Recovery Drinks Market Size (2024 – 2030)

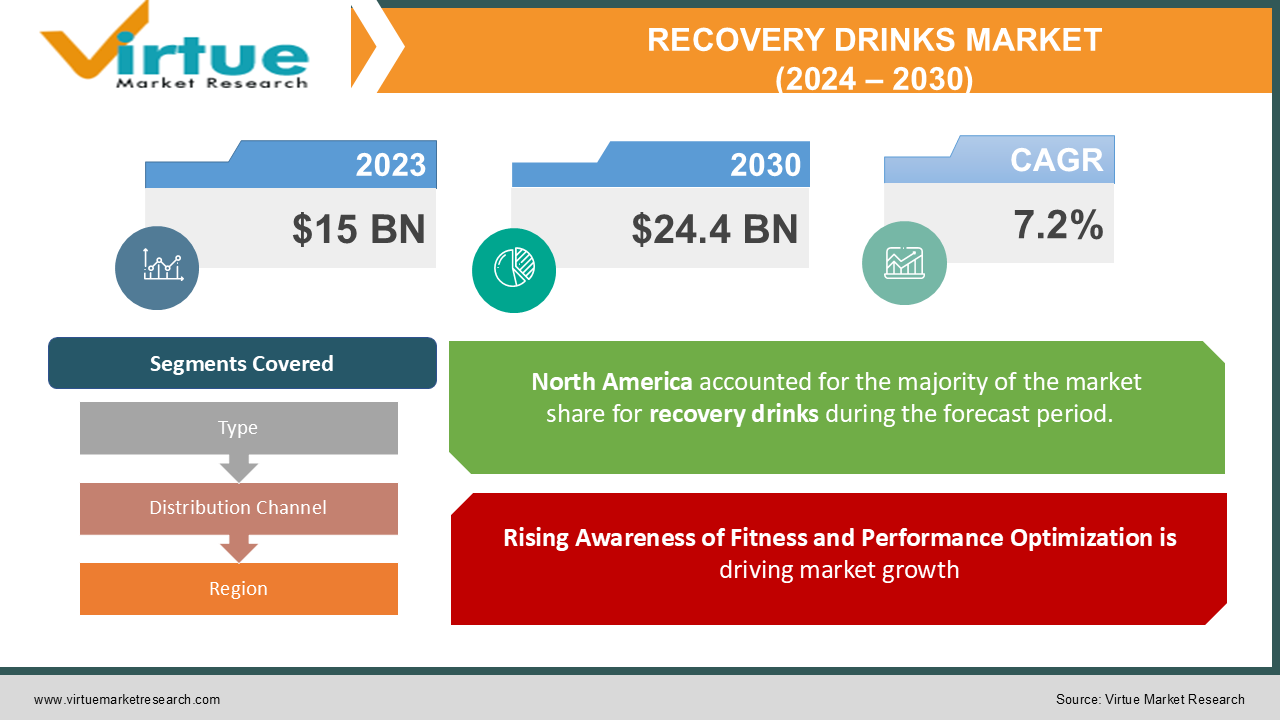

The Global Recovery Drinks Market was valued at USD 15 billion in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030. By the end of 2030, the market is projected to reach USD 24.4 Billion.

Recovery drinks are beverages designed to restore hydration, replenish electrolytes, and support muscle recovery post-exercise or physical activity. They often contain a combination of proteins, carbohydrates, electrolytes, vitamins, minerals, and amino acids, tailored to help athletes and fitness enthusiasts recover more effectively. Recovery drinks include sports beverages, protein shakes, functional juices, and electrolyte-infused water. The growing awareness of health and fitness, coupled with the rising trend of high-intensity workouts, endurance sports, and recreational fitness activities, has boosted the demand for recovery drinks. As consumers increasingly look for ways to optimize post-workout recovery and enhance athletic performance, the market is experiencing rapid growth. Additionally, plant-based recovery beverages and functional beverages are gaining traction, reflecting shifting consumer preferences toward natural and sustainable products.

Key Market Insights:

There is a huge demand for protein recovery drinks, especially among athletes and fitness enthusiasts to help in muscle repair and strength development. Due to the growing popularity of plant-based nutrition, the demand for vegan protein recovery drinks from sources like pea, rice, and hemp protein is on the rise.

Ready-to-drink beverages comprise the largest share of the recovery drinks market. Such products provide convenience to users who are busy in life and do not find the time to prepare any meal or drink.

Asia-Pacific is turning out to be one of the key regions in the recovery drinks market with growing disposable incomes and fitness activity participation.

Online retail channels are also vital in the distribution mode of recovery drinks, offering a huge assortment of niche products and individualized solutions to the targeted market.

Global Recovery Drinks Market Drivers:

Rising Awareness of Fitness and Performance Optimization is driving market growth:

The growing global awareness of health and wellness has resulted in increased participation in fitness activities, including running, cycling, strength training, and team sports. Recovery drinks play a critical role in supporting athletes' post-workout recovery, replenishing lost electrolytes, and repairing muscle tissues. As consumers focus more on performance optimization and muscle recovery, they are turning to scientifically formulated recovery drinks that offer specific benefits. The trend of high-intensity interval training (HIIT) and endurance sports has further boosted the need for quick and effective recovery solutions.

Growth of Plant-Based and Functional Beverages is driving market growth:

The rise of plant-based diets has driven demand for recovery drinks made from non-dairy protein sources such as peas, hemp, and rice. Plant-based recovery drinks cater to a growing segment of consumers who are vegan, lactose-intolerant, or environmentally conscious. Additionally, functional beverages enriched with amino acids, vitamins, antioxidants, and probiotics are gaining popularity. Consumers are increasingly seeking beverages that provide multiple benefits, such as enhanced digestion, immunity support, and muscle recovery, all in one product. These innovative offerings appeal to health-conscious individuals looking for clean-label and multi-functional recovery solutions.

Convenience and Accessibility through RTD Formats and E-commerce Channels are driving market growth:

Busy lifestyles and the demand for on-the-go consumption have fueled the popularity of ready-to-drink (RTD) recovery beverages. These products are convenient and eliminate the need for mixing powders or preparing shakes, making them ideal for post-workout consumption. The growth of e-commerce platforms has also contributed to the market expansion, as consumers increasingly prefer online shopping for personalized recovery drinks, subscription models, and niche functional products. Social media marketing and fitness influencers further amplify the appeal of recovery drinks, particularly among younger, fitness-oriented consumers.

Global Recovery Drinks Market Challenges and Restraints:

High Production Costs and Regulatory Compliance are restricting market growth:

Recovery drinks require high-quality ingredients, including proteins, amino acids, and electrolytes, which can increase production costs. Plant-based protein sources are often more expensive than traditional dairy proteins, such as whey or casein. Additionally, manufacturers must comply with strict food safety regulations and labeling standards, particularly in regions like North America and Europe. Regulatory compliance related to health claims, product certifications, and ingredient safety can create barriers to market entry for new players. Companies must carefully manage production costs and adhere to regulatory standards while maintaining product quality and competitive pricing.

Competition from Alternative Recovery Solutions is restricting market growth:

The recovery drinks market faces competition from other recovery solutions, including protein bars, functional foods, and dietary supplements. Many consumers prefer solid food options for post-workout nutrition, such as protein-enriched snacks or meal replacements. Additionally, some athletes use traditional foods like bananas or electrolyte-rich coconut water to support their recovery. The availability of a wide range of recovery products creates intense competition, making it challenging for recovery drinks to maintain market share. Companies need to continuously innovate and differentiate their offerings to stay ahead in a crowded market.

Market Opportunities:

The global recovery drinks market is going to grow exponentially due to innovation, changes in consumer preferences, and new market penetration. One of the major opportunities is in the area of customized recovery drinks. As consumers are getting more specific about their particular fitness goals, dietary requirements, and lifestyle preferences for the products, brands are taking advantage of technology and data to create bespoke formulations that suit the unique health requirements of individuals. Plant-based and organic recovery drinks appear to be another promising area. Increasing demand for sustainable and natural products means that companies offering organic and eco-friendly recovery options are likely to attract conscious consumers looking for healthier choices. So indeed there is a tremendous amount of opportunity in functional beverages that can provide related functions regarding muscle recovery and immune status, as well as enhancement of cognitive functions as mood improvers. They service more varied and diversified forms of consumer needs. That said, they are much more appealing. Other agreements involve deals with exercise centers, gyms, and sporting events producers, which provide excellent opportunities for strong brand recognition in front of customers. By partnering with fitness clubs and event programmers, firms are able to market recovery drinks as part of the workout recovery process, thus ensuring the products reach the desired demographic. Apart from that, D2C platforms and subscription services open avenues for brands to develop meaningful long-term relationships with customers through such customized recovery drink offers. In total, embracing such opportunities creates a bright future for the market for recovery drinks because people who are more health-oriented and conscious have changing demand requirements.

RECOVERY DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Coca-Cola Company, PepsiCo Inc. (Gatorade), Abbott Laboratories (Ensure), Nestlé S.A. (Boost), MusclePharm Corporation, Glanbia Plc (Optimum Nutrition), Herbalife Nutrition Ltd., Clif Bar & Company, Orgain, Inc., BioSteel Sports Nutrition Inc. |

Recovery Drinks Market Segmentation: By Type

-

Protein-based Recovery Drinks

-

Carbohydrate-based Recovery Drinks

-

Electrolyte Replacement Drinks

-

Functional Juices and Smoothies

-

Others

Protein-based recovery drinks dominate the market due to their effectiveness in muscle repair and strength recovery. These drinks are widely consumed by athletes and fitness enthusiasts across all levels.

Recovery Drinks Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Retail

-

Specialty Health Stores

-

Others

Online retail holds a significant share in the distribution segment, as consumers increasingly prefer the convenience of purchasing recovery drinks through e-commerce platforms.

Recovery Drinks Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is the most dominant region in the global recovery drinks market, driven by the high participation rate in sports and fitness activities. The region's well-established sports nutrition industry and consumer focus on wellness further support market growth.

COVID-19 Impact Analysis on the Recovery Drinks Market:

The COVID-19 pandemic had mixed effects on the recovery drinks market. First, it negatively impacted sales since most gyms and sports events were restricted, making it challenging to continue normal fitness routines. However, the pandemic actually heightened the focus on health and immunity, which intensified demand for functional beverages as a whole, including recovery drinks. With the rising popularity of home workouts as well as outdoor fitness activities, many people started going for recovery products to be able to support their respective exercise routines. This alone helped boost consumption among workout-at-home enthusiasts. Online channels also became an important outlet for sales during the period of the pandemic. This drove consumers to look towards the ease of e-commerce for getting health and wellness products so that brands can reach larger audiences. During the pandemic, there have also been accelerated trends for plant-based nutrition and clean-label products, with active demand from consumers for natural recovery solutions free from artificial additives. Companies quickly launched drinks claiming immunity-boosting effects as a recovery drink with changing preferences and adapting to this. This further emphasized how essential hydration and nutrition have become in these trying times. Overall, the COVID-19 pandemic posed initial difficulties, but at the same time, it opened growth opportunities and innovations in the recovery drinks market to align with changed consumer priorities toward health and wellness.

Latest Trends/Developments:

There are several trends shaping the future of the recovery drinks market significantly. For instance, it has sustainable and vegan recovery beverages wherein consumers are becoming increasingly inclined toward more sustainable, non-cruel products. The primary driver of this shift is an increasing awareness of health and environmental issues. Innovation in flavor profiles is also becoming popular, where the appeal of recovery drinks is enhanced by exotic fruits and botanical ingredients. These unique flavors cater to inquisitive consumers looking for new flavor experiences. Sustainability is the primary focus, and manufacturers are willing to spend on recyclable, eco-friendly packaging to provide consumers with products that support the cause. This also only makes consumers more brand loyal and creates a huge plastic waste problem. There are functional ingredients such as adaptogens, nootropics, and collagen incorporated into recovery drinks. These ingredients will combine various health benefits in one beverage product, which is most attractive to consumers who value holistic wellness solutions. Apart from this, growing trends of D2C and subscription services open avenues to establish long-term customer-brand relationships and provide tailored recovery solutions according to specific client requirements. Finally, their expansion into the market can be done with the involvement of sports teams, gym collaborations, and fitness personalities through their respective channels because these partnerships can best aid the brands in reaching their audience effectively. Overall, these trends will drive the demand for recovery drinks as it strives to adapt to these future changes and satisfy the diverse needs of health-conscious buyers.

Key Players:

-

The Coca-Cola Company

-

PepsiCo Inc. (Gatorade)

-

Abbott Laboratories (Ensure)

-

Nestlé S.A. (Boost)

-

MusclePharm Corporation

-

Glanbia Plc (Optimum Nutrition)

-

Herbalife Nutrition Ltd.

-

Clif Bar & Company

-

Orgain, Inc.

-

BioSteel Sports Nutrition Inc.

Chapter 1. Recovery Drinks Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Recovery Drinks Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Recovery Drinks Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Recovery Drinks Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Recovery Drinks Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Recovery Drinks Market – By Type

6.1 Introduction/Key Findings

6.2 Protein-based Recovery Drinks

6.3 Carbohydrate-based Recovery Drinks

6.4 Electrolyte Replacement Drinks

6.5 Functional Juices and Smoothies

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Recovery Drinks Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Convenience Stores

7.4 Online Retail

7.5 Specialty Health Stores

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Recovery Drinks Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Recovery Drinks Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 The Coca-Cola Company

9.2 PepsiCo Inc. (Gatorade)

9.3 Abbott Laboratories (Ensure)

9.4 Nestlé S.A. (Boost)

9.5 MusclePharm Corporation

9.6 Glanbia Plc (Optimum Nutrition)

9.7 Herbalife Nutrition Ltd.

9.8 Clif Bar & Company

9.9 Orgain, Inc.

9.10 BioSteel Sports Nutrition Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Recovery Drinks Market was valued at USD 15 billion in 2023 and is expected to reach USD 24.4 billion by 2030, growing at a CAGR of 7.2%.

Key drivers include the rising awareness of fitness and performance optimization, the growth of plant-based beverages, and the demand for convenient RTD products.

The market is segmented By Type (Protein-based Recovery Drinks, Carbohydrate-based Recovery Drinks, Electrolyte Replacement Drinks, Functional Juices and Smoothies, and Others); By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Health Stores, Others).

North America is the most dominant region, driven by high fitness participation rates and a well-established sports nutrition industry.

Leading players include The Coca-Cola Company, PepsiCo Inc., Abbott Laboratories, Nestlé S.A., and MusclePharm Corporation.