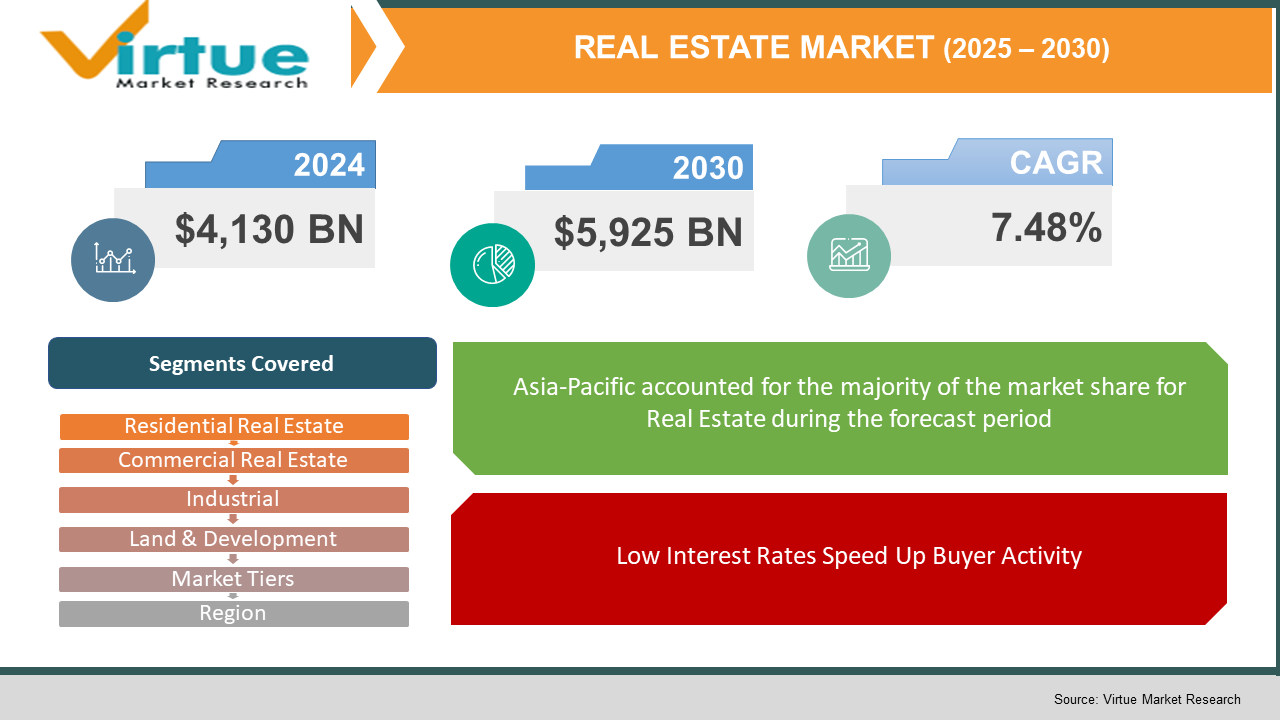

Real Estate Market Size (2025-2030)

The Real Estate Market was valued at $4,130 billion and is projected to reach a market size of $5,925 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.48%.

The real estate market includes land and buildings like homes, offices, warehouses, and stores. It's all about buying, selling, and using these properties, and technology is changing the way things work. PropTech plays a big role here, bringing tools like AI for property valuations, online tours, and blockchain for smart contracts, which is making deals faster and more transparent. There are different types of properties—residential, commercial, industrial, and more—all with their quirks, but they’re all benefiting from better data and easier processes. Many players in the market are using AI for pricing predictions and blockchain to make contracts easier. Companies like iBuyers are using tech to offer quick cash for homes by analyzing data automatically, which cuts down on the usual hassles of real estate. Websites and apps like Zillow and Trulia have changed how people find market properties, with online leads now outpacing traditional methods.

Key Market Insights:

Smart techs like sensors and health-monitoring systems are changing the game for electric wheelchairs. Features like health tracking and easy access to medical records are making them more useful. Electric wheelchairs now make up over 35% of the market, showing a shift towards tech-savvy mobility aids.

The pandemic did hit production hard, with a 20-25% drop as supply chains were disrupted, but demand bounced back quickly since healthcare focused on helping elderly and recovering patients. Hospitals and long-term care centers kept using them, and home care also saw an increase.

With about 15% of the global population living with disabilities and an aging population, the demand for these solutions is on the rise. More than 40% of wheelchair users are over 65, which shows the need for accessible and comfy options.

Countries like India, which deal with many road accident-related disabilities, are starting to be viewed as promising markets. Even though they're still in the early stages, government backing and better awareness are likely to drive growth. The Asia-Pacific area is expected to provide over 30% of future demand.

Lightweight, foldable, and customizable wheelchairs are getting popular, especially among younger, active folks. Meanwhile, manual wheelchairs still make up 50-55% of the market because they're affordable and easy to maintain, while fancier models are catching the eye of wealthier buyers and institutions.

Real Estate Market Key Drivers:

Low Interest Rates Speed Up Buyer Activity.

Lower mortgage rates are making it easier for first-time buyers and investors to jump into the market. Places like India and the U.S. are seeing a lot of new buyers come in as rates drop, which is helping both home and business sales. When borrowing gets cheaper, it encourages developers to start new projects, and buyers feel more confident, leading to more transactions.

Tech is Changing Real Estate.

Technology is changing how people buy, sell, and manage properties. From AI tools that help with pricing to blockchain contracts, buyers now look for 3D virtual tours, real-time price checks, and easy online transactions. For real estate agents and developers, smart data cuts down on wasted time and helps to find the right audience. The use of PropTech has skyrocketed since 2011, clearly showing that going digital is now a must in this industry.

Changing Demographics is Shaping Demand.

Millennials and Gen Z are looking for homes differently—they prefer walkable suburbs, and flexible work/live spaces, and often choose to rent. At the same time, older baby boomers are downsizing or looking for smart homes that are easier to get around. This mix of preferences is prompting developers to rethink building designs and community setups, sparking new ideas in planning and design.

Real Estate Market Restraints and Challenges:

Dealing with Rising Costs and Other Challenges in Real Estate.

Right now, the real estate market is dealing with a lot of issues that are holding back growth and making housing less accessible. First off, construction costs are going up because of inflation, tariffs, and shortages of materials, which is blowing budgets and pushing back project timelines. Then there are zoning rules and complicated permitting processes that make it tough to build affordable multi-unit homes. On top of that, labor shortages and issues with supply chains are driving up wages and causing delays because there aren't enough skilled workers or consistent material supplies. Financing is also a problem because tight credit and high interest rates make it hard for developers and buyers. Plus, the economy is jumping between good times and slowdowns, which makes demand, pricing, and investor confidence all over the place. To tackle these challenges, we need to reform regulations, build stronger supply chains, develop the workforce, and come up with smarter funding solutions to create a more efficient and affordable real estate market.

Real Estate Market Opportunities:

Tech, Sustainability, Suburbia, and New Investments in 2025.

In 2025, the real estate scene is shaping up to be full of chances thanks to some clear trends. People are leaning towards smart, eco-friendly homes that save energy and come with green features, making them more desirable and worth more when it comes to selling. Smaller cities and suburbs are growing fast since more folks are working from home—places like Boise, Charlotte, and Tampa are seeing big jumps in population and investments. Build-to-rent and shared living spaces are on the rise, especially for younger generations looking for rental options, providing steady income and room to grow. Alternative investment areas like data centers, senior housing, and shared ownership models are starting to take off thanks to tech changes, making it easier to invest. Plus, green building projects are getting more attention and support with various regulations and incentives popping up around the world.

REAL ESTATE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.48% |

|

Segments Covered |

By Residential Real Estate , Commercial Real Estate , Industrial , Land & Development , Market Tiers , Market Tiers and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Prologis, Inc., Brookfield Asset Management, CBRE Group, Jones Lang LaSalle (JLL), Savills plc, Emaar Properties, Sun Hung Kai Properties, American Tower Corporation, Mitsui Fudosan, Aldar Properties |

Real Estate Market Segmentation:

Real Estate Market Segmentation: By Residential Real Estate

- Single‑family homes

- Condos and townhouses

- Multi‑family buildings

Condominiums and townhouses are quickly becoming popular, especially in cities, because they're affordable, convenient, and have a modern look. This sector is expected to grow about 4% a year until 2030, due to a trend for dense living and smart-home features, appealing to young pros who want easy-maintenance homes. Mixed-use spaces with lots of amenities are also helping this market adapt.

On the other hand, single-family homes still lead the market, making up around 64-88% of sales in many places. People continue to want more space, privacy, and the chance to personalize their homes. With the rise of remote work and a focus on private yards, this segment remains strong. Their steady resale value and the desire to pass homes down through generations keep single-family homes a mainstay in real estate.

Real Estate Market Segmentation: By Commercial Real Estate

- Office

- Retail/shops/restaurants

- Industrial (warehouses, manufacturing, logistics)

- Multi‑family (large apartment complexes)

- Special purpose (hotels, healthcare facilities, self-storage)

The industrial and logistics sector is growing fast in commercial real estate, driven by booming e-commerce, supply chain upgrades, and new last-mile delivery hubs, especially small warehouses for instant delivery services. This trend is backed by rising investments, with industrial properties leading to global CRE investments in early 2024.

On the other hand, office space still makes up about a third of global commercial real estate this year. Even with challenges from hybrid work and old spaces being repurposed, offices remain a key asset. In main markets, vacancy rates are balancing out as underperforming buildings get knocked down or changed into something new.

Real Estate Market Segmentation: By Industrial

- Warehouses

- Manufacturing

The warehousing sector is currently the fastest-growing part of industrial real estate, grabbing about 55% of the market due to the rise in e-commerce and logistics. Major logistics companies and retailers are leasing and building warehouses near cities and transport hubs to support online orders and returns, driving this growth. Vacancy rates are low, often under 5% in many U.S. areas, as developers rush to create new fulfillment centers, especially in metro and tier-two cities. Tech advancements like automation and smart systems boost the efficiency of these warehouses.

While warehousing is growing quickly, manufacturing facilities still make up about 30% of market value and play a key role in regional economies. They support various industries, from traditional heavy manufacturing to modern clean-tech facilities, which are becoming more common due to trends like onshoring. These properties need special infrastructure, making them less interchangeable but essential for long-term planning. So, even though warehouses get a lot of attention for quick gains, manufacturing real estate provides a stable foundation for economic strength.

Real Estate Market Segmentation: By Land & Development

- Raw

- Buildable Land

Raw, undeveloped land is quickly becoming the hottest segment, especially in suburban and nearby urban areas. With a low starting price and flexibility, it’s drawing in investors. As cities grow, the value of these land parcels can jump significantly—often yielding 2 to 5 returns over five to ten years in developing areas. The chance to create something new adds to its appeal.

On the other hand, buildable land, which has roads, utilities, and zoning for construction, holds the largest market share. Its main draw is stability and immediate use: buyers can quickly start projects and see income from rent or construction. Big investors and housing brands usually focus on these parcels for larger residential or commercial developments, making it the core of real estate.

Real Estate Market Segmentation: By Investment Vehicles & Institutional Segments

- REITs (Real Estate Investment Trusts)

- Private Equity Real Estate

REITs, or Real Estate Investment Trusts, are quickly becoming a popular investment choice, giving people access to income-generating properties with the added benefit of being able to buy and sell easily. Equity REITs, which focus on industrial, healthcare, and data centers, are particularly strong because they must pay out at least 90% of their earnings as dividends. In 2023, the Asia-Pacific REIT market, especially in India, saw a 31% growth, thanks to investor interest in new retail and office spaces. With the dominance of industrial properties and growing residential offerings, equity REITs are a liquid and dividend-rich option for real estate exposure.

Private Equity Real Estate is currently the largest part of institutional investment, making up 51.2% of real estate investments in the U.S. as of late 2023. Major players like Blackstone, Brookfield, and ESR have raised trillions in PE capital worldwide. In the first half of 2024, more than $3 billion was invested in India's real estate, with over half going to warehousing. This shows how adaptable private equity is, able to seek value in various real estate sectors and influence major trends globally.

Real Estate Market Segmentation: By Market Tiers

- Tier I (Primary)

- Tier II (Secondary)

- Tier III (Tertiary)

Tier II and III cities are the fastest-growing real estate spots right now due to their affordability, better infrastructure, and changing buyer preferences. In India, these areas made up 44% of land purchases across 3,294 acres in 2024, with housing sales jumping 20–23% year over year in 60 locations. Cities with populations of 50,000 to 100,000 (Tier II) and 20,000 to 50,000 (Tier III) are popular among developers for their low land prices and solid returns. The rise in investments in residential, commercial, and industrial real estate is supported by better connectivity and urban facilities like metro lines and IT parks.

On the other hand, Tier I cities like Delhi, Mumbai, Bangalore, and Chennai still lead the real estate game in terms of volume, price growth, and economic impact. With strong infrastructure, top-notch schools and hospitals, and busy commercial areas, demand is steady in these regions. Properties in these major cities tend to offer high returns, especially in the luxury market, despite the high costs and limited supply. While growth may be slower, these markets provide stability and lower risks, making them attractive for large investments.

Real Estate Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

The Asia-Pacific region is a big player in the global real estate scene, holding around 35% of the market share. This is due to rapid urban growth in places like China, India, and Southeast Asia. North America and Europe come next, making up about 30% and 25% of the market, respectively, with their stable markets and established property rights. Latin America, the Middle East, and Africa have smaller shares, around 5% each, mainly due to economic ups and downs and mixed infrastructure. Still, these regions have areas where there's a chance for significant growth, especially in urban and resort projects.

COVID-19 Impact Analysis on the Real Estate Market:

The COVID-19 pandemic really shook up the real estate market. Lockdowns and uncertainty about home values led to a quick drop of about 30-35% in home sales in places like Wuhan and across the U.S. Commercial areas like retail, office spaces, and hotels took a big hit, with office vacancies rising sharply (in Manhattan, for example, retail rents fell around 13% and office space vacancies hit about 14%). On the flip side, industrial and logistics properties held strong since e-commerce took off, and demand for housing bounced back quickly thanks to low mortgage rates and people moving to remote work—suburban and bigger homes became hot items. This shift led to a “donut effect” where city centers lost their appeal, while the suburbs and less crowded places became more popular. Developers and property owners stepped up their digital game, using virtual tours and online transactions to keep up with demand. The investment scene slowed down as investors got a bit cautious, but started picking up again in safer areas like healthcare and logistics. Even though some urban trends changed—like prices in remote areas normalizing and city retail making a comeback—hybrid work, tech-driven processes, and the need for flexible housing are now changing how real estate operates for good.

Trends/Developments:

In February 2025, Apollo Global Management said it would buy Bridge Investment Group for $1.5 billion in stock. This move will nearly double Apollo's real estate assets and strengthen its commercial real estate debt and multifamily investments.

In February 2025, CoStar Group bought Matterport for about $1.6 billion. This shows how important PropTech is in real estate with its 3D and AI-driven digital twin tech.

In February 2024, Barratt Homes announced it was acquiring Redrow for £2.5 billion. This deal creates a strong player in UK housing construction, aiming to deliver over 22,000 homes each year.

In January 2024, LondonMetric Property wrapped up a £1.9 billion deal to buy LXi REIT, which boosts its focus on long-term commercial property with leases tied to inflation.

In September 2023, Blackstone agreed to purchase Tricon Residential, a Canadian residential firm, for $3.5 billion. This is a big step for Blackstone's multifamily portfolio in North America.

Key Players:

- Prologis, Inc.

- Brookfield Asset Management

- CBRE Group

- Jones Lang LaSalle (JLL)

- Savills plc

- Emaar Properties

- Sun Hung Kai Properties

- American Tower Corporation

- Mitsui Fudosan

- Aldar Properties

Chapter 1. Real Estate Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Real Estate Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Real Estate Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Real Estate Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Real Estate Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Real Estate Market – By Residential Real Estate

6.1 Introduction/Key Findings

6.2 Single‑family homes

6.3 Condos and townhouses

6.4 Multi‑family buildings

6.5 Y-O-Y Growth trend Analysis By Residential Real Estate

6.6 Absolute $ Opportunity Analysis By Residential Real Estate Residential Real Estate , 2025-2030

Chapter 7. Real Estate Market – Commercial Real Estate

7.1 Introduction/Key Findings

7.2 Office

7.3 Retail/shops/restaurants

7.4 Industrial (warehouses, manufacturing, logistics)

7.5 Multi‑family (large apartment complexes)

7.6 Special purpose (hotels, healthcare facilities, self-storage)

7.7 Y-O-Y Growth trend Analysis Commercial Real Estate

7.8 Absolute $ Opportunity Analysis Commercial Real Estate , 2025-2030

Chapter 8. Real Estate Market – By Industrial

8.1 Introduction/Key Findings

8.2 Warehouses

8.3 Manufacturing

8.4 Y-O-Y Growth trend Analysis Industrial

8.5 Absolute $ Opportunity Analysis Industrial , 2025-2030

Chapter 9. Real Estate Market – By Land & Development

9.1 Introduction/Key Findings

9.2 Raw

9.3 Buildable Land

9.4 Y-O-Y Growth trend Analysis Land & Development

9.5 Absolute $ Opportunity Analysis Land & Development , 2025-2030

Chapter 10. Real Estate Market – By Investment Vehicles & Institutional

10.1 Introduction/Key Findings

10.2 REITs (Real Estate Investment Trusts)

10.3 Private Equity Real Estate

10.4 Y-O-Y Growth trend Analysis Investment Vehicles & Institutional

10.5 Absolute $ Opportunity Analysis Investment Vehicles & Institutional , 2025-2030

Chapter 11. Real Estate Market – By Market Tiers

11.1 Introduction/Key Findings

11.2 Tier I (Primary)

11.3 Tier II (Secondary)

11.4 Tier III (Tertiary)

11.5 Y-O-Y Growth trend Analysis Market Tiers

11.6 Absolute $ Opportunity Analysis Market Tiers, 2025-2030

Chapter 12. Real Estate Market , By Geography – Market Size, Forecast, Trends & Insights

12.1. North America

12.1.1. By Country

12.1.1.1. U.S.A.

12.1.1.2. Canada

12.1.1.3. Mexico

12.1.2. By Residential Real Estate

12.1.3. Commercial Real Estate

12.1.4. By Market Tiers

12.1.5. Industrial

12.1.6. Land & Development

12.1.7. Investment Vehicles & Institutional

12.1.8. Countries & Segments - Market Attractiveness Analysis

12.2. Europe

12.2.1. By Country

12.2.1.1. U.K.

12.2.1.2. Germany

12.2.1.3. France

12.2.1.4. Italy

12.2.1.5. Spain

12.2.1.6. Rest of Europe

12.2.2. By Residential Real Estate

12.2.3. By Market Tiers

12.2.4. By Land & Development

12.2.5. Industrial

12.2.6. Software / Content Type

12.2.7. Investment Vehicles & Institutional

12.2.8. Countries & Segments - Market Attractiveness Analysis

12.3. Asia Pacific

12.3.1. By Country

12.3.2.1. China

12.3.2.2. Japan

12.3.2.3. South Korea

12.3.2.4. India

12.3.2.5. Australia & New Zealand

12.3.2.6. Rest of Asia-Pacific

12.3.2. By Residential Real Estate

12.3.3. By Market Tiers

12.3.4. Commercial Real Estate

12.3.5. Investment Vehicles & Institutional

12.3.6. Industrial

12.3.7. Land & Development

12.3.8. Countries & Segments - Market Attractiveness Analysis

12.4. South America

12.4.3. By Country

12.4.3.3. Brazil

12.4.3.2. Argentina

12.4.3.3. Colombia

12.4.3.4. Chile

12.4.3.5. Rest of South America

12.4.2. By Residential Real Estate

12.4.3. By Market Tiers

12.4.4. Commercial Real Estate

12.4.5. Industrial

12.4.6. Investment Vehicles & Institutional

12.4.7. Land & Development

12.4.8. Countries & Segments - Market Attractiveness Analysis

12.5. Middle East & Africa

12.5.4. By Country

12.5.4.4. United Arab Emirates (UAE)

12.5.4.2. Saudi Arabia

12.5.4.3. Qatar

12.5.4.4. Israel

12.5.4.5. South Africa

12.5.4.6. Nigeria

12.5.4.7. Kenya

12.5.4.12. Egypt

12.5.4.12. Rest of MEA

12.5.2. By Residential Real Estate

12.5.3. Commercial Real Estate

12.5.4. By Market Tiers

12.6.5. Land & Development

12.5.6. Investment Vehicles & Institutional

12.5.7. Industrial

12.5.8. Countries & Segments - Market Attractiveness Analysis

Chapter 13. Real Estate Market – Company Profiles – (Overview, Residential Real Estate Portfolio, Financials, Strategies & Developments)

13.1 Prologis, Inc.

13.2 Brookfield Asset Management

13.3 CBRE Group

13.4 Jones Lang LaSalle (JLL)

13.5 Savills plc

13.6 Emaar Properties

13.7 Sun Hung Kai Properties

13.8 American Tower Corporation

13.9 Mitsui Fudosan

13.10 Aldar Properties

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Urban growth, more disposable income, and digital changes are pushing real estate development and investment around the world.

The main areas are residential, office spaces, and logistics. These sectors are adopting tech and focusing on sustainability

AI is improving property evaluations, helping with facility management, and making it easier to find tenants

Asia-Pacific and Europe are at the forefront, thanks to smart city projects, a growing population, and investments in infrastructure.

Trends to watch include smart buildings, ESG standards, co-living arrangements, digital twins, and AI-based real estate tools