Read-Out IC Market Size (2025 – 2030)

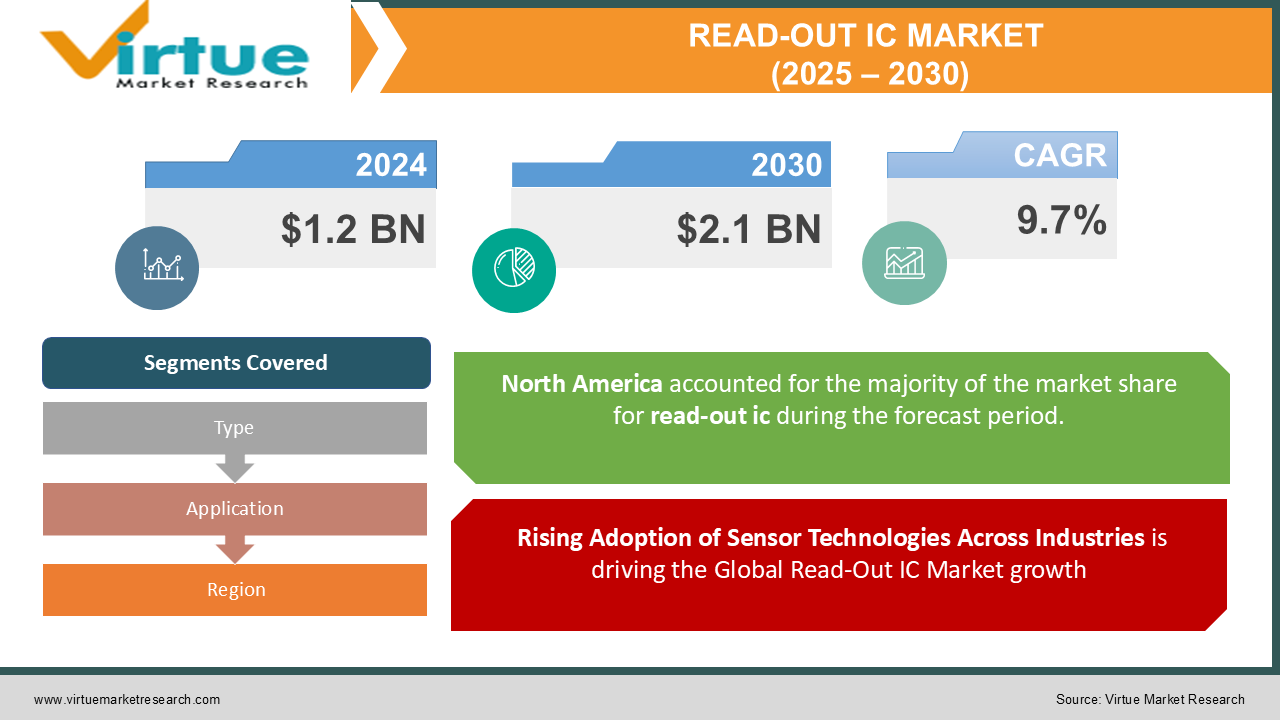

The Global Read-Out IC Market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.1 billion by 2030, growing at a CAGR of 9.7% during the forecast period (2025–2030).

Read-out integrated circuits (ROICs) are essential components in sensor systems, serving as the interface between sensors and digital systems by converting sensor signals into usable digital data.

The rising demand for advanced sensor technologies in applications like medical imaging, automotive safety systems, and aerospace is driving the growth of the market. Innovations in ROICs, including higher resolution, lower power consumption, and enhanced integration, are broadening their adoption across industries.

Key Market Insights

The digital read-out IC segment dominated the Global Read-Out IC Market, accounting for 65% of revenue in 2024, owing to their widespread use in advanced imaging and high-speed applications.

Medical applications held the largest market share in 2024, driven by the growing adoption of ROICs in diagnostic imaging devices such as CT scanners and MRI systems.

Asia-Pacific emerged as the fastest-growing region, with a CAGR of 10.8%, fueled by rising demand for consumer electronics and automotive innovations.

Technological advancements in high-speed ROICs are opening new possibilities in defense and aerospace applications.

The integration of ROICs with AI and machine learning for data analysis is a key trend shaping the market.

Increasing investments in MEMS (Micro-Electro-Mechanical Systems) and optoelectronics are driving the adoption of advanced ROICs.

Miniaturization and low-power designs are gaining traction, particularly in portable medical and consumer electronic devices.

Global Read-Out IC Market Drivers

1. Rising Adoption of Sensor Technologies Across Industries is driving the Global Read-Out IC Market growth

The growing integration of sensors in diverse applications, including automotive safety systems, medical imaging devices, and industrial automation, is a primary driver of the ROIC market. Advanced ROICs enhance sensor performance, enabling applications like autonomous driving, IoT, and wearable technology.

In the medical field, ROICs are critical in diagnostic imaging systems for providing precise and high-resolution images. In the automotive sector, the growing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles is boosting the demand for ROICs to support LiDAR, radar, and camera systems.

2. Technological Advancements in ROICs are driving the Global Read-Out IC Market growth

Continuous advancements in ROIC design and manufacturing are enhancing their performance and reliability. Features like low noise, high sensitivity, and faster readout speeds are expanding their application scope. Innovations in hybrid ROICs, which combine analog and digital functionalities, are gaining attention for their efficiency and versatility.

The development of low-power ROICs is particularly significant for portable and battery-operated devices, such as wearables and medical devices, where energy efficiency is critical.

3. Increased Demand for High-Resolution Imaging is driving the Global Read-Out IC Market growth

High-resolution imaging requirements in fields like medical diagnostics, surveillance, and aerospace are driving the adoption of advanced ROICs. Technologies such as CMOS and InGaAs-based ROICs offer high resolution and sensitivity, making them suitable for applications like hyperspectral imaging and night vision. Additionally, the growing use of ROICs in satellite imaging and defense applications for target detection and monitoring is further propelling market growth.

Global Read-Out IC Market Challenges and Restraints

1. High Cost of Development and Integration is restricting the Global Read-Out IC Market growth

The development of advanced ROICs involves significant investment in research and manufacturing. Factors like precision design, testing, and quality assurance add to production costs, making ROICs relatively expensive. This cost factor poses a challenge for small and medium-sized enterprises (SMEs) and limits the adoption of ROICs in cost-sensitive markets. Furthermore, integrating ROICs into complex systems requires specialized expertise, which can further escalate costs.

2. Limited Standardization and Compatibility Issues is restricting the Global Read-Out IC Market growth

The lack of standardized protocols and designs across industries can create compatibility issues, hindering the seamless integration of ROICs with various sensor systems. This challenge is particularly pronounced in emerging applications like IoT and smart devices, where interoperability is crucial for efficiency. Moreover, differences in regional regulations and manufacturing standards can complicate product development and market entry for global players.

Market Opportunities

The Global Read-Out IC Market presents substantial growth opportunities fueled by the expanding applications of these crucial components in emerging technologies such as 5G, the Internet of Things (IoT), and Artificial Intelligence (AI). The integration of ROICs with these advanced technologies is unlocking new avenues for innovation and application across various sectors. In Consumer Electronics, the burgeoning market for wearables, smart home systems, and mobile gadgets is driving a strong demand for ROICs that offer high performance, low power consumption, and compact designs. The automotive industry is witnessing a surge in the adoption of ROICs, driven by the rapid advancement of autonomous driving and electrification. These circuits are critical components in LiDAR, radar, and other sensor systems essential for vehicle safety and navigation. In Medical Imaging, the increasing prevalence of chronic diseases and the growing need for early diagnosis are fueling investments in advanced imaging technologies, where ROICs with high sensitivity and resolution play a pivotal role. Furthermore, the Aerospace and Defense sector is witnessing a growing demand for precision imaging and sensing technologies, driving the development of robust and high-performance ROICs. The rising adoption of ROICs in satellite imaging for environmental monitoring and resource management further contributes to this growth. Emerging markets in Asia-Pacific and Latin America are poised for significant growth due to rising investments in healthcare, automotive, and consumer electronics sectors. These factors collectively point towards a promising future for the Global Read-Out IC Market, characterized by continued innovation and expansion across diverse applications.

READ-OUT IC MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Texas Instruments, Analog Devices, STMicroelectronics, Teledyne Technologies, AMS AG, Broadcom Inc., ON Semiconductor, Maxim Integrated, Renesas Electronics, NXP Semiconductors |

Read-Out IC Market Segmentation - By Type

-

Analog Read-Out ICs

-

Digital Read-Out ICs

The digital read-out IC segment commanded the largest market share in 2024, a testament to its superior performance characteristics and seamless integration with modern digital systems. Digital read-out ICs offer several key advantages over their analog counterparts, including significantly faster data processing speeds, higher levels of precision and accuracy, and enhanced noise immunity. These superior performance attributes enable digital read-out ICs to capture and process data with exceptional fidelity, making them ideal for demanding applications that require high-resolution and real-time data acquisition. Furthermore, the inherent compatibility of digital read-out ICs with modern digital systems simplifies system integration and enables seamless data transfer and processing within complex electronic systems. This combination of factors has contributed to the widespread adoption of digital read-out ICs across a broad range of industries, including medical imaging, industrial automation, and scientific research, solidifying their position as the dominant technology within the read-out IC market.

Read-Out IC Market Segmentation - By Application

-

Medical

-

Automotive

-

Consumer Electronics

-

Aerospace

-

Others

Medical applications currently dominate the Global Read-Out IC Market , holding the largest revenue share. This significant market dominance stems from the widespread utilization of ROICs in a diverse range of diagnostic imaging systems and patient monitoring devices. In medical imaging, ROICs play a crucial role in technologies such as X-ray, computed tomography (CT), magnetic resonance imaging (MRI), and ultrasound. These circuits are responsible for efficiently reading out the signals detected by imaging sensors, enabling high-resolution image acquisition and subsequent analysis. Furthermore, ROICs are integral components of various patient monitoring devices, including electrocardiograms (ECGs), electroencephalograms (EEGs), and other vital sign monitors. By enabling precise and real-time data acquisition, ROICs contribute significantly to the accurate diagnosis and effective treatment of various medical conditions, thereby solidifying their position as a cornerstone technology within the healthcare sector.

Read-Out IC Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America dominated the Global Read-Out IC Market with a 38% market share, attributed to its strong focus on innovation, advanced healthcare systems, and the presence of key market players. The U.S. is the largest contributor, driven by high demand for ROICs in medical imaging and aerospace applications. Canada is also witnessing growth, supported by investments in automotive safety and environmental monitoring technologies.

COVID-19 Impact Analysis

The COVID-19 pandemic had a multifaceted impact on the Global Read-Out IC Market. While the surge in demand for medical imaging devices due to increased healthcare needs initially boosted the market, disruptions in supply chains and manufacturing activities temporarily hindered growth. Post-pandemic, the market is experiencing a robust recovery as industries resume operations and invest heavily in advanced sensor systems. The pandemic has underscored the critical role of healthcare infrastructure, driving increased investment in this sector. Moreover, the rising adoption of telemedicine and remote patient monitoring devices, facilitated by advancements in ROIC technology, is further fueling market demand. These factors, combined with the ongoing advancements in AI and machine learning, are poised to drive significant growth in the ROIC market in the coming years.

Latest Trends/Developments

The field of Readout Integrated Circuits (ROICs) is undergoing significant transformation, driven by several key trends. The integration of AI and Machine Learning is revolutionizing data analysis and decision-making, enabling advanced applications in medical imaging and automotive safety. Simultaneously, there's a strong focus on miniaturization, leading to the development of compact and low-power ROICs for emerging applications like wearables and the Internet of Things (IoT). Advancements in materials, such as the adoption of InGaAs and hybrid CMOS technologies, are enhancing performance, particularly in high-resolution and hyperspectral imaging. Furthermore, the expansion of emerging markets, notably in Asia-Pacific and Latin America, is creating new growth avenues for ROICs, fueled by rising investments in healthcare and consumer electronics. Finally, sustainability initiatives are gaining prominence, with manufacturers prioritizing eco-friendly designs and energy-efficient ROICs to address environmental concerns. These converging trends are shaping the future of ROIC technology, driving innovation and expanding its reach across various industries.

Key Players

-

Texas Instruments

-

Analog Devices

-

STMicroelectronics

-

Teledyne Technologies

-

AMS AG

-

Broadcom Inc.

-

ON Semiconductor

-

Maxim Integrated

-

Renesas Electronics

-

NXP Semiconductors

Chapter 1. Read-Out IC Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Read-Out IC Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Read-Out IC Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Read-Out IC Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Read-Out IC Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Read-Out IC Market – By Type

6.1 Introduction/Key Findings

6.2 Analog Read-Out ICs

6.3 Digital Read-Out ICs

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Read-Out IC Market – By Application

7.1 Introduction/Key Findings

7.2 Medical

7.3 Automotive

7.4 Consumer Electronics

7.5 Aerospace

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Read-Out IC Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Read-Out IC Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Texas Instruments

9.2 Analog Devices

9.3 STMicroelectronics

9.4 Teledyne Technologies

9.5 AMS AG

9.6 Broadcom Inc.

9.7 ON Semiconductor

9.8 Maxim Integrated

9.9 Renesas Electronics

9.10 NXP Semiconductors

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Read-Out IC Market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.1 billion by 2030, growing at a CAGR of 9.7%.

Key drivers include the rising adoption of sensor technologies, advancements in ROIC design, and increasing demand for high-resolution imaging.

Segments include Type (Analog, Digital) and Application (Medical, Automotive, Consumer Electronics, Aerospace, Others).

North America dominates the Global Read-Out IC Market with a 38% share, driven by strong innovation and high demand in medical and aerospace applications.

Major players include Texas Instruments, Analog Devices, STMicroelectronics, Teledyne Technologies, and AMS AG.