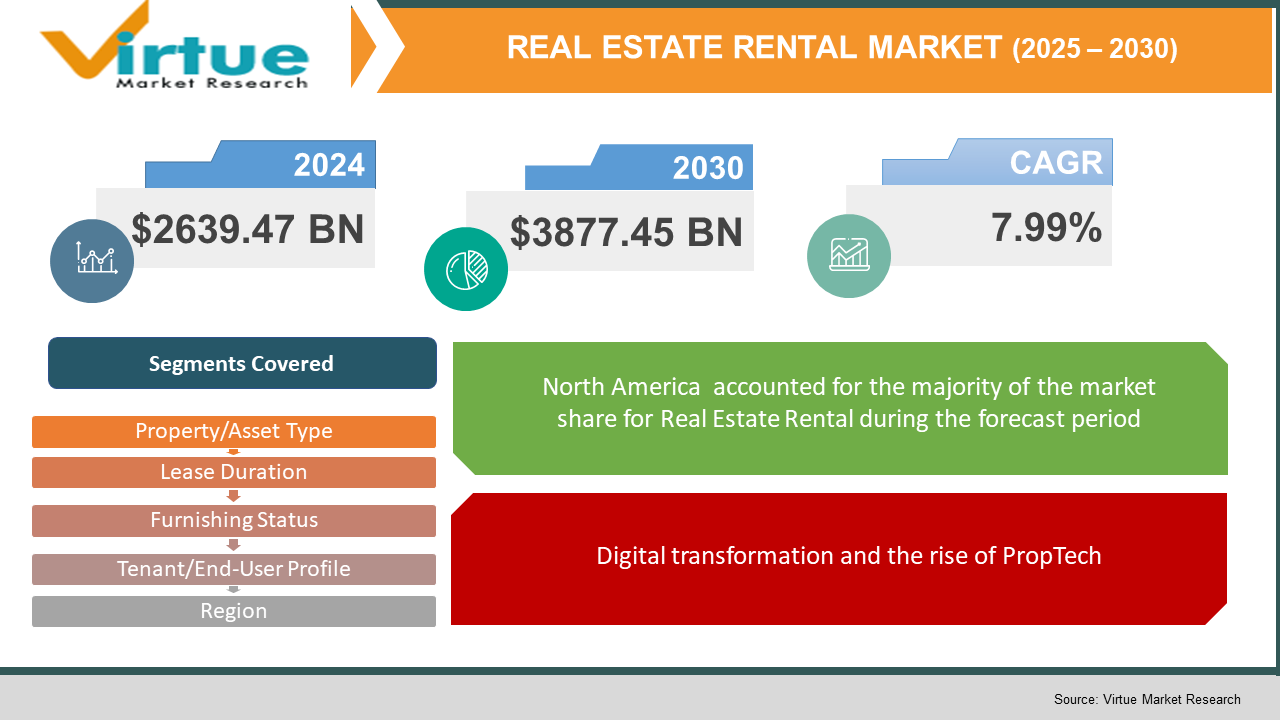

Real Estate Rental Market Size (2025-2030)

The Real Estate Rental Market was valued at $2639.47 billion and is projected to reach a market size of $3877.45 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.99%

The real estate rental market has a lot of different types of properties and uses, giving people flexible living and working spaces. You can find everything from single-family homes and apartments to office buildings, warehouses, and retail spaces, catering to both short- and long-term renters. This market includes various property types, how long leases last, whether spaces are furnished or not, who the tenants are, and what the properties are used for. For example, residential rentals can be unfurnished, semi-furnished, or fully furnished. On the commercial side, you'll see shared workspaces and big industrial properties. There are also specialized rentals like student housing, senior living, vacation rentals, and co-living spaces to meet specific needs. The market keeps changing, with new property management tech and the ability to work with existing buildings. Rental properties serve a bunch of purposes, including living, working, retail, storage, and temporary stays. There's a growing focus on sustainable practices, smart home features, and flexible leases as both landlords and tenants look for better, affordable options.

The industry includes a mix of traditional real estate companies, property developers, major landlords, and tech platforms, all adding to its lively nature. Partnerships and investment in tech are reshaping how this sector works, making rentals an important part of the property world. As the need for adaptable spaces increases, rentals are key for both short-term needs and long-lasting stability for many people.

Key Market Insights:

The use of digital leasing platforms and mobile property management tools has really taken a toll on the economy. Now, over 65% of renters in North America are using online portals for finding places, applying, and paying rent. This move to digital makes sense, as people want convenience and clarity when it comes to renting.

With changes in what tenants want and the rise of remote work, about 38% of rental properties now offer flexible lease terms like month-to-month or mid-term options. Plus, fully furnished rentals have jumped by 27% over the past year, meeting the needs of mobile professionals, students, and those relocating temporarily.

There’s also a big growth in student housing, co-living spaces, and rentals for seniors. Student rentals now make up 12% of new multifamily developments in cities. These niche rental types focus on community living and specific amenities to keep tenants happy and coming back.

More than 40% of property managers are adding smart home tech, like smart locks and thermostats, to boost energy efficiency and tenant satisfaction. Green certifications and eco-friendly building practices are becoming key in competitive city markets.

As hybrid and remote work become the norm, there’s been a 22% rise in leasing activity in suburban and smaller cities. Tenants are looking for bigger spaces, outdoor areas, and better prices away from the usual urban spots. This shift is pushing landlords to change their approach and rework their marketing to tap into this new demand.

Real Estate Rental Market Key Drivers:

Digital transformation and the rise of PropTech.

Property technology, which includes things like AI tools for valuations, online leasing options, and smart home features, is really changing how we handle rentals. These technologies simplify a bunch of tasks—like screening potential tenants and handling maintenance requests—making life easier for property managers and providing a better experience for renters. As more property owners start using these technological solutions, they're able to keep up with changes in the market and ensure that their properties have a steady flow of tenants.

Trends in demographics and urban living.

There’s a big push of people moving to cities these days, especially young folks like millennials and members of Gen Z. This trend is driving up demand for rental properties. These younger generations often want flexible living options, prefer to rent through digital platforms, and look for places that come with lots of amenities. Because of this shift in what renters want, developers are increasingly leaning towards creating co-living spaces and mixed-use buildings in urban areas.

Challenges with supply and affordability.

We're facing a tough situation when it comes to housing availability. There isn’t enough new housing being built right now, thanks to strict zoning laws, high construction costs, and rising interest rates. This shortage means that there’s more competition for rentals, leading to higher rents, which in turn is pushing some people to move further out into the suburbs. Many renters are also looking for more flexible leasing options as buying a home becomes harder to achieve for many. Despite these challenges, the demand for rentals remains strong.

Real Estate Rental Market Restraints and Challenges:

Main Issues and Challenges in the Rental Market Today.

The rental market is facing tough times as rents are rising faster than people's incomes in many cities, making it harder for tenants and pushing for more regulations. New rules around how rents can be set and restrictions on pricing algorithms have been put in place to help renters, but they also create extra work for landlords. On top of that, economic ups and downs, like high interest rates and inflation, are driving up mortgage and insurance costs, which cuts into the profits for investors and puts pressure on property managers. At the same time, trying to go digital is tough due to high costs, older systems that don’t work well together, cybersecurity threats, and a lack of skilled workers, especially among the older generation. This makes it hard for many companies to take full advantage of new tech in the property sector. All these issues together make it a tricky situation where finding a balance between what tenants can afford, following the rules, dealing with economic challenges, and adopting new technology is crucial for a healthy rental market.

Real Estate Rental Market Opportunities:

Top Opportunities in the Rental Market.

The rental market is going digital with online leasing, tenant screening, and smart-home features. These tech tools help property managers save time and costs while making tenants happier. Virtual reality and 3D tours are also becoming popular, making it easier for potential renters to check out places without leaving home. Co-living and shared renting options are on the rise and appeal to those looking for affordable living situations. Plus, eco-friendly building upgrades like energy-efficient systems are what renters want these days, and they can also help lower bills. Lastly, data analytics and AI are helping landlords predict rent prices and keep track of maintenance needs. All these changes create great opportunities for everyone involved in the rental market to improve their services and grow their businesses.

REAL ESTATE RENTAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.99% |

|

Segments Covered |

By Property/Asset Type , Commercial Rentals , Lease Duration , Furnishing Status , and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Greystar Real Estate Partners, Lincoln Property Company, Cushman & Wakefield, CBRE Group, Colliers International, JLL (Jones Lang LaSalle), Newmark Knight Frank, Vonovia SE, Invitation Homes, American Homes 4 Rent |

Real Estate Rental Market Segmentation:

Real Estate Rental Market Segmentation: By Property/Asset Type

- Residential Rentals (Single‑family homes, Multi‑family units, Townhouses, Luxury residences)

- Commercial Rentals (Office spaces, Retail shops/restaurants, Industrial)

- Specialized and Niche Assets (Student housing, Senior housing, Vacation and short‑term rentals, Single-room occupancy or micro‑units)

The specialized rental market, which includes student housing, senior living, vacation rentals, and co-living spaces, is growing the fastest right now. Short-term rentals are booming thanks to platforms like Airbnb and VRBO, and mid-term stays are also picking up as travel resumes. Co-living and micro-units are becoming popular too, especially among Millennials and Gen Z who want affordable urban living options. Student and senior housing are also thriving due to changing demographics and better policies.

On the other hand, residential rentals—like single-family homes, apartments, and luxury places—make up about 70% of the rental market. These types of rentals dominate globally, with single-family and multi-family homes leading the way, especially in suburban build-to-rent communities as homeownership gets tougher. Luxury rentals continue to rise, attracting renters who want top-notch amenities and flexible options.

Real Estate Rental Market Segmentation: By Lease Duration

- Short-Term Rentals

- Mid-Term Rentals

- Long-Term Rentals

Short-term rentals, like those on Airbnb and VRBO, are growing fast, especially in tourist spots and cities. They can charge a lot more—two to three times what long-term leases make—thanks to dynamic pricing. Mid-term rentals (1-6 months) are also getting popular with remote workers, often bringing in 50-100% more than traditional leases while keeping turnover costs down. This shift shows that more renters want flexibility.

Long-term leases (12+ months) still dominate the market due to their steady income and easier management. Though they yield less than short- or mid-term rentals, they provide a reliable monthly cash flow and shorter vacancy times. Plus, tenants usually stick around longer, which helps with property care and maintenance. This stability is crucial even as the quicker-growing rental options rise.

Real Estate Rental Market Segmentation: By Furnishing Status

- Unfurnished

- Semi-furnished

- Fully furnished

Fully furnished rentals are growing fast, popular among urban professionals, students, and expats looking for ready-to-move-in homes. They come with all the furniture and appliances, making them easy to rent, often costing 25-40% more than unfurnished places. The short-term flexibility attracts investors and leads to quick rentals, especially in cities and vacation spots.

Semi-furnished rentals are also in demand, offering a good mix of cost and convenience. These come with basic furniture like beds and kitchen cabinets, which let renters customize their space. They're a hit with families and young professionals, plus they mean less maintenance for landlords, leading to higher occupancy rates in city markets.

Real Estate Rental Market Segmentation: By Tenant/End-User Profile

- Individuals & Families

- Students

- Corporate/Business Tenants

- Seniors

- Specialized Users

Seniors are increasingly renting out their homes and sharing spaces with others. In the U.S., the number of people over 65 looking for roommates jumped by 48% from 2023 to 2024. Services like Nesterly connect older homeowners with younger renters, helping with affordability and reducing feelings of loneliness. This trend is a smart way to cope with rising housing costs, benefiting both retirees and students.

Rentals for individuals and families still make up the bulk of the market. In India, over 69% of tenants are salaried individuals, with families also looking for detached homes. This ongoing demand supports long-term rental options and influences property development to focus on privacy and stability.

Real Estate Rental Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

North America is at the top of the rental market, making up about 35% of rentals worldwide. This is due to strong demand, many online rental platforms, and a mix of short and long-term rental options. Europe comes next at around 28%, thanks to steady demand for urban rentals and lots of long-term leases. The Asia-Pacific region is the fastest-growing, grabbing about 25% of the market, driven by booming cities, rising incomes, and more digital rental services, especially in big countries like China and India. Latin America has around 7%, and the Middle East and Africa put together account for about 5%, with growth happening because of urban development, a young population, and more investment in real estate. Together, these areas shape the rental market today, showing a mix of stable and fast-growing trends.

COVID-19 Impact Analysis on the Real Estate Rental Market:

The COVID-19 pandemic really shook up the rental market in many places. In big cities like Mumbai and Chennai, rents dropped by 20–25% and 10–12% respectively. This was mostly because so many people were working from home, losing their jobs, or moving away. In Europe, the number of available rental flats shot up by about 53% in early 2021, leading to rent cuts of over 10% in some areas. In the U.S., cities like New York saw a surge in empty apartments, with around 67,000 unoccupied units and rent dropping by about 10%. This situation led to eviction freezes that affected millions. Commercial real estate took a hit too, with office rentals down by 36% in some Indian cities, and U.S. office vacancies hitting highs not seen in two decades. On the other hand, suburban and regional rentals became more popular as people looked for bigger, cheaper spaces. Landlords had to deal with lost income and uncertainty, but many held onto their properties or even bought new ones at lower interest rates. As things started to normalize, rental markets bounced back, but it was uneven cities slowly started recovering while suburban and flexible rentals did better than expected.

Trends/Developments:

In June 2025, a big investment group bought 3,590 garden-style apartment units across South Carolina, Georgia, Tennessee, and Louisiana for $625 million. With 95% of the units filled, this shows that investors are still interested in steady rental properties in growing Sun Belt areas.

In May 2025, a well-known multifamily real estate trust acquired 360 units in Maryland for $5 million. They’re focusing on upgrades, making things more energy-efficient, and improving shared amenities to enhance the living experience for residents.

In February 2025, two top rental listing platforms teamed up. One became the main source for multifamily rental listings (25+ units) for the other. This partnership helped smaller platforms expand their reach and made it easier for renters to find what they were looking for.

In November 2024, a major real estate analytics platform combined national rental data into its property intelligence tools. This gives investors and asset managers quick access to rental price trends, occupancy stats, and market comparisons.

Key Players:

- Greystar Real Estate Partners

- Lincoln Property Company

- Cushman & Wakefield

- CBRE Group

- Colliers International

- JLL (Jones Lang LaSalle)

- Newmark Knight Frank

- Vonovia SE

- Invitation Homes

- American Homes 4 Rent

Chapter 1. Real Estate Rental Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Real Estate Rental Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Real Estate Rental Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Real Estate Rental Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Real Estate Rental Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Real Estate Rental Market– By Property/Asset Type

6.1 Introduction/Key Findings

6.2 Residential Rentals (Single‑family homes, Multi‑family units, Townhouses, Luxury residences)

6.3 Commercial Rentals (Office spaces, Retail shops/restaurants, Industrial)

6.4 Specialized and Niche Assets (Student housing, Senior housing, Vacation and short‑term rentals, Single-room occupancy or micro‑units)

6.5 Y-O-Y Growth trend Analysis By Property/Asset Type

6.6 Absolute $ Opportunity Analysis By Property/Asset Type , 2025-2030

Chapter 7. Real Estate Rental Market– By Lease Duration

7.1 Introduction/Key Findings

7.2 Short-Term Rentals

7.3 Mid-Term Rentals

7.4 Long-Term Rentals

7.5 Y-O-Y Growth trend Analysis By Lease Duration

7.6 Absolute $ Opportunity Analysis By Lease Duration , 2025-2030

Chapter 8. Real Estate Rental Market– By Furnishing Status

8.1 Introduction/Key Findings

8.2 Unfurnished

8.3 Semi-furnished

8.4 Fully furnished

8.5 Y-O-Y Growth trend Analysis Furnishing Status

8.6 Absolute $ Opportunity Analysis Furnishing Status , 2025-2030

Chapter 9. Real Estate Rental Market– By Tenant/End-User Profile

9.1 Introduction/Key Findings

9.2 Individuals & Families

9.3 Students

9.4 Corporate/Business Tenants

9.5 Seniors

9.6 Specialized Users

9.7 Y-O-Y Growth trend Analysis Tenant/End-User Profile

9.8 Absolute $ Opportunity Analysis Tenant/End-User Profile , 2025-2030

Chapter 10. Real Estate Rental Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Property/Asset Type

10.1.3. By Furnishing Status

10.1.4. By Lease Duration

10.1.5. Tenant/End-User Profile

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Property/Asset Type

10.2.3. By Furnishing Status

10.2.4. By Lease Duration

10.2.5. Tenant/End-User Profile

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Property/Asset Type

10.3.3. By Tenant/End-User Profile

10.3.4. By Lease Duration

10.3.5. Furnishing Status

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Tenant/End-User Profile

10.4.3. By Lease Duration

10.4.4. By Property/Asset Type

10.4.5. Furnishing Status

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Furnishing Status

10.5.3. By Tenant/End-User Profile

10.5.4. By Lease Duration

10.5.5. Property/Asset Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. REAL ESTATE RENTAL MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 Greystar Real Estate Partners

11.2 Lincoln Property Company

11.3 Cushman & Wakefield

11.4 CBRE Group

11.5 Colliers International

11.6 JLL (Jones Lang LaSalle)

11.7 Newmark Knight Frank

11.8 Vonovia SE

11.9 Invitation Homes

11.10 American Homes 4 Rent

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

More people are moving to cities, the rise of remote work, and the use of online rental platforms.

Millennials, college students, corporate renters, and remote workers

AI listings, virtual tours of properties, and smart lease management systems.

Up-and-coming tech hubs, college towns, and cities where a lot of people are moving.

Flexible lease terms, furnished places, co-living spaces, and environmentally friendly housing.