Ready-to-Drink Whey Protein-based Beverages Market Size (2024 – 2030)

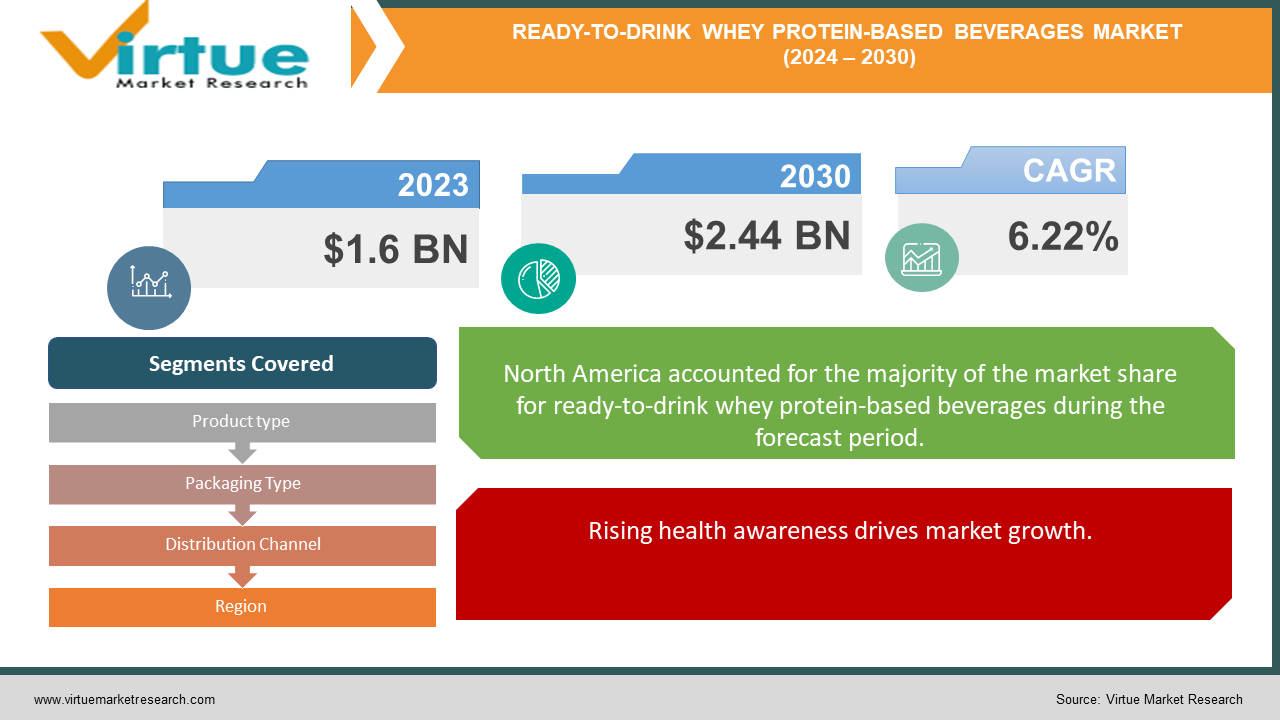

The Ready-to-Drink Whey Protein-based Beverages Market was valued at USD 1.6 Billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 2.44 Billion by 2030, growing at a CAGR of 6.22%.

Whey proteins offer superior nutritional benefits, a neutral flavor, and are easily digestible, enhancing their appeal as a protein source in ready-to-drink (RTD) beverages and driving market growth. Moreover, whey protein includes all the essential amino acids required by the body, making it a preferred option for protein beverage manufacturers. Its growing consumption is not only linked to muscle building but also to its anti-aging properties. Glutathione in whey protein helps slow aging, while amino acids contribute to skin elasticity and firmness.

Key Market Insights:

The market is being propelled by several key factors, including growing health awareness, rising fitness trends among the general population, shifting consumer preferences and lifestyles, the launch of innovative RTD protein beverages, and vigorous marketing and promotional efforts by manufacturers.

Ready-to-Drink Whey Protein-based Beverages Market Drivers:

Rising health awareness drives market growth.

The RTD protein beverages market is being driven by a significant shift towards prioritizing personal health and well-being. People across various demographics are increasingly aware of the link between diet and overall health, seeking products that support their wellness goals and offer nutritional value. RTD protein beverages, rich in essential proteins, vitamins, minerals, and other nutrients, cater to this health-conscious trend. Additionally, educational campaigns about nutritional awareness, obesity risks, and the importance of a balanced diet are boosting market growth. Government initiatives promoting healthy lifestyles and the convenience of RTD protein beverages in meeting protein needs further contribute to the market expansion.

Increasing fitness trends among individuals drive market growth.

The burgeoning fitness culture is a crucial factor driving market growth. With more individuals engaging in physical activities like gym workouts, sports, and fitness routines, the demand for nutrition to support muscle recovery and growth has increased. Protein, essential for muscle development, has become a key nutrient for fitness enthusiasts. RTD protein beverages provide a quick and accessible source of protein, fitting seamlessly into post-workout routines and athletic training regimes. Additionally, the emphasis on physical appearance, strength, and endurance in popular culture has strengthened the connection between fitness and protein intake. Social media influencers, fitness trainers, and the broader fitness community frequently advocate for protein supplementation, further boosting the demand for convenient protein sources like RTD protein beverages.

Changing consumer preferences and Different lifestyles increases market growth.

The modern consumer's lifestyle, marked by fast-paced schedules and multitasking, has made convenience and portability pivotal to the success of the RTD protein beverages market. These beverages offer an effortless way to consume essential nutrients without the need for preparation or cooking. Packaged in portable containers, they seamlessly fit into daily routines, whether consumed on the way to work, after a workout, or during a quick lunch break. The convenience of having a nutritious, balanced meal in a single bottle appeals to both working professionals and busy individuals. Additionally, the variety in packaging options, from single-serving bottles to larger family packs, allows for tailored choices based on individual needs.

Ready-to-Drink Whey Protein-based Beverages Market Restraints and Challenges:

Strict regulations hinder market growth.

The global ready-to-drink (RTD) protein beverages market has seen substantial growth propelled by rising consumer demand for fitness and wellness products. However, this growth is accompanied by challenges related to regulatory concerns. Stringent regulations imposed by various authorities can impact market expansion, aiming to ensure consumer safety, product quality, and accurate labeling.

These regulations present obstacles for manufacturers in the RTD protein beverages sector. RTD protein beverages often contain various ingredients, including plant-based proteins, vitamins, and minerals, necessitating proper allergen control to prevent cross-contamination. Manufacturers are mandated by regulations to accurately disclose allergens in their products and implement measures to prevent accidental allergen contamination.

Regulatory agencies establish rigorous standards for food safety and quality to safeguard consumers from potential health hazards. These standards encompass guidelines for manufacturing practices, ingredient sourcing, and quality control measures. RTD protein beverage manufacturers must adhere to these standards to ensure product safety. Additionally, incorporating novel ingredients and additives, such as plant-derived proteins and functional ingredients, may require approval from regulatory authorities before commercial use. This process can be time-consuming and costly, potentially slowing product development and market entry.

Ready-to-Drink Whey Protein-based Beverages Market Opportunities:

Organic and Flavored Sports Nutrients to Create Opportunities.

Globally, consumer preferences for cleaner ingredients and organic foods are rising, particularly in response to the growing demand for protein drinks among those leading active and healthy lifestyles. To capture substantial market share, market participants are focusing on developing innovative products that meet consumer needs. Additionally, consumers are favoring options with novel and inventive flavors, prompting businesses to create new products to accommodate these evolving preferences. Consequently, the introduction of new products and technological advancements presents lucrative market opportunities.

READY-TO-DRINK WHEY PROTEIN-BASED BEVERAGES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.22% |

|

Segments Covered |

By Product type, Packaging Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

MyProtein, GNC, OPTIMUM NUTRITION, As it is Nutrition, Muscle Asylum, MyFitFuel, Nutrabay, MuscleBlaze |

Ready-to-Drink Whey Protein-based Beverages Market Segmentation: By Product type

-

whey protein concentrate (WPC)

-

whey protein isolate (WPI)

-

whey protein hydrolysate (WPH)

Whey protein concentrate (WPC) is considered the best overall option among protein supplements. Numerous options are available online, and it is the most cost-effective while retaining most of the beneficial nutrients naturally found in whey. Many individuals also prefer its taste, likely due to the presence of lactose and fat. Whey protein is popular among athletes, bodybuilders, fitness models, and those looking to improve their gym performance.

Whey Protein Concentrate (WPC) is a group of dry dairy ingredients utilized to enhance food products with concentrated whey protein. It is created by extracting a specific proportion of non-protein components from pasteurized whey obtained during cheese processing.

Ready-to-Drink Whey Protein-based Beverages Market Segmentation: By Packaging Type

-

Bottles

-

Cans

-

Cartons

-

Pouches

Bottles are dominating the market due to their user-friendly, resealable packaging, ideal for on-the-go consumption. Their portable nature makes them a preferred choice for consumers with active lifestyles, as they can be easily carried to the gym, office, or outdoor activities. Available in various sizes, bottles cater to different consumer needs, from single servings to family-sized packages. Additionally, bottles are often made of transparent materials, allowing consumers to see the product, and enhancing its visual appeal.

Ready-to-Drink Whey Protein-based Beverages Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Stores

-

Others

The supermarket and hypermarket sector commands the largest market share globally for ready-to-drink protein beverages. These retail formats excel due to their expansive retail space and ability to cater to diverse consumer preferences. The proliferation of businesses and the growing presence of hypermarkets and supermarkets play a pivotal role in driving market growth by boosting sales of ready-to-drink (RTD) protein beverages. Moreover, the availability of multiple brands in these mass merchandisers boosts consumer demand for protein beverage products. To meet the rising demand for protein powders, supermarkets have also introduced their brands of protein beverages.

Following closely, the online retail sector holds the second-largest market share. Rapid advancements in digital technology have integrated online and offline retail experiences, creating a seamless platform that merges physical and digital shopping experiences. Online channels offer the convenience of home delivery, allowing consumers to shop from anywhere without the need to travel.

Ready-to-Drink Whey Protein-based Beverages Market Segmentation- by Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is poised to dominate the market with the largest share of ready-to-drink protein beverages. The region's demand is driven by increasing awareness of healthy lifestyles and a growing working population seeking convenient, nutritious beverage options. Factors such as disposable income levels, demographic trends, and widespread availability of products on retail shelves further contribute to the expansion of the RTD market in North America.

Conversely, the Asia-Pacific region is expected to experience the fastest growth. Countries like China and India, with expanding middle-class populations, are seeing heightened consumption across various sectors, particularly in health and fitness. This potential has attracted significant investments from multinational brands in the region's health drink markets. Additionally, consumers in Asia-Pacific are increasingly seeking a wider range of ready-to-drink health supplements, driven by lifestyle enhancements, a preference for sustainable products, and growing health consciousness. The rising demand for plant-based RTD protein beverages further underscores this trend.

COVID-19 Pandemic: Impact Analysis

Interruptions in the supply chain can indeed result in production delays, higher costs, and dissatisfaction among customers. To mitigate these risks, businesses must develop resilient supply chain strategies and diversify their supplier base. By doing so, they can better navigate disruptions and maintain smooth operations.

The benefits associated with consuming whey protein, such as its contribution to market growth, underscore the importance of a stable and reliable supply chain. Businesses in the protein industry rely on consistent access to quality whey protein to meet consumer demand and drive market expansion. Implementing robust supply chain practices ensures continuity in product availability and supports sustained market growth.

Latest Trends/ Developments:

-

In May 2023, Upbeat Drinks Ltd. introduced a new Sour Berry Protein Energy ready-to-drink beverage, blending caffeine and protein. This non-carbonated, clear whey isolate drink features all nine essential amino acids, 4000 mg of BCAAs, and Vitamin B complex, thereby expanding the company's product portfolio.

-

In March 2023, Premier Protein, a brand under BELLRINGS BRANDS, INC. (BRBR), entered the vegan protein market with its NEW Plant Protein Powder. Known for its popular taste, affordable pricing, and clear nutritional benefits, this product launch is expected to attract a new consumer base to the brand.

Key Players:

These are the top 10 players in the Ready-to-Drink Whey Protein-based Beverages Market: -

-

MyProtein

-

GNC

-

OPTIMUM NUTRITION

-

As it is Nutrition

-

Muscle Asylum

-

MyFitFuel

-

Nutrabay

-

MuscleBlaze

Chapter 1. Ready-to-Drink Whey Protein-based Beverages Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ready-to-Drink Whey Protein-based Beverages Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ready-to-Drink Whey Protein-based Beverages Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ready-to-Drink Whey Protein-based Beverages Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ready-to-Drink Whey Protein-based Beverages Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ready-to-Drink Whey Protein-based Beverages Market – By Product Type

6.1 Introduction/Key Findings

6.2 whey protein concentrate (WPC)

6.3 whey protein isolate (WPI)

6.4 whey protein hydrolysate (WPH)

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Ready-to-Drink Whey Protein-based Beverages Market – By Packaging Type

7.1 Introduction/Key Findings

7.2 Bottles

7.3 Cans

7.4 Cartons

7.5 Pouches

7.6 Y-O-Y Growth trend Analysis By Packaging Type

7.7 Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 8. Ready-to-Drink Whey Protein-based Beverages Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets/Hypermarkets

8.3 Convenience Stores

8.4 Online Stores

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Ready-to-Drink Whey Protein-based Beverages Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Packaging Type

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Packaging Type

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Packaging Type

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Packaging Type

9.4.4 By Packaging Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Packaging Type

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Ready-to-Drink Whey Protein-based Beverages Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 MyProtein

10.2 GNC

10.3 OPTIMUM NUTRITION

10.4 As it is Nutrition

10.5 Muscle Asylum

10.6 MyFitFuel

10.7 Nutrabay

10.8 MuscleBlaze

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Whey protein includes all the essential amino acids required by the body, making it a preferred option for protein beverage manufacturers. Its growing consumption is not only linked to muscle building but also to its anti-aging properties.

The top players operating in the Ready-to-Drink Whey Protein-based Beverages Market are - MyProtein, GNC, OPTIMUM NUTRITION, As it is Nutrition, Muscle Asylum, MyFitFuel, Nutrabay, MuscleBlaze.

The benefits associated with consuming whey protein, such as its contribution to market growth, underscore the importance of a stable and reliable supply chain.

Consumers are favoring options with novel and inventive flavors, prompting businesses to create new products to accommodate these evolving preferences. Consequently, the introduction of new products and technological advancements presents lucrative market opportunities.

The Asia-Pacific region is expected to experience the fastest growth.