Rapid DNA Analysis Market Size (2024 –2030)

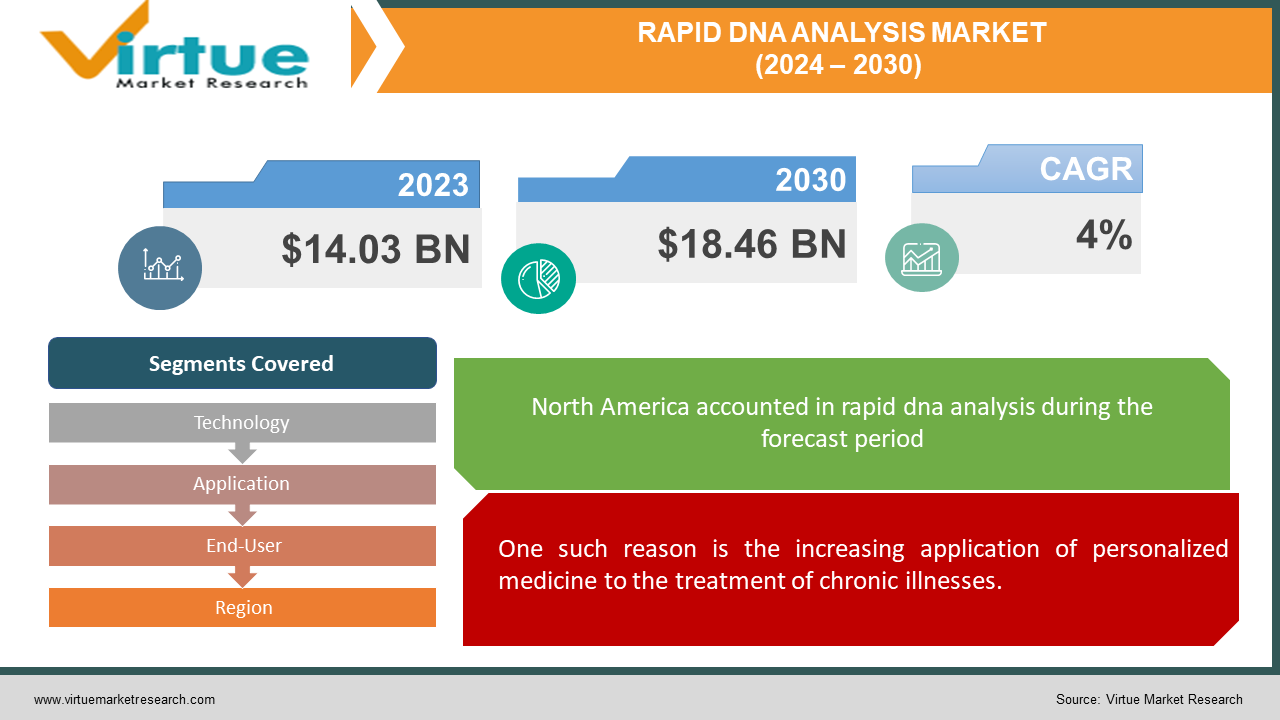

The Global Rapid DNA Analysis Market was valued at USD 14.03 billion in 2023 and is projected to reach a market size of USD 18.46 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4%.

The FBI uses a completely automated procedure known as "Fast DNA" to generate a DNA profile from a reference sample obtained using a buccal swab. Automated procedures including extraction, amplification, separation, detection, and allele calling are part of this hands-free procedure. This "swab-in-profile out" process aims to produce DNA results fast enough to influence critical decisions in intelligence, homeland security, military, and forensics. To fully benefit from fast DNA systems for victim identification in disaster situations, homeland security, law enforcement, and the military, they must also be field-portable.

Key Market Insights:

Compared to several days for traditional DNA analysis methods, the average time for rapid DNA analysis is between 30 and 2 hours.It is projected that the potential addressable sample size for the global rapid DNA analysis market is approximately 50 million samples annually.Like traditional DNA analysis techniques, rapid DNA analysis has an accuracy success rate of about 99.9% in identifying individuals.Approximately 60% of the demand for fast DNA analysis services and products comes from law enforcement agencies.

Global Rapid DNA Analysis Market Drivers:

The increasing need for prenatal and newborn screenings that aim to detect congenital abnormalities and emphasize early identification and intervention has led to the requirement for DNA testing in these screening programs.

The need for DNA testing has increased as a result of increased emphasis on early health issue detection, particularly in newborn screening programs and during pregnancy to detect birth defects. The need for DNA testing is also driving industry growth, as it is necessary for services such as biobanking cord blood. As illnesses worsen, more medical professionals are anticipated to use genetic testing to assess their patients' health, which will increase demand for DNA testing.

One such reason is the increasing application of personalized medicine to the treatment of chronic illnesses.

The need for DNA diagnostics is anticipated to rise for several reasons. The growing use of personalized medicine, which focuses on modifying medical treatments based on an individual's genetic composition, to treat chronic diseases is one important contributing factor. As a result, there is now a higher need for HLA typing and DNA testing to inform treatment choices. Growth in the market is also anticipated to be driven by technological developments that make it possible to commercialize next-generation diagnostic tools based on genetic analysis. Genetic analysis can now be done more precisely and sophisticatedly thanks to technological advancements, which expand testing options and improve diagnostic precision. All things considered, these factors are probably going to help the market for DNA diagnostics grow.

Rapid DNA Analysis Market Challenges and Restraints:

One of the biggest barriers to the market's expansion is the high cost of developing diagnostic tests. The implementation of novel methodologies necessitates significant expenditures for research and development (R&D). Many businesses in the industry may find it difficult to grow as a result of these costs. Furthermore, stringent government laws governing DNA testing and the requirement for a well-defined reimbursement scheme may present difficulties for newcomers. Possible competitors may be discouraged from entering the market by the difficulty of navigating reimbursement policies and adhering to regulations. To guarantee the DNA diagnostics market's continuous expansion as well as a favorable climate for competition and innovation, these issues must be resolved.

Rapid DNA Analysis Market Opportunities:

There are numerous prospects for expansion and innovation in the market for rapid DNA analysis. One significant opportunity is to apply fast DNA technology to healthcare settings for disease diagnosis, genetic testing, and personalized medicine, in addition to traditional forensic applications. This growth has the potential to spur adoption in clinics and medical labs, improving patient care and treatment results. Rapid DNA analysis can also be used to improve the efficiency and accuracy of victim identification and identity verification procedures in border security, immigration control, and disaster response systems. Furthermore, developments in automation and miniaturization technologies open up possibilities for creating rapid DNA analysis devices that are portable and field deployable, suitable for remote or resource-constrained environments.

RAPID DNA ANALYSIS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Technology, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc., Illumina Inc., Rapidhit, ANDE Corporation, IntegenX Inc., General Electric Company, DNASwift, Universal Forensics Laboratory, Micropia, Abbott Medical Optics Inc. |

Global Rapid DNA Analysis Market Segmentation: By Technology

-

PCR

-

Microarray

-

Next-Generation Sequencing

At 50.03% of the DNA diagnostics market's revenue in 2023, PCR-based diagnostics held the biggest market share. This dominance is a result of the extensive use and accessibility of PCR-based tests, which are provided by numerous businesses. PCR is a useful tool for identifying genetic variations linked to diseases like cancer, infectious diseases, and genetic disorders because it is extremely sensitive and specific and can detect minute amounts of DNA. The Los Angeles-based company Sensible Diagnostics stated in May 2023 that it would introduce a 10-minute point-of-care PCR device by early 2024. This announcement is anticipated to propel the advancement of PCR-based diagnostic technology. Due to technological advancements, next-generation sequencing (NGS)--based diagnostics are expected to grow at a rate of 7.98%. NGS is appropriate for several applications, including transcriptome analysis, targeted gene panels, exome sequencing, and whole-genome sequencing, since it enables high-throughput sequencing of multiple samples at once. Precision medicine is dependent on NGS-based diagnostics to enable targeted therapy based on individual genetic profiles and individualized treatment decisions. Growth in this market will be sustained by the availability of various platforms for DNA sequencing and analysis, which offer quick, precise, and efficient diagnosis.

Global Rapid DNA Analysis Market Segmentation: By Application

-

Cancer genetics tests

-

Newborn Genetic Screening

With 29.58% of revenue in 2023, cancer genetics tests were the most popular application in the DNA diagnostics market. The rising incidence of cancer globally, individualized treatment plans, and improvements in DNA sequencing technologies such as next-generation sequencing (NGS) are all contributing factors to this dominance. NGS allows for the simultaneous analysis of multiple genes, which lowers the cost and increases the effectiveness of cancer genetic testing. For instance, hereditary ovarian and breast cancers are associated with mutations in genes such as BRCA1 and BRCA2. Using cancer genetics tests to identify these mutations aids in proactive screening and preventive measures for more susceptible individuals. DNA testing is also highly beneficial for the diagnosis and clinical confirmation of infectious diseases, particularly for diseases like MRSA, hepatitis B and C, HIV, tuberculosis, chlamydia, gonorrhea, and human papillomavirus (HPV). Furthermore, the growing application of DNA diagnostics in oncology to detect tumors and biomarkers will propel market expansion in the coming years.

Global Rapid DNA Analysis Market Segmentation: By End-User

-

Critical Military

-

Forensic

-

Security

-

Biomedical Research

With little to no human intervention, forensic fast DNA technology can produce a DNA profile in less than two hours. Compared to conventional DNA methods, this process is much faster and requires only one automated device to complete. Fast DNA has advantages in speed and can be applied in non-laboratory settings like crime scenes, border crossings, booking stations, and disaster areas. Departments of Homeland Security, Defense, Immigration, and the Department of Justice would all be impacted by the adoption of rapid DNA testing. It could be applied to mass casualty incidents, criminal justice systems, and military intelligence for biometric identification. DNA analysis plays a critical role in biomedical research to confirm the origin of cells and guarantee reproducibility, particularly when human cells are used. This helps avoid research errors brought on by misidentification under a microscope or the use of incorrect cell types.

Global Rapid DNA Analysis Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

With roughly 42.45% of the market revenue share in 2023, North America dominated the DNA diagnostics market. The government's support of DNA testing research, the advanced healthcare infrastructure, and the high prevalence of chronic diseases are the main causes of this dominance. Prenatal screening, pharmacogenomics, ancestry testing, and disease risk assessment are among the many applications of genetic testing that are common in North America thanks to state-of-the-art labs and advantageous reimbursement guidelines. With a predicted CAGR of 6.23% from 2023 to 2030, China and India are predicted to grow at the fastest rates in the Asia Pacific region. The introduction of cutting-edge DNA sequencing technologies like NGS and greater government incentives for R&D are what are driving this growth. Thanks to technological developments, DNA diagnostics are now more widely available, efficient, and reasonably priced. Because of the increased awareness and prevalence of pathogenic diseases during this time, the market for DNA testing is expected to grow at a compound annual growth rate (CAGR) of 4.50%.

COVID-19 Impact on the Global Rapid DNA Analysis Market:

The SARS-CoV-2 virus is the cause of the COVID-19 pandemic, which is seriously affecting economies and public health around the world. Numerous symptoms affecting the brain, heart, lungs, bowels, kidneys, and sepsis can be caused by this virus. Certain people may experience diseases such as direct viral organ infection, immune system dysregulation, cytokine storm syndrome, and blood clotting problems. Rapid DNA testing has seen an increase in demand as a result of these effects. Although the long-term health effects of COVID-19 recovery are still unknown, genetic alterations, such as chromosome rearrangements, insertions/deletions, and modifications to DNA bases, can result in genomic instability. Genomic instability can also result from exposure to physical, chemical, or biological agents that alter DNA replication and repair mechanisms. Aging, Alzheimer's disease, cancer, type 2 diabetes (T2D), and other illnesses have all been linked to genomic instability.

Latest Trend/Development:

Numerous trends and advancements are contributing to the rapid growth of the DNA analysis market. DNA profiling is becoming faster, more accurate, and portable thanks to ongoing technological advancements like automation and miniaturization, which also lessen the need for human intervention. Beyond conventional forensic applications, this technology is being used for biometric identity verification, disaster victim identification, border security, immigration control, and security measures enhancement. It also makes rapid DNA matching with databases possible. Rapid DNA analysis is also becoming more popular in the healthcare industry for genetic testing, diagnosing genetic illnesses, and personalized medicine, which is helping to drive its growing market share and adoption. All things considered, these developments are increasing the adaptability, accessibility, and influence of rapid DNA analysis in a variety of fields and applications.

Key Players:

-

Thermo Fisher Scientific Inc.

-

Illumina Inc.

-

Rapidhit

-

ANDE Corporation

-

IntegenX Inc.

-

General Electric Company

-

DNASwift

-

Universal Forensics Laboratory

-

Micropia

-

Abbott Medical Optics Inc.

Market News:

-

The FBI authorized the National DNA Index System (NDIS) for ANDE in January 2022. With this approval, NDIS laboratories that meet the necessary qualifications can process DNA samples using ANDE technology, and then compare the resulting ANDE DNA IDsTM to the FBI's Combined DNA Index System (CODIS) program without the need for technical evaluation or human interpretation.www

Chapter 1. Rapid DNA Analysis Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Rapid DNA Analysis Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Rapid DNA Analysis Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Rapid DNA Analysis Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Rapid DNA Analysis Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Rapid DNA Analysis Market – By Technology

6.1 Introduction/Key Findings

6.2 PCR

6.3 Microarray

6.4 Next-Generation Sequencing

6.5 Y-O-Y Growth trend Analysis By Technology

6.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Rapid DNA Analysis Market – By End-User

7.1 Introduction/Key Findings

7.2 Critical Military

7.3 Forensic

7.4 Security

7.5 Biomedical Research

7.6 Y-O-Y Growth trend Analysis By End-User

7.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Rapid DNA Analysis Market – By Application

8.1 Introduction/Key Findings

8.2 Cancer genetics tests

8.3 Newborn Genetic Screening

8.4 Y-O-Y Growth trend Analysis By Application

8.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Rapid DNA Analysis Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology

9.1.3 By End-User

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Technology

9.2.3 By End-User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Technology

9.3.3 By End-User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Technology

9.4.3 By End-User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Technology

9.5.3 By End-User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Rapid DNA Analysis Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Thermo Fisher Scientific Inc.

10.2 Illumina Inc.

10.3 Rapidhit

10.4 ANDE Corporation

10.5 IntegenX Inc.

10.6 General Electric Company

10.7 DNASwift

10.8 Universal Forensics Laboratory

10.9 Micropia

10.10 Abbott Medical Optics Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Rapid DNA Analysis Market was valued at USD 14.03 billion in 2023.

Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4%.

The driving factors are the growing need for prenatal and newborn screenings and the growing use of personalized medicine applications in the management of chronic illnesses.

The market restraint is the high development costs of these diagnostic tests.

Cancer genetics tests and Newborn Genetic Screening are the segments according to applications.