Railway Cables Market Size (2024 – 2030)

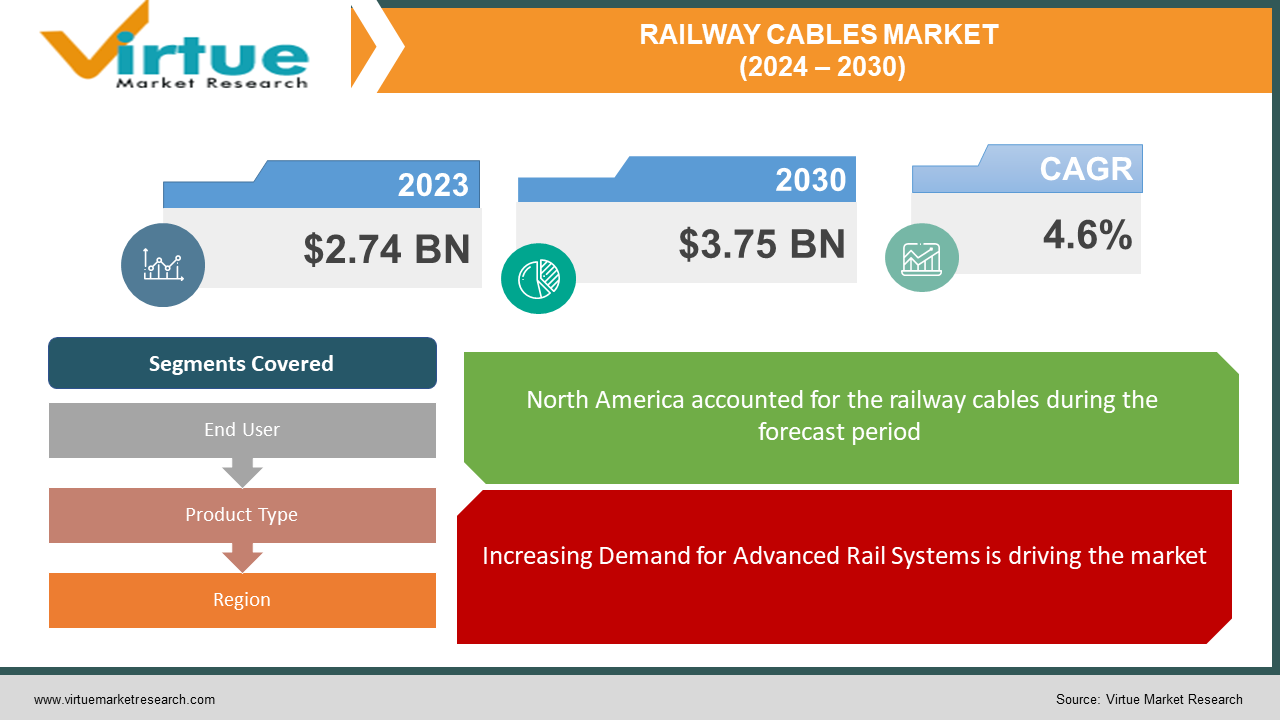

The Global Railway Cables Market was valued at USD 2.74 billion in 2023 and will grow at a CAGR of 4.6% from 2024 to 2030. The market is expected to reach USD 3.75 billion by 2030.

Railway cables are the lifelines of modern trains, carrying power, controlling signals, and transmitting data throughout the network. Unlike regular cables, they face tough conditions - from vibrations and extreme temperatures to fire risks and complex regulations. These specialized cables come in various forms, powering trains (overhead or traction cables), enabling communication (signaling cables), and managing internal systems (control cables). With rising investments in electrification and high-speed rail, the railway cable market is seeing steady growth, driven by demands for safety, efficiency, and technological advancements. So, next time you ride a train, remember the hidden network of cables silently keeping your journey smooth and safe.

Key Market Insights:

The global railway cables market is on a promising growth trajectory, fueled by factors like expanding networks, rising urbanization, and increasing adoption of high-speed rail. Asia Pacific leads the charge, driven by China's massive infrastructure projects. Technological advancements in fire resistance, data transmission, and lightweight materials are key trends. Signal and network cables hold the largest market share, while control and power segments showcase potential. Stringent regulations on safety and fire performance influence market dynamics. Major players like Prysmian, Nexans, and LS Cable & System compete fiercely, emphasizing innovation and regional expansion. Overall, the market presents lucrative opportunities for manufacturers who adapt to evolving technologies and regional demands.

Global Railway Cables Market Drivers:

Increasing Demand for Advanced Rail Systems is driving the market

The future of rail travel is speeding ahead, powered by a network of specialized cables. High-speed lines, with their supersonic whizzes, require cables built for endurance, handling immense electricity surges and data flows at breathtaking speeds. In bustling cities, expanding metro systems rely on these intricate pathways to ensure smooth, reliable commutes, demanding efficient solutions that can handle the constant ebb and flow of passengers. But the transformation goes beyond speed and convenience. The shift towards electric locomotives is electrifying the demand for robust power and signaling cables, ushering in a new era of cleaner, more sustainable travel. These specialized lifelines of the railway system are not just passive conductors, but key players in shaping a faster, safer, and more environmentally conscious future for rail travel.

Focus on Safety and Efficiency is driving the market

Safety is paramount in the fast-paced world of railways, and cables are no exception. Stringent regulations are raising the bar, demanding cables that not only perform flawlessly but also resist fire in critical situations. These regulations drive manufacturers to innovate, creating fire-resistant materials and incorporating advanced diagnostics into cables, allowing for real-time monitoring and ensuring timely interventions. But safety isn't the only focus. Modern railways are embracing real-time data management, weaving a web of communication and monitoring systems. This necessitates the adoption of advanced data transmission cables, like fiber optics, capable of handling the surge of information flowing through the network. This data isn't just passive observation; it fuels intelligent transportation systems, optimizing operations and maximizing efficiency. Specialized cables become the silent partners in this dance of data, enabling automation and ensuring smooth operation. From fire safety to data highways, these cables are more than just conductors; they are the backbone of a smarter, safer, and more efficient railway system.

Rapid infrastructure development is driving market growth

The global railway landscape is shifting eastward, with emerging economies like China and India acting as powerful locomotives driving market growth. Rapid infrastructure development in these countries translates to significant demand for railway cables. From high-speed rail networks crisscrossing vast landscapes to sprawling metro systems connecting burgeoning megacities, the need for robust and specialized cabling solutions is skyrocketing. This demand isn't solely organic; government initiatives are playing a crucial role. Public investments in railway upgrades and expansion programs are pouring fuel into the fire, creating a fertile ground for market growth. These initiatives not only address the need for efficient transportation infrastructure but also unlock economic opportunities, further solidifying the role of railway cables as vital cogs in the growth engine of these emerging economies. With ambitious plans and substantial investments, the future of the railway cables market seems undeniably bright, fueled by the rising power of the East.

Global Railway Cables Market challenges and restraints:

Stringent Regulations and Testing are the biggest hurdle

The path to market for railway cables isn't a breezy track, but rather a rigorous gauntlet of testing and regulations. Safety, the paramount concern, is enshrined in strict performance standards that leave no room for error. Each cable must endure a battery of tests, simulating extreme temperatures, vibrations, fire resistance, and even chemical attacks. This stringent process ensures they're the sturdy workhorses powering and controlling trains, but it comes at a cost. Development timelines lengthen, adding to the financial burden, especially for new entrants who lack the economies of scale of established players. Navigating this complex landscape requires not just expertise but also significant investment in testing facilities and specialized equipment. However, the rewards are substantial. Compliance opens doors to a lucrative market with high barriers to entry, offering a chance to become a trusted supplier in this critical industry. For those daring to enter the arena, the challenge lies in balancing innovation and rigorous testing, ensuring they develop not just cutting-edge solutions but also cables that can demonstrably withstand the unforgiving demands of the railway environment.

Fluctuating Raw Material Prices is the biggest hurdle

The very threads that power and guide our trains face a volatile reality – the fluctuating prices of raw materials. Copper and aluminum, the lifeblood of railway cables, dance to an unpredictable tune, leaving manufacturers scrambling to adapt. A sudden surge in copper prices can send production costs soaring, squeezing profit margins and forcing difficult pricing decisions. Manufacturers are left in a precarious balancing act, trying to maintain stable pricing for customers while grappling with the whims of the market. This uncertainty can discourage investment in new technologies and innovations, potentially hindering the overall progress of the industry. However, some are finding their rhythm to this erratic music. Long-term contracts with suppliers, diversification of raw materials, and hedging strategies are becoming the new mantras. The quest for sustainable alternatives also gains momentum, offering a potential escape from the price rollercoaster. The future of railway cables may lie in navigating this volatile landscape, finding innovative solutions to ensure the smooth flow of data and power, unfazed by the ebbs and flows of the raw material market.

Cybersecurity Threats are the biggest hurdle

The rapid digitization of railways, while promising efficiency and convenience, brings a chilling side effect - heightened vulnerability to cyberattacks. These attacks can target data transmission cables, the unsung heroes silently carrying critical information. A successful breach could disrupt operations, tamper with signals, or even cause physical harm. This grim possibility necessitates robust cybersecurity measures, but these come at a cost. Implementing firewalls, encryption, and intrusion detection systems adds another layer of complexity and expense to already intricate cable manufacturing. Moreover, the threat requires vigilant monitoring and updates, demanding ongoing investment in cybersecurity expertise. Manufacturers find themselves caught between a rock and a hard place - balancing affordability with the critical need to safeguard sensitive data. The solution may lie in collaboration. Joint efforts between manufacturers, governments, and cybersecurity experts can develop standardized security protocols and share threat intelligence, creating a united front against cyber threats. Ultimately, safeguarding data transmission cables is not just an expense, but an investment in the secure and reliable future of our digitalized railway systems.

Market Opportunities:

Lucrative opportunities abound in the global railway cables market! Rising investments in high-speed rail, expanding networks, and urbanization in Asia Pacific create a fertile ground. Embrace innovations in fire-resistant, lightweight, and high-data-transmission cables to cater to evolving needs. Focus on the burgeoning control and power cable segments, while solidifying dominance in signal and network sectors. Adapt to stringent safety regulations and prioritize regional expansion strategies. Collaborate with railway authorities and infrastructure developers to secure major projects. Leverage technological advancements like fiber optics and smart cables to differentiate your offerings. By staying ahead of the curve and addressing regional demands, you can unlock the true potential of this promising market.

RAILWAY CABLES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By End User, Product Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Prysmian Group, Nexans, LS Cable & System, Hitachi Metals, TE Connectivity, Leoni, Eland Cables, NKT Cables, Fujikura, Sumitomo Electric Industries |

Railway Cables Market Segmentation - by End User

-

High-Speed Rail

-

Conventional Rail

-

Urban Rail Systems

-

Freight Rail

Railway cables cater to diverse needs. High-speed rails demand specialized, fire-resistant, high-data cables for efficient communication and safety. Conventional rail utilizes a wider variety depending on specific uses. Urban rail systems require compact, lightweight options for tight spaces. Freight trains prioritize robust, reliable cables for heavy-duty tasks. Notably, high-speed rail experiences the fastest growth due to global infrastructure projects, while conventional rail exhibits slower growth as it's already well-established in many regions. Understanding these nuances is crucial for cable manufacturers to tailor offerings and target potential markets effectively

Railway Cables Market Segmentation - by Product Type

-

Signal Cables

-

Network Cables

-

Control Cables

-

Power Cables

Railway cables come in various flavors, each with its niche. Signal cables, the safety sentinels, ensure smooth train control, experiencing steady growth as safety remains paramount. Network cables, the information highways, are witnessing explosive growth driven by the surge in data transmission and automation. Control cables, the puppeteers behind doors, and lighting maintain consistent growth fueled by rising passenger expectations. Power cables, and the energy arteries, see stable growth as existing networks expand. However, other specialty cables, like fire-resistant and lightweight options, are the rising stars, experiencing the fastest growth due to stricter regulations and sustainability demands. This diverse landscape offers opportunities for manufacturers to cater to specific needs and capitalize on the booming segments

Railway Cables Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

-

-

The global railway cables market dances to different tunes across regions. Asia Pacific, fueled by China and India's infrastructure push, takes the crown for the fastest growth, demanding signal, network, and power cables for their expanding high-speed rail ambitions. In contrast, Europe, a mature market focused on safety and maintenance, exhibits slower growth. Here, opportunities lie in specialty cables like fire-resistant and lightweight options that meet stringent regulations. North America, though well-established, maintains steady growth driven by technological advancements and infrastructure upgrades, with data-driven and fire-resistant cables in high demand. Emerging regions like Latin America and Middle East & Africa hold future promise, requiring diverse and cost-effective solutions as their railway networks blossom. Understanding these regional nuances is key for market players to waltz into the right markets with the perfect cables

COVID-19 Impact Analysis on the Global Railway Cables Market

The COVID-19 pandemic dealt a harsh blow to the global railway cables market, disrupting supply chains, stalling infrastructure projects, and plummeting passenger and freight traffic. Demand shrunk significantly, impacting production, revenue, and employment. However, the market exhibits signs of recovery as restrictions ease and infrastructure investments resume. Stimulus packages and a focus on sustainable transportation offer hope for renewed growth. Stringent hygiene protocols and remote work models have spurred demand for specific cable types catering to upgraded signaling and communication systems. Additionally, the pandemic has accelerated digitalization trends in the railway industry, creating opportunities for smart and data-driven cable solutions. While challenges remain, the market's inherent resilience and adaptability, coupled with strategic shifts towards post-pandemic needs, point towards a gradual return to pre-pandemic levels and the emergence of new market opportunities.

Latest trends/Developments

The Global Railway Cables Market is buzzing with innovation! Fire-resistant materials like mica tapes and intumescent coatings are trending, ensuring enhanced safety in demanding environments. Data transmission takes center stage, with fiber optic cables enabling faster communication and network efficiency for advanced signaling systems. Lightweighting solutions using aluminum and composite materials reduce train weight and energy consumption, aligning with sustainability goals. Additionally, smart cables with embedded sensors are gaining traction, offering real-time monitoring of cable health and performance, optimizing maintenance, and boosting operational efficiency. These trends, coupled with increasing demand for high-speed rail and stricter fire regulations, paint a picture of a dynamic and evolving market brimming with exciting opportunities for innovative manufacturers.

Key Players:

-

Prysmian Group

-

Nexans

-

LS Cable & System

-

Hitachi Metals

-

TE Connectivity

-

Leoni

-

Eland Cables

-

NKT Cables

-

Fujikura

-

Sumitomo Electric Industries

Chapter 1. Railway Cables Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Railway Cables Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Railway Cables Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Railway Cables Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Railway Cables Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Railway Cables Market – By Product Type

6.1 Introduction/Key Findings

6.2 Signal Cables

6.3 Network Cables

6.4 Control Cables

6.5 Power Cables

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Railway Cables Market – By End User

7.1 Introduction/Key Findings

7.2 High-Speed Rail

7.3 Conventional Rail

7.4 Urban Rail Systems

7.5 Freight Rail

7.6 Y-O-Y Growth trend Analysis By End User

7.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Railway Cables Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Railway Cables Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Prysmian Group

9.2 Nexans

9.3 LS Cable & System

9.4 Hitachi Metals

9.5 TE Connectivity

9.6 Leoni

9.7 Eland Cables

9.8 NKT Cables

9.9 Fujikura

9.10 Sumitomo Electric Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Railway Cables Market was valued at USD 2.74 billion in 2023 and will grow at a CAGR of 4.6% from 2024 to 2030. The market is expected to reach USD 3.75 billion by 2030.

Increasing Demand for Advanced Rail Systems, Focus on Safety and Efficiency, and Rapid infrastructure development are the reasons that are driving the market.

Based on end-user it is divided into four segments – High-Speed Rail, Conventional Rail, Urban Rail Systems, Freight Rail

Asia-Pacific is the most dominant region for the Railway Cables Market.

Prysmian Group, Nexans, LS Cable & System, Hitachi Metals, TE Connectivity, etc.