods, such as solvent-based recycling and direct recycling, have shown promise in enhancing the quality and efficiency of the recycling process, enabling higher recovery rates and better performance characteristics of the recycled carbon fiber. These advancements are expected to further drive the adoption of recycled carbon fiber in high-performance applications like aerospace, automotive, and sports equipment. Another notable trend is the rise of circular economy initiatives, where companies are increasingly looking for ways to close the loop on materials and reduce waste. The recycled carbon fiber market fits perfectly within this framework, as it allows companies to reuse valuable resources and minimize their environmental impact. Industries like automotive and aerospace are focusing on circularity, integrating recycled carbon fiber into their production processes to reduce raw material consumption and lower emissions. This trend is expected to continue gaining momentum as companies and governments emphasize the need for sustainable practices. Additionally, the increasing demand for lightweight materials in industries like automotive and aerospace is driving the use of recycled carbon fiber. As electric vehicles become more prevalent, the need for lightweight components to improve energy efficiency has become a priority. Recycled carbon fiber offers a sustainable solution to this challenge, enabling manufacturers to reduce vehicle weight without compromising on strength and durability.

Key Players in the Market:

-

Carbon Conversions, Inc.

-

ELG Carbon Fibre Limited

-

Recitec Recycling

-

SGL Carbon

-

Toray Industries

-

Zoltek

-

Vartega, Inc.

-

Kureha Corporation

-

Teijin Limited

-

U.S. Recycled Carbon Fiber (USRCF)

-

Hexcel Corporation

-

AMT Composites

-

Prodrive Composites

-

BASF SE

-

Recycled Carbon Fiber, LLC

Chapter 1. Recycled Carbon Fiber Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Recycled Carbon Fiber Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Recycled Carbon Fiber Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Recycled Carbon Fiber Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Recycled Carbon Fiber Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Recycled Carbon Fiber Market – By Type

6.1 Introduction/Key Findings

6.2 Chopped Carbon Fiber

6.3 Continuous Carbon Fiber

6.4 Milled Carbon Fiber

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Recycled Carbon Fiber Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Online Sales Platforms

7.4 Distributors and Resellers

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Recycled Carbon Fiber Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Recycled Carbon Fiber Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Carbon Conversions, Inc.

9.2 ELG Carbon Fibre Limited

9.3 Recitec Recycling

9.4 SGL Carbon

9.5 Toray Industries

9.6 Zoltek

9.7 Vartega, Inc.

9.8 Kureha Corporation

9.9 Teijin Limited

9.10 U.S. Recycled Carbon Fiber (USRCF)

9.11 Hexcel Corporation

9.12 AMT Composites

9.13 Prodrive Composites

9.14 BASF SE

9.15 Recycled Carbon Fiber, LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

One of the most significant drivers of growth in the recycled carbon fiber market is the growing emphasis on sustainability. As industries strive to reduce their carbon footprints and shift towards more environmentally responsible practices, the demand for recycled materials, including carbon fiber, has surged.

One of the most significant concerns in the recycled carbon fiber market is the high cost associated with the recycling process itself. While recycled carbon fiber offers cost savings compared to virgin carbon fiber, the technologies currently used for recycling carbon fiber—such as thermal, chemical, or solvent-based methods—remain expensive and energy-intensive.

Carbon Conversions, Inc., ELG Carbon Fibre Limited, Recitec Recycling, SGL Carbon, Toray Industries, Zoltek, Vartega, Inc., Kureha Corporation, Teijin Limited.

Europe currently holds the largest market share, estimated at around 35%.

Asia Pacific has shown significant room for growth in specific segments.