Rare Earth Elements Market Size (2024 – 2030)

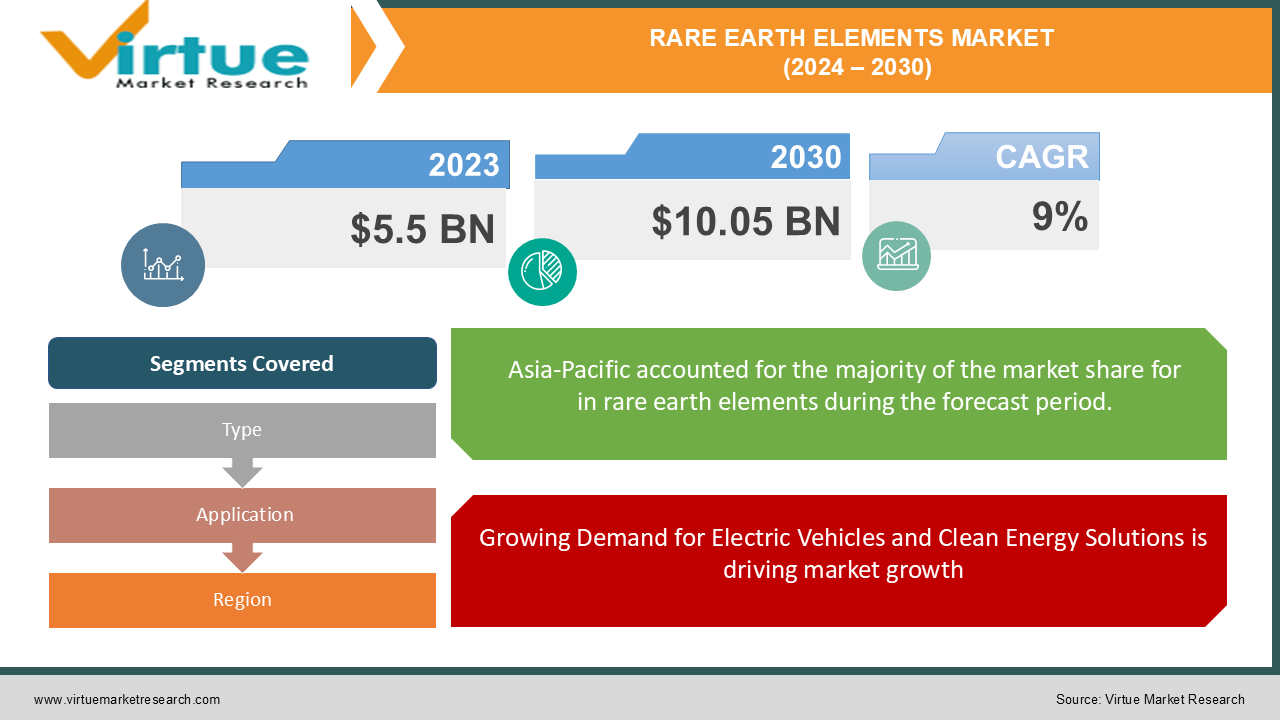

The global Rare Earth Elements (REE) Market was valued at approximately USD 5.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9% from 2024 to 2030. By 2030, the market is expected to reach USD 10.05 billion.

Rare earth elements are a group of 17 chemical elements that are essential in numerous high-tech applications such as electric vehicles (EVs), wind turbines, smartphones, and defense technologies. Their unique magnetic, luminescent, and electrochemical properties make them vital for green technologies and industrial advancements. The increasing demand for sustainable technologies like renewable energy and electric vehicles is driving the need for rare earth elements. Governments worldwide are focusing on reducing carbon emissions, promoting clean energy, and electrifying transportation, which has led to a growing need for rare earth elements such as neodymium, praseodymium, and dysprosium. Moreover, the shift toward high-tech manufacturing in electronics and telecommunications further propels demand for these critical elements.

Key Market Insights

Rare earth elements are essential in consumer electronics like smartphones, laptops, and televisions. Lanthanum, cerium, and europium, in particular, are used in screen displays, glass polishing, and phosphors for color displays, making them crucial for the consumer electronics market, which is continually growing with new technological innovations.

A significant portion of rare earth production is concentrated in China, which controls more than 60% of global supply. The dominance of China in rare earth production creates supply chain vulnerabilities for other countries, especially during trade tensions. Many nations are increasingly looking to diversify their sources of rare earths to reduce dependence on China.

Governments around the world are investing in the development of domestic rare earth mining and processing capabilities to secure a stable supply. The U.S., EU, and Japan are notable for their efforts to reduce reliance on Chinese supplies, with policies to encourage exploration, mining, and recycling of rare earth materials.

Global Rare Earth Elements Market Drivers

Growing Demand for Electric Vehicles and Clean Energy Solutions is driving market growth: The rising demand for electric vehicles (EVs) and renewable energy technologies is a major driver of the rare earth elements market. Neodymium, praseodymium, and dysprosium are used in the production of high-performance permanent magnets, which are critical components in EV motors and wind turbines. As governments around the world implement stricter regulations on carbon emissions and promote the transition to clean energy, the adoption of electric vehicles and renewable energy technologies is growing rapidly. For instance, the European Union and China have set ambitious targets for EV adoption, while the U.S. has introduced tax incentives for EV buyers. The demand for rare earth elements is expected to surge as manufacturers scale up the production of EVs and renewable energy infrastructure. In addition to EVs, rare earth elements are essential in energy-efficient lighting solutions and the production of batteries. As global efforts to reduce greenhouse gas emissions and improve energy efficiency continue, the demand for rare earth elements in these applications is expected to grow significantly. The shift toward sustainable technologies presents a massive opportunity for the rare earth elements market, with high-tech industries increasingly relying on these critical materials.

Technological Advancements in Electronics and Telecommunications is driving market growth: The electronics and telecommunications sectors are experiencing rapid technological advancements, driving the demand for rare earth elements. REEs such as europium, terbium, and yttrium are used in phosphors for flat-panel displays, LED lighting, and lasers. Additionally, cerium and lanthanum are widely used in the glass industry for polishing and optical applications, including camera lenses and fiber optics. With the global demand for smartphones, televisions, and laptops increasing steadily, the rare earth elements market is expected to benefit from the continuous expansion of the electronics industry. Moreover, 5G technology and the Internet of Things (IoT) are creating new growth opportunities for rare earth elements. The rollout of 5G networks requires advanced telecommunications equipment that relies on rare earth elements for high-performance magnets, signal transmission, and communication technologies. As IoT devices become more widespread in industries such as healthcare, manufacturing, and smart cities, the demand for REEs will continue to increase. This growing reliance on high-tech devices and advanced telecommunications systems will drive the rare earth elements market over the coming years.

Government Support and Strategic Initiatives for Domestic Supply Chains is driving market growth: Governments in several countries are taking proactive measures to secure a stable supply of rare earth elements. Given the strategic importance of REEs in defense, energy, and industrial applications, many nations are investing in domestic mining and processing capabilities to reduce their dependence on Chinese supplies. The United States, the European Union, and Japan have introduced initiatives to encourage the exploration and development of rare earth resources, including financial support for mining projects, tax incentives, and policies that promote recycling and efficient use of REEs. In the U.S., the Department of Energy has invested in the development of rare earth mining projects and processing technologies to establish a domestic supply chain. Similarly, the European Union’s Critical Raw Materials Act aims to ensure access to critical raw materials, including rare earth elements, by supporting new mining operations and developing recycling capabilities. These government-led initiatives are expected to boost domestic production, reduce supply chain risks, and foster innovation in rare earth element extraction and processing technologies.

Global Rare Earth Elements Market Challenges and Restraints

Environmental Concerns and High Cost of Extraction is restricting market growth: One of the significant challenges facing the rare earth elements market is the environmental impact associated with their extraction and processing. The mining and refining of rare earth elements require large amounts of energy and generate hazardous waste, including radioactive materials. The environmental degradation caused by rare earth mining has raised concerns, particularly in regions like China, where most of the world's rare earth elements are produced. Stringent environmental regulations and the high cost of complying with these regulations pose challenges for the rare earth mining industry. In addition to environmental concerns, the high cost of rare earth extraction and refining presents a barrier to market growth. The process of separating rare earth elements from ore and purifying them into usable forms is complex and expensive. These challenges have led to limited production outside China, as many countries struggle to compete with China's cost-efficient mining operations. To address these challenges, companies are increasingly investing in research and development (R&D) to develop more sustainable and cost-effective extraction methods, including recycling rare earth elements from electronic waste and improving the efficiency of mining operations.

Geopolitical Tensions and Supply Chain Dependence is restricting market growth: The concentration of rare earth production in China poses significant supply chain risks for industries that rely on these critical materials. China controls more than 60% of global rare earth production and dominates the refining and processing stages. This dependence on a single country for rare earth supplies creates vulnerabilities, especially in the event of geopolitical tensions, trade disputes, or export restrictions. For example, during the U.S.-China trade war, China threatened to limit rare earth exports, raising concerns about the availability of these materials for industries such as electronics, defense, and renewable energy. As a result, many countries and companies are seeking to diversify their supply chains by developing alternative sources of rare earth elements. Efforts are being made to increase rare earth mining and processing capabilities in regions such as the U.S., Australia, and Canada. Additionally, companies are exploring partnerships and joint ventures to secure long-term supply agreements with reliable suppliers. However, the challenge of reducing reliance on Chinese supplies will require significant investment and collaboration between governments and the private sector.

Market Opportunities

The growing demand for rare earth elements in emerging technologies presents significant opportunities for market growth. The increasing adoption of electric vehicles, renewable energy technologies, and advanced electronics is driving the demand for rare earth magnets, batteries, and phosphors. As industries continue to evolve and innovate, the need for high-performance materials like rare earth elements will expand, creating new opportunities for market players. One of the key areas of opportunity is in the recycling of rare earth elements from end-of-life products, such as electronics, batteries, and magnets. Recycling technologies are gaining traction as a sustainable solution to reduce waste and ensure a stable supply of rare earth materials. Governments and companies are investing in R&D to improve the efficiency of rare earth recycling and recovery processes, which will help meet the growing demand while reducing environmental impact.

RARE EARTH ELEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

China Northern Rare Earth Group High-Tech Co., Lynas Corporation Ltd., MP Materials Corp., Iluka Resources Limited, Hitachi Metals, Ltd., Arafura Resources Ltd., Texas Mineral Resources Corp., Ucore Rare Metals Inc., Greenland Minerals Ltd., Shenghe Resources Holding Co. |

Rare Earth Elements Market Segmentation - By Type

-

Light Rare Earth Elements (LREEs)

-

Heavy Rare Earth Elements (HREEs)

Light Rare Earth Elements (LREEs) dominate the market, accounting for the majority of rare earth production globally. LREEs, such as neodymium, cerium, and lanthanum, are widely used in applications ranging from electric vehicle motors to wind turbines and consumer electronics. The high demand for LREEs in permanent magnets, glass polishing, and catalysis applications is a key factor contributing to their dominance in the market.

Rare Earth Elements Market Segmentation - By Application

-

Magnets

-

Catalysts

-

Metallurgy

-

Polishing

-

Glass Additives

-

Phosphors

Magnets are the largest application segment for rare earth elements, driven by their use in electric vehicles, wind turbines, and consumer electronics. Rare earth magnets made from neodymium, praseodymium, and dysprosium are essential for the production of high-efficiency motors and generators, which are increasingly in demand due to the global transition to clean energy technologies.

Rare Earth Elements Market Segmentation - By Region

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East & Africa

Asia-Pacific is the dominant region in the global rare earth elements market, driven by China’s leadership in rare earth production and processing. China’s vast rare earth reserves and cost-efficient extraction techniques make it the largest supplier of rare earth elements. In addition, the rapid growth of high-tech industries in the region, including electronics, automotive, and renewable energy, is fueling demand for rare earth materials.

COVID-19 Impact Analysis on the Rare Earth Elements Market

The COVID-19 pandemic disrupted global supply chains, including rare earth production and processing. Temporary mine closures, labor shortages, and logistical challenges led to reduced production capacity and supply constraints. However, the demand for rare earth elements remained resilient due to their critical role in essential industries such as healthcare, defense, and electronics. As economies recover and industries resume normal operations, the rare earth elements market is expected to regain momentum, with a strong focus on securing stable supply chains and reducing reliance on single-source suppliers.

Latest Trends/Developments

The rare earth elements market is witnessing several key developments, including the shift toward sustainable mining and recycling technologies. Companies are investing in R&D to develop eco-friendly extraction methods and improve the recycling of rare earth elements from end-of-life products. Additionally, the rising demand for high-performance rare earth magnets in electric vehicles and renewable energy systems is driving innovation in magnet production, with a focus on reducing material waste and improving efficiency.

Key Players

-

China Northern Rare Earth Group High-Tech Co.

-

Lynas Corporation Ltd.

-

MP Materials Corp.

-

Iluka Resources Limited

-

Hitachi Metals, Ltd.

-

Arafura Resources Ltd.

-

Texas Mineral Resources Corp.

-

Ucore Rare Metals Inc.

-

Greenland Minerals Ltd.

-

Shenghe Resources Holding Co.

Chapter 1. Rare Earth Elements Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Rare Earth Elements Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Rare Earth Elements Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Rare Earth Elements Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Rare Earth Elements Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Rare Earth Elements Market – By Types

6.1 Introduction/Key Findings

6.2 Light Rare Earth Elements (LREEs)

6.3 Heavy Rare Earth Elements (HREEs)

6.4 Y-O-Y Growth trend Analysis By Types

6.5 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Rare Earth Elements Market – By Application

7.1 Introduction/Key Findings

7.2 Magnets

7.3 Catalysts

7.4 Metallurgy

7.5 Polishing

7.6 Glass Additives

7.7 Phosphors

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Rare Earth Elements Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Rare Earth Elements Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 China Northern Rare Earth Group High-Tech Co.

9.2 Lynas Corporation Ltd.

9.3 MP Materials Corp.

9.4 Iluka Resources Limited

9.5 Hitachi Metals, Ltd.

9.6 Arafura Resources Ltd.

9.7 Texas Mineral Resources Corp.

9.8 Ucore Rare Metals Inc.

9.9 Greenland Minerals Ltd.

9.10 Shenghe Resources Holding Co.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global rare earth elements market was valued at USD 5.5 billion in 2023 and is projected to reach USD 10.05 billion by 2030, growing at a CAGR of 9%.

Key drivers include the growing demand for electric vehicles, renewable energy technologies, and consumer electronics, as well as government initiatives to secure domestic supply chains.

The market is segmented by product type (Light Rare Earth Elements and Heavy Rare Earth Elements) and by application (Magnets, Catalysts, Metallurgy, Polishing, Glass Additives, Phosphors, and Others).

Asia-Pacific is the most dominant region, driven by China’s leadership in rare earth production and the growing demand from the region’s high-tech industries.

Leading players include China Northern Rare Earth Group, Lynas Corporation, MP Materials, Iluka Resources, and Hitachi Metals.